Stablecoins as the next Central Bank (Centrifuge at EthCC)

Source: https://www.youtube.com/watch?v=RHK2kgnWgd0

What is a central bank?

Central banks are created by countries or organizations to manage the currency used by people in those countries.

They are responsible for increasing or decreasing the money supply and ensuring financial stability, primarily by targeting inflation.

In crypto, people often mistake changes in money supply alone for inflation, which is incorrect.

Inflation occurs when the growth of the money supply outpaces the growth of the value of goods and services in an economy.

How Central Banks Target Inflation:

- Buying or selling assets: This is how they effectively "print" or "burn" money.

- Adjusting interest rates charged to banks. These interest rates influence the rates banks charge their customers for loans.

Banks are required to keep a percentage of their holdings in cash with the central bank.

Central banks are meant to be independent. However, governments often exert control over central banks to influence currency use globally. Governments have strong incentives to control foreign policies and global trade to impact their currency.

Cassidy (the speaker) suggests that stablecoins have the potential to become the next version of central banks.

Cassidy mentions a previous talk given at EthCC in 2019, which goes into more detail about inflation and how it applies to token networks.

Control the currency (5:20)

Control of currency by nation-states equates to control of world trade. The U.S. and China have significant control over global policies due to their currency dominance.

Most global trade is conducted in U.S. dollars, and China is pushing for increased use of the renminbi, especially in Asia.

The current system can put many people into terrible financial situations due to currency fluctuations and policy changes:

- Brazil, which conducts substantial trade in U.S. dollars, is forced to react to U.S. central bank policy changes.

- Countries have strong incentives to defend their currencies, often through force. Many wars and conflicts are rooted in the defense of currencies and control of global trade.

Stablecoins offer the possibility to decouple currency from domestic nation-state policies. A complete separation from nation-state currency control is unlikely. However, stablecoins offer a step towards more independence in global trade currencies.

How can stablecoins change this? (8:20)

Limitations of Traditional Central Banking:

- Central bank policies have limited and uncertain pass-through to individuals (known as the transmission mechanism).

- Current central bank stimulation methods don't directly provide money to individuals.

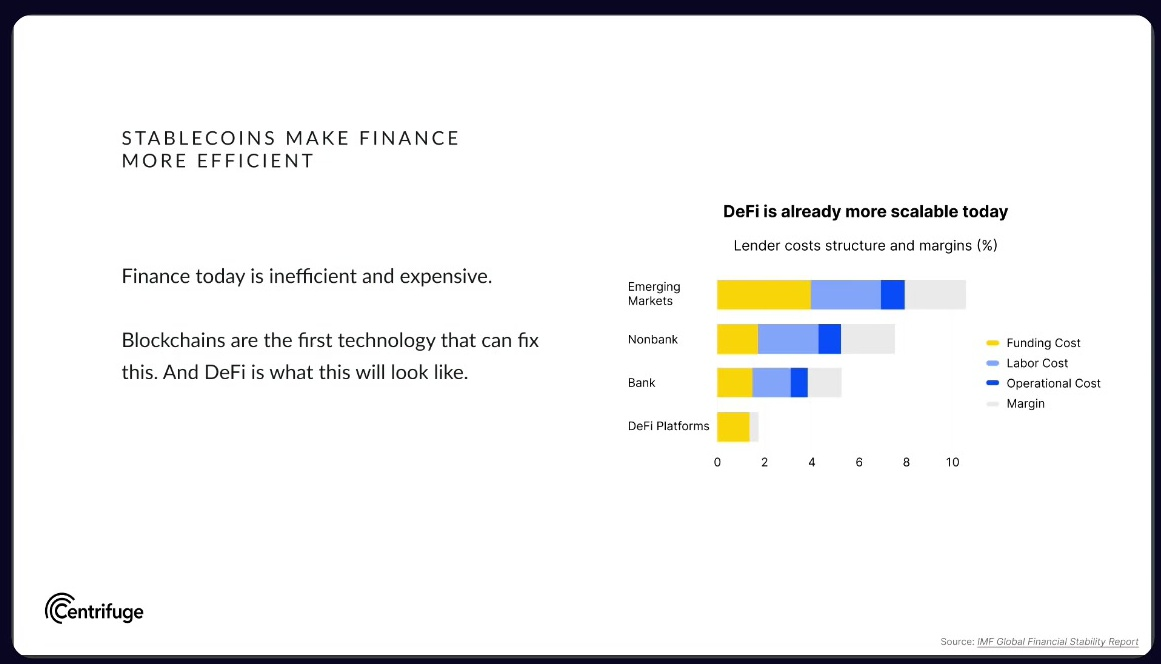

Blockchain technology is making finance more efficient, easier to use, and more accessible. Unlike traditional central banking, stablecoins allow individuals to interact directly with the currency.

