Powering up intents in DeFi

Source : https://www.youtube.com/watch?v=irgtVpSJTv4&list=PPSV

Intents

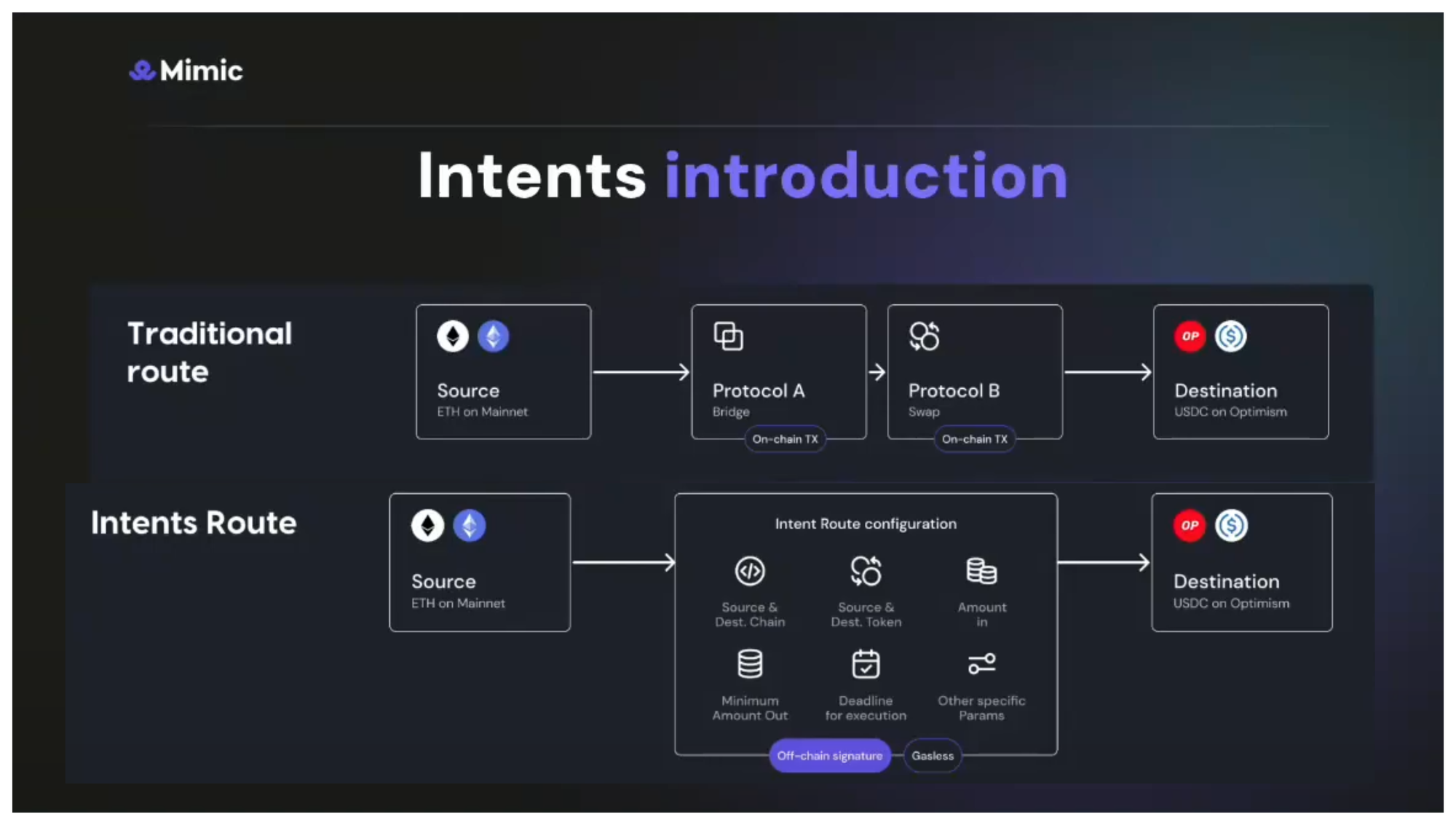

Intents introduction (1:45)

In traditional DeFi Operations, users have to define both "what" they want to achieve and "how" to execute it.

