Tokenbrice : Shaping the liquidity on Maverick

Source : https://www.twitch.tv/videos/2025405807

Summary

- Why Maverick compared to other DEXs?

- Setting up a pool on Maverick

- Liquidity shaping

- Attracting liquidity providers

Why Maverick ?

The knockout argument (8:30)

Maverick is interesting to use because its liquidity efficiency is greater than on other DEXs.

With equivalent volumes, Maverick needs less liquidity. From a project's point of view, this reduces the maintenance costs to manage liquidity.

Maverick's lifecycle (10:30)

Maverick is still in the early stages of development compared to other well-established DEXs like Curve or Balancer.

So there is an opportunity for projects to position themselves early on Maverick, similar to Frax which owes its success to its early positioning on Convex.

In addition, a project that creates a Boosted Pool can get free MAV to amplify its pools in the future.

Configuring pools

Swap fees (12:50)

These are the fees charged by the liquidity pool on each token swap. These fees are then redistributed to the liquidity providers ("LPs") in the pool. On Maverick, the swap fees on a Maverick pool are between 0.2 bps (0.002)% and 300 bps (3%).

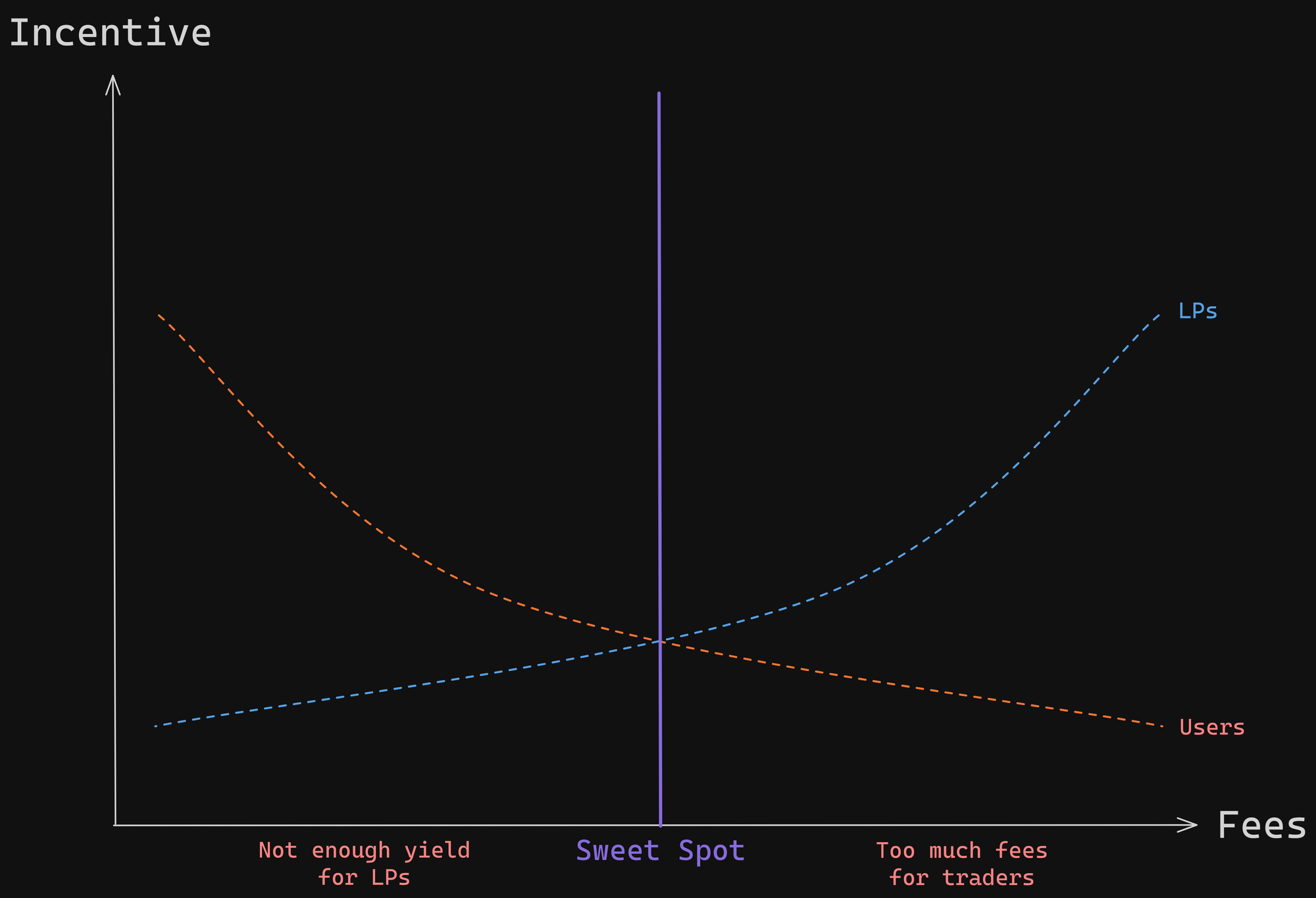

