Seer, a next generation prediction market (Kleros at EthCC)

Source: https://www.youtube.com/watch?v=1ChW3h-bDBc

Prediction markets

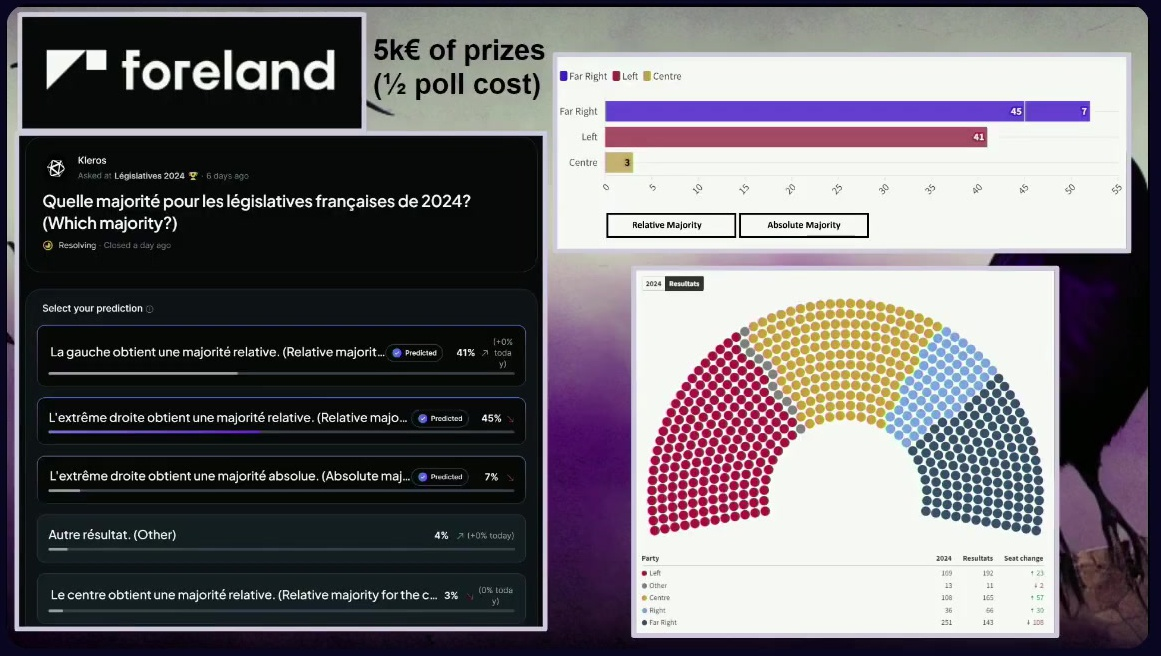

A prediction market for the French election provided more accurate results than traditional polls. The market gave a 41% chance of the left winning, which happened, while most polls focused on the far right winning.

It provided more comprehensive information, including probabilities for various outcomes at a lower price. The prediction market costs about half the price of a traditional poll (€5,000).

