The DeFi Collective 26/10/2023

Source : https://twitter.com/DeFiCollective_/status/1716381990713241886

The problem with Real World Assets, a.k.a. RWAs (04:00)

If we analyze a protocol in the perspective of resiliency, there is no trustless way to make the link between an off-chain asset and what it represents on chain.

Some examples :

- Tokenized real estate are relying on some form of company somewhere in the real world that manages those assets

- USDC exists and is backed thanks to off-chain entities. The company Circle is responsible for its issuance, cash reserves are held in various US banks and USDC depegged because Signature bank, Silicon Valley Bank and Silvergate declared bankruptcy

They might be represented on-chain, but they are essentially at the whim of a few centralized actors that is doing the intermediary. That's why Tokenbrice would like to highlight RWA-free stablecoins like crvUSD, f(x), Liquity or Gravita.

The speakers introduce their stablecoins

f(x) Protocol (8:30)

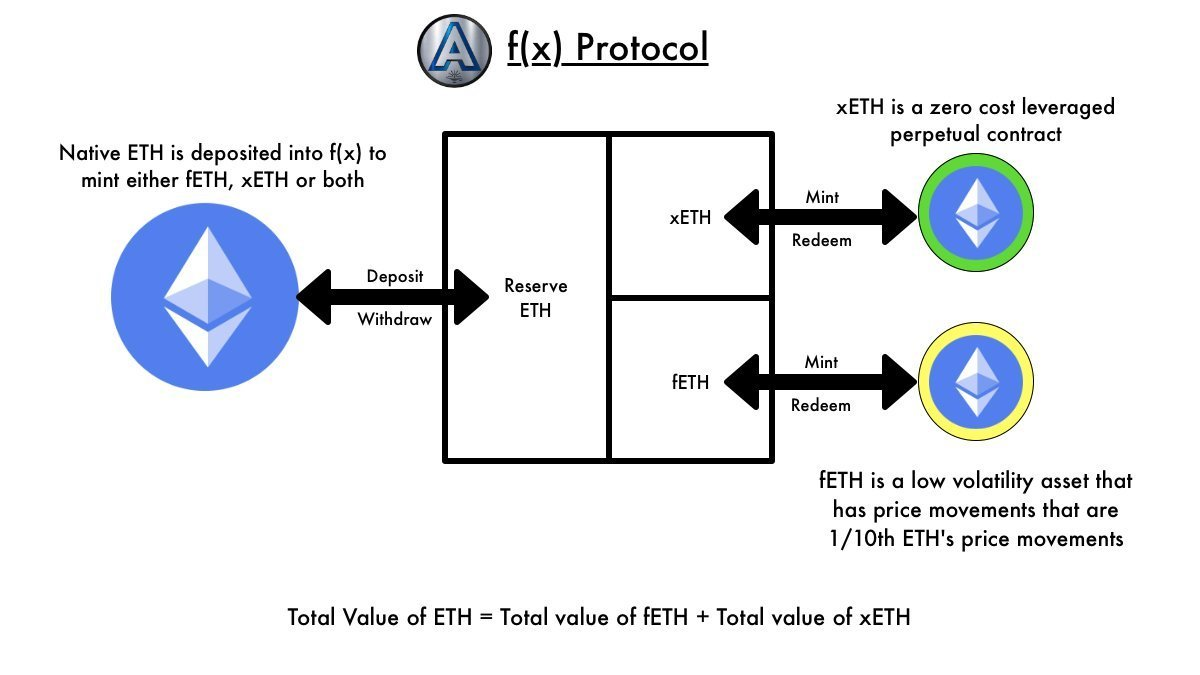

f(x) Protocol was created by AladdinDAO in reaction to the USDC depeg in march 2023. It takes ETH and it separates it into two different tokens :

- fETH is a low volatility token that moves at 10% of the price movements of ETH

- xETH can be imagined as leveraged ETH.

Only staked ETH can be used to mint those tokens. This means they don't take any exposure to the real world, both on the reserves side and on the side of issued stablecoins.

