Not Monolithic, Not Modular, But Aggregated (Morpho at EthCC)

Source: https://www.youtube.com/watch?v=usGRczWUZl4

Monolithic vs Modular lending (1:50)

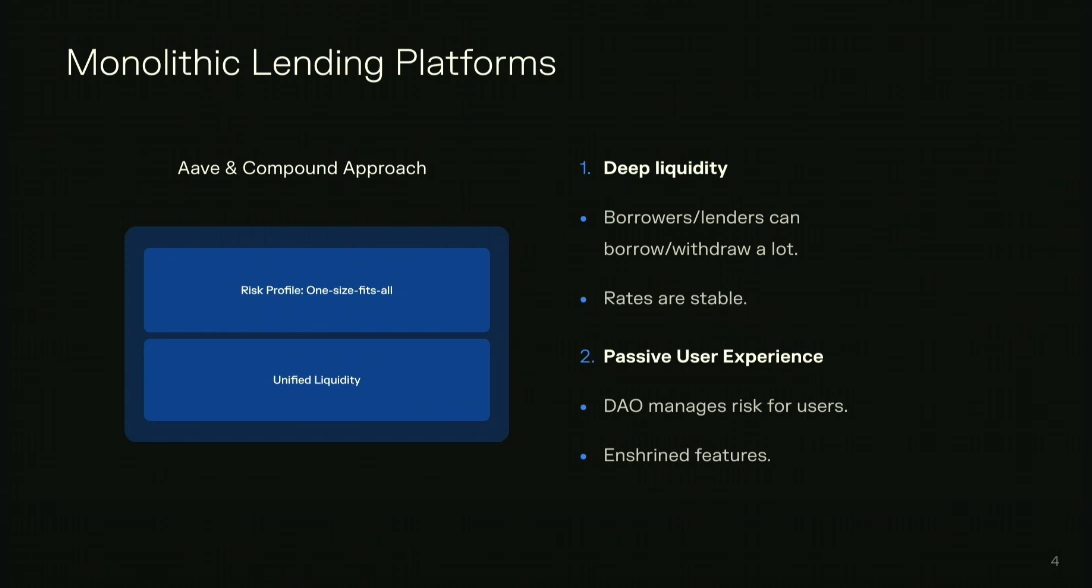

There are 2 main approaches to lending and borrowing protocols:

- Monolithic lending pools

- Modular lending platforms

Monolithic Lending Pools were introduced by Compound: a single large pool of liquidity for each asset with its interest rates, liquidity accounting, and risk management

Advantages:

- High liquidity for borrowers and lenders

- Stable interest rates due to deep liquidity

- Good user experience (easy entry and exit)

Disadvantages:

- One-size-fits-all risk model (exposure to all assets in the pool)

- Large, complex codebase (e.g., Aave ~7,000 lines, Compound ~3,000 lines)

- Risk management governed by token holders:

