MEVconomics.wtf Part 1

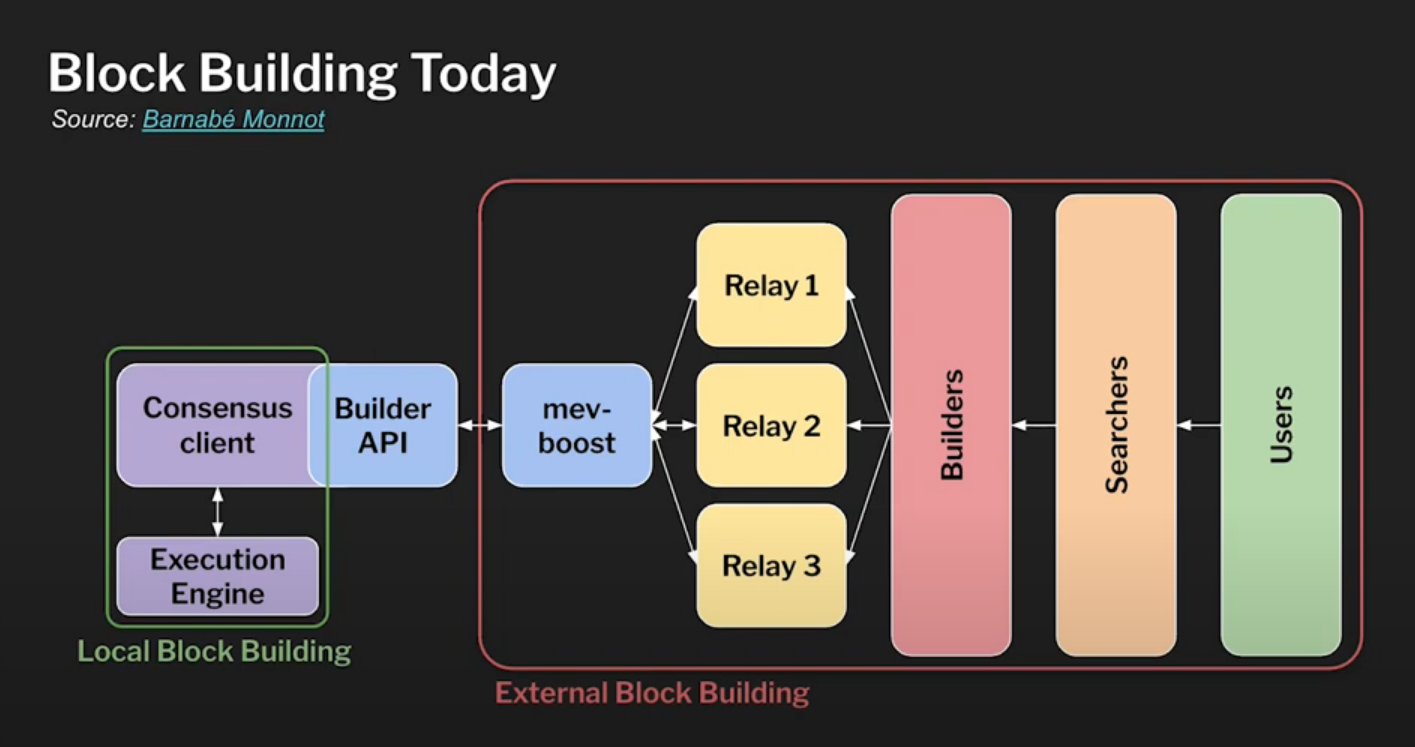

Block building today (1:00)

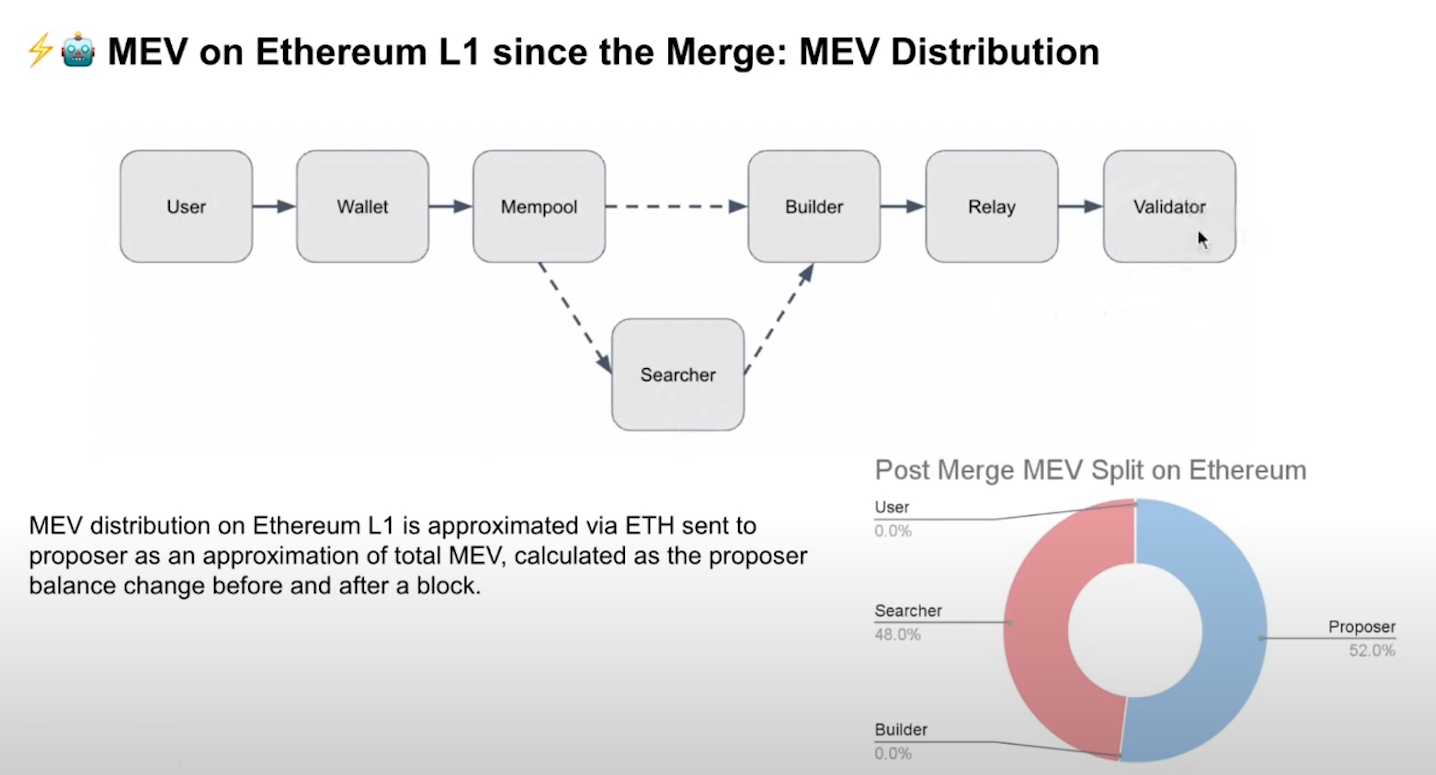

- Users send transactions

- Searchers bundle transactions ans send them to builders through relays

- Builders create blocks and propose them to validators

The separation between proposers and builders (aka PBS) allows validators to have permissionless access to MEV without needing sophisticated actors.

