The Spectrum of Stablecoin Permissioning

Source : https://www.youtube.com/watch?v=85251eBKFqI

What is a stablecoin ? (0:45)

A Stablecoin is similar to a bank liability. Stablecoins maintain a stable value by being backed by collateral that is held to guarantee this value ($1 in most of the cases). Different stablecoins use different types of collateral like regular currencies, crypto assets, or financial assets.

The risks to maintaining the value (or the "peg") come from the collateral and the system used to issue and redeem the stablecoin.

With banks, the collateral is controlled centrally by the bank. There is risk if many people try to redeem deposits at once and the bank doesn't have enough liquid collateral. This can mean not everyone gets their money back.

For crypto stablecoins, how decentralized the system is affects the risks. More decentralized systems spread out risks across many collateral holders and issuers. But there is still risk if the collateral drops in value or if redemption demands exceed liquid collateral.

The main point is that all stablecoins carry some risk of not being worth $1 when redeemed, like bank deposits. But crypto stablecoins with decentralized models can reduce some of those risks versus centralized systems like banks. However, crypto stablecoins bring their own risks that need to be evaluated.

What is the point of Decentralized Finance aka "DeFi" ? (2:30)

The main goal of DeFi is to reduce counterparty risk. Counterparty risk is when the other party you are dealing with fails to uphold their end of an agreement. This happens rarely but can be disastrous.

With DeFi, smart contracts replace counterparties. Smart contracts are rules coded into a program that execute automatically without human intervention. This eliminates counterparty risk as the smart contract code will execute as written.

For stablecoins, this means the rules for collateral and redeeming coins for $1 are guaranteed by code, not a company. There is no longer risk of a company mismanaging collateral or refusing redemptions due to discretion or financial troubles.

Everything is transparent on a blockchain. Anyone can verify collateral backing and redemptions are working properly. Traditional systems like banks lack this transparency.

Finally, DeFi systems are universally accessible to anyone since they just require an internet connection. No need for legal identities or approvals like with banks.