Liquity (17:30)

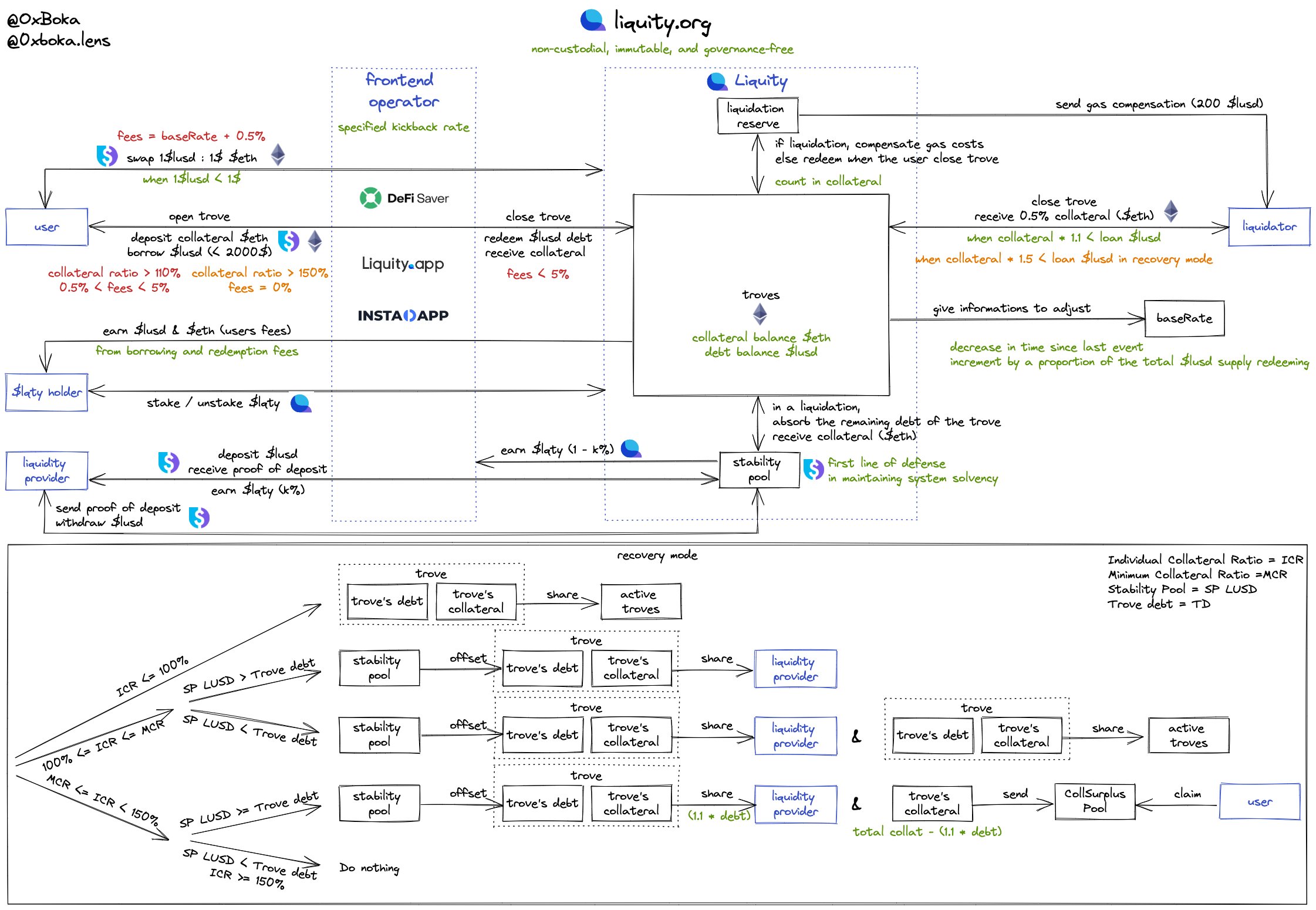

Liquity is known to be the current most resilient stablecoin. During the USDC depeg, Liquity's LUSD defended peg the most quickly of all of the other stables.

