The future of DeFi: intents (1inch at EthCC)

Source: https://www.youtube.com/watch?v=07UZT-Rnc84

Intents are planned actions aimed at achieving desired goals

Intent-based architecture focuses on what users want to achieve, not how they achieve it

What are intents?

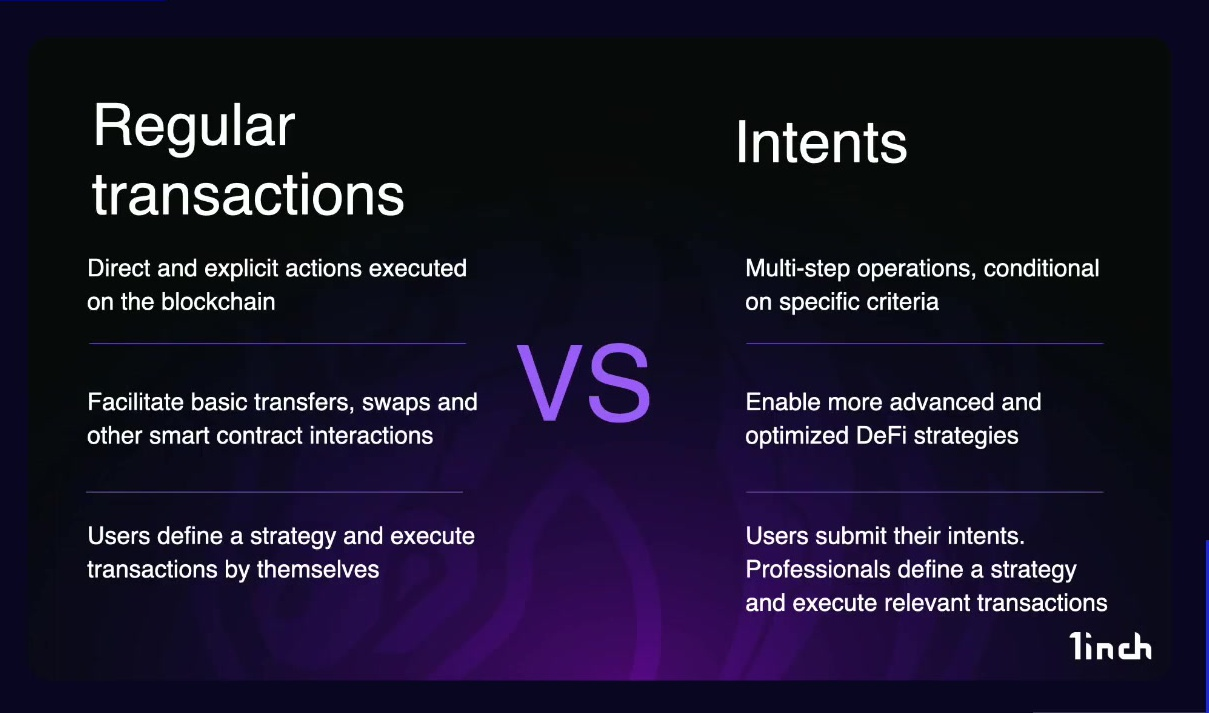

Traditional blockchain transactions:

- Require signing, creating, and sending to the blockchain

- User pays for transaction

- Transactions are public and visible in mempool, making them vulnerable to attacks

Intents Traditional transactions:

- Can be multi-step operations based on conditions

- Allow for complex strategies

- User declares what they want, but doesn't execute it themselves

- Professional executors handle the execution

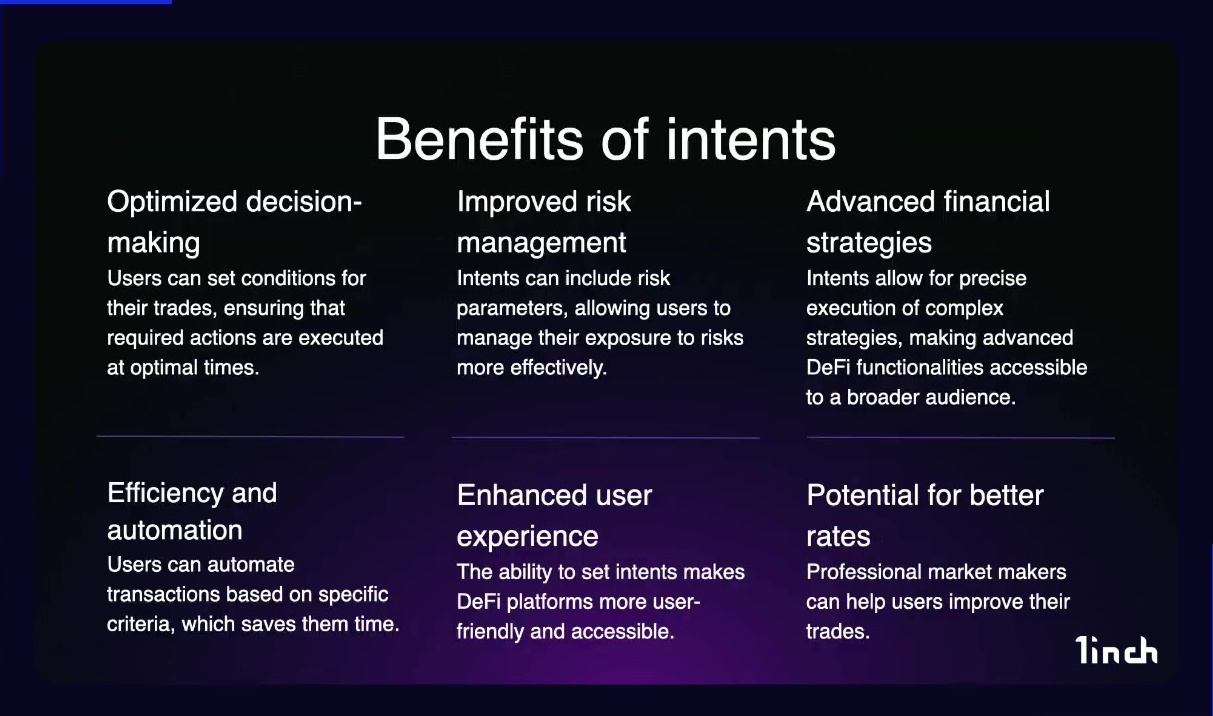

With intent, users focus on what they want, not how to achieve it. So they can include multi-step interactions, execution can be time-based, and intents reduce the risk of being exploited by malicious actors.