Traders want to swap their tokens with as little fees as possible and liquidity providers want to have the best possible yield. So you have to choose your swap fees based on competing pools, and find a compromise :

- Lower fees reduce LP returns, so higher external incentives are needed to provide competitive yield

- Higher fees generate more yield, but less volume because high-fee pools are chosen less often by aggregators.

You also have to take into account revenue capture by protocols. On Maverick, 100% of fees go to LPs. There is no revenue capture by the DAO as on Curve or Balancer.

Example : On Curve and Balancer, only 50% of collected fees are redistributed to LPs. For the stETH/ETH pair which is 1 bps (0.01%) in fees, it's as if they were getting 0.005% in fees.

To create a competitive pool on Maverick, you can create a pool with 0.8 bps (0.008%) in fees. Thus, traders pay less and LPs earn more compared to an identical pool on Curve and Balancer.

Width (19:30)

Width : Percentage of price range width over which liquidity is deployed. The smaller the width, the more concentrated the liquidity, ranging from 0.01% to 50%.

There is no silver bullet for determining ideal width. However, a good practice to follow is that our Boosted Pools have 8 to 10 ticks

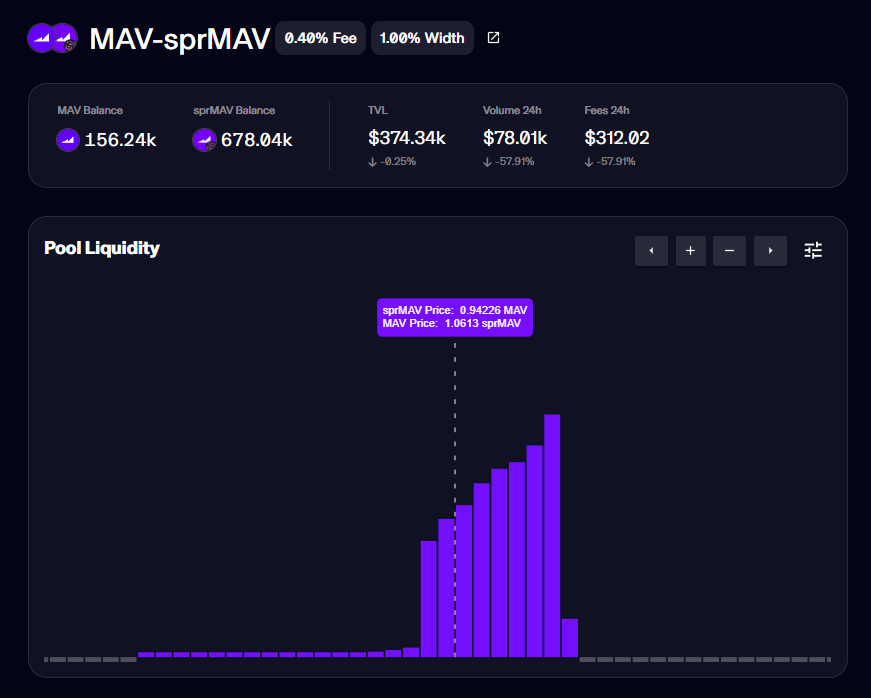

The MAV/sprMAV pool has 10 ticks at 1% width, so the pool can contain 10% price variance.