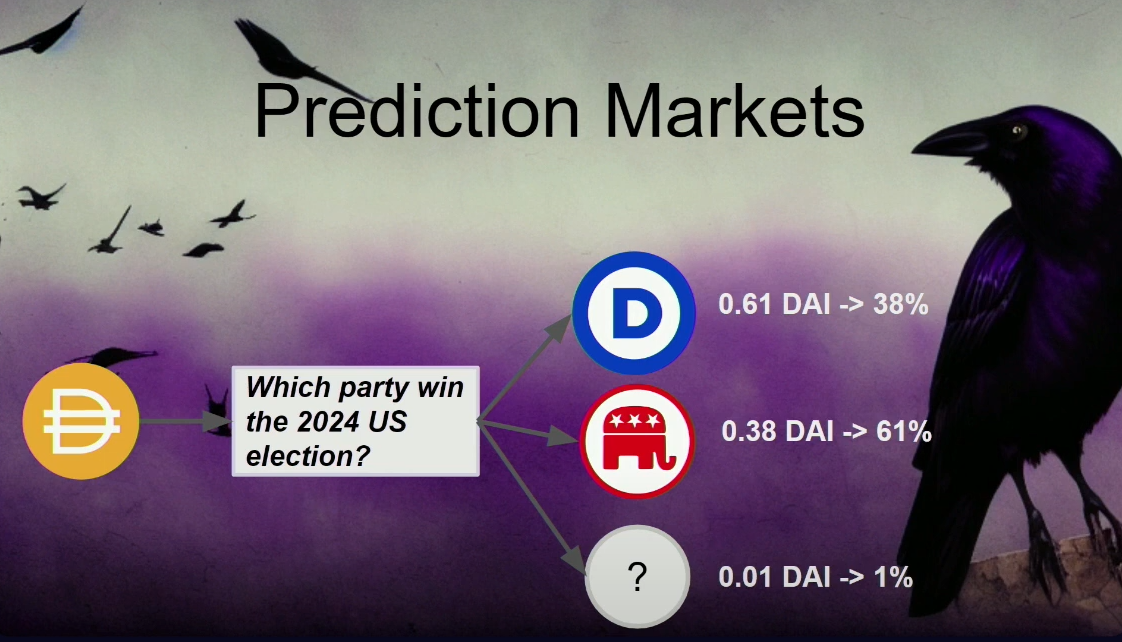

The basic structure of prediction markets has tokens that represent different outcomes (e.g., different political parties winning an election). These tokens are traded and their prices reflect the perceived probability of each outcome.

Example: If a "Democrat wins" token trades at 61 cents, it suggests a 61% chance of Democrats winning.

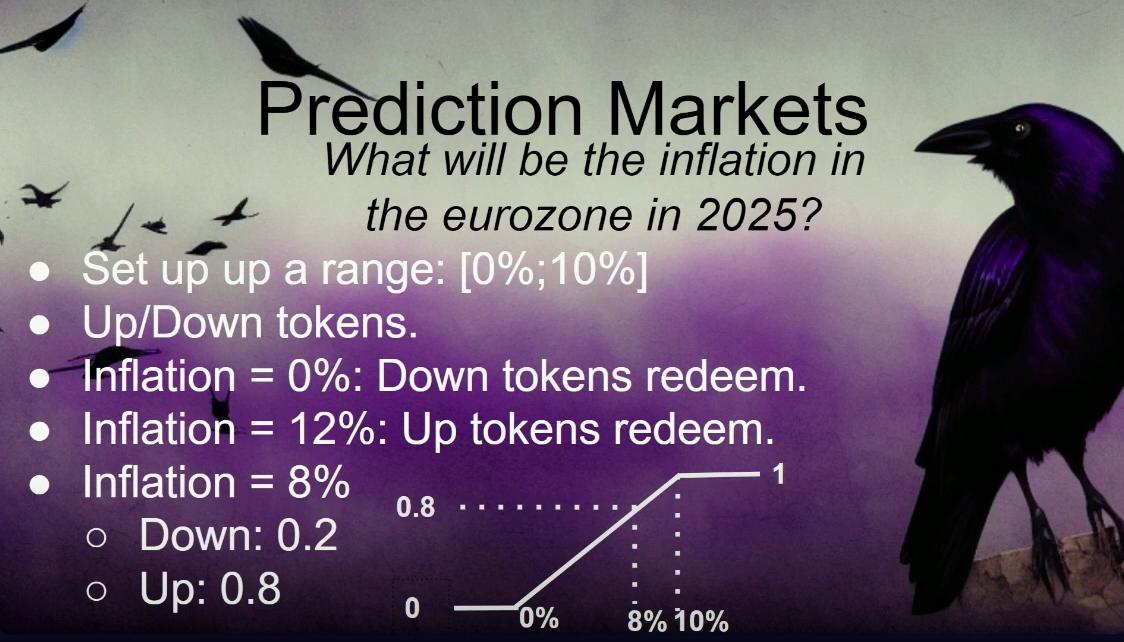

Scalar prediction markets can predict numeric values within a range (e.g., inflation rate).

It uses "up" and "down" tokens that redeem proportionally based on the actual outcome, and allows for predicting average expected values (e.g., 8% expected inflation).

