MEVconomics.wtf Part 5

ETHconomics

MEVconomics flows (0:30)

MEV is not inherent to the blockchain itself, it arises from the economic games and financial activities built on top of the blockchain.

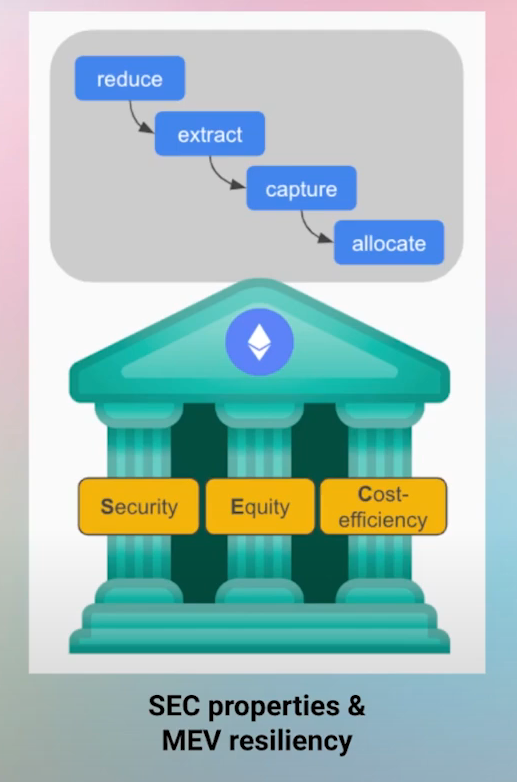

That said, MEV involves the whole system, so we need to reduce MEV through 4 ways :

- Reduce MEV through clever protocol design at the game level and transaction inclusion level (Most people working in this area are focused on the transaction inclusion game)

- Efficient methods to extract the remaining MEV (today this is largely searchers/builders)

- The extracted MEV must be captured in a trustless way (Order Flow Auctions or other trustless protocols)

- The captured MEV must be allocated properly to optimize incentives (we essentially need to make sure that this flows back to the users)

What should be the goal of MEV allocation ? (5:30)

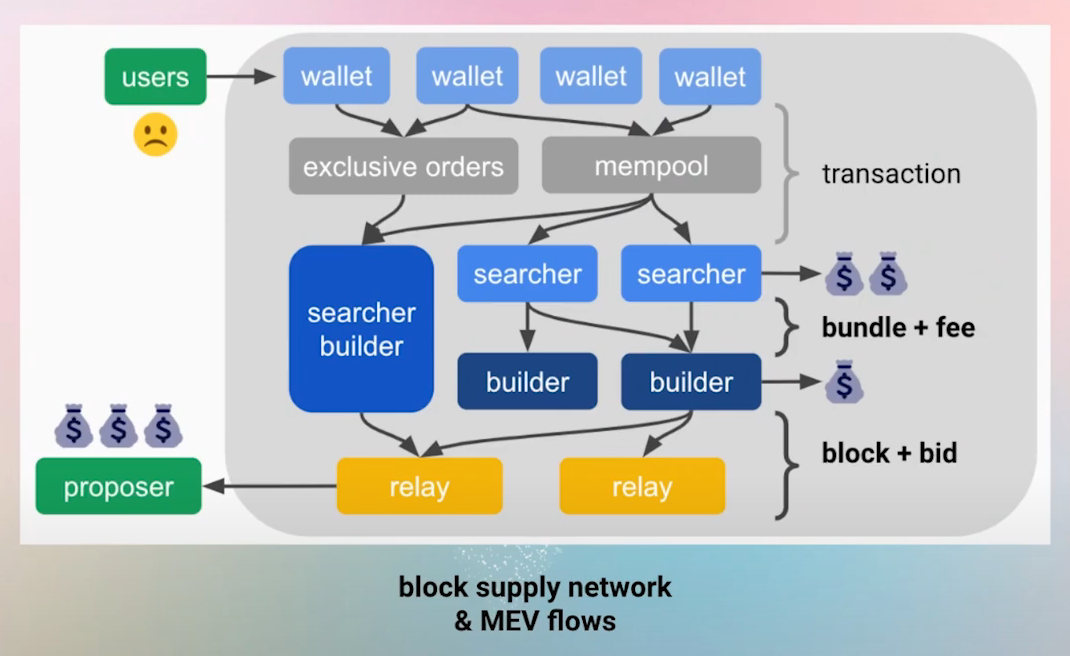

We tend to think of MEV flows in a supply chain paradigm, but it's more of a complex supply network

