Navigating DeFi in 2024

Source : https://www.youtube.com/watch?v=_8-P_Kq-dqs

Speakers introduction

CMT Digital is a Blockchain investments and policy/regulatory advocacy subsidiary of CMT Group. CMT Digital launched first venture fund in 2018, and invested in over 150 portfolio companies.

Matt previously worked at Blockchain Research Institute in Canada, and joined CMT Digital in 2021.

Aryan is at CMT Digital for 6.5 years. He started as a junior trader, researcher for event-driven trades, and is an early DeFi user

The DeFi landscape

Less opportunities as a whole (5:00)

High yields opportunities were higher on 2020 (for example, Sushiswap's UMA pool with 30-40% APR). These opportunities are less common today as the environement became crowded with more active users and more TVL

Now success seems to be on a case-by-case basis, depending on the narratives, the blockchains, and the project himself

Regular Airdrops VS Points Programs (6:45)

Points program seem to be favored if done correctly, like Pendle or Gearbox. Transparency and clear allocation rules are crucial for the success of points programs

On the other hand, a quick dilution or issues with reward distribution can turn the points program against the project, like Renzo or Eigenlayer.

Regular airdrops could make a comeback as an alternative to points programs

In any case, points programs are travelling an experimentation phase, just like airdrops before. This is a trial and error process

Future of cashflow (10:10)

Teams are exploring recent products and mechanisms to maintain revenue streams and adapt to market conditions

MakerDAO is one of those :

- Strong revenue growth driven by higher interest rates and Ethena launch

- Positioned on protocols like Eigenlayer and Morpho vaults

MakerDAO's revenue composition shifted from predominantly RWA-based (60-70%) to crypto-backed loans (now ~33%). RWA revenues remained relatively stable, that's just crypto backed loans which became a more significant revenue source

Other projects like Maple pivoted to offer new products to combat potential rate hike decreases. Maple's private credit facility, direct lending pools, and account growth indicate interest in new offerings

As a result, aggregate TVL across Maple's products surpassed $175M, a level not seen since 2022

Tokenized Equities (15:50)

The demand for Tokenized Equities is limited and speakers are skeptical about future demand :

- Challenges around custody, tokenization process, legal/regulatory considerations

- Lack of robust DeFi product offerings to make tokenized equities attractive

- Uncertainty around the total addressable market for tokenized equities

Future of infrastructure

Narratives for the next 6-12 months (18:30)

There is a rise of alternative virtual machines (Alt VMs) with Solana, and Ethereum Rollups (Starknet, Aztec, Arbitrum with Stylus...), and speakers think this will continue

In response, execution frameworks are becoming more interoperable and multi-chain

In the end, there will be a ransition from declarative transaction building to more generalized multi-hop, multi-VM execution frameworks. The main challenge is to connect those pieces

Intent Market Structure (20:35)

There is an ongoing debate and exploration of intent-based execution approaches : should the margin distribution lie in market makers, or decentralized solver networks ?

In market makers :

- Market makers are private entities incentivized to match and undercut the cost of decentralized execution

- As market making becomes more competitive, they will push execution costs lower

- Market makers will build up valuable data on common routes, asset swaps, etc. from fulfilling user intents

In decentralized solver networks :

- Decentralized solvers can leverage the data aggregated by market makers' initial activities. This data allows solvers to optimize common routes and potentially undercut market maker costs

- Solvers being decentralized may allow them to operate more capital/cost efficiently than centralized market makers

- It's conceivable solvers could hold the margin by setting a low cost baseline that market makers cannot compete with

Neutral points :

- The middleware/RFQ infrastructure layer may struggle to capture meaningful margin, being stuck between market makers and application layers

- Where the margin resides (market makers vs solvers) could become a "fiery debate" as interests conflict

Fighting against toxic order flow (28:00)

Addressing the issue of toxic order flow and the associated impermanent loss (IL) and loss-versus-rebalancing (LVR) for liquidity providers (LPs) is important for making decentralized exchanges (DEXs) a viable trading solution.

- Ambient introduced new mechanisms

- CoWswap has reduced latency and has bonding requirements

- Dynamic fees (Trader Joe, Uniswap V4, Maverick V2) are expected to help cut LVR

The conversion from traditional transaction execution to intents networks will depend on where the good, non-toxic flow exists.