Example: To receive USDC on Optimism from Mainnet, users need to bridge from Mainnet to Optimism and then swap ETH to USDC, requiring multiple on-chain transactions.

With intents, users only need to define "what" they want to achieve. Intents are signed messages that specify the desired end state and constraints, and the "how" (execution) is handled by third-party solvers or fillers.

Example : Users define the source and destination chains, tokens, and desired amounts, and then sign an off-chain (gasless) transaction.

Intents have several benefits :

- Simplified user experience by abstracting away the execution details.

- Potential cost savings by allowing solvers to batch and optimize transactions.

- Increased composability by enabling complex operations through a single intent.

Improvement margin (3:45)

Current intent implementations are limited :

- Most intent-based protocols have isolated systems, meaning intents created in one protocol can only be executed within that protocol.

- Lack of compatible standards for intents across different protocols.

- Existing attempts at standardization (e.g., Anoma's Intent Machine, ERC-7683) are still in early stages.

- Cross-chain limitations exist, and current intents are not well-suited for automation.

Mimic's approach aims to address those limitations

Powering-up intents

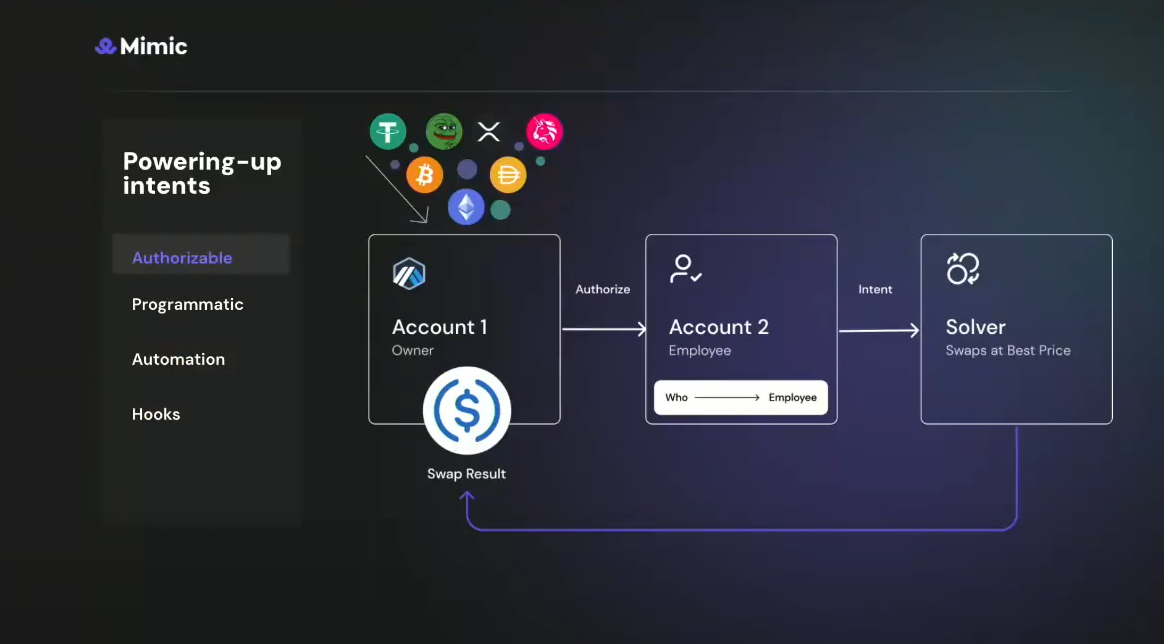

Authorizable intents (5:30)

Allows authorizing employees or other parties to create intents on behalf of a wallet or account. Limits can be set on the authorized parties, restricting their access to specific operations.