We need to measure and define metrics around inclusion delays, validator deviations from honest behavior, etc. Having data on these complex supply network properties will allow designing better protocols

The best way to allocate MEV is like a fair tax based on the externalities different players impose. This minimizes losses for honest users

Rig Open Problems (6:30)

Rig Open Problems (ROP) is an initiative to research and measure the complex properties and metrics of the MEV supply network

We are bringing together various ecosystem players to collaborate on understanding real MEV data, and the goal is using the data to design better protocols and systems

MEVconomics

MEV Precedence (7:45)

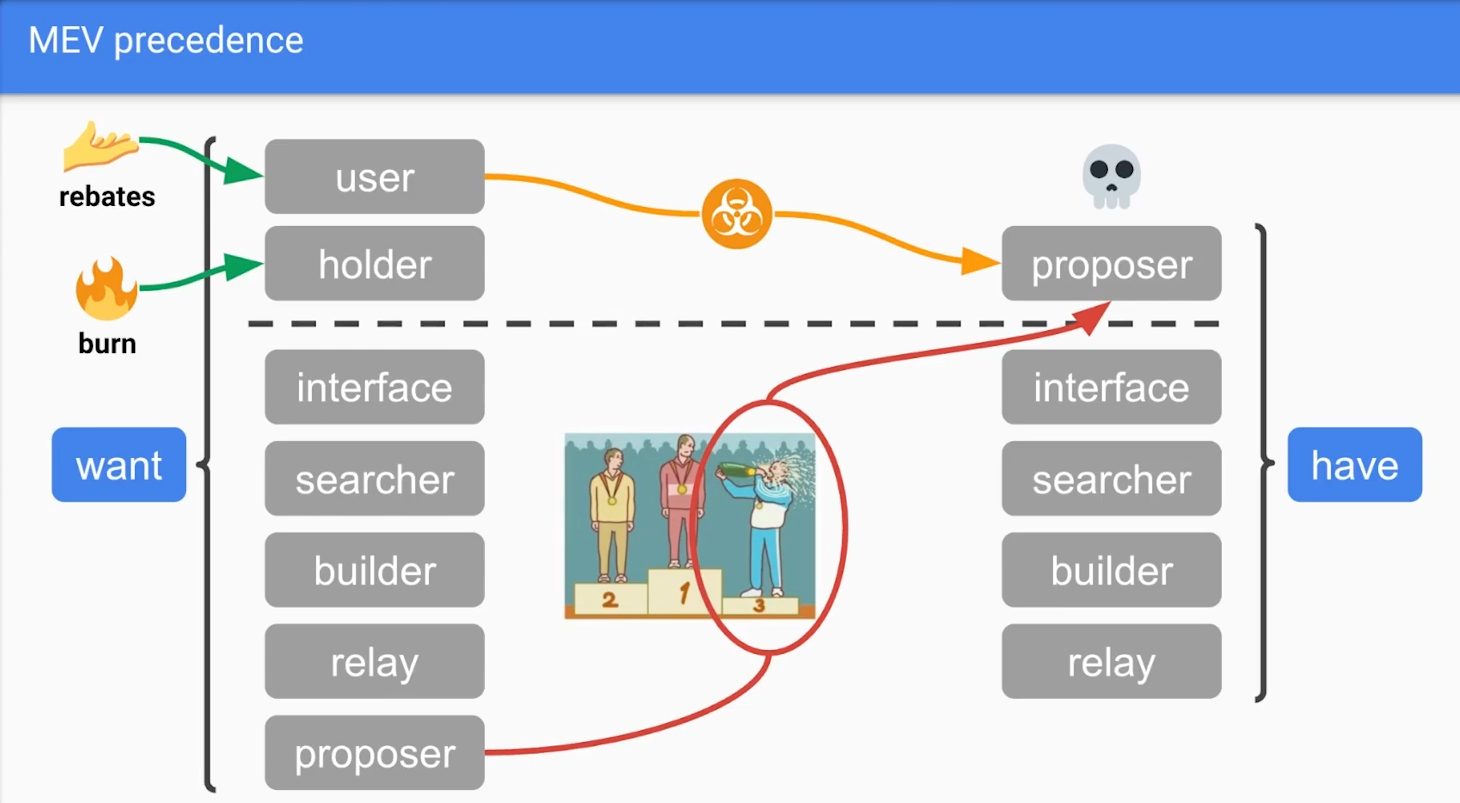

MEV Precedence is the order in which the MEV should be transmitted to the various parties

Two parties should have top precedence for MEV, according to Justin :

- Top precedence for users. Users initiate MEV through their on-chain activity, so they should capture the value they create.

- Token holders should have next precedence. The way they receive flows is through burn, and we already have base fees burn with EIP-1559. But we can implement further "MEV burn" mechanisms which can redirect more extracted MEV to holders

Proposers have incorrectly top precedence (9:30)

Currently, Proposers just pick the highest MEV bid. And this leads to behaviors that harm users :

- Incentivizes reorgs. Large MEV payouts incentivize proposers to reorg and steal high value blocks

- Centralization. Since most proposers lose the "lottery", they need to pool MEV, which leads to centralization

- "Rug pulls". Pool operators can steal large MEV payouts beyond their collateral/reputation at stake

- Overpaying for security. Excess staking demand during MEV spikes dries up ETH supply needed for decentralized stablecoins etc.

All those bahaviors are called "Toxic MEV", and Proposers get the most from those economic flows, whereas users are penalized.

