ve(3,3) with Velo/Aerodrome

Source : https://www.youtube.com/watch?v=gyMGupPQGSg

Velodrome Introduction

What is Velodrome ?

Velodrome combines multiple DeFi primitives into a single protocol. Firstly, Velodrome integrates multiple liquidity structures :

- x*y=k Automated Marker Maker (Uniswap V2)

- Concentrated Liquidity (Uniswap V3)

- Stableswap (Curve)

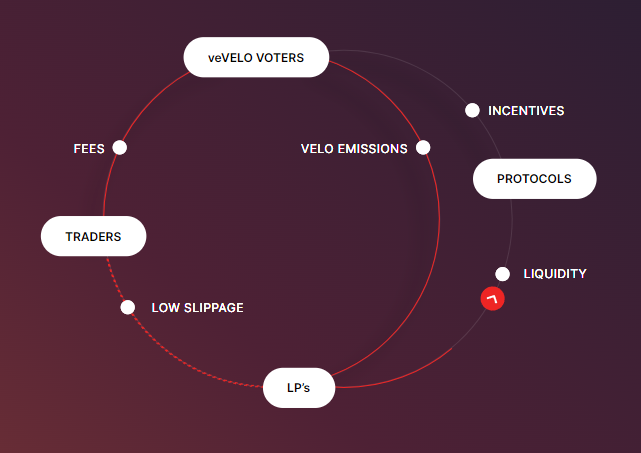

And Velodrome uses ve(3,3) for the incentive model.

What is ve(3,3) ? (2:45)

Somehow, the incentive model combines veTokens and built-in incentives (like Convex).

Furthermore, the locked tokens create a "veNFT" which is transferable, whereas veTokens are not.

This model aims to balance value extraction between LPs and token holders. If the DEX is valuable, it prevents LPs from extracting all accrued value and rewards token holders when the product is successful

So this is well-designed for ecosystems hungry for liquidity

The ve(3,3) model came from the foundations of Andre Cronje's Solidly project.

The success of Velo/Aerodrome model (6:40)

The Solidly model was a great idea, but the execution was flawed :

- 100% rebase on emissions discouraged ongoing locking/participation

- Emission schedule had to be adjusted to be more sustainable

Ace was an early believer in the revolutionary design of ve(3,3) for capturing long-term protocol growth. He noticed that even in bear markets, ve(3,3) has interesting flywheel effects.

So Velodrome decided to improve the model on several points. Firstly, they tweaked some features :

- Added gauges

- Removed LP Boost

- Added auto-compounding (similar to Votium)

Secondly, focus on being the key liquidity hub for targeted ecosystems with attracted incentives, new project launches, and liquidity inflows. So this is harder for forks to gain traction on more competitive chains like Arbitrum

Thirdly, strategic partnerships and execution. There was an opportunistic partnership with Optimism when it had little DeFi. This upgraded Solidly model brought over users and protocols from Fantom ecosystem and Optimism rewarded Velodrome's value-add.

Benefits of Velo/Aerodrome model (35:00)

- Aligns incentives for positive-sum behaviors across participants (traders, protocols, liquidity providers, lockers)

- Lockers never get diluted as they earn rebases equivalent to net inflation

- Creates a network effect. Liquidity providers earn tokens and can choose to swap or lock them, and protocols can leverage native tokens as incentives to build self-sustaining liquidity programs

We are moving away from OlympusDAO's 100% Rebase Mechanics. The "3,3" labeling is now more of a meme, as the 100% rebase aspect did not work as intended. But the model still promotes highly aligned incentives across participants

Story of Velodrome

Connection between Ace & Alex (13:50)

Ace and Alexander have known each other for a long time :

- They were introduced by a mutual friend, Jason Hitchcock

- They were friends and "degens" in the previous bull market, with Ace helping to get Alexander interested in DeFi early on.

Alex met Jason in San Francisco after the pandemic, and Jason "red-pilled" him on crypto, quitting his job and started contributing to projects, leading to working on DAOs and eventually building protocols like Velodrome and Aerodrome.

All the power and potential of DeFi starts from here : If you show up and contribute, things can move quickly in the DeFi space.