Example: A treasury manager can authorize an employee to create intents for converting tokens to USDC on a specific wallet.

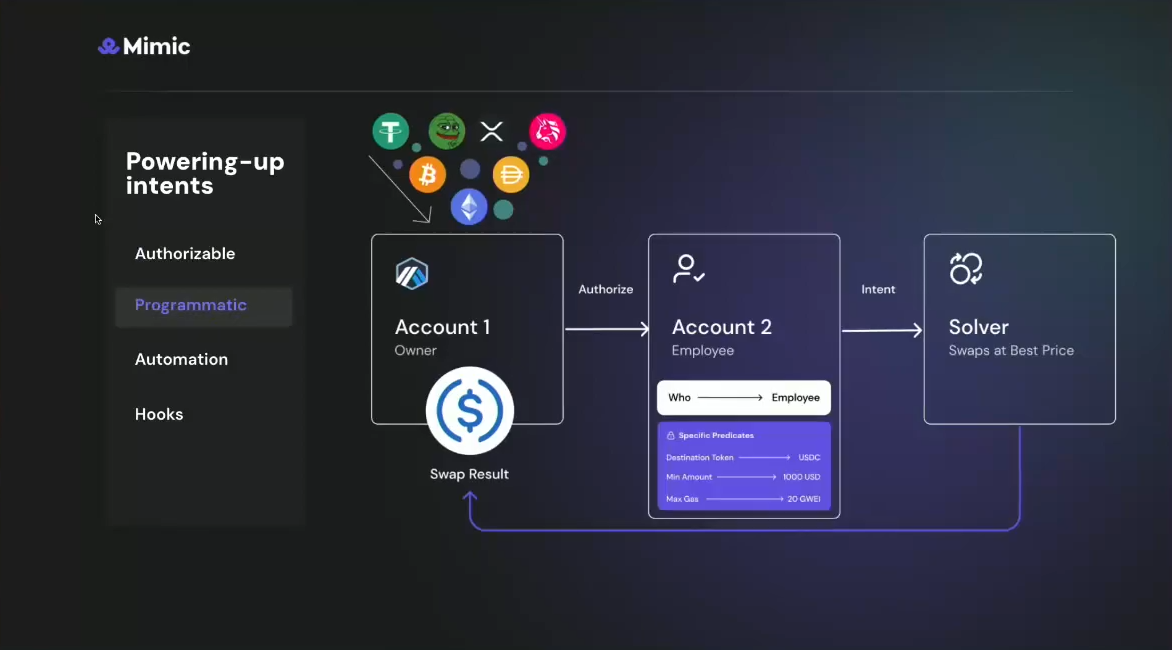

Programmatic intents (6:10)

Intents can be programmed with predicates and constraints. It allows specifying conditions like the destination token, minimum swap amount, maximum gas limit, etc.

Programmatic intents ensures authorized parties can only perform transactions within the defined parameters.