The ETH/sprMAV pool has 9 ticks at 10% width, so the pool can contain 90% price variance.

There need to be enough ticks for efficient price tracking, but not too many ticks either because each tick has associated gas costs : too many ticks means a lot of expenses to enter and exit as an LP.

The optimal width stems from the type of tokens that make up the pair, and the price range to cover over 8-10 ticks :

- LSD (stETH, rETH) & large stablecoins (USDC, USDT): 0.10% width

- Small stablecoins (GHO, DYAD): 0.20% width

- Volatile pairs (ETH/MAV): 10-25% width

Modes (25:00)

After choosing the fees and width, they need to be consistent between the static pool and the dynamic pools.

- Static : We place our tick in a specific interval and it stays there. The static mode is itself declined in several forms (exponential, flat, single bin).

- Left : we choose this mode to readjust the tick when the price of the asset on the left side of the pair increases compared to the other (ETH/LUSD).

- Right : we choose this mode to readjust the tick when the price of the asset on the right side of the pair increases compared to the other (ETH/LUSD).

- Both : the left and right modes allow adjusting liquidity when the price goes in one direction, but not the other. The both mode allows going in both directions.

One way or another, there always needs to be a static pool. When in doubt, it's best to adopt a "flat" structure, where liquidity is evenly distributed.

In dynamic modes, the price evolves but at no point are assets exchanged. These modes have several advantages:

- It is much more difficult to manipulate the price.

- It avoids having to trust liquidity managers (especially when we see what's going on with Gamma).

For the wstETH/ETH pool, you could adopt a left mode to track the exchange price evolution.

The both mode is the most used because it follows the price in both directions (maybe because LPs are afraid of doing it wrong).

Liquidity shaping

The basic solution (32:15)

The structure will mainly depend on the pairs on which we will deposit our liquidity. But in general, there are some common points :

- 1 Static pool distributed over about 10 ticks. This gives us a good base to give the price. It's a model that works pretty much everywhere (Example: wstETH/ETH).

- 1 Left/right/both pool that concentrates liquidity on 1-2 ticks.

Even if it's not the most optimized structure, it is robust and more efficient than Curve and Balancer which are flat.

Pegged assets (Stablecoins, liquid wrappers...) (36:15)