Velo/Aerodrome's roles (19:30)

Aerodrome was born at ETHDenver 2022, following discussions with Optimism and Base teams :

- Base needed its own native liquidity solution, similar to Velodrome's role on Optimism

- Base was launching without a token, lacking incentives/rewards for liquidity

So Aerodrome's role is to build and grow the Base ecosystem. Aerodrome would integrate vertically into Base's products, services, and partnerships and serve as the native liquidity hub

For its part, Velodrome's role is to extend horizontally across the Optimism "super chain". As more projects build on the OP stack, Velodrome can provide liquidity and facilitate deploying projects across OP chains.

There are lots of advantages about having one liquidity hub (Velodrome) across super chains :

- Simplified incentive distribution compared to individual Layer 1s

- Enables seamless user/liquidity movement across interoperable chains

- Fosters competition between chains to attract liquidity via incentives

- Velodrome's incentive model can grow liquidity pie

In the end, Velo/Aerodrome are synergic : Velodrome enables cross-chain liquidity providing, and Aerodrome focuses on integrating Base's unique offerings

Why focus on Base ? (26:10)

Initial thesis was that the alt-L1 chains would fail as subsidies dried up, and builders would congregate towards Ethereum L2s

Optimism was identified as a growth area due to developments like danksharding, and OP Stack.

Among the L2s built with the OP Stack, Base (built by Coinbase) was seen as a potential winner :

- Well-resourced publicly traded company with crypto expertise

- Understood making crypto accessible to masses

- Relationships with major institutions

- Base was seriously committed to bringing its business on-chain (e.g. USDC)

- Potentially even larger than the Optimism "super chain"

Hence, Velodrome team was convinced Base could rapidly become the largest Ethereum L2, and did a fair launch of Aerodrome distributed to active Velodrome users (no provate sale)

Was it a fair launch with Coinbase ? (33:30)

Coinbase did not get preferential terms for their investment. They acquired tokens like any other participant, either by farming/earning rewards or swapping on-chain.

That was the second time in Coinbase history they went straight on-chain.

Velo/Aerodrome VS Curve

Comparison with Curve (38:50)

The Curve community has a lot of criticism towards velodrome and aerodrome model :

- Those models as just inflationary flashes that won't last

- They provide economic stimulus and positive externalities that can't be measured by emissions vs rewards alone

According to Alex, there are key differences between Velodrome and Curve models :

- Curve splits fees 50/50 between Liquidity Providers and veCRV, reducing rewards to veCRV

- veCRV voters not incentivized to vote for most productive pools (voters get the same revenue no matter the fees), whereas Velo/Aerodrome do

- Locked positions are liquid (veNFTs) without needing derivatives like Convex

Hence, all Velo/Aero features (liquid locking, voting, auto-compounding) are built into base layer with no extra fees, and it has potential to attract multiples of Uniswap's TVL by combining aligned incentives with concentrated liquidity.

On the other hand, Curve has multiple layers (Convex, Votium etc.) which give more the impression of extracting value than of developing Curve as a whole

Avoiding project rivalry (52:20)

Although both communities criticize each other, DAdvisoor thinks it's a waste of time to criticize. the focus should be on one's own house.

There is innovation happening in both the Curve camp and the Velodrome/Aerodrome camp anyway.

Furthermore, protocols are excited about Uniswap V4, which could make liquidity on Velodrome, Aerodrome, and Curve even more efficient with hooks and intents.

Who creates the most positive sum game ? (57:15)

Arguments in favor of Velo/Aerodrome :

- Their tokenomic model incentivizes liquidity provision directly based on trading volume/fees, potentially creating a more efficient system compared to Curve's socialized incentives.

- Projects can directly incentivize liquidity for their tokens by competing for liquidity rewards, allowing better bootstrapping of liquidity.

- Currently generating significantly higher rewards for liquidity providers compared to Curve+Convex (e.g., 6.5x more rewards in a given week).

- Potential to capture maximal swap efficiency and direct a high percentage of trading fees to token holders, something not seen before.

- Gaining legitimacy and "lendingness" (trust in the platform) as TVL and numbers improve.

Arguments in favor of Curve :

- Despite a different incentive model, Curve's DEX has shown comparable volume/TVL efficiency to Uniswap V2, suggesting incentives may not be the primary driver of efficiency.