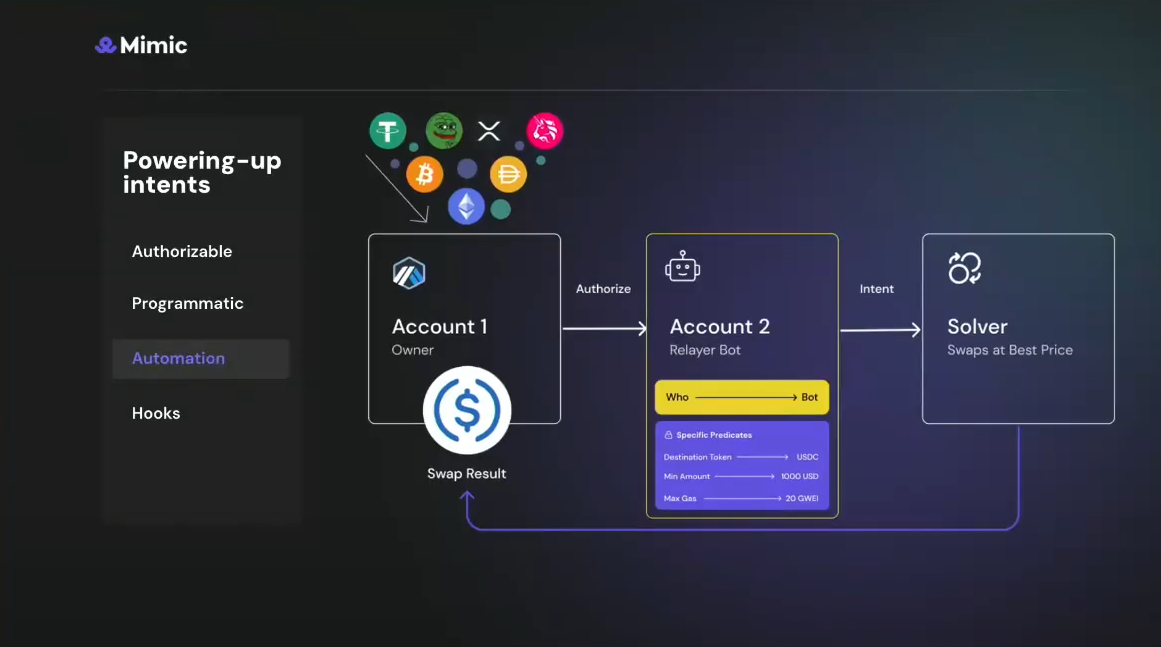

Automated intents (7:05)

Intents can be automated by authorizing bots to create and execute them. Bots are limited by the programmed predicates, mitigating security risks.

Enables scaling intent creation and execution without manual intervention.

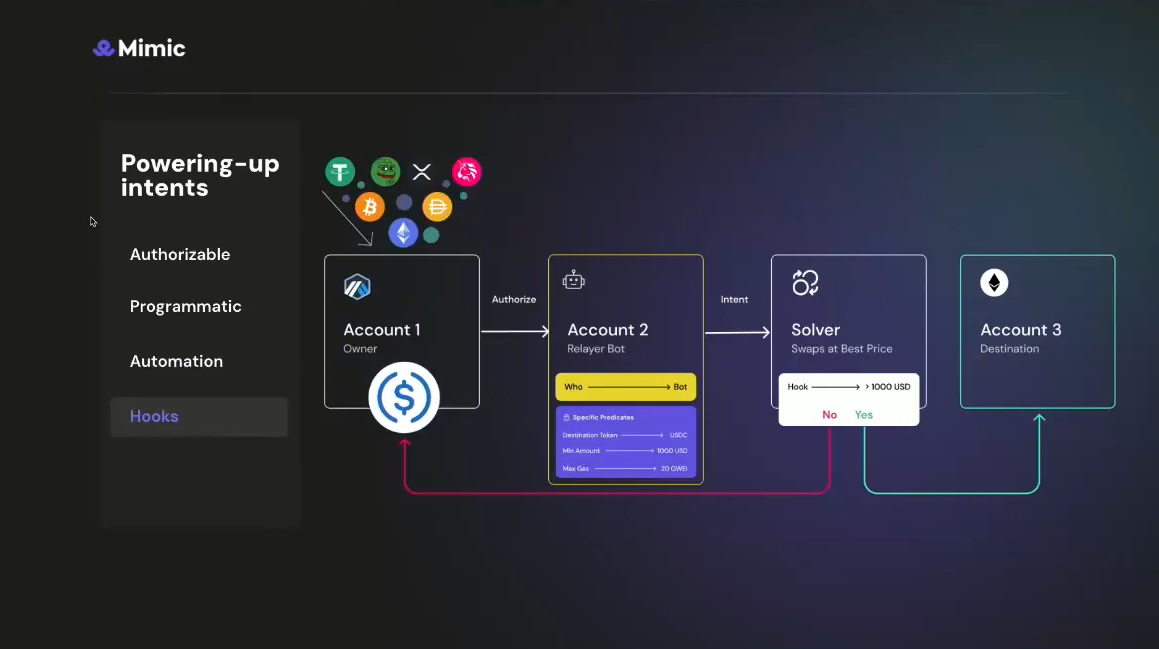

Hooks for intents (8:00)

Hooks can be added to intents, enabling callbacks or additional transactions, and can be triggered before or after the intent is executed.