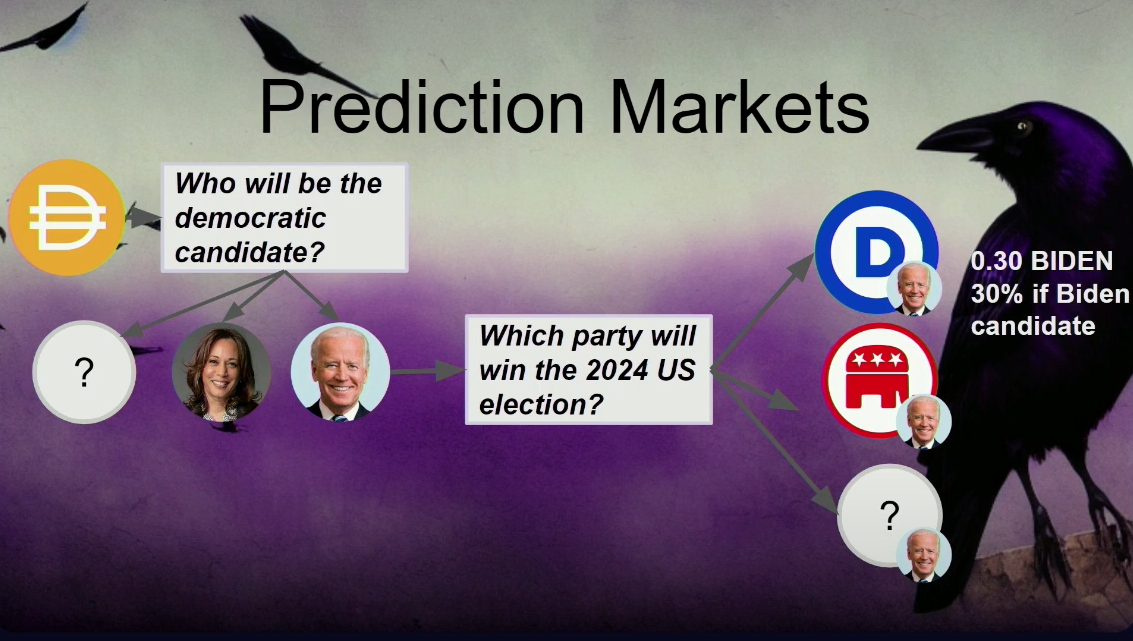

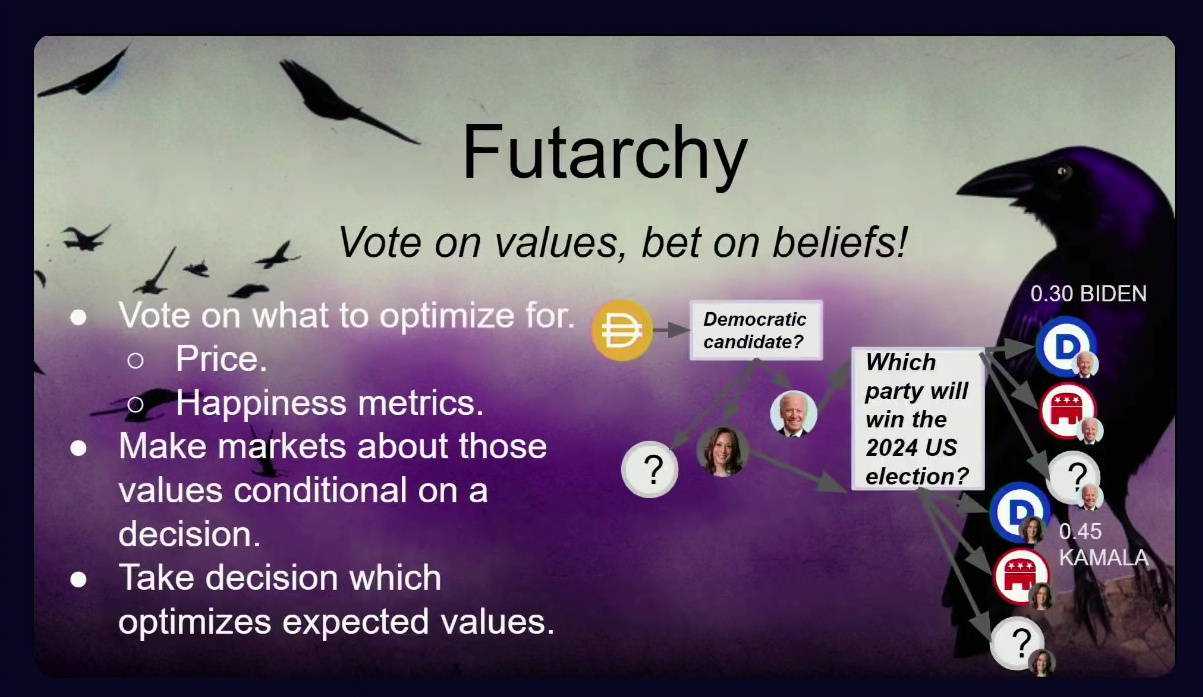

Chained prediction markets combine multiple related predictions (e.g., who will be the Democratic candidate and which party will win).

It allows for calculating conditional probabilities (e.g., the chance of Democrats winning if Biden is the candidate).

Advantages of prediction markets:

- Can be more accurate than traditional polling methods.

- Potentially more cost-effective.

- Provide probabilities for multiple outcomes, not just the most likely one.