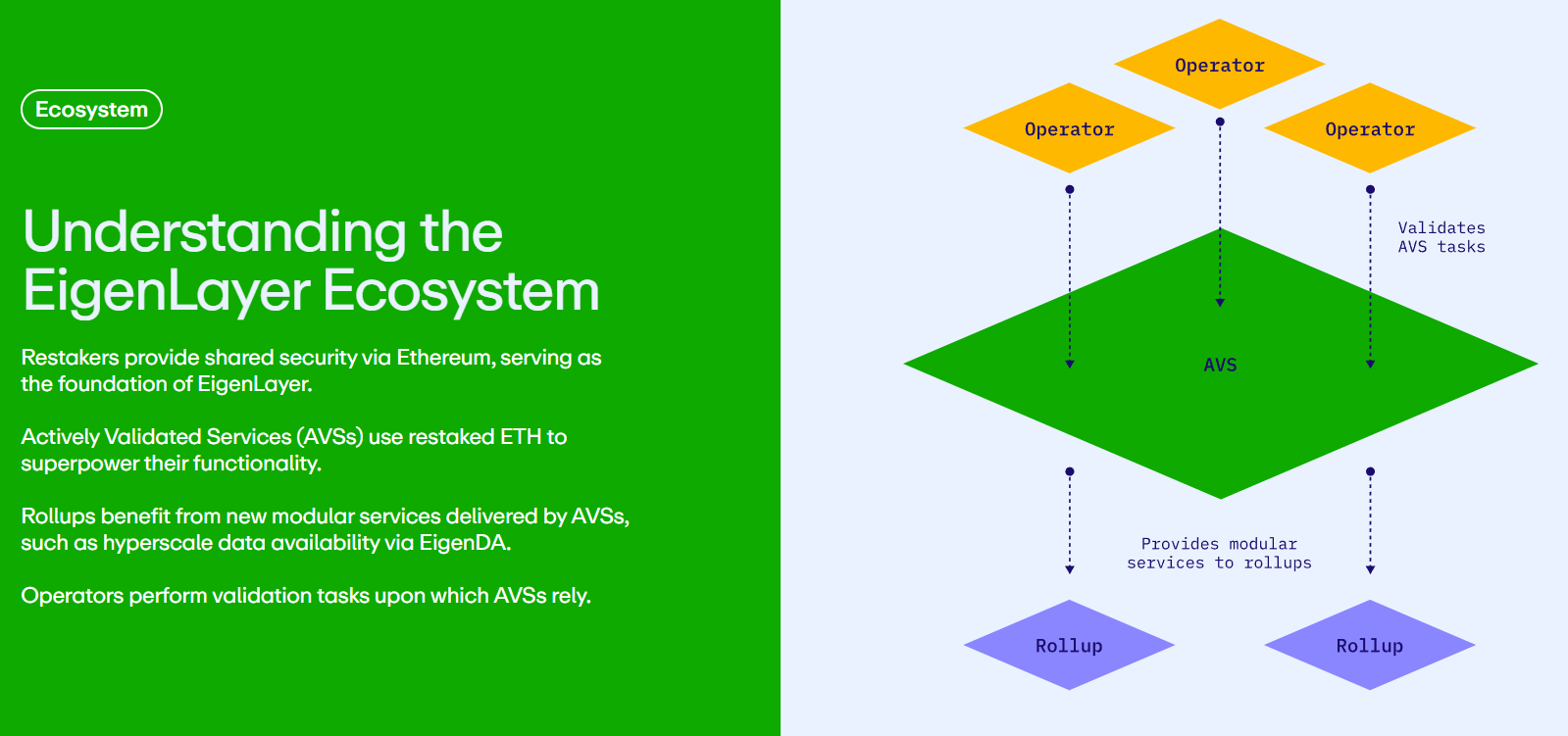

Restaking

Success of Swell (25:50)

When tokens are staked on Swell, they accrue sequencer fees, solving the disconnect between token holders and sequencers seen in existing Layer 2 solutions like Optimism and Arbitrum.

Swell has already generated over $1 million in sequencer fees with a 10% take rate, and Matt believes it could potentially reach $5 million in a bull market.

Swell has amassed over $2 billion in Total Value Locked (TVL) within a month of launch, showing that enhanced staking rewards is a real value proposition.