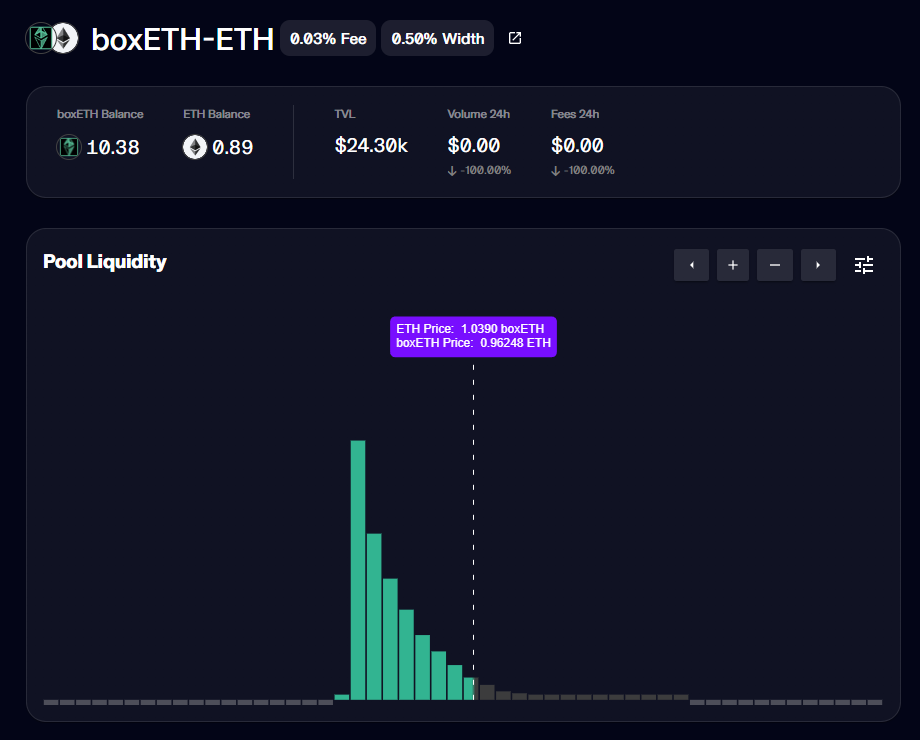

For assets with peg deviation (stables, liquid wrappers), we can optimize the static pool this way :

On the boxETH/ETH pair, we make a bigger and bigger buy wall as users buy boxETH.

Conversely, on the MAV/sprMAV pair, we make a bigger and bigger sell wall as users sell their MAV.

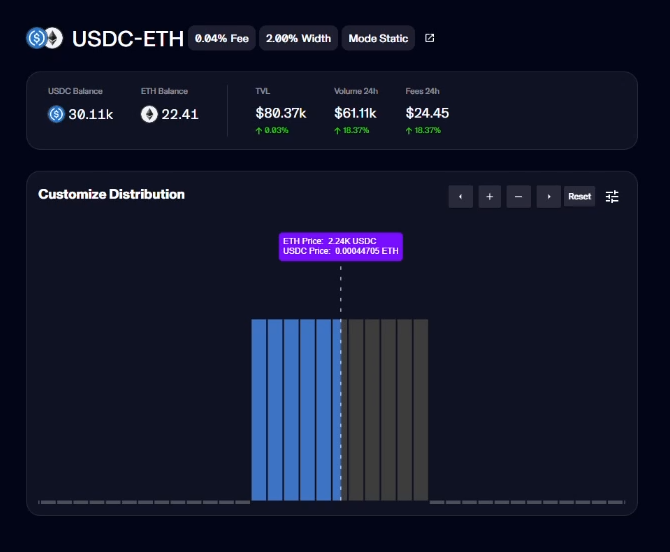

We can also make an "exponential" shape : a wall in both directions to maximize volume at the current price.

This structure is suitable for tokens that evolve within a price range, this is useful for volatile/stable pairs (ETH/USDC) and volatile/volatile pairs (ETH/WBTC).

Outside of these special cases, the flat static structure + dynamic mode remains optimal. It is necessary to do a case-by-case analysis based on the tokens, and run tests.