Some Liquity features :

- Technical risks are at minimum : Liquity is only on Ethereum mainnet and only ETH can be deposited to mint LUSD

- Smart contracts are immutable, and there is no official front-end

- There is no governance, only game theory

Those wishing to issue LUSD pay 0.5%-5% borrowing costs depending on demand. This fee is hard coded and there is no interest rate

Liquidations on Liquity don't depend on a fixed liquidation threshold like MakerDAO or Aave. The system looks more like a "time bomb".

The user with the lowest collateral ratio carries the bomb, and it explodes on "redemption", i.e. when a user redeems his LUSDs to recover his ETHs.

Gravita (12:30)

Gravita is a friendly fork (open source copy) of Liquity, with several differences :

- We can mint stablecoins with ETH and Liquid Staking Derivatives (stETH, rETH...)

- Gravita is deployed on mainnet and Arbitrum. They will deploy on other Layer 2s later

crvUSD (22:15)

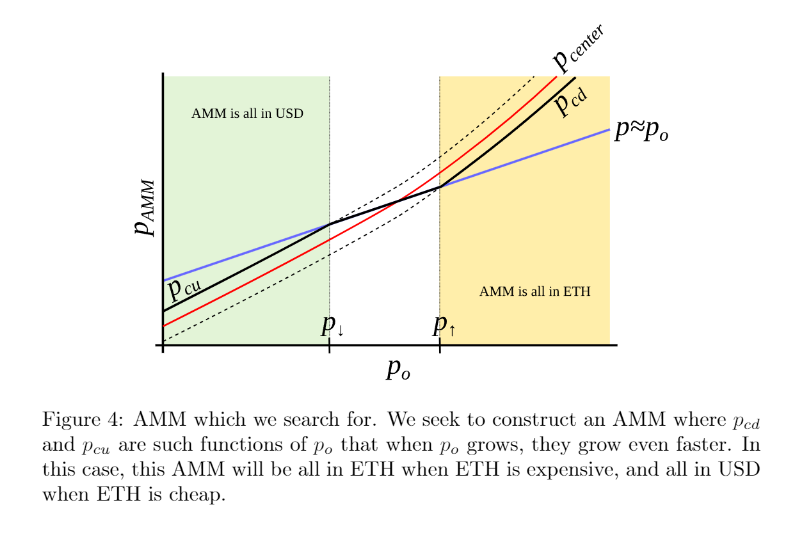

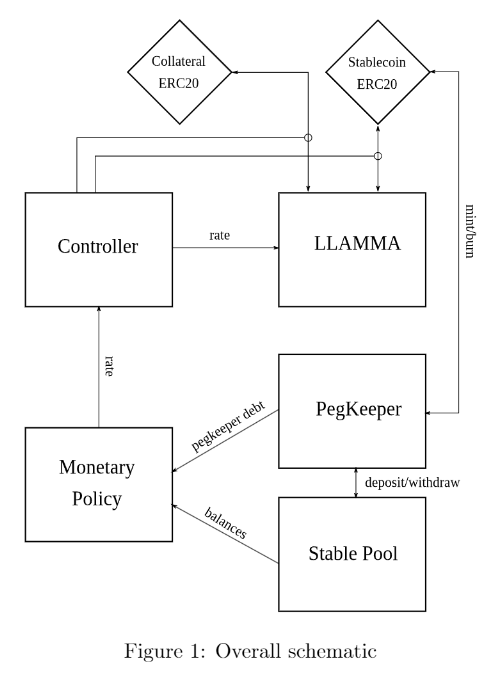

crvUSD is the stablecoin issuer from Curve. The innovation proposed by crvUSD is "LLAMMA" : Instead of a classic liquidation system, positions with volatile assets are gradually converted into stablecoins when the value of the collateral decreases, and conversely when it increases.

Only ETH and WBTC can be deposited to mint crvUSD. The speaker emphasized that Curve's DAO, which votes to add new collateral, analyzes its quality and the risks involved.

Although the WBTC (Bitcoin as an ERC-20 on Ethereum) is minted and owned by a centralized company (BitGo), Curve's DAO thinks that the counterparty risk is low enough, so they don't have a policy of excluding RWAs. That said, assets backed by real-world loans or real estate would probably never be added.