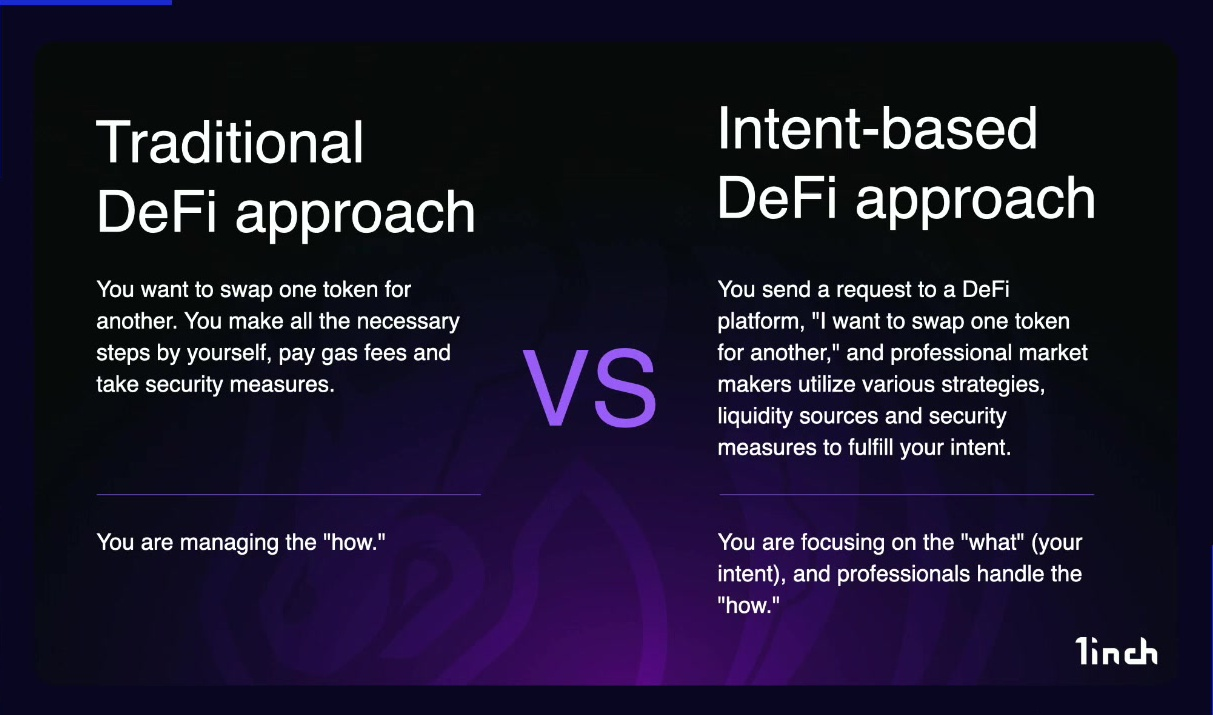

Example with the traditional swap:

- User finds an exchange (e.g., Uniswap, Sushiswap, 1inch)

- Select assets to swap

- Creates, signs, and sends transaction

The user manages the "how" of execution

Intent-based swap:

- User declares desire to sell one asset for another

- Shares intent with professional executors

Executors handle the "how" of the swap

What intents currently exist in the DeFi market? (4:40)

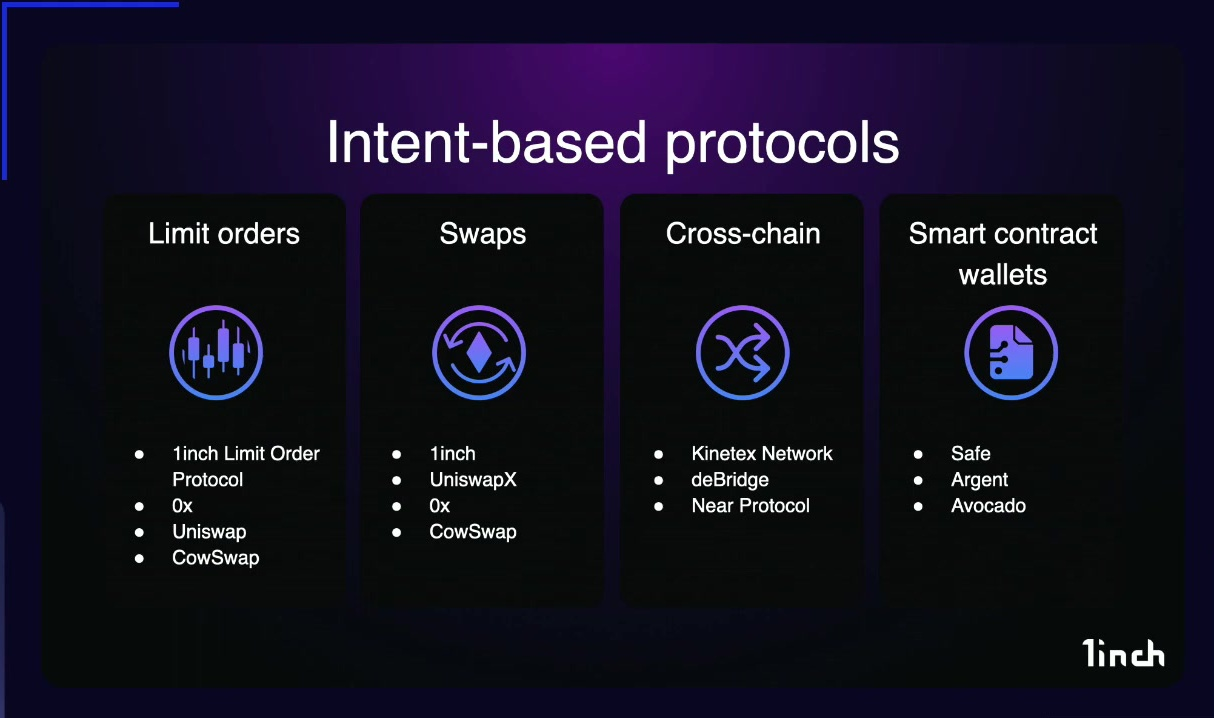

Almost everything is possible with intent. The main use cases are limit orders, swaps, cross-chain, and smart wallets.