This is a significant breakthrough in central banking concepts.

Stablecoins could potentially replace the concept of trickle-down economics, as they offer the possibility of direct economic impact on individuals.

If successful, stablecoins could lead to nation-states losing control over currency, but this will likely face significant resistance from those in power.

Challenges may include regulatory pushback and pressure from beneficiaries of the current system.

Cassidy emphasizes the importance of creating decentralized stablecoins despite the challenges and encourages the audience to have the energy to face the upcoming fight against established powers.

More than a technology (14:20)

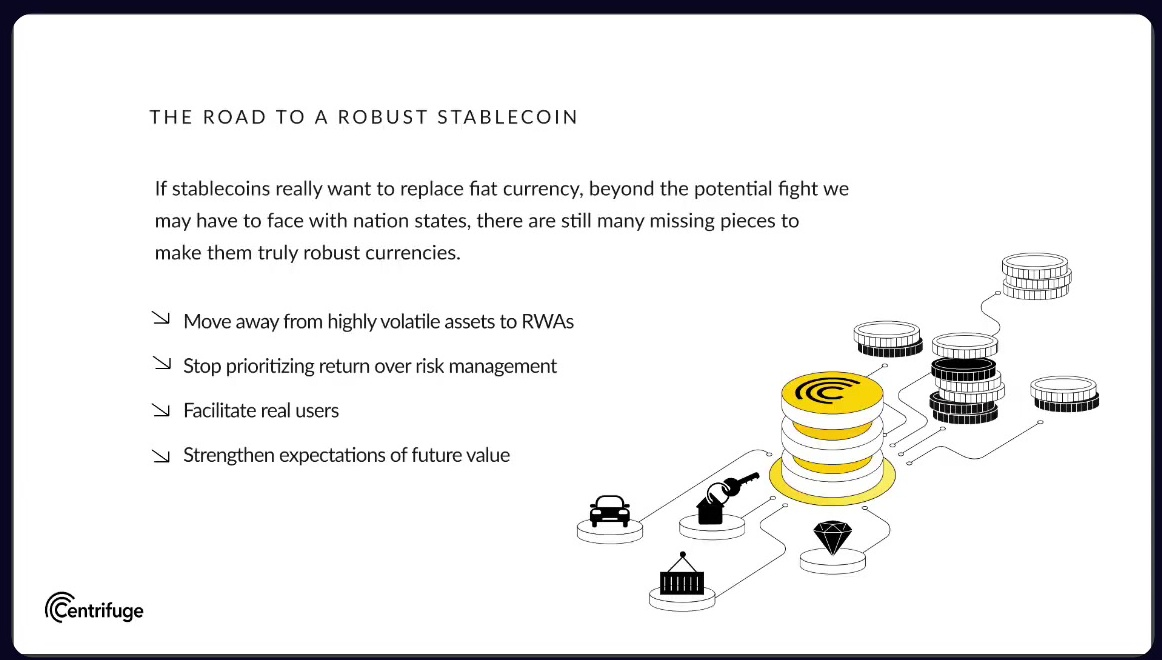

Fundamental building blocks are missing in current stablecoin ecosystems to replace fiat currencies:

- There is a tendency for stablecoins to be backed by crypto-native assets only. We need more diversity in assets, especially RWAs

- Very few people use stablecoins to buy goods and services of real value.

- Current stablecoins prioritize high returns, often leading to riskier assets as backing.

Cassidy expresses a desire for more individual agency over currency, separated from foreign and domestic policies.

Perception is everything. Currency stability is largely based on perception and expectations. The user has to believe in the stability and future of a currency.

Questions and answers (19:45)

Can you speak more about the positive knock-on effects of having a stable decentralized currency that is global?

A global stablecoin could decouple international trade from the influence of specific national currencies (like the US dollar).

Countries wouldn't be as affected by the domestic policies of nations whose currencies dominate global trade. For example, Brazilian exporters trading with Nigeria wouldn't need to rely on US dollars

A global currency would better serve international transactions that don't involve the country issuing the currency.

Regarding stablecoins backed by real-world assets, is there a specific asset you have in mind, and how would you manage risk?

- Government bonds

- Stocks

- Mortgages

- Invoices.

About risk management, Cassidy mentions Centrifuge's work with stablecoins like Maker and Aave on risk management strategies.