Hooks allow creating complex sequences of DeFi transactions (swap, bridge, stake, lend, etc.) automatically.

Example: Adding a hook to withdraw funds to a hardware wallet after a swap intent is executed.

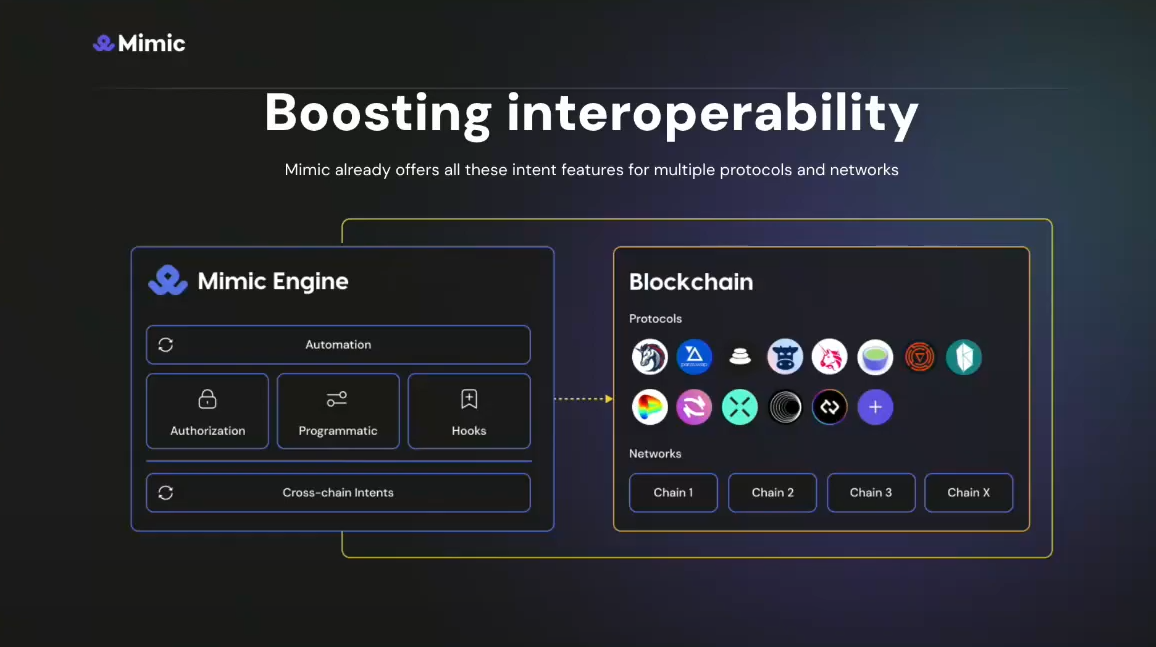

Boosting interoperability (9:15)

These features (authorizable, programmatic, automated, hooks) can be composed together.

So we can have flexibility in programming and automating complex DeFi operations through a single intent.