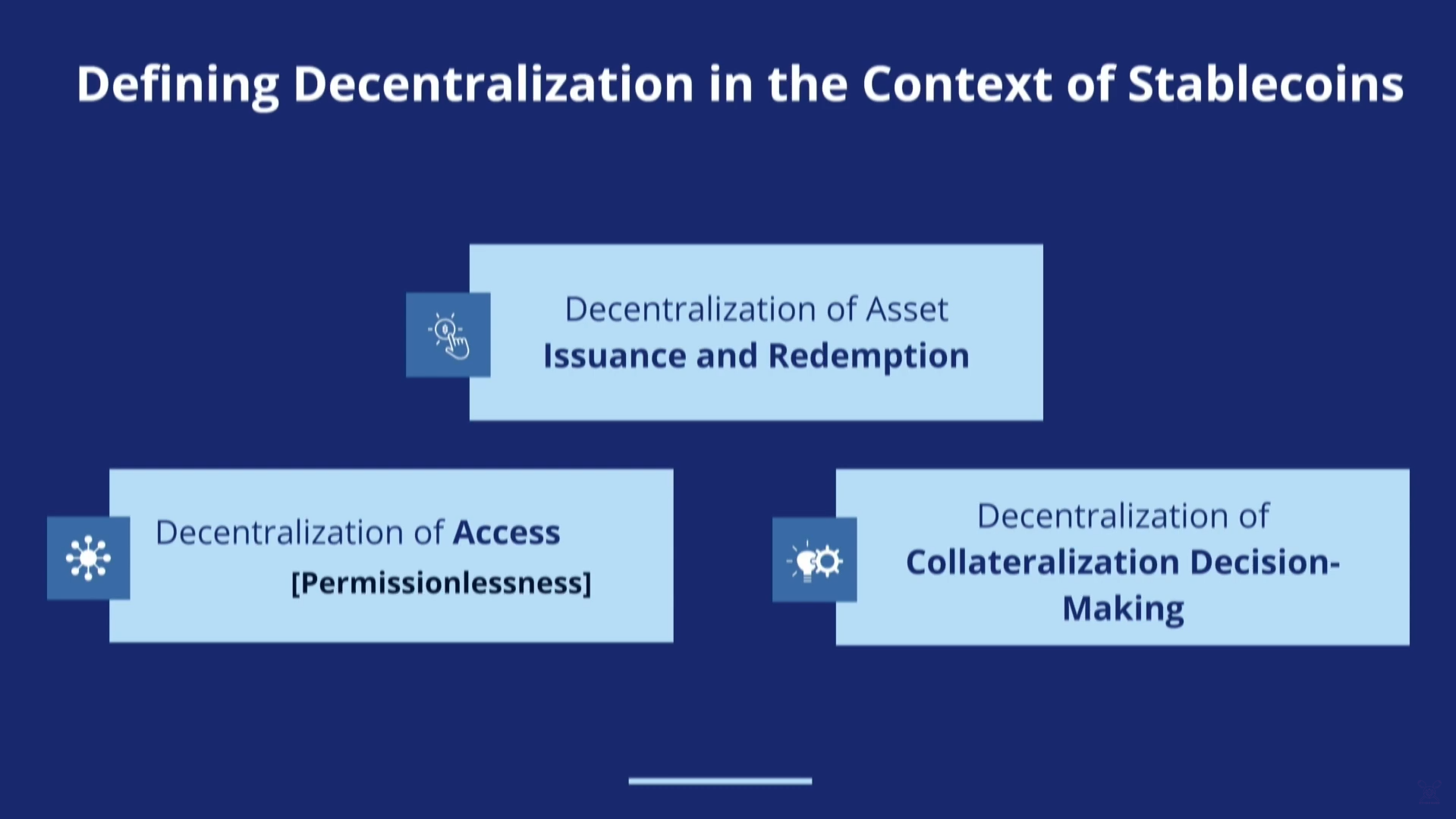

What does it mean for a stablecoin to be decentralized ? (4:20)

There are three main aspects of decentralization for stablecoins :

- Issuance and redemption : How coins are created and exchanged back into the original money. More decentralized options let anyone participate without permission. Centralized ones limit access.

- Collateral : What assets back the stablecoin value. Decentralized options spread collateral across many holders. Centralized ones concentrate assets in a single party.

- Governance : Who controls parameters and rules of the system. Decentralized governance spreads control through voting. Centralized governance concentrates control into a small group.

Decentralization is a specter (5:50)

Fully decentralized stablecoins like LUSD from Liquity have open participation, distributed collateral, and no governance. No central party controls the system.

Partially decentralized stablecoins like DAI from MakerDAO have decentralized governance and collateral but require permission for issuance and redemption. There is still some centralization.

Fully centralized ones like Tether have collateral, issuance, redemption, and governance controlled by a single company. This concentrates risks and requires trusting the company.

Why does decentralization of access matter ? (7:15)

A key goal of DeFi is to make financial services open to anyone globally. Requiring identity verification (KYC) or permission goes against this ethos.

Decentralized access for stablecoins means anyone can obtain and use them without restrictions. This achieves the DeFi goal of democratizing finance.

It also enables full composability, which means the ability to plug stablecoins into other DeFi apps and services. Composability is crucial for DeFi innovation. Restricted access limits composability.

Centralized issuance and redemption gives control to a single party. This introduces risks like :

- Freezing or seizing assets, harming users.

- Central party mismanaging collateral or commit fraud.

- Governance making decisions that negatively impact users.

- Compliance rules blocking users from accessing funds.

Smart contracts avoid these risks by automating issuance and redemption per coded rules. No centralized control means no centralized risks or ability to block users.

The actual big trend (9:20)

The big trend of the year so far has been yield bearing stablecoins from Real World Assets (RWAs). The reason why Slater (the speaker) wanted to give this talk is that we have to be concerned about the decentralization tradeoffs that occur for most of those models.

Many stablecoins now offer yield to users. This is positive as it shares value, aligning with DeFi principles. However, these yield-bearing stablecoins often have downsides:

- KYC requirements : Needing identity verification goes against DeFi's open ethos. It limits composability as other DeFi apps can't integrate KYC assets without legal risk.

- Restricted transfers : Some claim to be permissionless but limit transfers to whitelisted parties. Again this restricts composability with permissionless protocols.

- Centralized issuance : Even if sharing yield, centralized entities take fees extracting value. Fully decentralized systems like DAOs share value more fairly.

- Custody risks : Centralized collateral custody opposes DeFi's aim of eliminating counterparty risk. MakerDAO's fully decentralized collateral pool is ideal.

Users should weigh the yield benefits against the decentralization tradeoffs.