- Lack of expertise leading to delegate risk management

- Potential conflicts of interest

- Large number of risk parameters

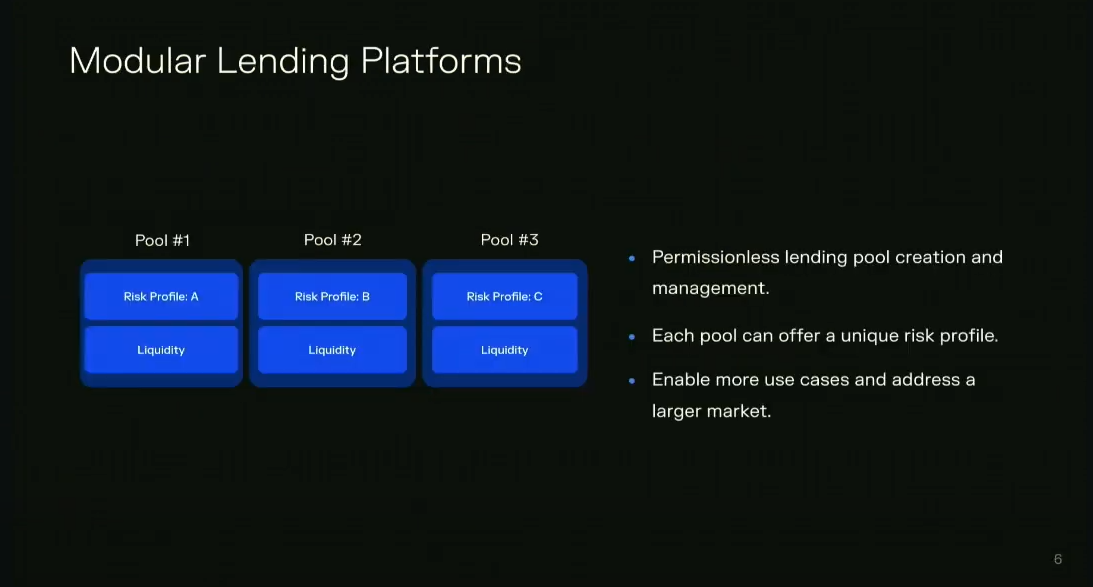

Modular Lending Platforms allow the creation of multiple lending pools with different parameters, so they can address a broader market beyond crypto speculation

Advantages:

- Greater robustness and diversity in use cases

- Customizable risk profiles and features

- Potential to serve markets like LRTs (Liquid Restaking Tokens) and RWAs (Real World Assets)

Disadvantages:

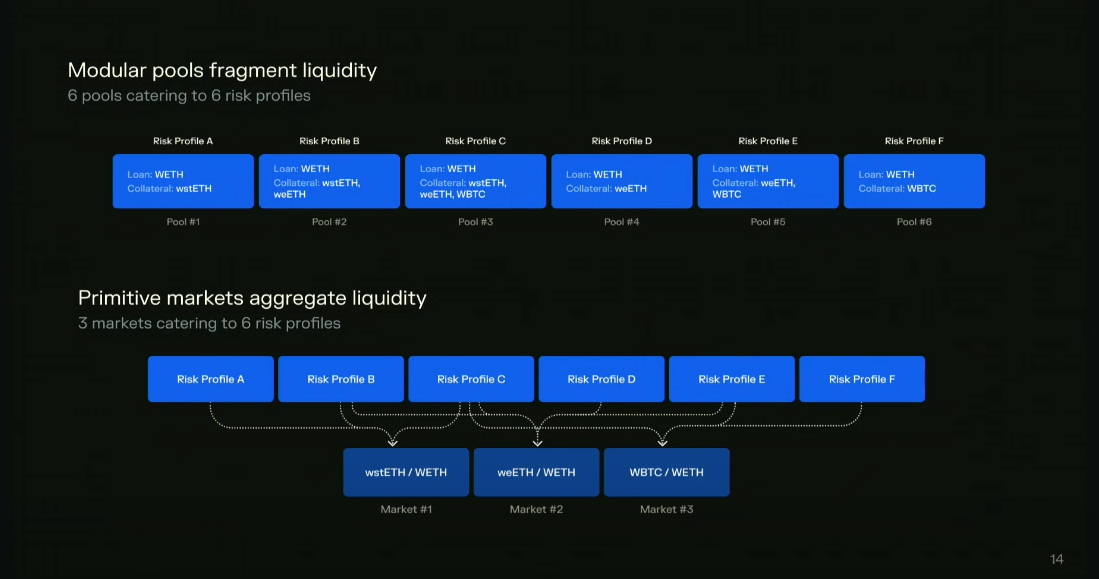

- Potential for liquidity fragmentation across multiple pools

- May require creating new pools for each use case

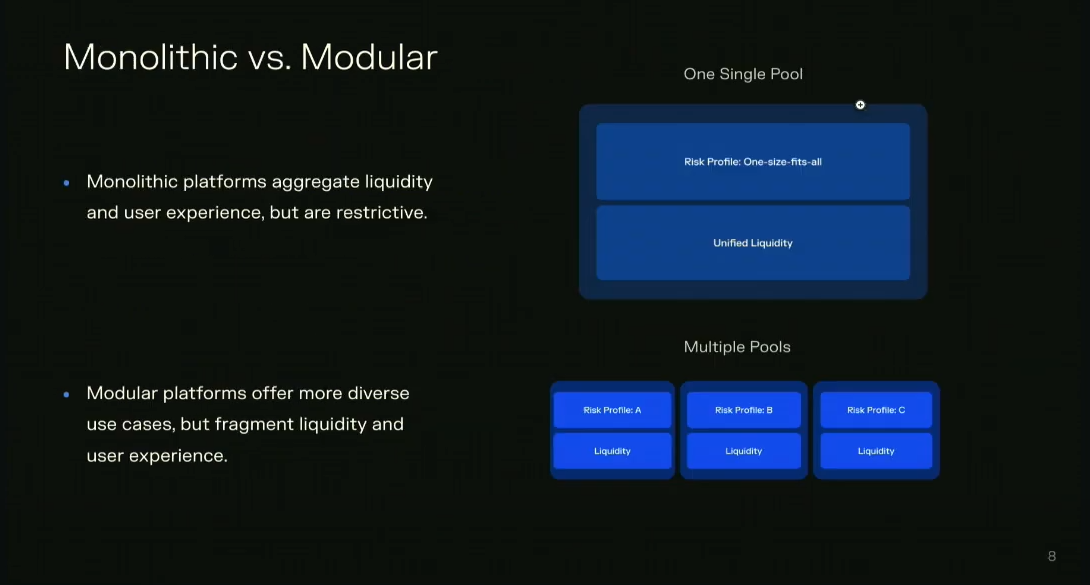

Each approach has its tradeoffs:

Monolithic has Better liquidity aggregation and user experience, but limited use cases and robustness concerns

Modular has more diverse use cases, but potential fragmentation of liquidity and user experience

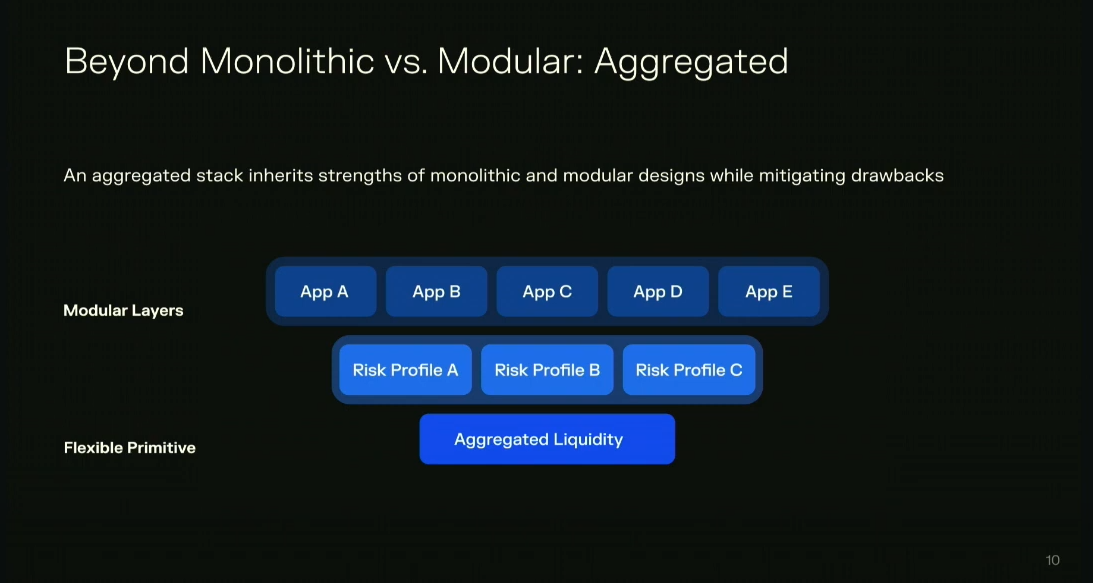

Paul (the speaker) suggests a middle-ground approach: an "aggregated lending stack" that aims to balance the advantages of both monolithic and modular approaches

Aggregated lending stack (8:20)