The risks (30:30)

Even though Restaking projects are interesting, speakers question themselves if such TVL is necessary. It is uncertain whether there will be a mass outflow from these projects eventually or if they can incentivize restakers to stay

Restaking does not pose a significant risk to the economic security layer, but the long-term draw for delegators to stay delegated is crucial.

AVS projects should bring value external to Ethereum to incentivize delegators to continue receiving rewards, and need to determine their minimum security requirements.

Furthermore, delegating to multiple AVS compounds the risk but not necessarily the yield, as each AVS may have different slashing conditions and yield denominations.

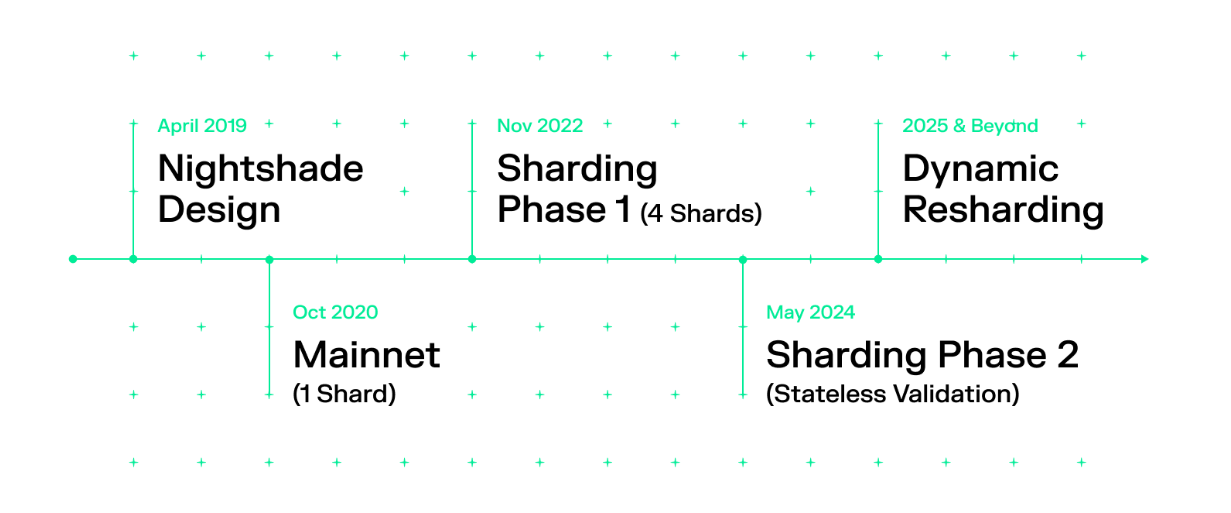

NEAR Awakening

In 2023, Solana came back and outshined the other blockchains. But since the beggining of the year, it seems Near is coming back too

Sharding Phase 2 (37:00)

Near has improved its infrastructure, and plans to position itself in the chain abstraction field. The idea of chain abstraction for execution is seen as an area that intents networks is also leaning towards.

Near is alive (38:00)

Near is seen as a real contender :

- Large existing user base through apps like Sweatcoin and Kai Ching, where users are interacting with blockchain technology without realizing it

- Critical mass of tooling, whether it's developer tooling for things like Java, or it's library support

They reached a point where it can be expandable, Near just need to choose where it wants to sit.

The AI narrative (41:30)

As investors are attracted to AI-related projects, Near can have a potential connection with this industry.

That said, Near has shown in the past that they can give in to the shiny object syndrome, with their Terra-like stablecoin (USN) in 2022, which has since been removed.

Arweave & AO

Launch of "AO" (43:10)

Arweave revolves around providing permanent storage, but they struggled to find a clear product-market fit within this aspect.

They recently launched "AO" on testnet, which is Arweave's Decentralized Compute Layer :

- It enables non-permanent storage in addition to immutable storage.

- It allows for state management and computation on top of blockchains, which was previously unavailable.

This adds a level of "liveness" to the storage layer, enabling triggerable events and arbitrary proofs over stored data.

Smart contract liveness (45:30)

A state change on one chain can emit an event log, triggering a signing event on another chain, enabling end-to-end processes across multiple chains.

It unlocks the potential for multi-chain execution and coordination, and features like limit orders and stop-loss mechanisms through multiple chains for example.