Trends since the merge (2:00)

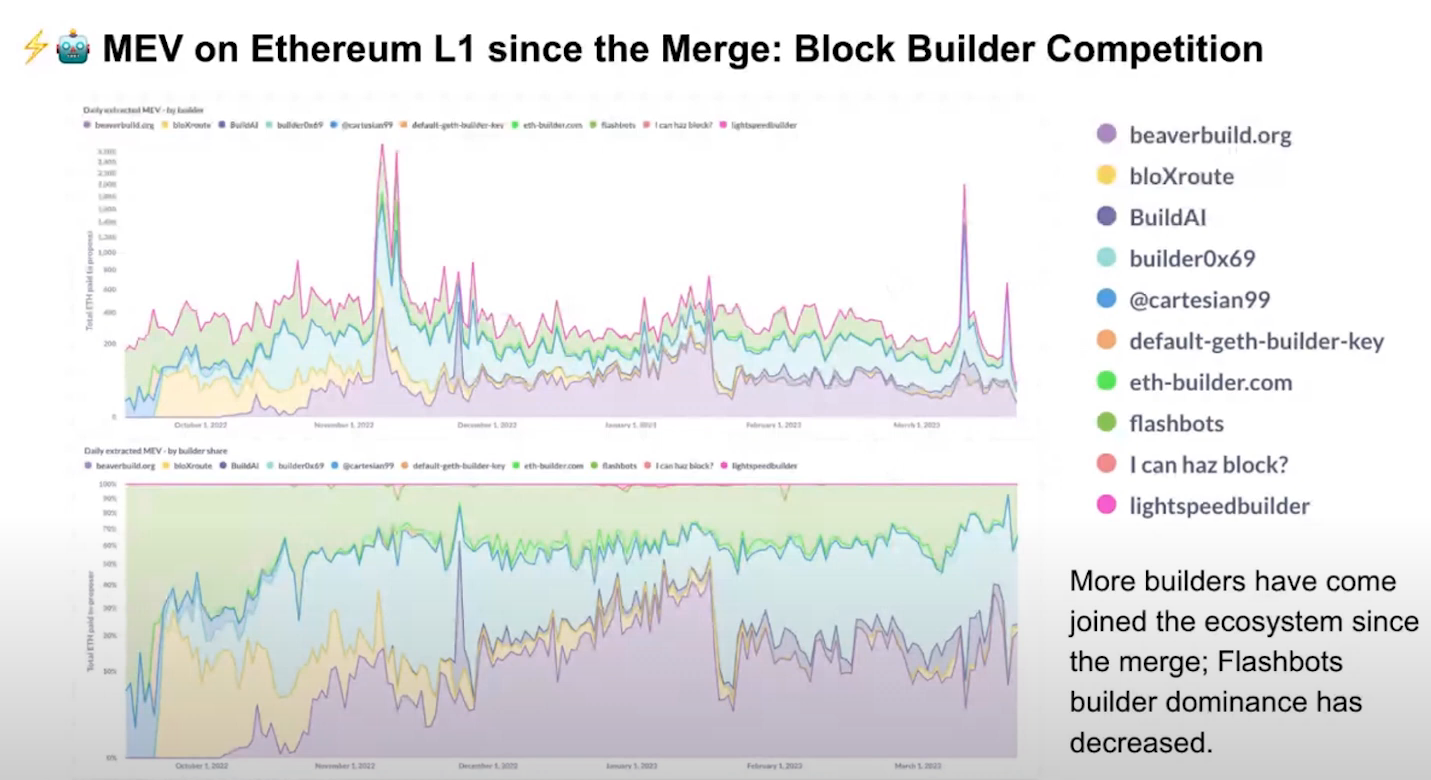

Since the merge, the builder market has become more diversified with many participants taking market share (we can thank Flashbots to have open-sourced their builder).

Some builders are able to make profits while others operate on a flat model passing everything through. But builders have the potential to add additional features in their role.

Centralizing Tendencies (3:00)

While there is currently a good amount of decentralization in the builder market, we need to decentralize more :

- Better privacy tech needed to coordinate

- Less trusted

- Return more value to users

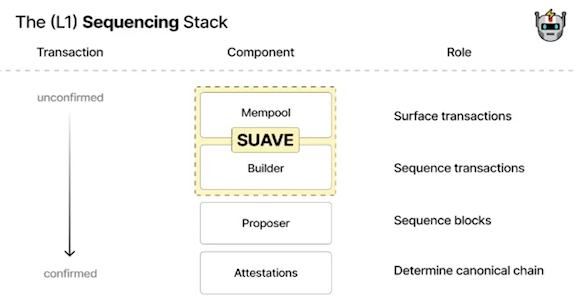

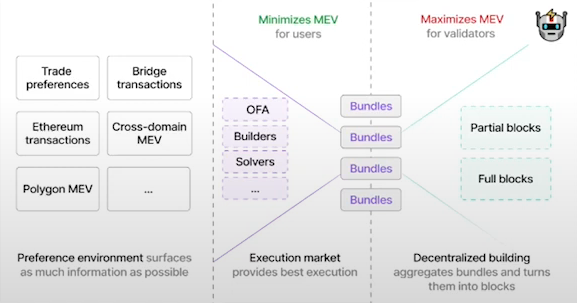

Efforts are being made to build a fully decentralized block building network with multiple participants contributing to building a single block. That is exactly what SUAVE does