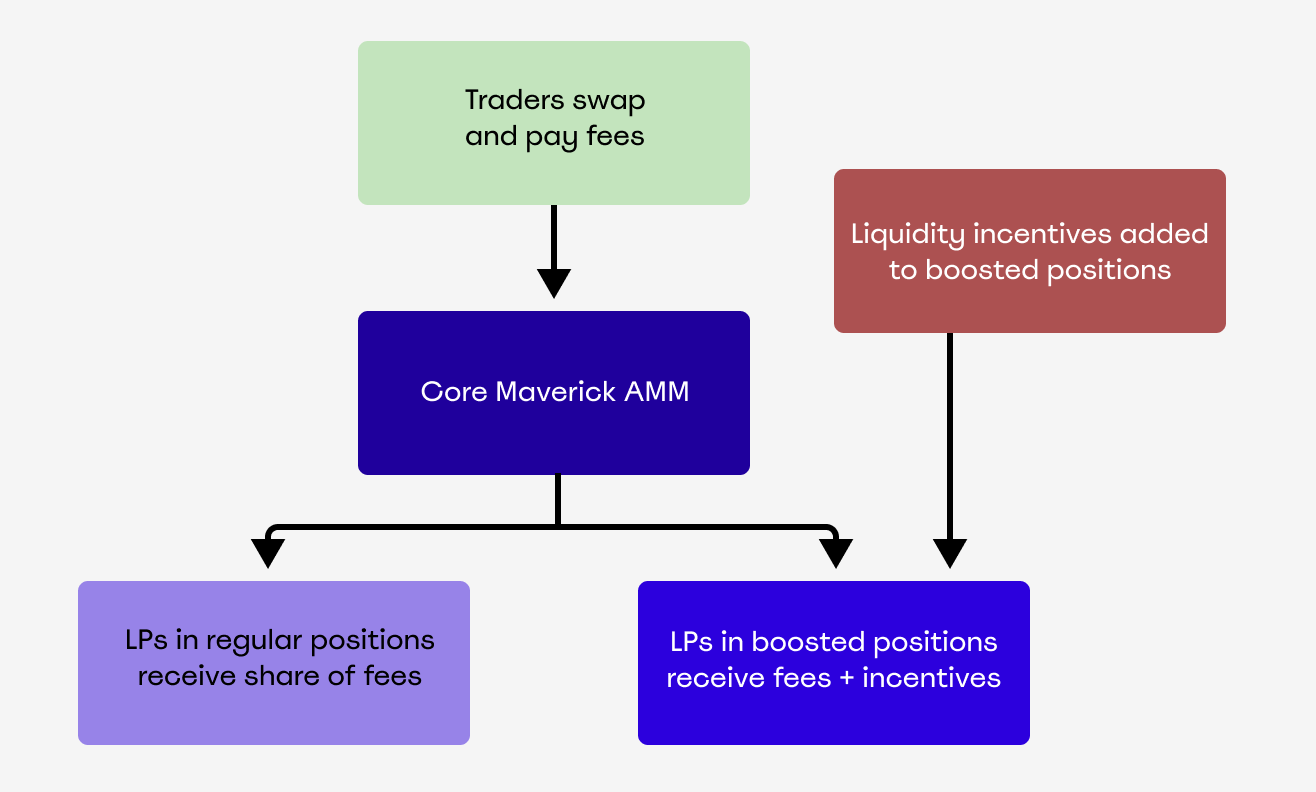

Boosted Positions

How it works (44:00)

Maverick offers a "Boosted Positions" system : projects give incentives to deposit liquidity at specific price intervals in a pool, and LPs get higher returns when they play along.

How to incentivize ? (45:00)

- Create a boosted position on a pool (example: ETH/MAV)

- Choose the daily incentive amount and incentive duration.

The distribution we will make is critical, because it is what will be offered to LPs and cannot be revoked once deployed.