Discussions about building stablecoins

Their take about stablecoins

Gravita : We need stablecoins that just behave differently in the sense that they are not subject to traditional finance (a.k.a. "TradFi") risk.

Liquity : they prioritize resilience above all else, even if this means a smaller market, because in the long term resilience will be the most important property of stablecoins.

crvUSD : RWAs carry a "timing risk" because someone may have more information and profit from it at the expense of others. With assets on the blockchain, signals are more visible if something happens.

f(x) Protocol : There is a niche for stablecoins that are unstoppable and disconnected from TradFi, which is poorly filled.

Are RWAs necessary ? (27:00)

Context : Speakers were talking whether RWAs backed stablecoins are necessary or if crypto-native stablecoins without real world exposure are preferable.

We don't need real world exposure...

While crypto-native stablecoins emphasize resilience against censorship and risks, if they don't have enough liquidity to support growing DeFi ecosystems being built on top of them, they can't provide a solid enough foundation as an alternative to real-world backed stablecoins like USDC.

There is a risk that if the liquidity isn't there, DeFi may end up largely built on top of stablecoins with real world asset exposure anyway.

...Or do we ?

Perhaps crypto-native stablecoins should start by emphasizing resilience first rather than liquidity, as the most resilient design is the hardest to achieve.

Over time, as innovations happen, they may become more scalable, and create usecases where RWAs can be used.

Consensus

Real-world assets are not inherently bad, and blockchains help connect them, but they should be kept off of stablecoin collateral backing widely used in DeFi. Otherwise there is systemic risk introduced.

How to build resilient stablecoins that scale ? (30:00)

A new model is the idea of a reserve-backed stablecoin, where the protocol acts as a built-in source of liquidity for its own stablecoin. This could scale up liquidity without requiring RWA exposure as collateral.

The reserve-backed model that protocols like Liquity V2 and f(x) use can help scale up crypto-native stablecoins by acting like a built-in market maker, enabling easy minting and redeeming of the stablecoin.

Plan update for Liquity V2 : it aims to back the stablecoin with staked ETH, allowing staking yields to be earned. There will also be a borrowing feature and leverage feature for going long ETH with downside protection.

Dyad founder entered the chat (39:00)

The founder of Dyad Protocol joins the discussion to provide some perspectives on using RWAs as collateral for stablecoins.

RWAs cover a wide spectrum of assets with different properties. A stablecoin connects those who want dollar liquidity against an asset they have, with those who want to earn a yield on dollar liquidity they provide.

They have additional risks beyond just price risk though, like regulatory and custody risks. So stablecoin designs should treat the assets as able to go to zero at any time. Issues also arise around permissionless liquidations if the RWA requires KYC ("Know Your Customer", identity verification), to custody.

Dyad Protocol handles this by having no users directly custody the RWA - it stays in vaults controlled by the immutable smart contracts.

Instead of selling the RWA in a liquidation, liquidators just gain the rights to mint stablecoins against that RWA's value. This avoids issues in needing to sell potentially illiquid assets.

Protect from counterparty risk

The crvUSD exemple (47:00)

crvUSD is the only stablecoin issuer to integrate RWAs with WBTC, so the protocol controls real-world asset (RWA) exposure through its "peg keepers" mechanism.

The peg keepers involve special pools that contain crvUSD paired with major centralized stablecoins like USDC :

- The protocol can mint new crvUSD into these pools when crvUSD is above its $1 peg, helping push the price back down.

- When crvUSD drops below its peg, the protocol can remove the pooled liquidity to sell the other stablecoins and buy back crvUSD.

So there is some reliance on external stablecoin prices. However, the exposure is contained because the asset held is a 50-50 CRVUSD-USDC pool token, not direct holdings of the external stablecoins. The maximum risk is limited by the total size of these special pools.

So there is some real-world exposure. An event like USDC depeg would likely affect crvUSD but it is designed to be capped based on the pool ceilings.

RWAs exposure is small (53:00)

RWAs exposure and leverage in DeFi is still quite small compared to what it could grow to. As capital efficiency increases, DeFi's exposure to these assets could rapidly rise.