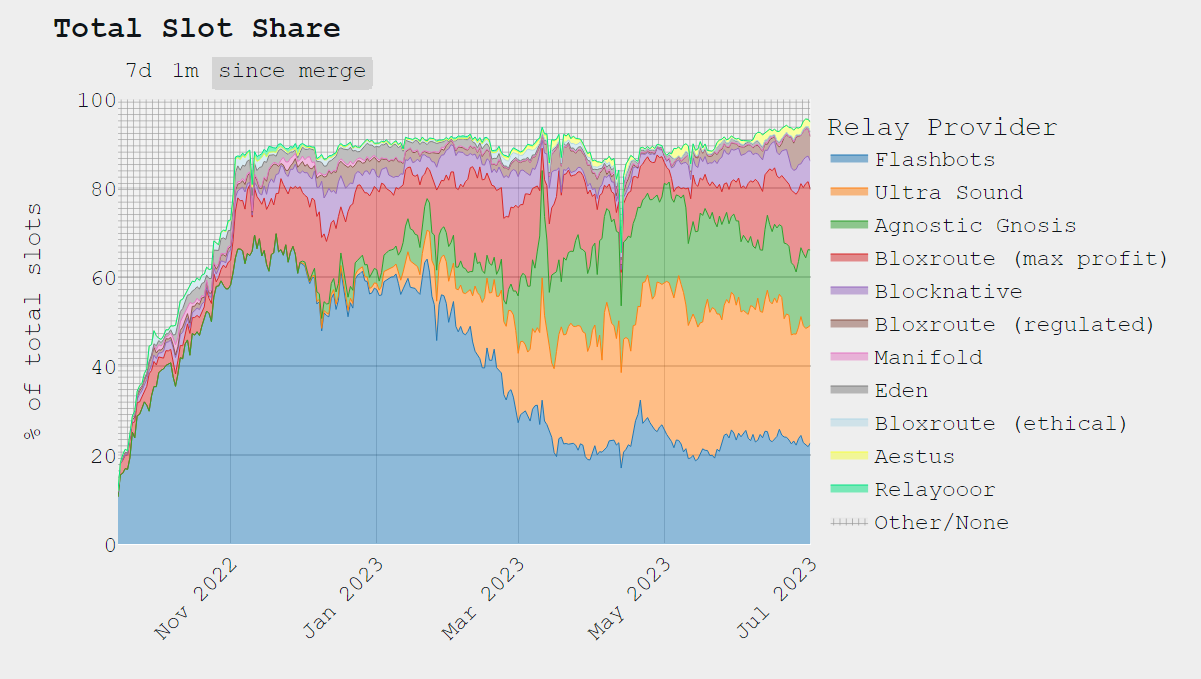

Relay Market (4:00)

Relays act as the pipes between builders and validators, transmitting blocks.

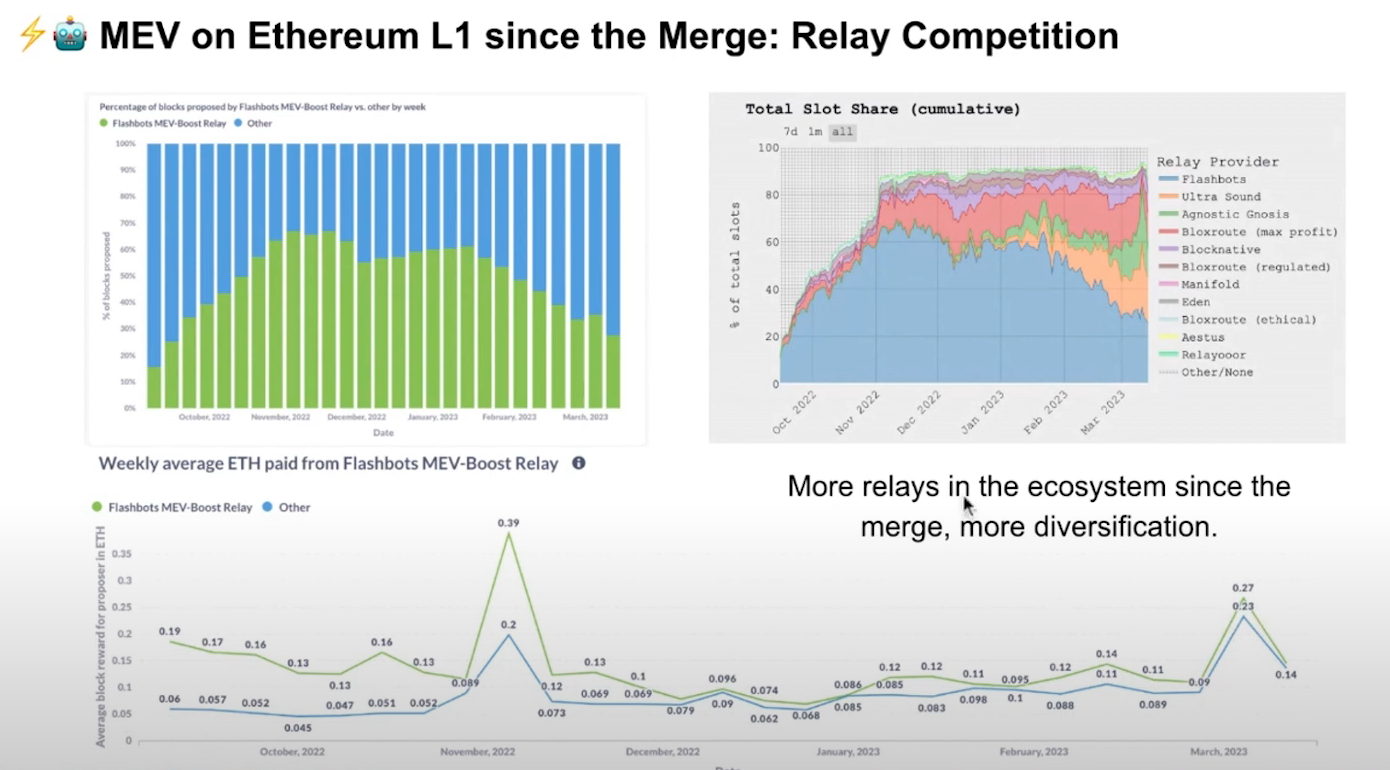

Initially, relays were centralized with flashbots being widely used. Diversification has occurred in recent months, with ultrasound relay which became bigger than Flashbots.

Ultrasound Relay offers a new concept called "Optimistic Relays", where latency is reduced by eliminating the need for relays to validate blocks before sending them to proposers. The problem is that blocks are no longer fully checked but collateralized by builders.