Liquidity providing (LP) could theoretically be done with intent. It isn't widely implemented yet, but it should be because LPs face vulnerabilities. Lots of users have lost money due to front-running, sandwich attacks, and Just-In-Time Liquidity.

Some startups are building intent-based cross-chain swaps. The most popular attempt is ERC-7683 built by Uniswap and Across.

Limit orders were introduced around 2017-2018 by 0x. 1inch entered the market around 2021 and now dominates with 85% market share.

Other players: Uniswap (with limit orders) and CowSwap

There are different approaches for intent-based swaps:

- CowSwap uses resolvers to provide call data, selects the best execution for users, and settlement done by the team

- 1inch Fusion uses the Dutch auction approach, to ensure decentralization and independent settlement on the blockchain

- UniswapX is also based on a Dutch auction mechanism

- 0x implements intent-based swaps. The protocol executes trades itself and pays gas costs for the user

In short, multiple players are entering the intent-based DeFi space. There are different approaches to solving similar problems (e.g., Dutch auctions vs. team-based settlement)

But they have the same objective: improving user experience (e.g., paying gas costs for users)

1inch fusion (7:15)

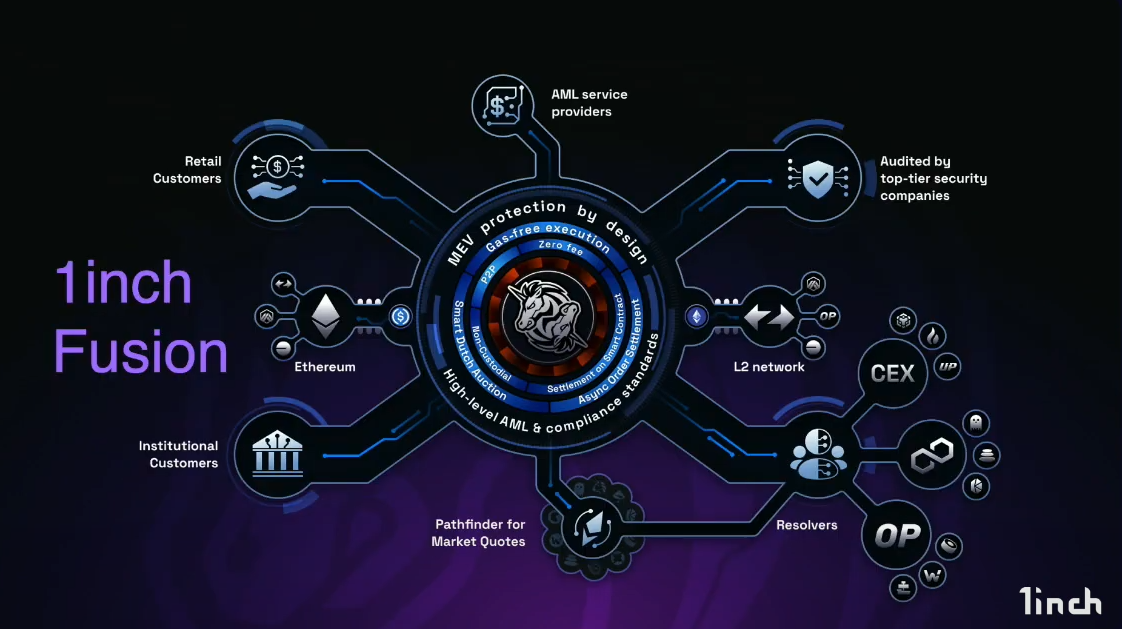

1inch Fusion Overview:

- Based on limit orders and smart contract technology

- Users sign off-chain orders

- Orders are shared with market makers and resolvers

- Supports both retail and institutional customers

- Supports multiple networks (e.g., Ethereum to ZKSync)