- Can work even with play money and prizes, not necessarily requiring real money.

- Can be used for various types of predictions (binary outcomes, scalar values, conditional probabilities).

- Applicable to different domains (politics, economics, etc.).

Challenges and solutions (4:30)

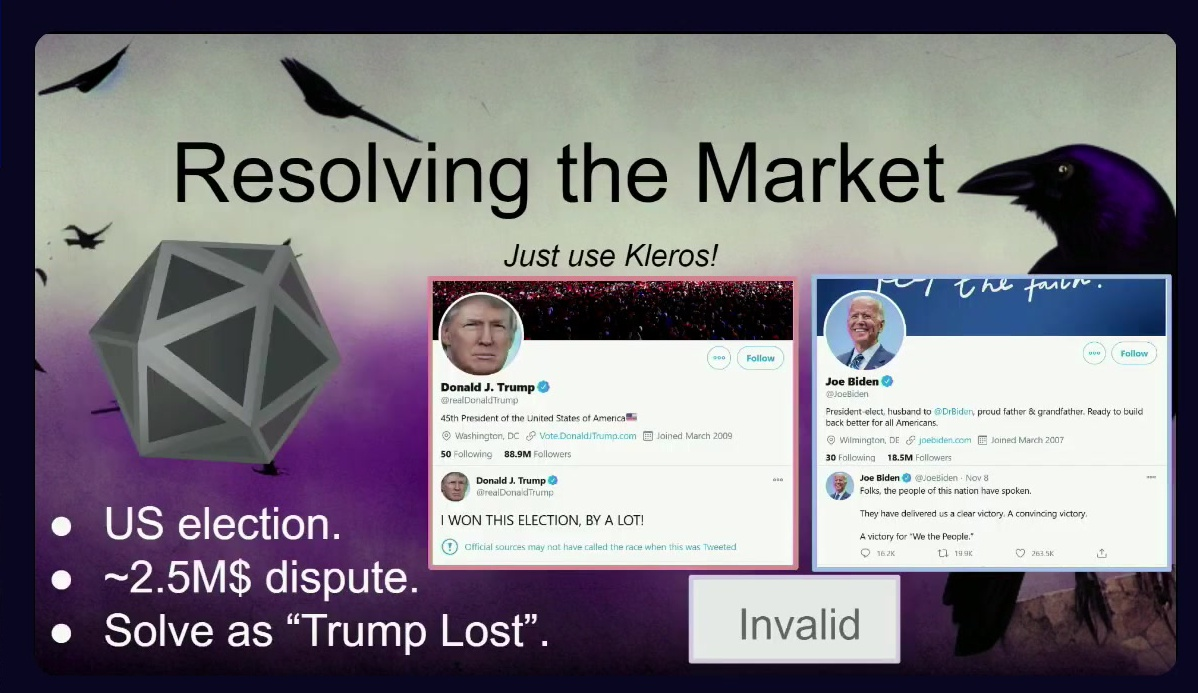

Kleros is mentioned as a solution for resolving prediction markets.

Example given: A controversial dispute about the 2020 US election results was resolved using Kleros, with $2.5 million at stake.