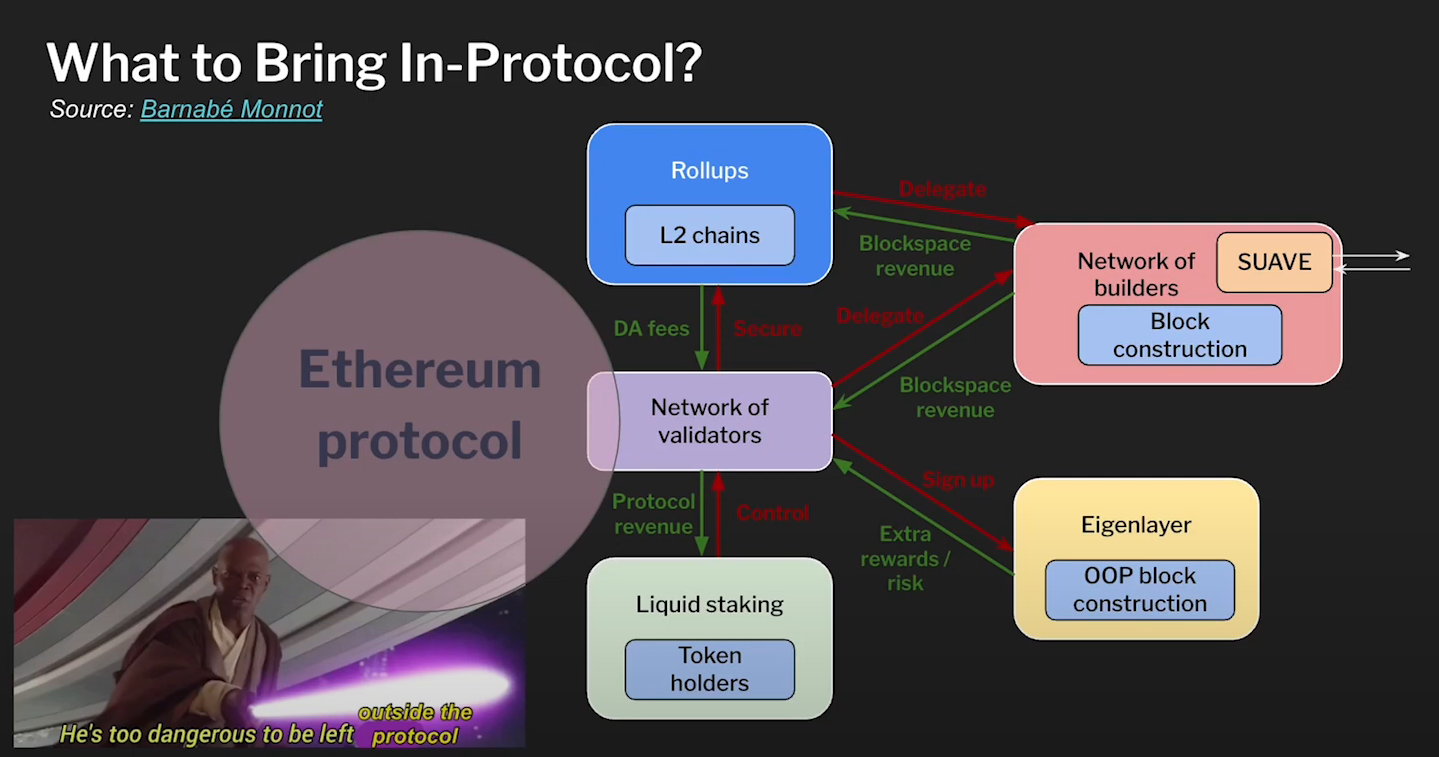

What to bring in-protocol ? (6:30)

The Ethereum protocol is currently simple, and most actors operate outside its core. A perfect example of that is in-protocol Proposer-Builder Separation (PBS). So relays are necessary due to the lack of market structure and allocation mechanism for PBS built into the protocol itself.

However, we can see mechanisms like Protocol-Enforced Proposer Commitments (PEPC, "pepsi") and Restaking to make the protocol more flexible

Making the Protocol More Flexible (8:00)

Proposal Builder Separation (PBS) is two things : market structure, and allocation mechanism.

The idea of making the protocol aware of external commitments is explored as an alternative to specific proposer-builder separation models. This is what PEPC aims to do, and this relates a lot to Restaking, as proposers can potentially opt into external commitments outside of the protocol

This raises a big question : what is actually the Ethereum protocol's job to guarantee ?

Markets overview

Validators Market (9:30)

A handful of opertaors do control a large amount at stake. While we have high economic security, we have to decentralise the actual state behind all this

For example, Lido made Lido Staking Router : anyone can develop on-ramps for new node operators ranging from solo stakers, to DAOs and Distributed Validator Technology (DVT)