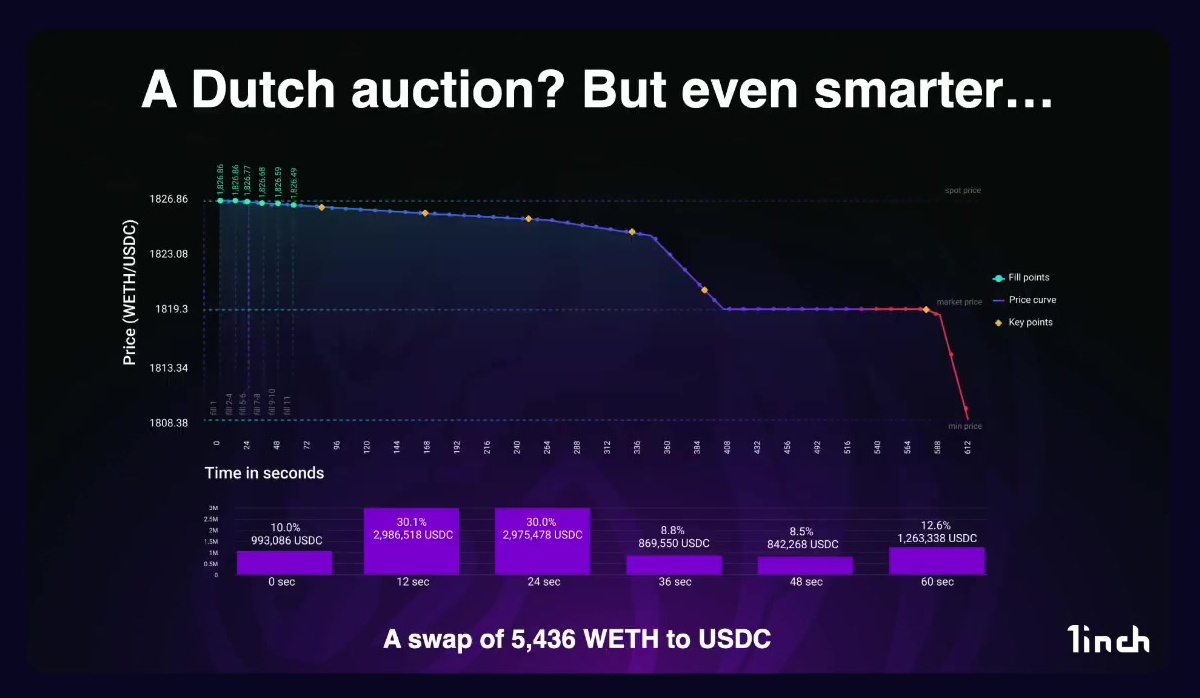

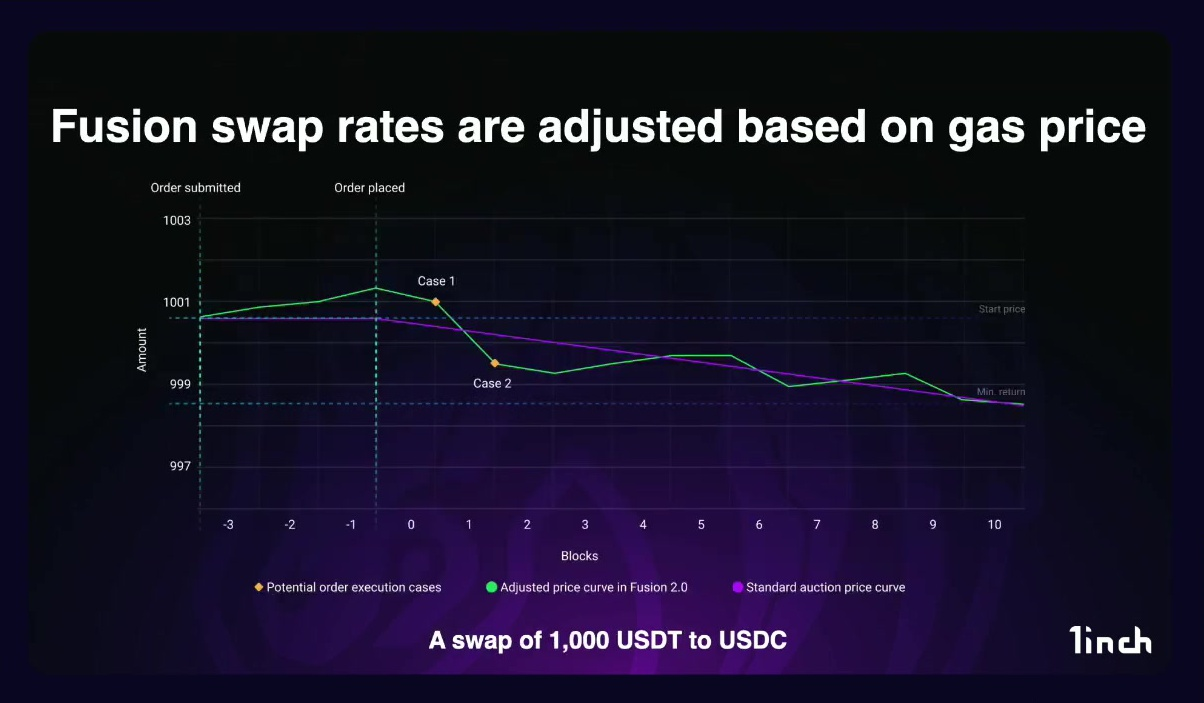

Dutch auction aims to maintain independent execution/settlement:

- Based on a non-linear function based on market liquidity

- Attempts to sell assets over time for better rates

- Allows partial fills by market makers

- Curve follows current market liquidity