Challenges in prediction markets:

- Opportunity cost. Funds locked in prediction markets can't be used in DeFi to earn yields

- Chicken and egg problem. Without liquidity, there are no traders. Without traders, there's no incentive for liquidity providers

- Impermanent loss. This is particularly problematic in prediction markets where outcomes tend towards 1 or 0.

Proposed solutions:

- For opportunity cost: Use yield-bearing assets (e.g., sDAI) instead of stablecoins.

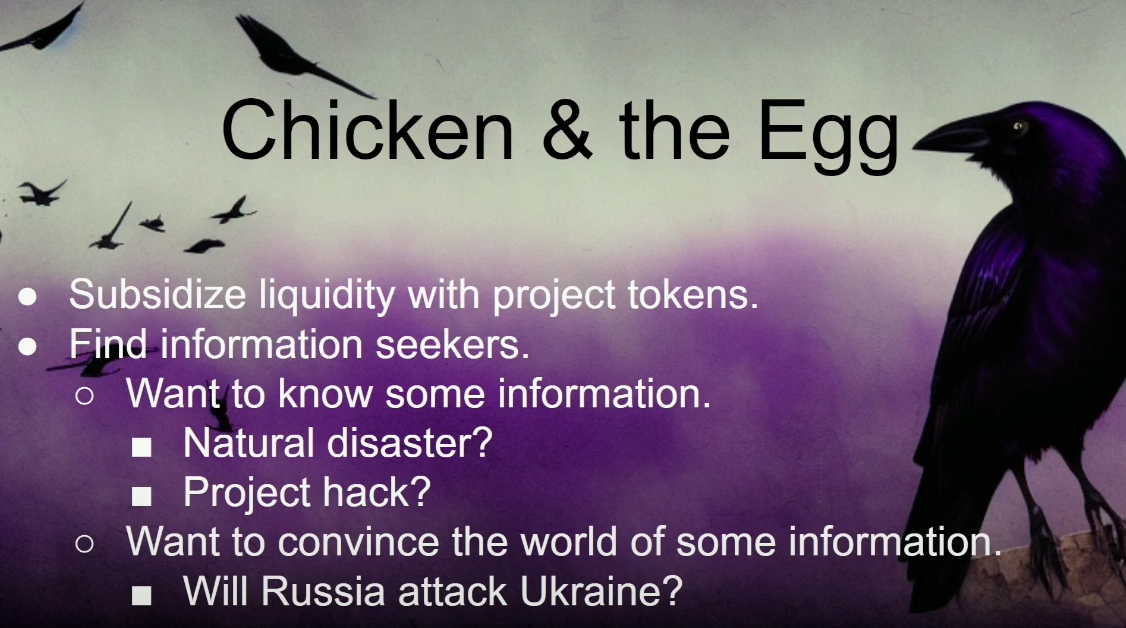

- For C&E problem: Provide liquidity incentives using project tokens, find information seekers willing to pay for market insights, and attract entities wanting to convince others of information they already know.