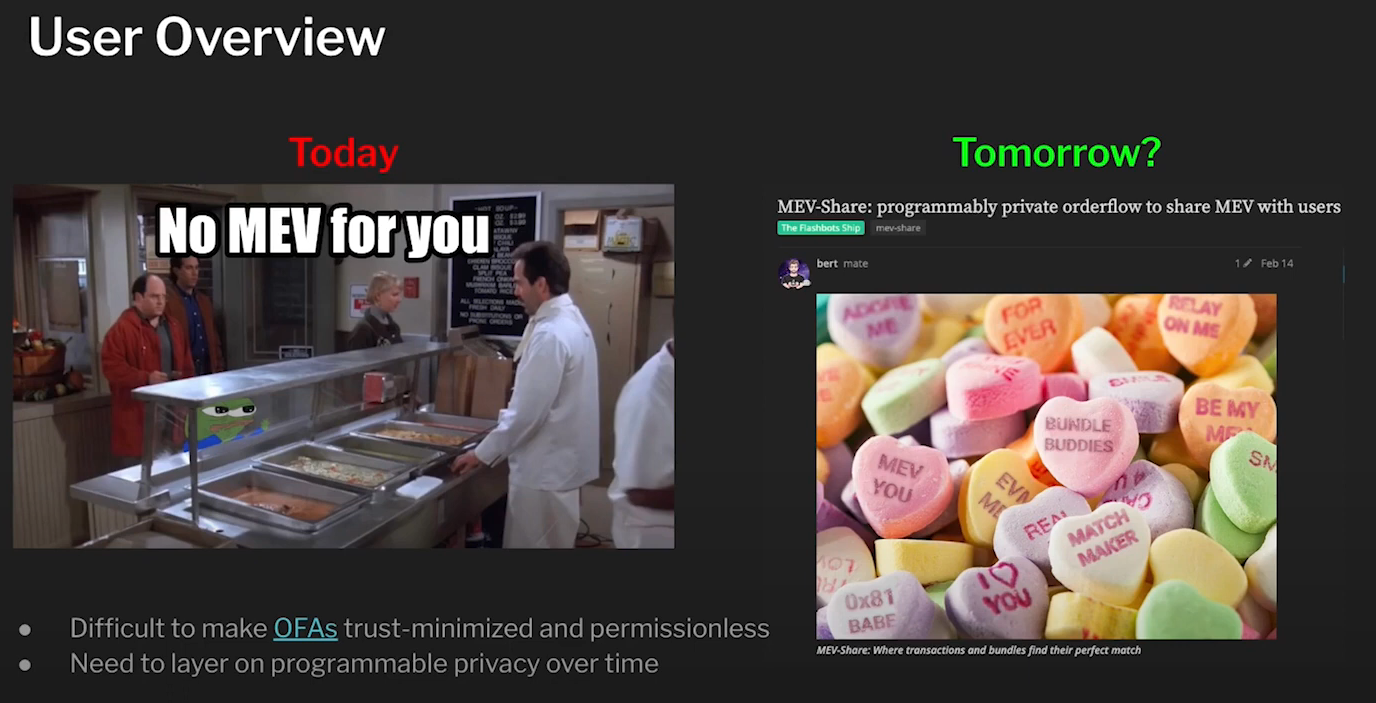

Value for users (10:30)

There's no competitive process where people are bidding the user back the actual value of what his order is creating. This is the core concept behind Order Flow Auctions (OFAs)

Order flow auctions involve a competitive process where searchers bid for the right to execute trades. Bidders can capture value by offering higher bids in the auction. The challenge lies in implementing trustless mechanisms for order flow auctions.

Wallets overview (11:45)

Wallets need to monetize their service. They aggregate user order flow and send it through the supply chain, so they have significant power in controlling where orders are executed. But striking private deals between wallet entities and builders, isn't this TradFi ?

A more desirable approach is to create a permissionless system that avoids centralizing forces, especially with OFAs

Application layer Overview (12:30)

In general-purpose environments like Uniswap, a significant portion of generated value benefits Ethereum validators, searchers, builders, etc. Applications aims to internalize MEV to capture more of this value for themselves :

- Osmosis implements a module where their validator automatically performs arbitrages and captures revenue for the application (ProtoRev)

- Another solution is to improve Proof-of-Stake economic security itself with MEV redistribuition

Layer 2 overview (13:15)

MEV is already a problem with centralized sequencers. It becomes worse with decentralization, because it introduces more problems and questions. For example, a first-come, first-served ordering lead to latency games and we can't build a fair game out of this

Some Shared Sequencers are under development :

- Shared sequencers, such as base roll-ups proposed by Justin, allow layer one to sequence multiple roll-ups.

- Other chains like Espresso and Metro offer shared sequencing layers for multiple roll-ups.

Shared sequencers provide exciting benefits but raise complex questions regarding economics and trust in these systems.

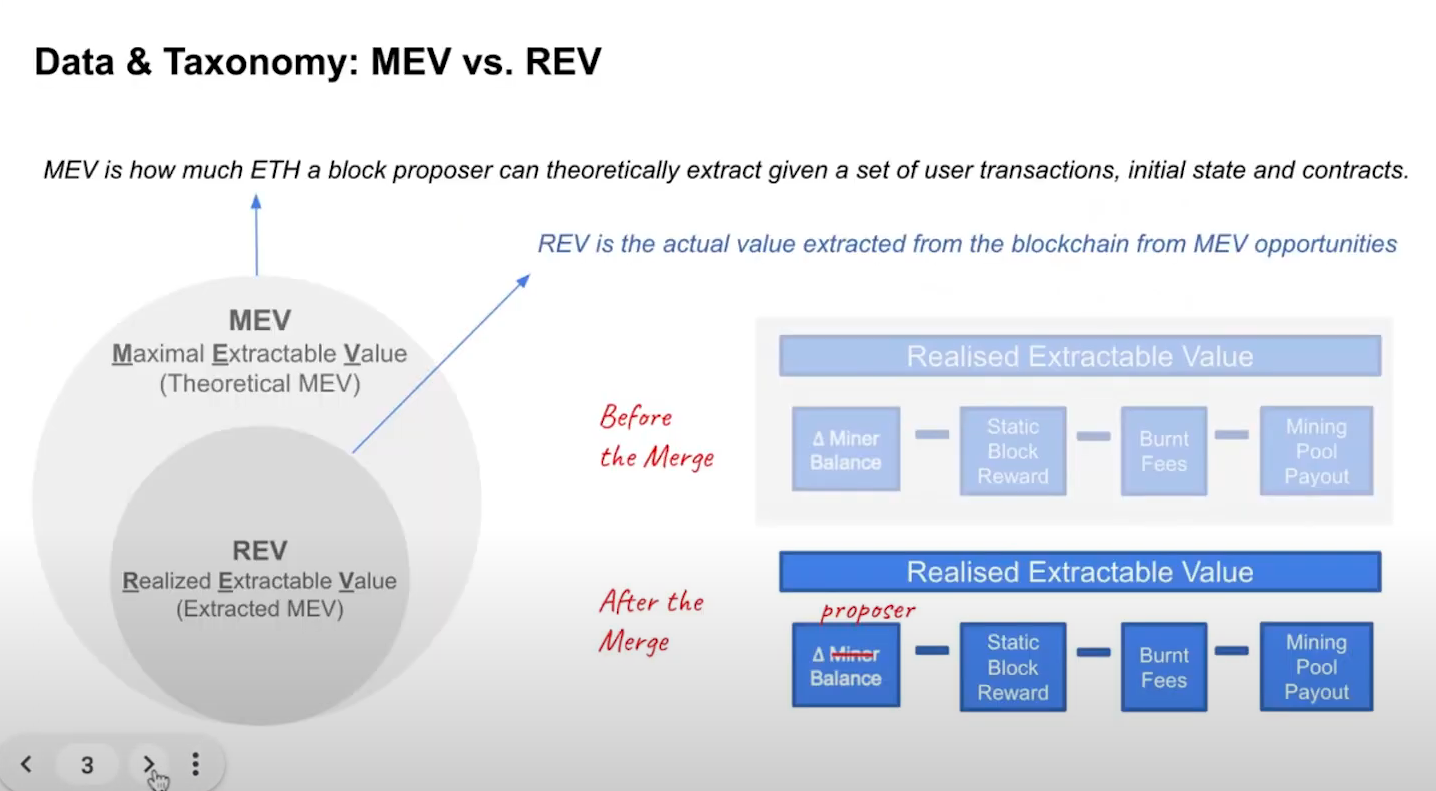

Taxonomy (0:45)

MEV is a theoretical value, whereas REV is the realized value extracted from MEV opportunities

Before the merge, REV was collected from the Miner balance change. After the merge, REV is collected from Proposer balance change, which is basically the same data. We use ETH send to Proposers as an approximation for the total REV.