1inch is currently building fusion V2 to improve settlement speed and efficiency, so most orders would be executed shortly after creation.

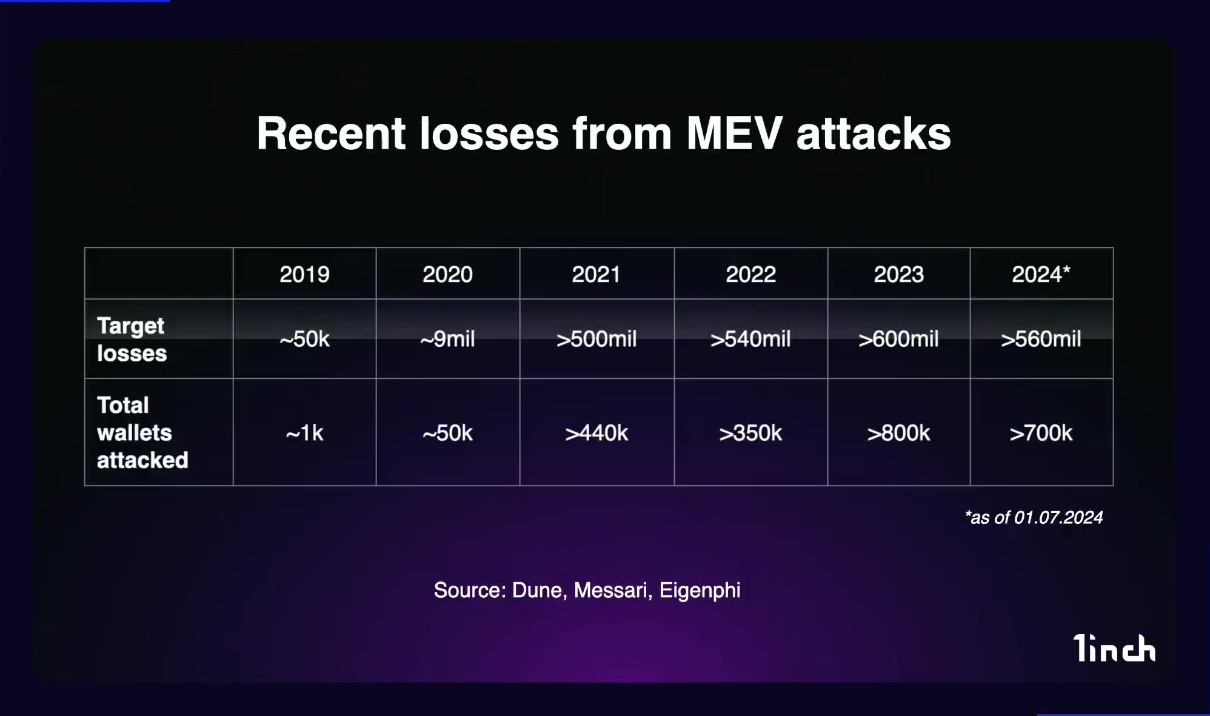

MEV attacks have resulted in significant losses for users. Sergej (the speaker) talks about his personal experience of losing 10 ETH to MEV attack