Use cases

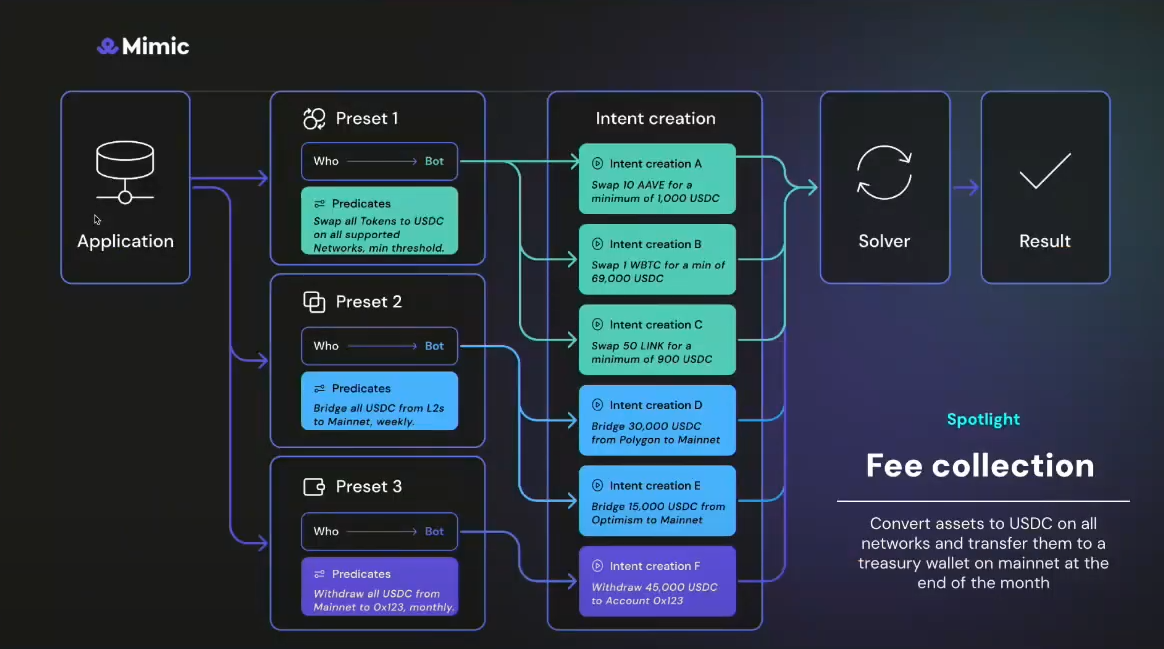

Fee collection (9:45)

Objective : Convert assets from various networks to USDC, then transfer them to a treasury wallet on Mainnet at the end of the month

Approach : set up 3 presets

- Authorize a bot to swap all tokens to USDC on supported networks with constraints (minimum threshold, gas limit, max slippage)

- Authorize the bot to bridge all USDC from Layer 2s to Mainnet once a week

- Authorize the bot to withdraw all USDC on Mainnet to a destination wallet

Workflow :

- Throughout the month, the bot creates intents to swap assets to USDC based on preset

- Once a week, the bot creates an intent to bridge USDC from Layer 2s to Mainnet based on preset

- At the end of the month, the bot creates an intent to withdraw all USDC on Mainnet to the treasury wallet based on preset

Benefits : Automated fee collection and conversion to USDC, consolidation of fees from multiple networks to a single Mainnet wallet. In other words, this is a set-and-forget approach