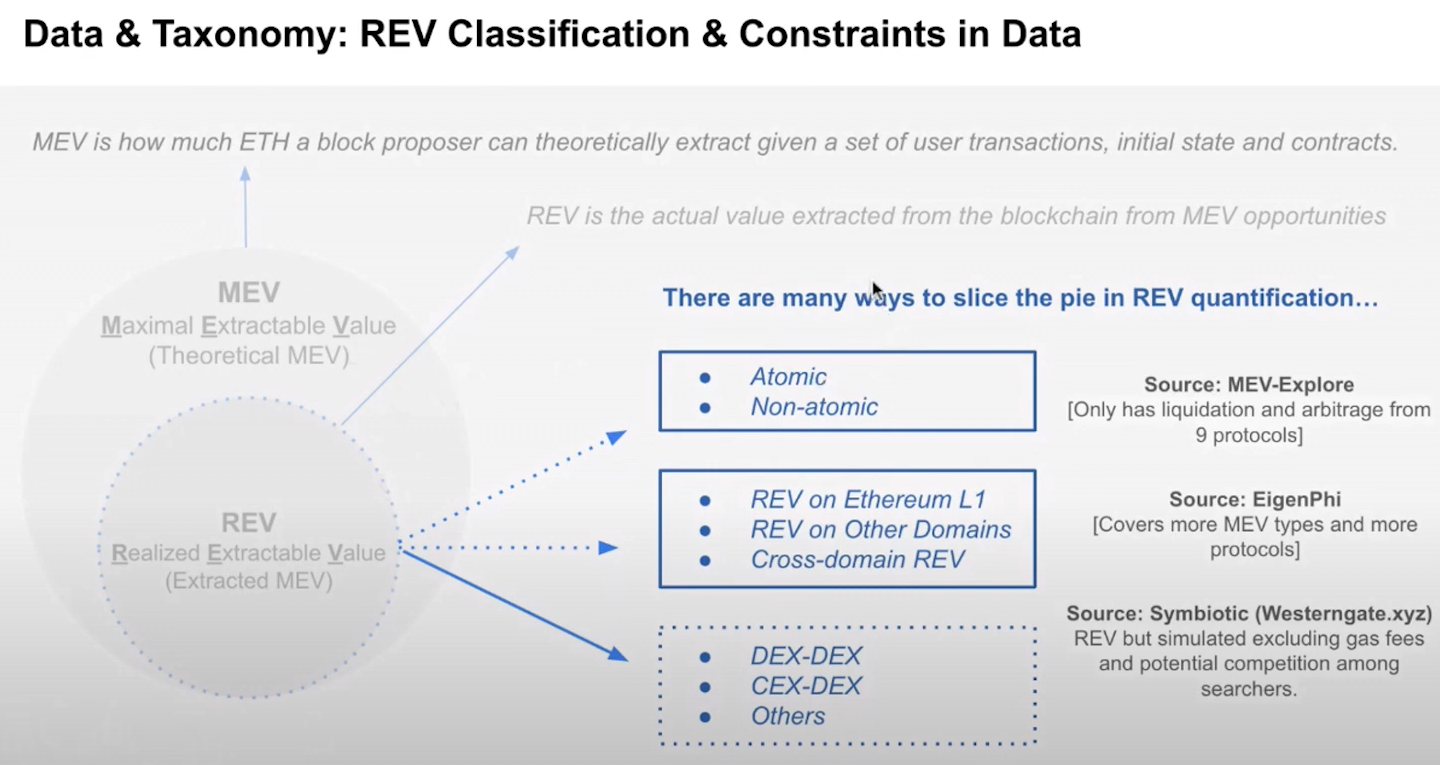

REV pie in sliced in many parts :

- REV on Atomic and non-atomic arbitrages (MEV-Explore)

- REV on Ethereum L1, Other chains, Cross-chain (EigenPhi)

- REV on exchanges (Odos)

Elaine mentions that sources provide some numbers related to MEV activities but it represents only a small portion of the overall picture.

Breakdown of MEV Distribution (5:00)

Assuming that only searchers and proposers receive MEV (excluding other parties involved), approximately 48% goes to searchers and 52% goes to proposers.

There has been an increase in relay competition since the merge, with more relays now available compared to earlier. Initially, there were only Flashbots and Block relays, but now there are multiple options. Flashbots' share of relay usage has been decreasing over time.