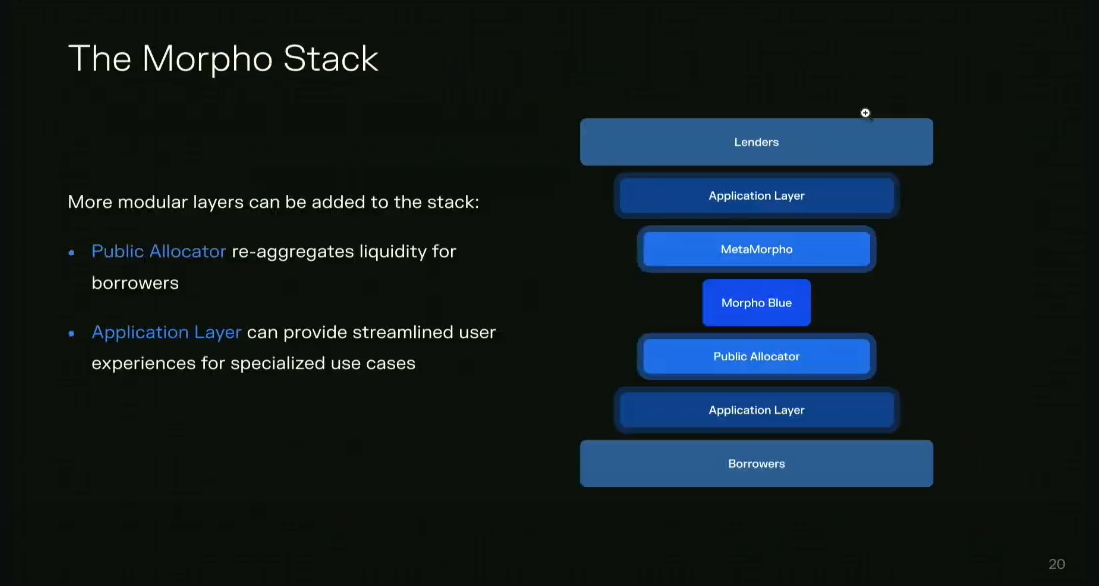

The aggregated lending stack has primitive markets and modular layers to balance flexibility and liquidity aggregation