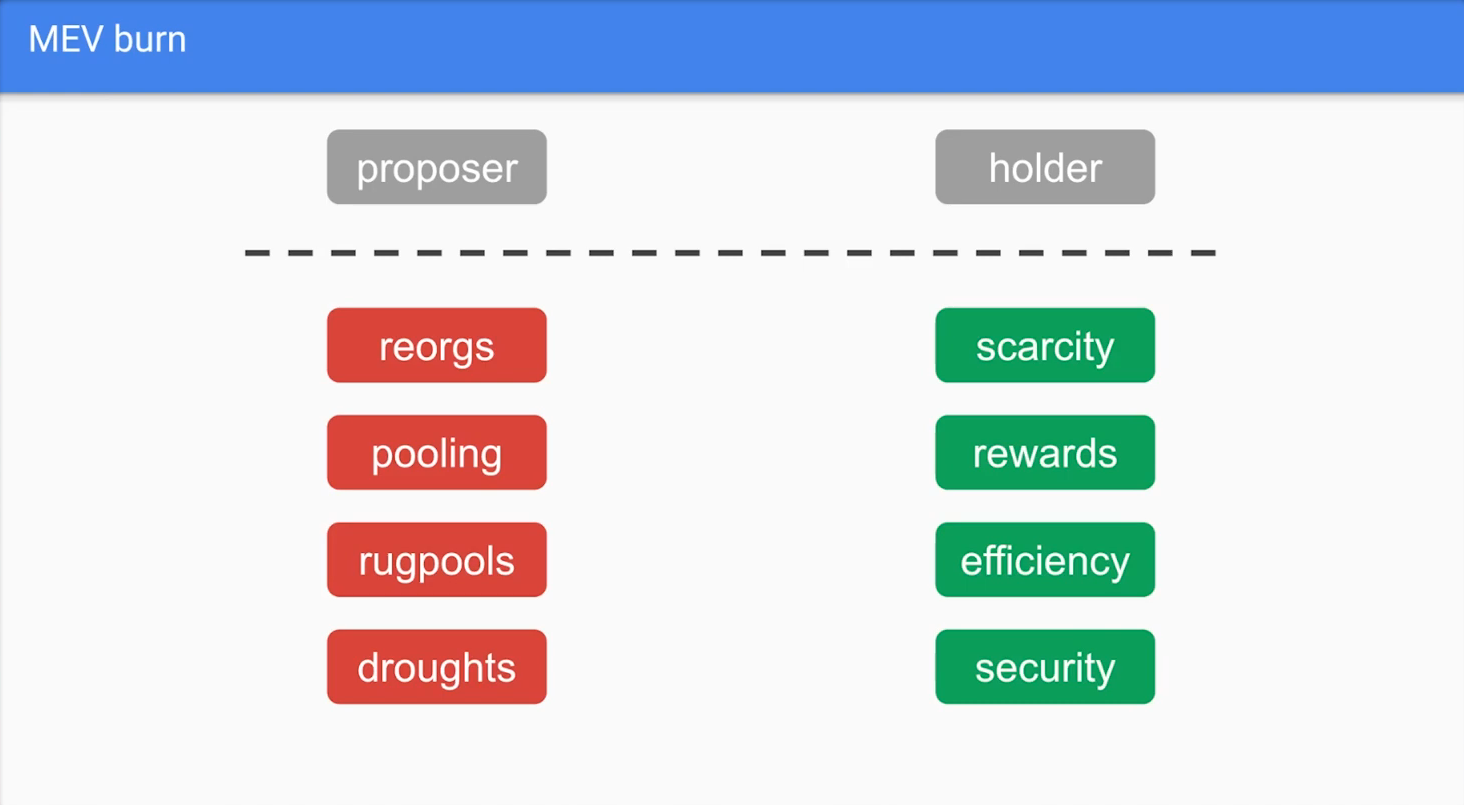

MEV Burn (13:30)

In order to avoid toxic MEV, we have to redirect MEV away from proposers and users/token holders should have top precedence for MEV. One way of achieving this is "MEV Burn"

What is MEV Burn ?

MEV burn consists in burning part of this MEV rather than letting it be captured by malicious actors. In concrete terms:

- Validators (block proposers) select sets of transactions (called payloads) submitted by block builders.

- The builders specify a "payload base fee" which is burned, even if the payload is invalid or revealed too late.

- Validators also impose a subjective "payload base fee floor", based on previously observed base fees.

- Honest validators select payloads that maximize the base fee burned.

In this way, a portion of potential MEV is burned at each block, smoothing out peaks and redistributing MEV to ETH holders. This discourages manipulation of transaction order and improves security & economic sustainability of the network.

MEV burn works in conjunction with EIP-1559 to put a price on two network externalities: congestion (EIP-1559) and contention (MEV burn).

Benefits (17:40)

- Increases ETH scarcity. Burning MEV increases ETH scarcity, pushing it more as the dominant money and settlement layer for Ethereum

- More equal rewards. Currently, the MEV portion makes most people lose money and a few are making money. With MEV burn, everyone earn kind of the same rewards.

- More efficient security, in the sense that you don't need as much issuance to pay for economic security

- Free ETH supply for economic bandwidth. With less ETH locked in staking, more is available for decentralized stablecoins and other economic needs

Protocol Credibility & Principal Agent Problems

PEPC "Pepsi" protocol (20:15)

PEPC (Protocol-enforced proposer commitments) is a proposed mechanism to allow Ethereum validators to enter into commitments with third parties in a permissionless and trustless way.

The idea is to allow validators to make commitments that are enforced by the protocol, so that validators cannot violate the commitments they make. For example, a validator could commit to letting a specific builder create their block. The protocol would enforce this by only considering valid a block made by that specific builder.

How it could work :

- Validators can submit commitments expressed as smart contract code when they propose a block. This code defines the commitments made by the validator.

- Other parties can check this code to verify the validator's commitments before interacting with them.

- The protocol enforces the commitments by only considering blocks valid if they satisfy the commitments made by the proposing validator

PEPC aims to provide the infrastructure for validators to outsource tasks while still retaining security guarantees from the protocol. This could allow more decentralization by letting less sophisticated validators outsourced complex tasks.