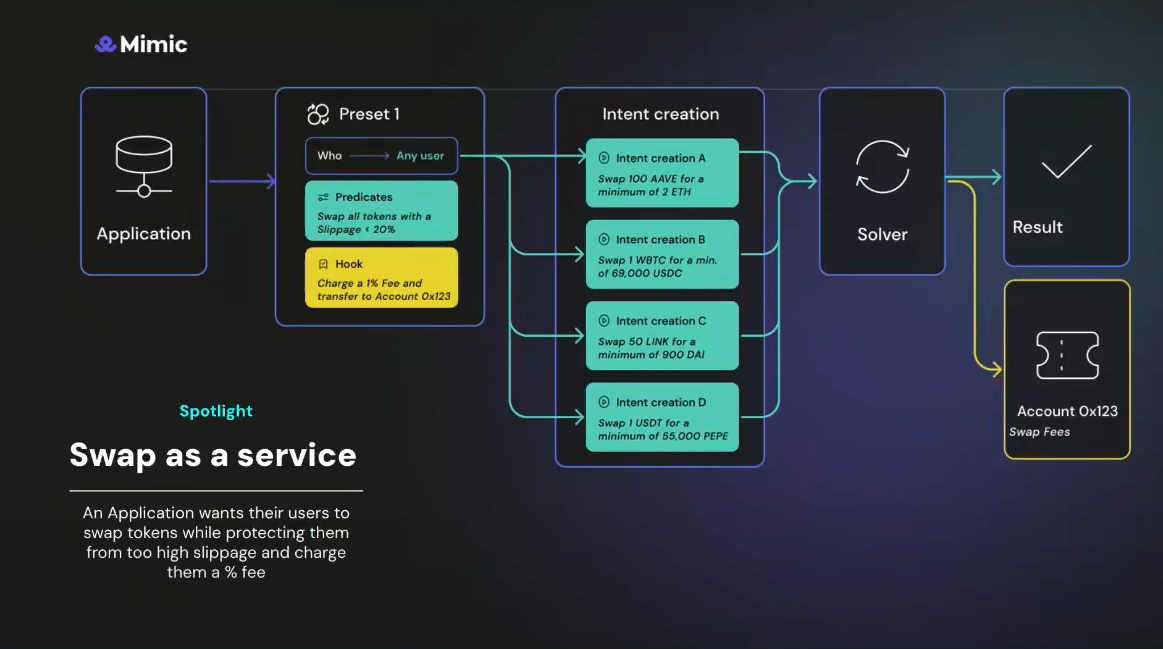

Swap-as-a-Service (12:15)

Objective : Allow application users to swap tokens with protection against high slippage, and charge users a percentage fee for the swap service

Approach :

- Set up a preset which Allow any user to swap all tokens with a slippage below a specified threshold (e.g., 20%)

- Add a hook charging

Workflow :

- Users can create their own intents for swaps under the preset (e.g., swap 100 AAVE for minimum 2 ETH), and solvers fill their intents

- After each swap, the 1% fee is transferred to the fee collection account based on the hook

Benefits : Provides a swap service with slippage protection for users, and automated fee collection for the application

The Big Picture

Integrating is cumbersome (13:25)

Applications need to integrate with multiple DeFi protocols and aggregators (DEXs, bridges, lending, staking, etc.) separately.

This process is cumbersome and requires significant development effort.

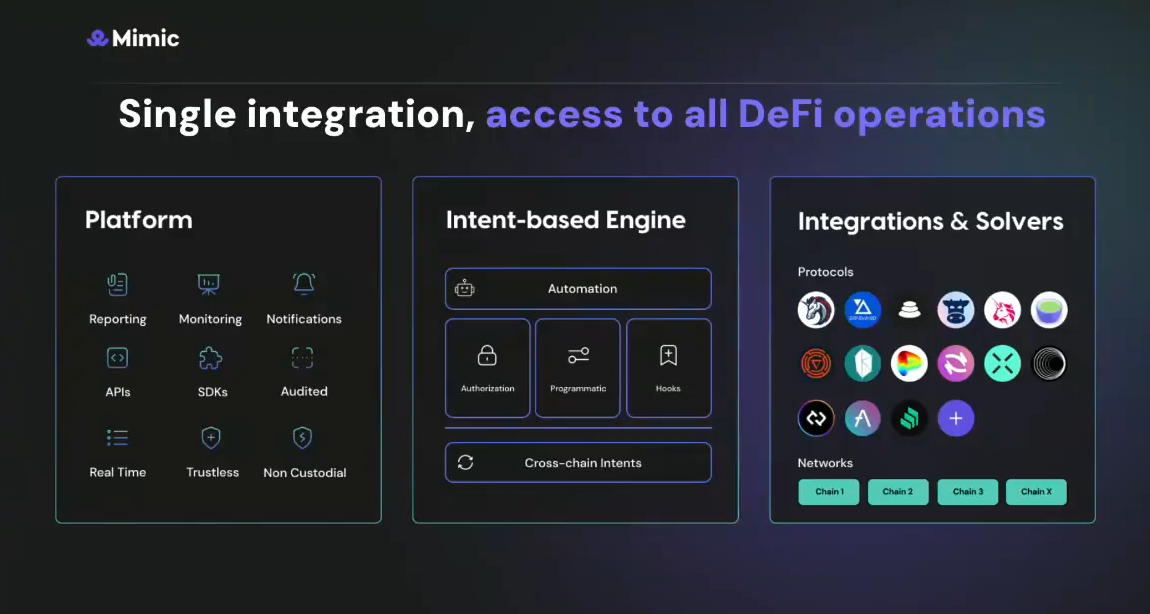

Single integration (14:10)