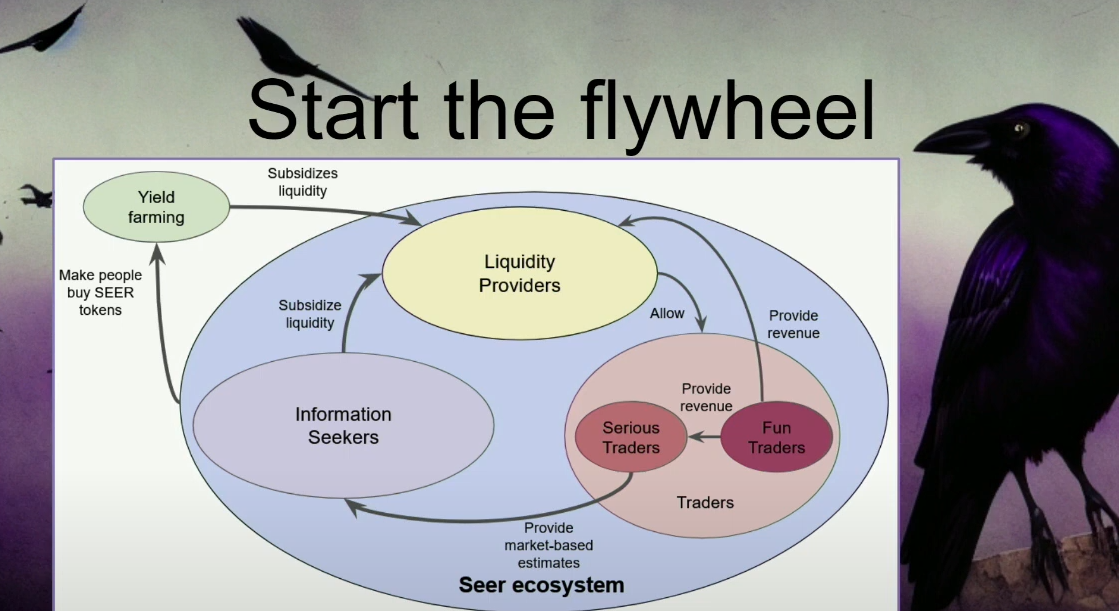

Seer flywheel concept:

- Start with project token incentives to attract liquidity providers.

- Liquidity attracts both casual and serious traders.

- Serious traders improve market accuracy.

- Accurate markets attract information seekers.

- Information seekers pay for market access, sustaining the system.

Revelation Loss

Sudden resolution of events (e.g., abrupt end to war) can cause losses for liquidity providers.

This creates a "human MEV" situation where quick traders can profit at the expense of market makers.

Real-world applications:

- Media seeking election predictions.

- Real estate projects assessing earthquake risks.

- Investors are evaluating crypto project risks.

- Governments trying to convince others of impending events (e.g., the US predicting Russia's invasion of Ukraine).

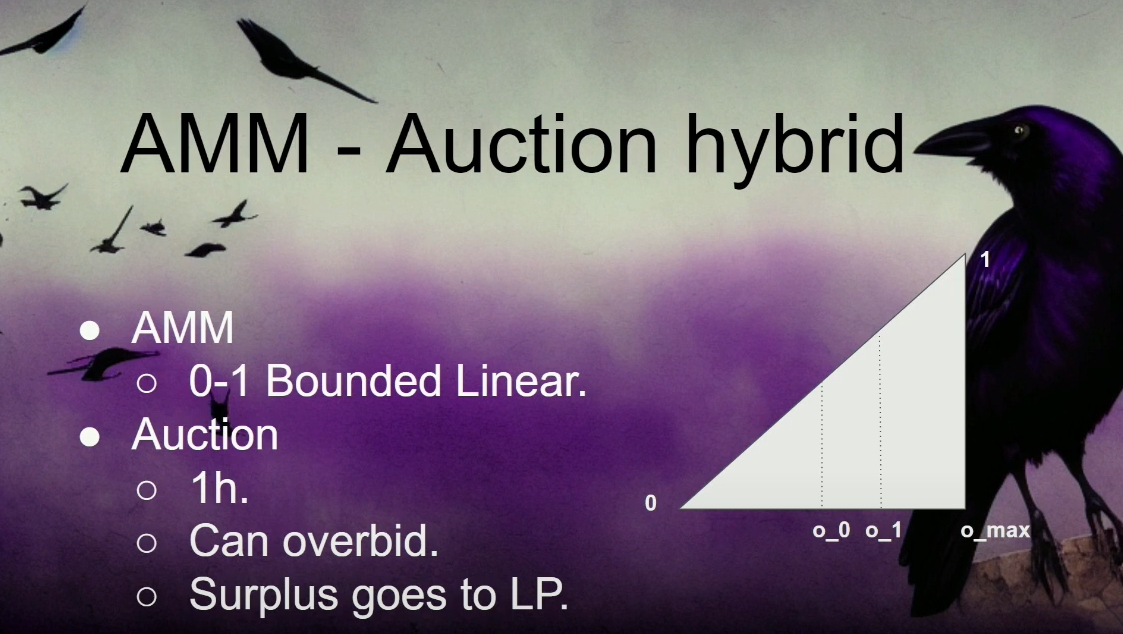

The proposed solution to the revelation loss problem is "Auction Hybrid AMM", combining an Automated Market Maker (AMM) with an auction process.

Key features:

- AMM constrained between 0 and 1 (maximum payout of the underlying asset).

- One-hour auction period for each order.

- If no competing bids, the order executes at AMM price after one hour.

- If new information emerges, allows for competitive bidding close to true value.