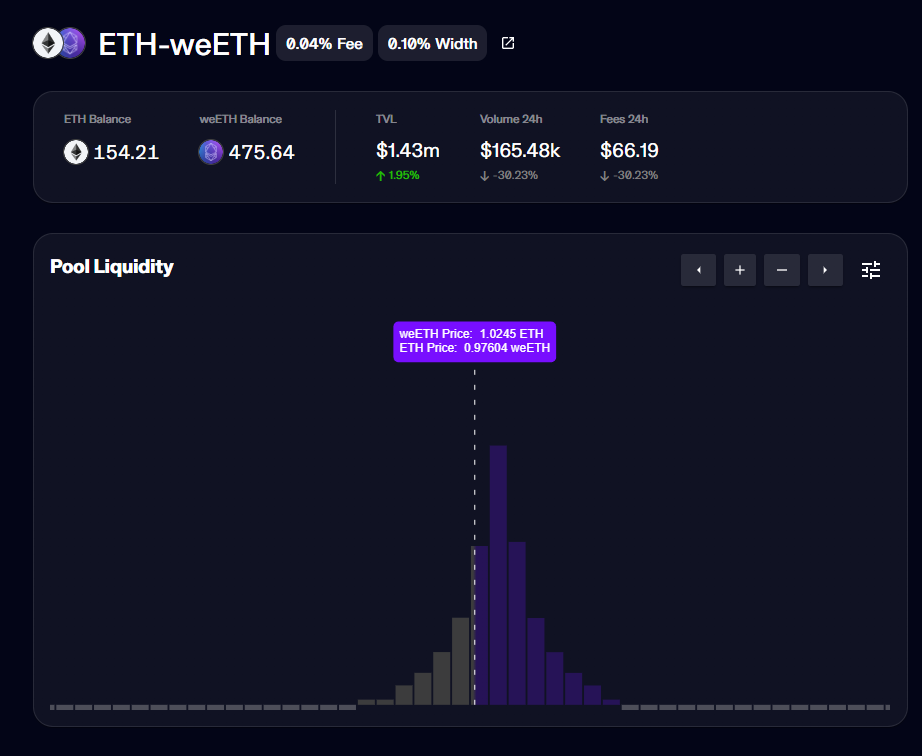

Common mistake example : ETH/weETH, the incentive period was set at 30 days, and the team finds itself stuck with an exponential distribution pool without a dynamic pool.

There was a missed opportunity to optimize liquidity and incentive sharing.

Brice's advices:

- Set a short incentive period (3-7 days) to test, then lengthen the duration.

- Create boosted pools on sundays to limit gas fees.

Matching program (49:45)

For projects doing boosted positions for the first time, it is possible to double the incentives in the token of their choice up to $5,000.

But this is not recommended for beginners. You should first test without matching, then contact the Maverick team to take advantage of this program.

Boosting static pools (51:20)

It is more reassuring for projects to create Boosted Positions on static pools. Static pools are predictable, while dynamic pools (left/right/both) are much less so.

Lido will prefer static pools: Let's say Lido has 400 stETH and 500 ETH lying around somewhere. They could provide liquidity to the wstETH/ETH pool to get the yields + MAV allocation.

Dynamic pools will mostly be used by degens on volatile/volatile pairs because they don't care about the operating mode, they just want the yield.

But we need to look at incentive results over the long term to determine the respective benefits and risks of static and dynamic pools.

Attracting liquidity providers (55:00)

There must be evangelization efforts from the project to attract liquidity :

- Initiate its existing community to Maverick (Brice is open to prepare a pitch for a project/DAO on adopting Maverick).

- Announce the opportunity directly to its users.

- Present a strategy via a governance proposal (even though there is not yet a concrete example of adoption by a DAO).

Of course, there are degens who are naturally interested in projects that offer Boosted Positions.

However, even if degens are good customers, a project's best customers are members of their community.

Questions

The wstETH is continually gaining value with staking revenue. So if we deposit in the pool, do we necessarily lose ? (57:30)

On Maverick, the pool can be configured in "left" mode only, to follow the wstETH appreciation.

This allows reconcentrating liquidity on the wstETH side when its price increases, so LPs can mostly follow the wstETH appreciation.

Of course there can be impermanent loss if ETH varies a lot, but the "left" mode reduces losses related to the natural appreciation of wstETH.

Why can collected fees sometimes move down ? (58:30)

The displayed fees only take into account active ticks. So if we remove ticks that were collecting fees on one of our positions, the total displayed collected fees amount will decrease.

Can you earn more in both mode than the other modes despite impermanent loss ? (59:30)

It all depends on the specific conditions: volume traded, incentives, price movement amplitude, etc.

The both mode can process more volumes (so generate more revenue), but we take more risks with impermanent loss.

The static mode has lower returns for lower risk, and the both mode has higher returns for higher risk.