Mimic aims to provide a single integration point for accessing all DeFi operations.

The solution consists of 3 main components :

- Intent-based engine (as discussed earlier)

- Network of solvers

- In-house integrations with DeFi protocols

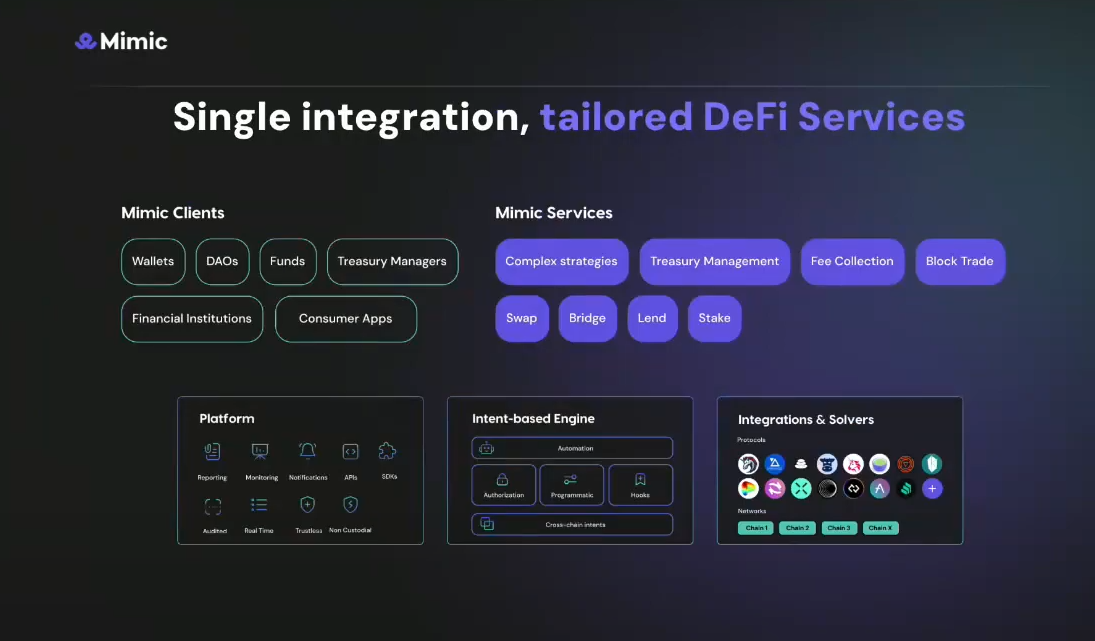

Tailored services (14:45)

This a platform that serves as the front-facing interface for users. It can also provide, reporting, monitoring, notifications, and access through APIs and SDKs.

Services :

- Building complex trading strategies

- Treasury management, rebalancing, exiting/entering positions

- Fee collection (as discussed earlier)

- Block trading (selling tokens with minimal price impact)

- Offering users DeFi services like swap, bridge, lend, stake, etc., through a single integration

Target customers :

- DAOs, wallets, and DeFi applications (current customers)

- Fund managers, treasury managers, and financial institutions

- Consumer applications that want to integrate with DeFi

Mimic's traction (16:40)

- Operating for over two years with a working infrastructure and product-market fit

- Team of 13 members

- Processed over $3.5 billion in total volume

- Executed 6.2 million transactions, with 117,000 automated transactions

- Performed 110 million transaction simulations