- The underlying DEX structure (like Uniswap V3's model) may play a more significant role in determining efficiency than incentives.

- Curve's complexity emerged from necessity due to its initial immutable token distribution, and the ecosystem built around it (like Convex) is a consequence of this.

- Curve's model may be more suitable for projects that cannot sustain liquidity through trading fees alone, as incentives are not directly competing with high-fee pairs.

Concerns about endogenous pools (1:09:40)

CurveCap has concerns about endogenous pools, where one of the tokens (VELO/AERO) pairs with something else

According to Alexander, the system is designed to self-calibrate rewards based on productive pools with high trading volumes.

Fees collected are not just from the native tokens but also from the other traded tokens like USDC, OP, or WETH. If trading volumes on native tokens decline, the system would redistribute emissions away from those pools, indicating it is working as intended.

Future of Velo/Aerodrome

Slipstream (1:14:00)

Slipstream is the mechanism created to address concerns about liquidity being withdrawn from major pools like USDC/ETH to chase incentives in native token pools.

Slipstream allows for Uniswap V3-style concentrated liquidity and efficient swaps for high-volume trading pairs.

By attracting more liquidity and combine them with the ve(3,3) model, Velodrome aims to attract 2-3x more liquidity than Uniswap for these pairs

Currently, Uniswap still captures the highest overall trading volume. By attracting more liquidity and volume, the system aims to outcompete Uniswap for certain pairs

Next steps (1:23:30)

Currently, Velo/Aerodrome have no plans to deploy on Ethereum mainnet or Solana. Their focus is expanding across the "OP Stack" / "super chain" ecosystem of rollup chains, as they believe more activity will come

The OP Stack has powerful network effects similar to Ethereum :

- Well-resourced teams making it easy/cheap to launch new rollup chains

- Interoperability means liquidity and fees will flow through those DEXes

- They work closely with major players like Coinbase on this "alliance strategy"

Slipstream (Curve's Uniswap V3 concentrated liquidity) has just started rolling out. If it can usurp Uniswap's volumes on Optimism, they plan to replicate on other OP Stack chains, as it makes huge volumes ($1 billion/week on Arbitrum)

Various topics

Yield farming or efficient liquidity ? (54:00)

It's an open question whether the market cares more about high APRs (yield farming) or efficient liquidity with market makers driving the flow.

Protocols like Velodrome offer high APRs (e.g., 700% on the OP/ETH pool), but it's uncertain if that will attract liquidity from Uniswap.

On the other hand, while protocols are building an ecosystem around Curve, ultimately bringing more TVL, the benefits might not accrue to the Curve DEX itself.

Ace admits he's a "yield junkie" and appreciates the consistent 40-50% APRs and weekly yield checks from the ve(3,3) model.

Alex became Ramses advisor(1:29:05)

Though not officially employed, Alexander became an advisor for Ramses (ve(3,3) DEX on Arbitrum).

He has been closely connected and collaborating with the Ramsés team for a long time, and believes Ramsés could play a bigger role on Arbitrum going forward.

Velo/Aerodrome wants to be the liquidity hub for "Super Chain", and Ramses wants to be the liquidity hub for Arbitrum

Retroactive Public Goods Funding, aka "RPGF" (1:31:40)

In RPGF3, some projects felt unrewarded compared to non-Optimism entities receiving funds. DAdvisoor asked how funding was handled by Optimism

According to Alex, RPGF are an "iterative experiment", and it seems RPGF4 will focus more on projects builders and be more data-driven

Alexander is optimistic RPGF4 will better reward projects based on their real on-chain impact, in order to align "impact = profit" incentives just like RPGFs are meant to be.

Recommandations for viewers (1:34:50)

Start by reading Andre Cronje's original blog post introducing Solidly. This gives background on the motivations and intended mechanisms behind the design

Join the Velodrome Discord and engage with the community, which is very active and willing to answer questions/Make strategies

Explore the UI/UX that abstracts away complexity. For example, the "maxi relay" to easily compound rewards automatically

Read available documentation and older medium articles. Read articles through the Discord community is recommended for most up-to-date information