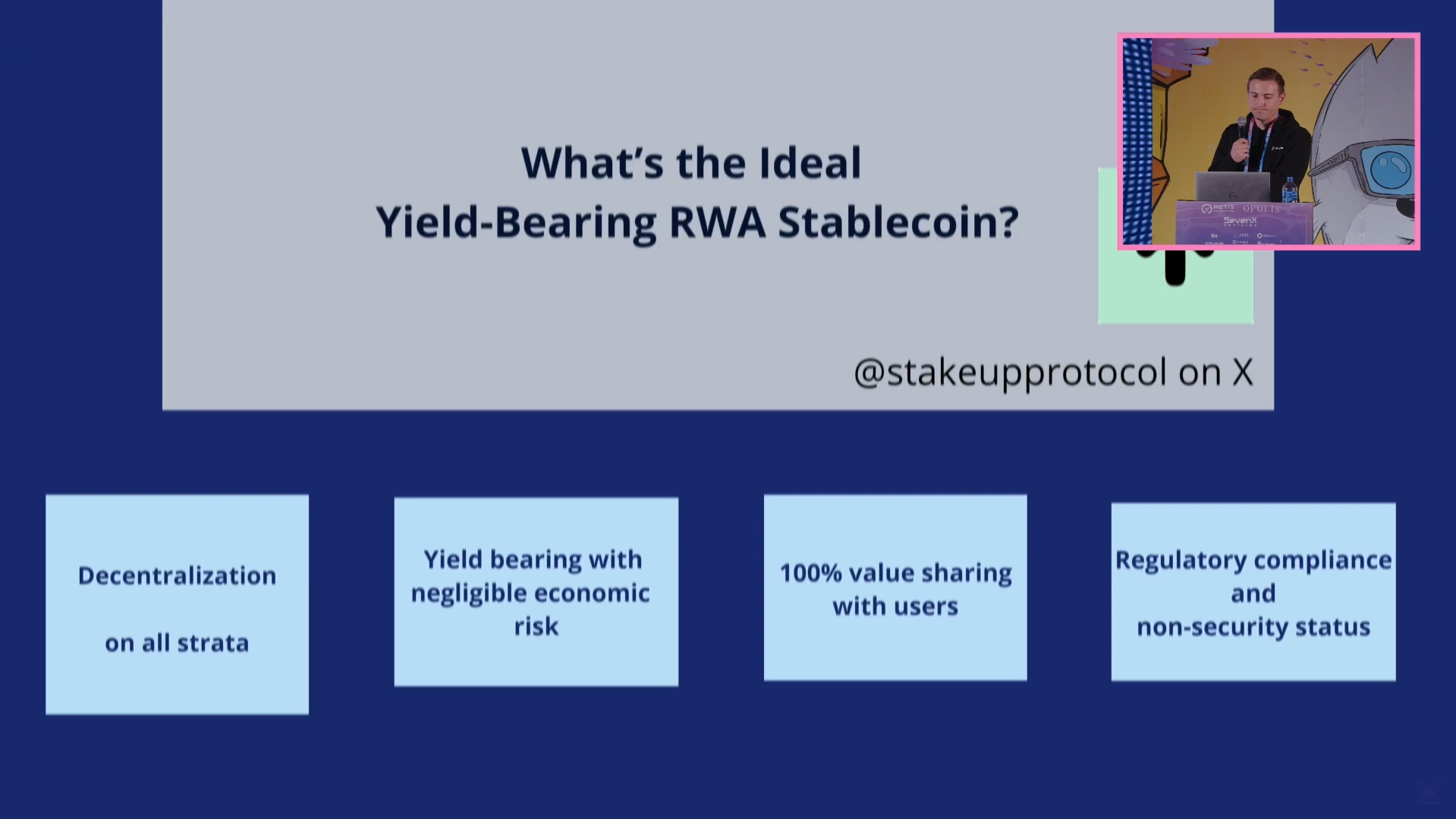

What is the ideal yield-bearing RWA stablecoin ? (12:25)

An optimal yield-bearing stablecoin for DeFi would have these features :

- Fully decentralized : No centralized entities controlling issuance, redemption, collateral, or governance

- Yields from risk-free assets : Interest comes only from very safe assets like cash and government bonds. Avoids risky investments that could lose money

- 100% value sharing : No fees taken by any centralized party, and all yield passed to users to be completely fair

- Regulatory compliant : Structured in a way that is legally compliant and not at risk of being considered a security

This is something StakeUp Protocol (the speaker's project) is trying to achieve.