MEV accelerated the latency game

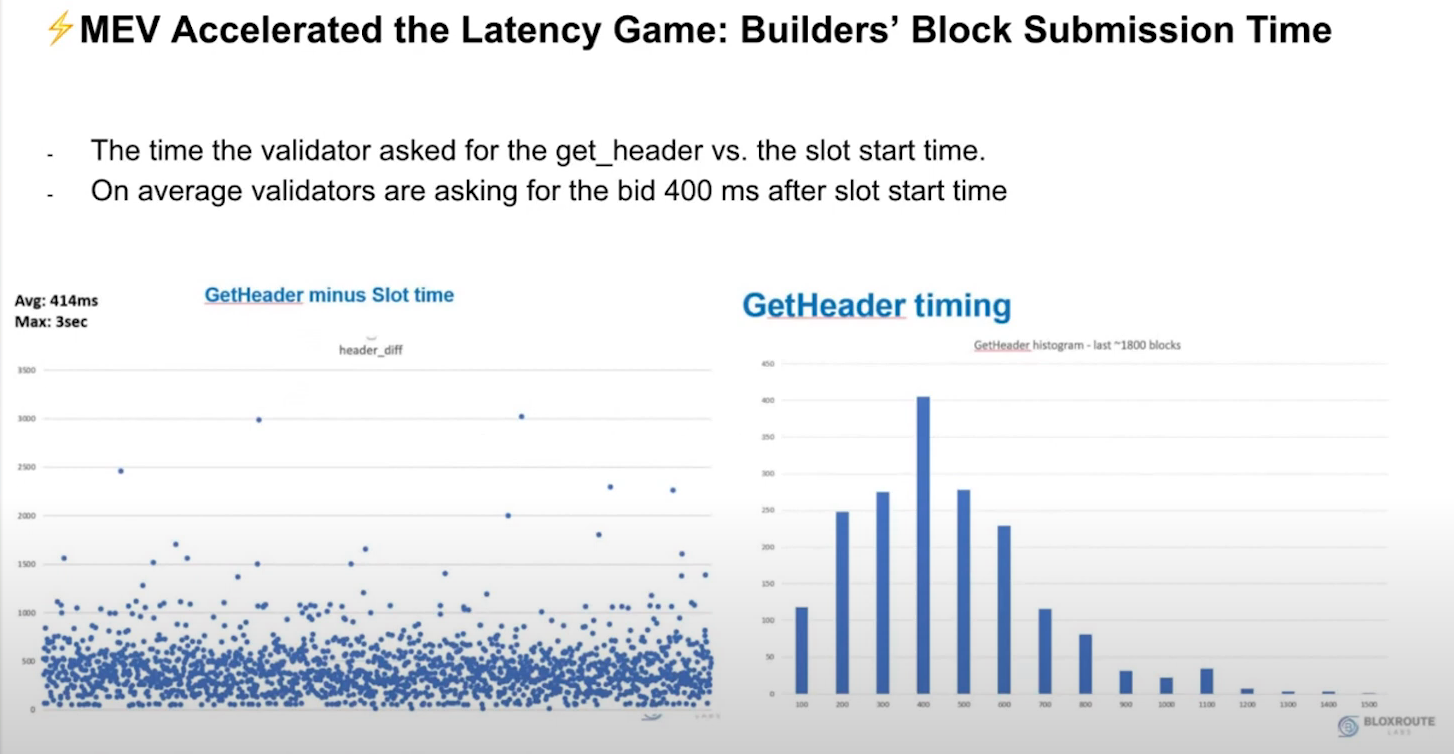

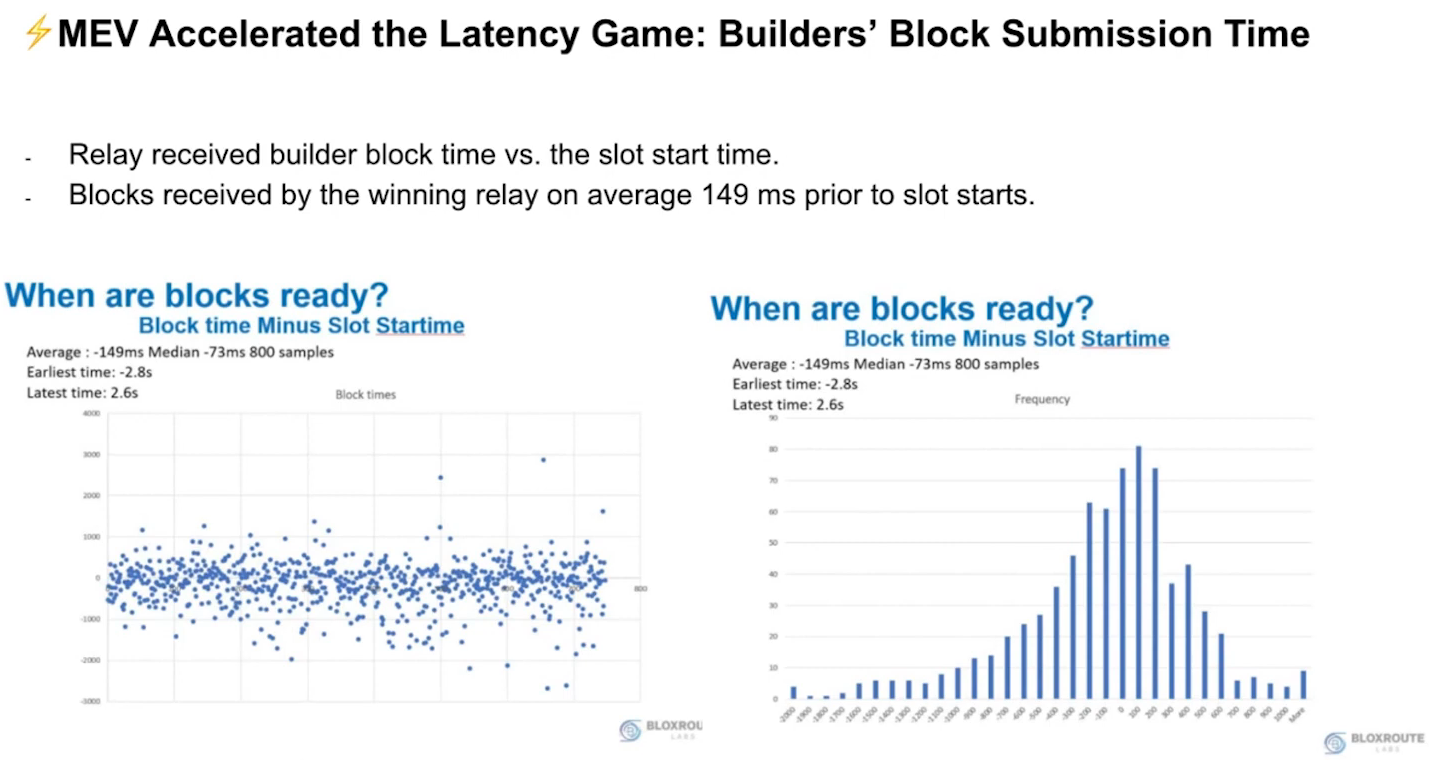

Builder's block Submission time (7:15)

- Validators are asking for the bid around 400 milliseconds on average after the slot starts

- The average winning blocks arrive on-chain approximately 149 milliseconds before the slot starts.