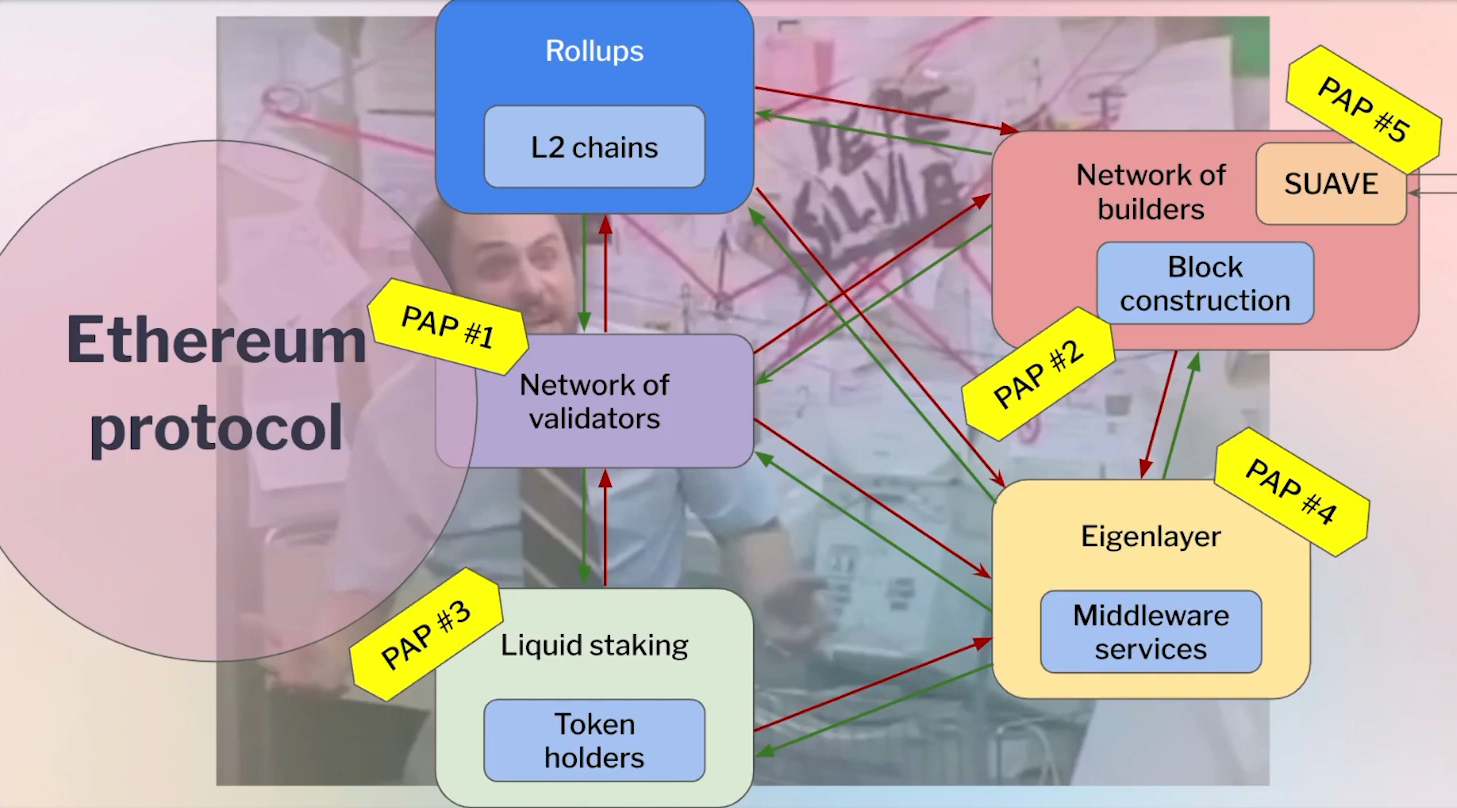

Protocol Credibility (21:40)

Protocol Credibility = Protocol Introspection + Protocol Agency

We saw that iterative community-driven protocol upgrades have worked well so far. The problem is, as economies grow more complex, more things get delegated, leading to misaligned incentives across fractured trust domains.. Those are called Principal-Agent Problems (PAP), and they lead to credibility risks.

PEPC introduces "programmable protocol credibility" to flexibly address principal-agent problems. It provides solutions for the protocol to see PAP as more "credible" since the validator set will defend commitments.

However, it may conflict with the goal of minimizing protocol commitments the community must indefinitely defend. In any case, work on credibility and commitments related to this theory are in progress

Q&A

Optimizing MEV allocation to align incentives (26:50)

Ideal MEV allocation is like a fair tax based on the externalities users impose on the system, this aligns incentives and minimizes losses.