Benefit: Minimizes losses for liquidity providers when sudden information changes occur.

Other use cases (10:00)

Betting on elections is the most demonstrated use case (high public interest, known voting dates)

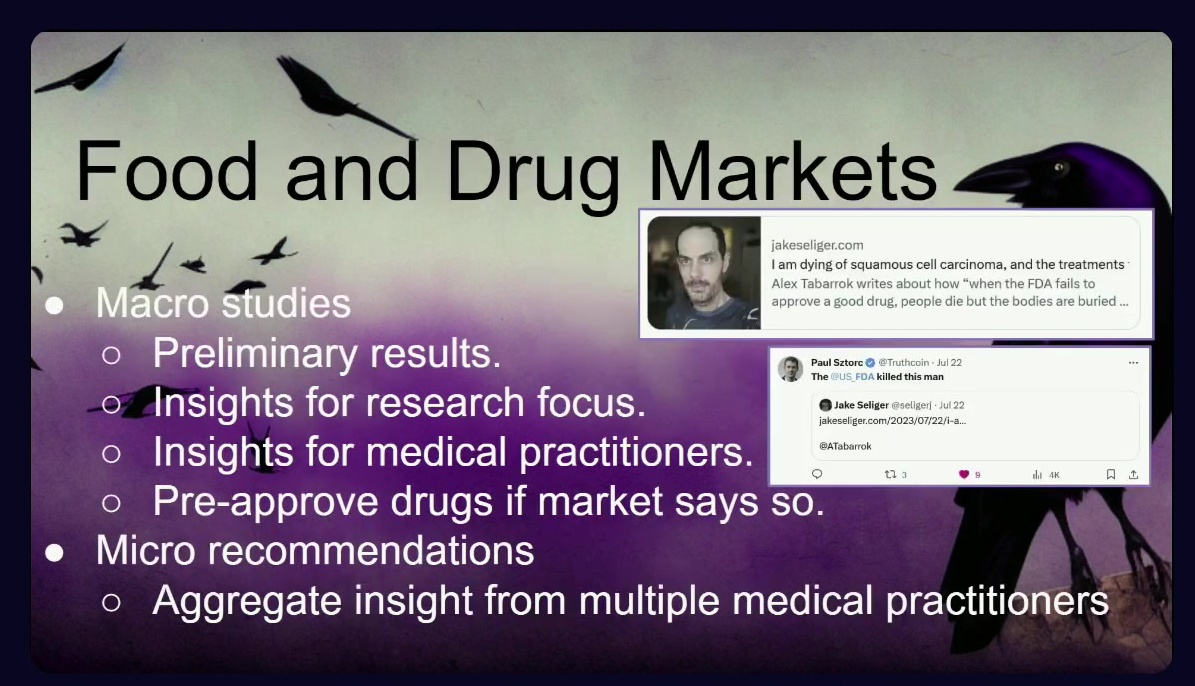

A novel application would be prediction markets for drugs and medical procedures.

Potential benefits would be to accelerate the approval of potentially life-saving treatments and counter conservative bias in regulatory agencies.

Process

Set up markets before clinical study results are available. If markets show a high likelihood of positive outcomes, consider allowing early access.

Micro-recommendations for Individual Health Decisions:

- Allow multiple medical practitioners to bet on outcomes of specific procedures or drugs.

- Enables individuals to make more informed choices based on aggregated expert opinions.

Current regulatory agencies tend to be risk-averse. They often prefer avoiding deaths from approving unsafe drugs over deaths from delayed approvals. Prediction markets could provide a data-driven approach to balance these risks.

Ethical and Regulatory Problems!

- While not explicitly stated, the proposal raises important ethical questions about using market mechanisms for medical decisions.

- Implementation would likely require significant regulatory changes or special jurisdictions.

The concept could extend beyond just drug approvals to other areas of medical decision-making and public health policy.