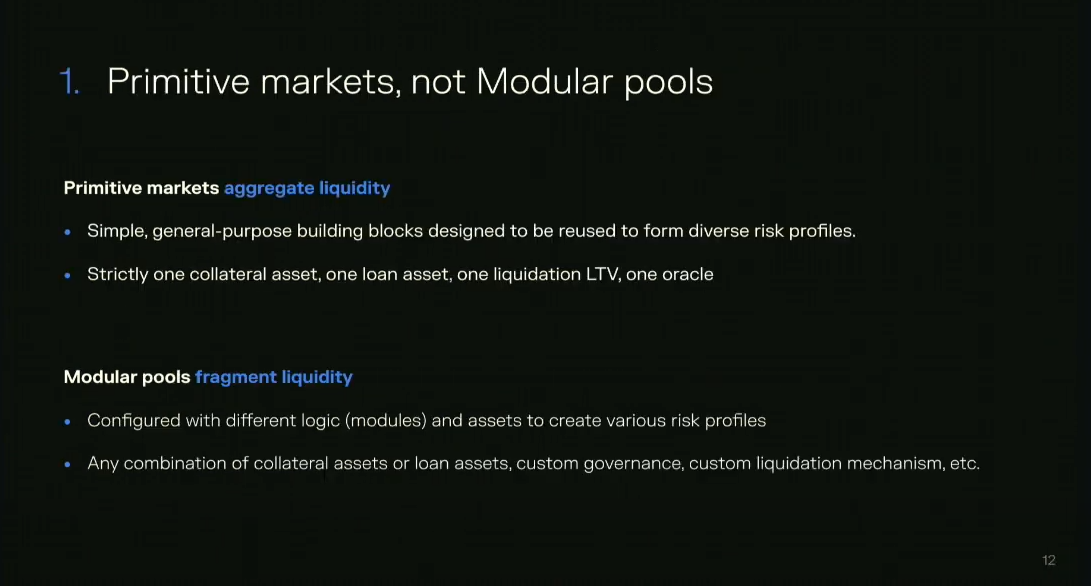

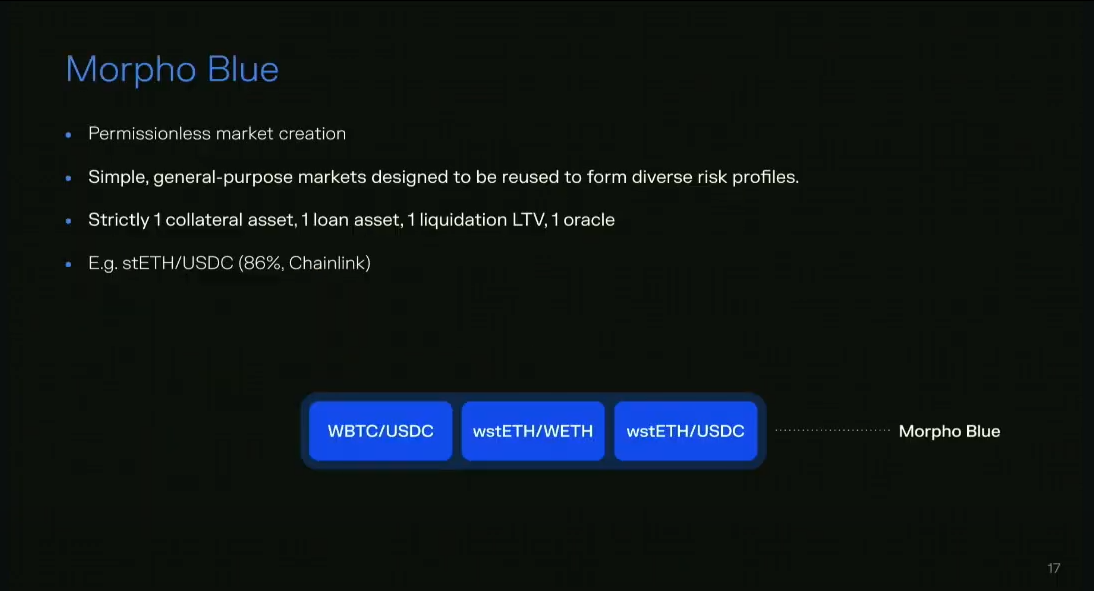

Primitive markets are small lending and borrowing primitives. They are unopinionated, ungoverned, and immutable.

Composed of:

- One collateral asset

- One loan asset

- One liquidation loan-to-value ratio

- One oracle

Example: ETH to borrow USDC at 86% LTV, priced by Chainlink

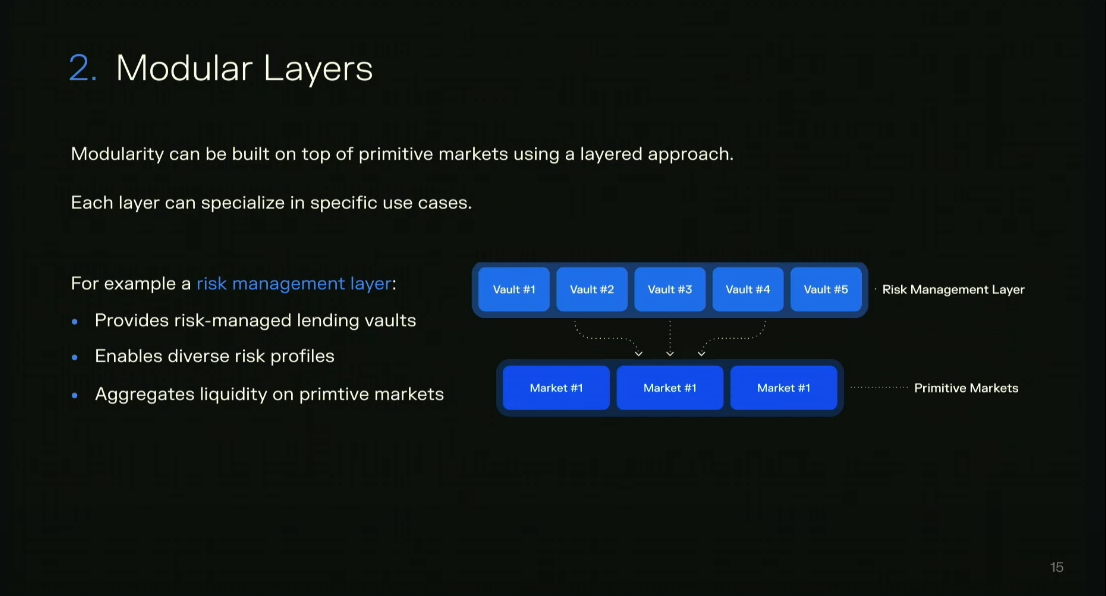

Modular layers are built on top of primitive markets. they can perform various functions:

- Risk management

- Account abstraction

- Other customizable features

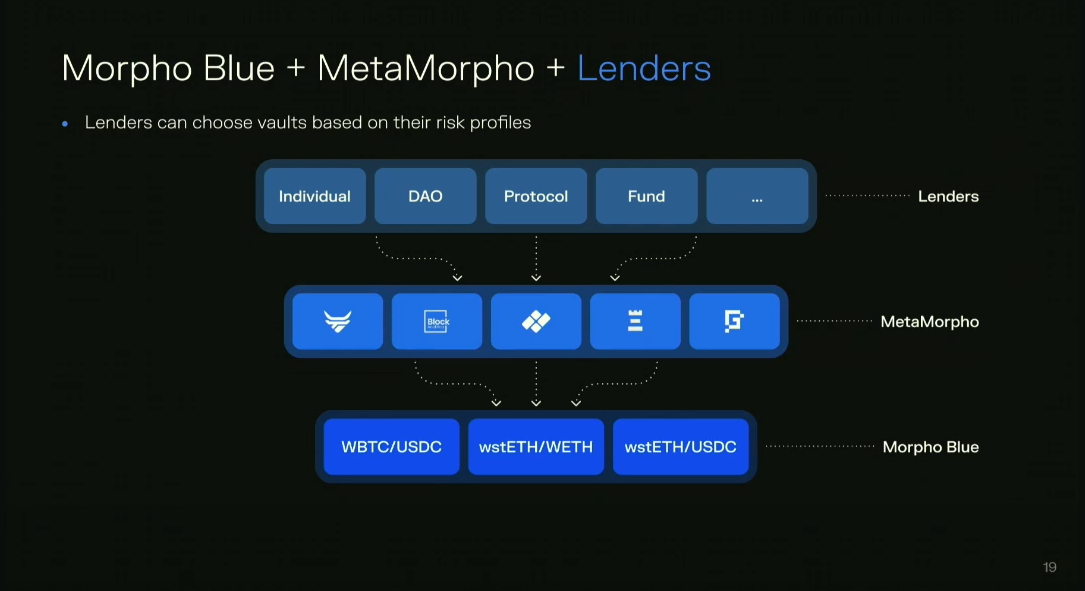

Those modular layers are optional for users and allow for the creation of diverse risk profiles that can compose with one another.

Benefits of this approach:

- Increased liquidity sharing between protocols

- More efficient use of capital

- Greater flexibility in creating complex risk profiles

- Ability to recreate multiple risk profiles using fewer primitive markets

Morpho Blue implements this concept of primitive markets. So protocols built on the Morpho stack can share liquidity to the extent they share risk

Example: If Aave and Compound both use stETH as collateral, they can share liquidity for that asset

Aggregation in practice: The Morpho Stack (12:30)

Paul uses the example of the stETH/USDC market and various vaults/protocols built on top of it (Steakhouse Vaults, Block Analytica Vaults, Bprotocol RE7, Gauntlet, Spark)

These vaults share some common primitives like stETH and thus can share liquidity to the extent they share the same risk profile. However, vaults with exposure to real-world assets may not share that liquidity.

Lenders can deposit into these various vaults, which then deposit into the underlying markets, allowing for aggregation across different markets.

This approach offers features like account abstraction (e.g., Morpho bundlers) and a public allocator (RFQ system for borrowers to access just-in-time liquidity)

Morpho Blue core characteristics:

- Approximately 600 lines of code

- Completely immutable

On the other hand, upgradeable protocols have large codebases (e.g., 7,000 lines) that require full audits for any changes, and upgrades can potentially introduce vulnerabilities to dependent systems.

This aggregated approach allows users to choose the level of risk management and account abstraction they desire, without fragmenting liquidity.

As more participants build on this stack, it can create network effects, improving rate arbitrage and overall efficiency across the ecosystem.

Questions & Answers (16:45)

Does Morpho Blue publish a balance sheet? Is it a bank?

Morpho Blue is not a bank, but rather an infrastructure provider for lending pools.

The lending pools built on top of the Morpho Blue infrastructure have their own "balance sheets", similar to traditional lending platforms like Aave and Compound.

Morpho Blue itself does not have a specific lending pool or balance sheet that it manages, as it is just providing the underlying infrastructure for others to build upon.