But given the complexity of the issues, we only have elements of an answer :

- Clearly separate consensus layer (issuance) and execution layer (fiscal) when managing MEV. Part of MEV should go towards validators to maintain incentives, and other part goes towards users. For example, in the type of allocation that an OFA system would do, there is a direct transfer back to the user

- MEV smoothing (via MEV Burn) doesn't fully solve issues. It doesn't address economic bandwidth drought from excess staking demand, and centralized committees create other risks

- Auctioning validator slots internalizes MEV. Validators pay more if they benefit from MEV at execution layer, and this links consensus and execution layers incentives

The key is using data to dynamically calibrate multi-layered allocation mechanisms that align user, validator, and protocol incentives. MEV burn and validator auctions could work together 👀

Layer 2s (32:20)

About Rollups

- Rollup teams are well-incentivized already with large market caps. They require large teams and take substantial risk

- Rollup capitalism will become commoditized over time. Like electricity and water, less incentivization needed eventually

- Rollups want maximal decentralization. Progressing from centralized sequencers to decentralized

- Rollups need fast execution and decentralization plan. Credible neutrality roadmap vital given network effects

Non-base rollups will dominate short/medium term

About Base Rollups

- Base rollups are part of the decentralization progression. Shifts sequencer from L2 to L1, leading to enshrined rollup

- Base rollups offer credibility, security, decentralization. This aligns with end goal of a mature and maximally neutral rollup

- However, it's unclear how base rollups provide pre-confirmations. But methods like Eigenlayer may enable these services

Base rollups are part of full rollup design space exploration

Do we need enshrined PBS ? (37:45)

MEV space evolves quickly week-to-week. Given its pace of change, we need more research before enshrining :

- See more data, experimentation before committing

- Figuring out optimal shape before needing to use

Alternative trust-minimizing solutions are worth exploring before committing. Relay operators want enshrined PBS, but being a relay operator has risks like hacks, collusion or theft. We need clever techniques to remove relay trust :

- Flashbots is working on using SGX to remove the relay

- Optimistic relaying roadmap incrementally progresses PBS

That said, according to participants, we'll have some sort of reasonable equilibrium in 1.5-2 years

Latency arbitrage races

Latency games in exchanges (0:20)

Research using message traffic data between traders and exchanges in UK equities market revealed astonishingly high volume of latency arbitrage races :

- 20% of trading volume was identified as races, with differences in milliseconds or microseconds between firms chasing the same arbitrage.

- Among those firms, only few ones won 50-85% of the races, showing centralization tendencies.

Centralized crypto exchanges also face latency games like spinning up nodes in cloud zones and pinging matching engines. Cloud hosted endpoints enable similar latency games to traditional markets among crypto exchanges.

Latency games in crypto (5:00)

Crypto likely has even more latency games due to ability to manipulate transaction ordering and timestamps. Examples are seen :

- Solana prioritized low block times, which led to strategies requiring validators to be located in high-end, low-latency data centers as AWS.

- Issues in sequencers like Arbitrum having to flag manipulation, but largely opaque to regular users.

On-chain latency games are less prevalent than traditional exchanges, but this is a growing problem and more complex than traditional markets

Winner takes all (8:00)

Latency games can be winner-take-all races that incentivize physical infrastructure centralization, or allow dispersed rents :

- With low fee sequencers, latency games manifest as spam

- High fees enable latency arbitrage

Eliminating latency games involves research, data, conversations, and philosophical thinking on concepts like geographic decentralization.

Ethereum's batch design reduces latency games, but cross-domain MEV with centralized exchanges creates pressure.

What if latency games were all about time ?

Nobody agrees about time (12:40)

We have discrete time, continuous time, relative time, and absolute time. There's a tendency towards relative competition, relative time rather than absolute time being important

Some kinds of latency games might be winner take all, whereas other kinds of latency games might not be different parties might discover tiny corners, tiny little arbitrage quarters. And that, for whatever reason, reminds of the real estate industry

The real estate industry (16:20)

The real estate industry is another industry with tons of rent seeking. The way that plays out economically is we have lots of small real estate brokers each fighting for their little scrap. But there is a centralizing tendency in that market, which is the real estate lobbies.