While they have a place, real-world assets on chain tend to be illiquid. So in a mass deleveraging event, trying to sell them could crash their value.

RWAs are hot spice (58:00)

This metaphor explains that they need to be diluted enough not to "burn" the protocol.

In DeFi, markets operate 24/7 with fast finality. But RWAs can expose protocols to real-world limitations, like entities being closed on weekends, as happened with USDC recently.

Another example was a stablecoin partially backed by real estate. When a bank run happened, people realized the real estate collateral was very illiquid, taking months to sell off, even if it had a high nominal value.

Managing risks is essential (1:00:00)

Protocols need mechanisms to account for potential delays or inability to instantly liquidate RWAs. Dyad Protocol's approach is minimizing RWA collateral, making it the last to be liquidated, and ensuring plenty of buffer from highly liquid crypto assets to absorb events before relying on selling RWAs.

The key mistakes are not properly accounting for risks of RWAs through dilution with enough liquid collateral, and lack of buffers that don't require instantly selling illiquid RWAs.

Dealing with governance

Responsibility and token holders (1:03:00)

While permissionless DeFi allows anything, protocols should still approach RWAs responsibly for ecosystem stability. However, governance token holders may not always care about responsibility, they just want high yields.

High yields could lead to protocols taking excessive RWA risks, and they can't be audited on-chain, adding to the uncertainty.

Educating users is important so they understand the true risks involved. Otherwise, there could end up being more situations like Terra's collapse.

An example is brought up of a protocol called Tai Money, which requires approval from stablecoin holders before adding new collateral types. This helps connect governance power to actual stablecoin exposure, avoiding whales with little stake controlling decisions.

Governance tokens utilities (1:06:30)

Since Liquity has no governance token, it is not relevant to this topic. For the other protocols represented like crvUSD and Gravita, giving stablecoin holders veto power over new collateral is discussed.

Governance token holders may not want to relinquish power or trust stablecoin holders to make good decisions. There are also practical challenges in getting stablecoin holders engaged in governance votes.

Some examples :

- Balancer's veBAL token which requires ETH to be locked to vote, connecting governance power to financial exposures.

- Yearn Finance's yETH token where holders vote on yield strategy composition because they are exposed to those risks.

For Gravita's upcoming governance plans, they want to give voice to all major stakeholders - stablecoin holders, governance token holders, and borrowers. Ideas like governance multipliers and veto powers are being considered to balance influence.

Realigning the interests (1:14:30)

f(x) Protocol's focus in adding new collateral assets is minimizing risk first, and maximizing yield second. They may add other major liquid staked ETH assets like rETH or frxETH as they have similar risk profiles to their current stETH collateral.

Liquity V2 plans to utilize staked ETH to bring some native yield to their reserve-backed stablecoin model. The yield can then be distributed out to users staking the stablecoin, rather than the protocol keeping it like USDC and USDT do currently with their treasury yields.

Tether (USDT) has made several billions in net profits from the US treasury bonds in their treasury

The goals are to keep yields crypto-native, through assets like staked ETH, and give users the yield the protocol earns through mechanisms like staking rewards, leverage trading fees, and liquidation fees.

Ending thoughts (1:21:00)

There is a place for both real-world asset (RWA) backed stablecoins and crypto-native stablecoins without RWA exposure. They serve different needs and have different tradeoffs.

Crypto-native stablecoins are more decentralized and censorship resistant, while RWA-backed ones can be more scalable. This is similar to the scalability vs decentralization tradeoff between blockchains like Ethereum and Solana.

There is also increasing competition among RWA-backed stablecoins which helps drive innovation. And new reserve-backed models for crypto-native stablecoins can improve scalability as well.

RWAs serve as a bridge to the outside world. Some connection is needed for crypto to make an impact, but risks should be minimized.

Market forces and incentives determine if a stablecoin ultimately holds its peg or not. Protocols aim to make sticking to the peg the path of least resistance.

The advice for builders is to treat RWAs as a last resort option when all other design choices fail to solve a need. Relying on them by default risks stability and resilience.

There is lots of experimentation happening now with many new stablecoin designs that take different approaches. In the end, the most robust models will emerge over time.