Basic idea: "Vote on values, bet on beliefs"

Used to optimize specific outcomes:

- Create conditional markets for proposals

- Predict outcomes based on proposal acceptance or rejection

We have a transition from human-centric to AI-driven markets. AI will dominate prediction markets, similar to online ad auctions

Potential to replace centralized machine learning systems in Web 2.0 with decentralized Web 3.0 markets

Applications of AI-driven Prediction Markets:

- Social media content recommendation

- Search engine result optimization

- Streaming service content suggestions

- Markets are conditional, only resolving for items shown to users

- AIs profit or lose based on accurate predictions of user preferences

About Seer (15:40)

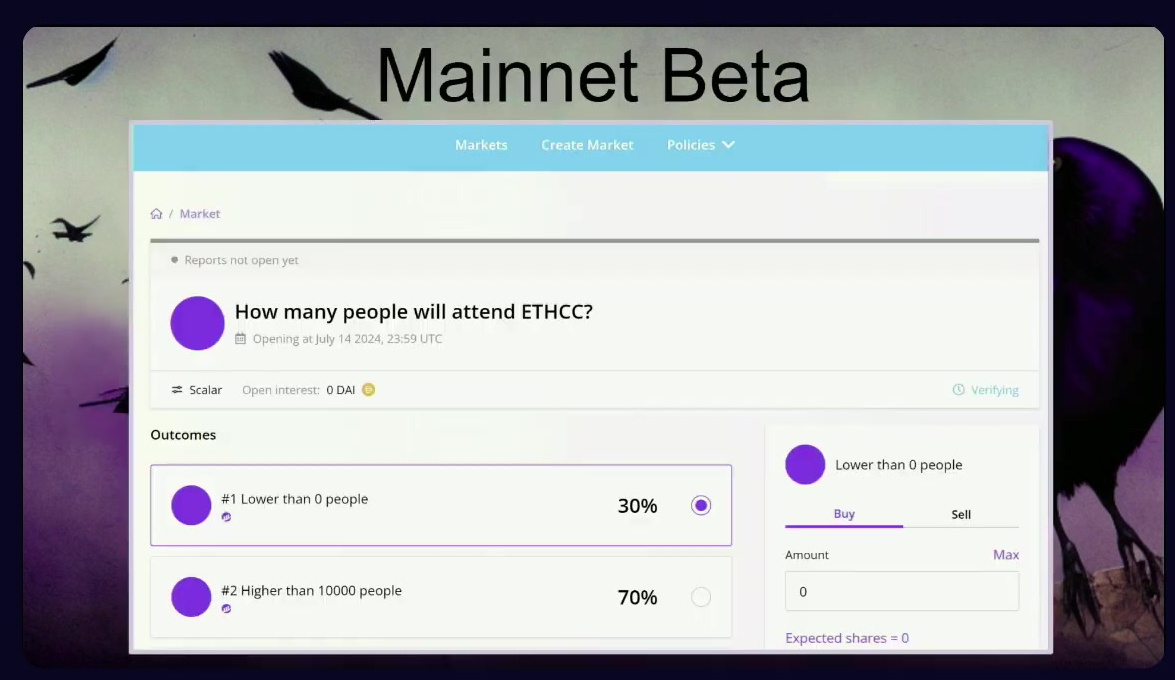

Seer is on mainnet beta. The team is awaiting for completion of security procedures (audits, code arena) and plans to launch incentives after security checks

Prediction markets were part of the early blockchain plan (Kleros originated from a prediction market project called StressCoin)

The thing is, current attempts like Polymarket didn't fully realize prediction market potential, and we can have more efficient information gathering and market operations, especially with AI-driven systems

Seer is presented as a solution to longstanding prediction market issues, as it aims to extend use cases and improve market efficiency

Questions & Answers (17:00)

Is it legal? Because I know that prediction markets are hard to do legally and I'm curious what's your position on this?

Legality likely depends on jurisdiction. Centralized markets like Polymarket have faced fines from the SEC.

The project aims to focus on information gathering rather than betting:

- The system operates entirely on smart contracts with no central operator.

- There's no entity holding funds in custody, which differentiates it from traditional gambling operations.

There's hope that regulators will eventually recognize the benefits of prediction markets, but Clement (the speaker) avoids advertising to US residents due to SEC concerns.

How do you prevent political activists from destroying the accuracy of the prediction of the probability given to a particular element?

The prediction market's accuracy improves over time through a capital accrual mechanism:

- Successful predictors accumulate more capital and gain more market influence.

- Poor predictors or manipulators lose capital and influence over time.

This self-correcting mechanism helps ensure the long-term accuracy of the markets.