1inch solves MEV protection by design using an Intent-based DeFi approach

Users sign off-chain messages (intents), so there is no direct gas payment by users. Gas costs can potentially included in the rate, and professional market makers/arbitrageurs execute only when profitable.

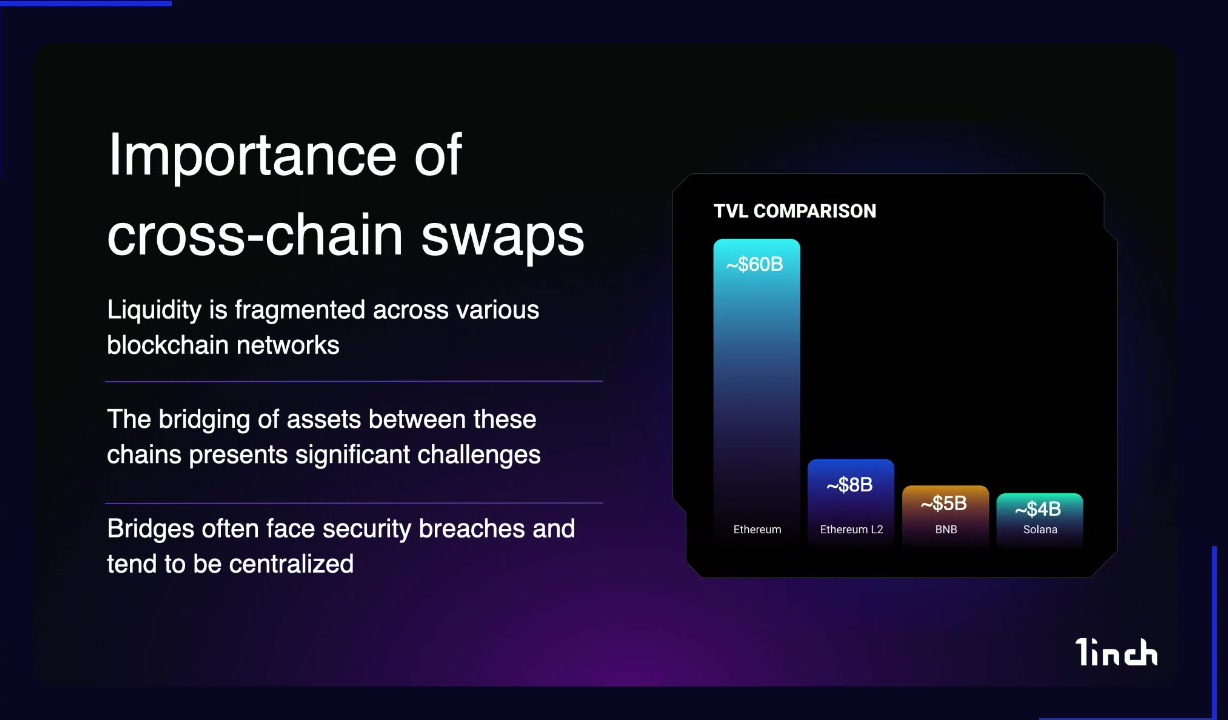

Future is cross-chain (14:30)

Liquidity must be cross-chain to prevent large price impacts on single chains. Bridging assets between chains is a significant challenge, but we must overcome this challenge.

Speaking of which, 1inch is building a new feature called "1inch atomic swaps, which enables cross-chain swaps with best execution across markets and platforms. (coming soon)

Intent-based systems to improve user experience. Users should be able to set orders without worrying about gas fees or execution details.

1inch introduced 1inch Web3 RPC in their dev portal. This allows developers and companies to easily make Web3 calls to blockchain nodes.