Lobbies help preserve the kind of flawed economic arrangement of needing a broker on the buyer and the seller side. Even though rent seekers would be very dispersed, they find a way to band together nonetheless.

Key is to align private incentives with social welfare, not socially wasteful activities.

Crypto VS TradFi

Differences with TradFi (26:10)

Unlike traditional finance where execution relies on trusted relationships, crypto allows more programmatic combinatorial orders spanning different venues at the same time :

- New crypto assets and protocols

- Leverage

- Auctions

- Cross-chain

All of those create arbitrage opportunities, and lead crypto market structure to evolve differently from lit exchanges in traditional finance.

Arbitrage that seems sophisticated is often just exploiting basic pricing differences that are obvious, but hard to technologically exploit quickly.

Competition on Risk (31:10)

During recent stablecoin crashes, passive LPs provided critical backstop liquidity as sophisticated firms rationally backed off extremely volatile arbitrage opportunities.

The varying risk profiles between passive liquidity providers (LPs) and sophisticated arbitrageurs creates a more robust system compared to if it was just zero-sum arbitrage competition.

MEV can't be fully solved

Fundamental limits (33:30)

There are fundamental limits on decentralized ordering :

- Perfect timestamping can't achieve true fairness due to relativity. The order of events depends on the observer's reference frame.

- Trusted timestamping would only shorten batch interval, not solve MEV. At best, timestamping approximates first-come-first-serve ordering, which still enables spam transactions or latency races to get favorable treatment.

- Frequent batch auctions could solve MEV at application layer by reducing winner-take-all dynamics related to fairness. But can't solve MEV at base protocol layer

Decentralized protocols can't escape the subjectivity inherent in ordering events, unlike centralized systems that can dictate a reference frame. Solving MEV completely may be impossible due to the unavoidable unfairness in how different observers will order events.

About Fairness (45:50)

There is no way to achieve perfect decentralized ordering without subjectivity. Geographic diversity increases coordination time which some may see as unfair, but lack of diversity subjects systems to centralized regulations

Parameterizing time intervals involves fairness tradeoffs :

- Shorter intervals favor lower latency participants

- Longer intervals disadvantage higher latency participants

True fairness is about rational distribution of rents. But no clear way to define rational rent distribution, different observers will order events differently

There are 2 open questions:

- What can you solve at the application layer ?

- What, if anything, can you solve at the protocol layer?

Batch auctions are "cartels" (52:00)

There is no value judgement calling them cartels. It's just a way to designate users saying "let's not get screwed together", and their impact can be positive or negative

But the cartel nature of batch auctions inevitably involves tradeoffs :

- General purpose chains : can accomodate diverse use cases, but this require aligning interventions like auctions with core protocol (like fitting Flashbots auction into Ethereum block production)

- Specialized chains : specialized batch auction chain would have clean abstraction from external venues, But some MEV remains from arbitrage across venues

This is an active area of experimentation and debate to determine the optimal approach.

The Hardware Edge (55:20)

Profits incentivize all kinds of innovative behavior, but we must align private profit incentives with what's socially useful for markets to avoid zero to negative-sum games (arbitrages are zero-sum games)

MEV risks are pushing towards specialized hardware, turning proof-of-stake systems into "proof-of-work". In other words, Complex crypto strategies create advantages for specialized hardware, risking centralization, like FPGAs in Solana MEV extraction.

About HFT fiber investments

There is no clear evidence that HFT fiber investments brought social value. Eric is open-minded that there could have been unanticipated benefits, but hasn't seen specific reasons or data showing this

It's hard to see a ton of social value getting from 5 microseconds to 4 microseconds, but that's just an intuition

There was a debate about distributing computation geographically or not :

😇For Phil, crypto should distribute computation geographically, not centralize into one hardware cartel

😈Michael thinks that geographic diversity is antagonistic to fairness because you're just increasing the actual amount of time for the network to coordinate

In any case, follow the Money

Currently MEV accrues mainly to validators, some searchers and users. The middlemen, like Flashbots, take some rents.

Ethereum Rate Group is focused on some of this stuff and that's going to be some really cool stuff to come out of that.