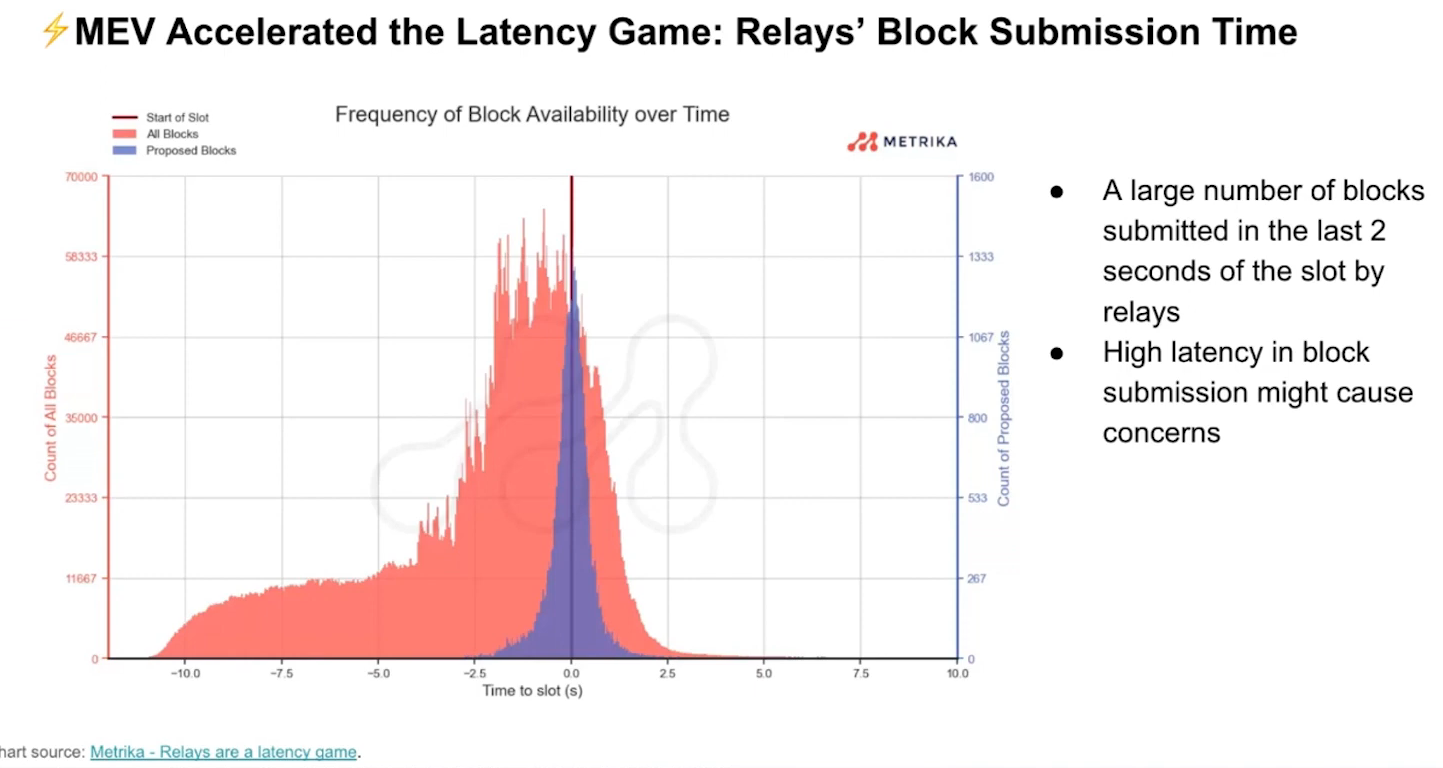

Impact of Block Submission Latency (8:00)

Most blocks are submitted in the last two seconds of the slot, causing high latency in block submission. High latency in block submission can lead to delays in attestation and network congestion.

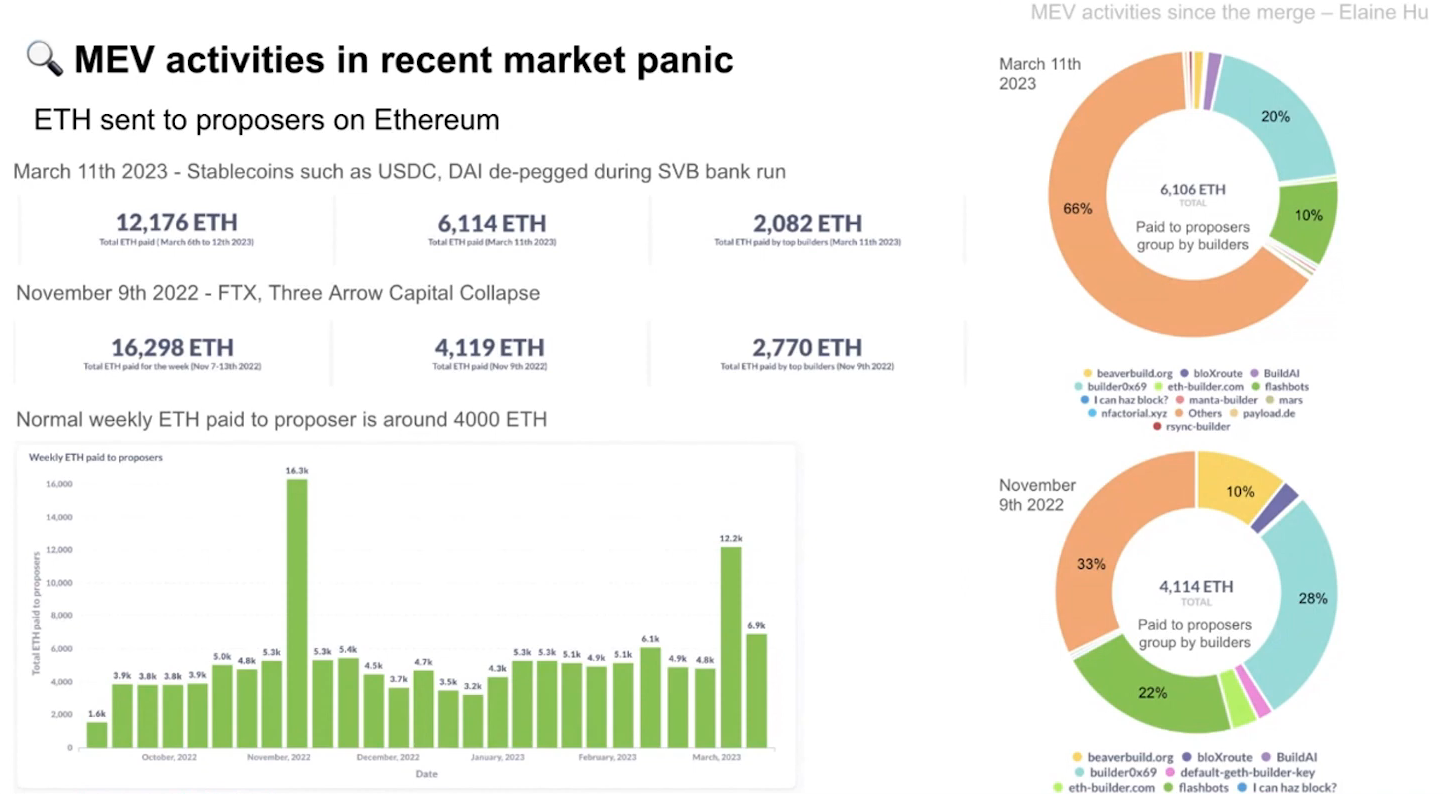

Market Panic events like FTX collapse and SVB bank run have highlighted these issues. Fortunately, SVB bank run recovered swiftly compared to the previous event.

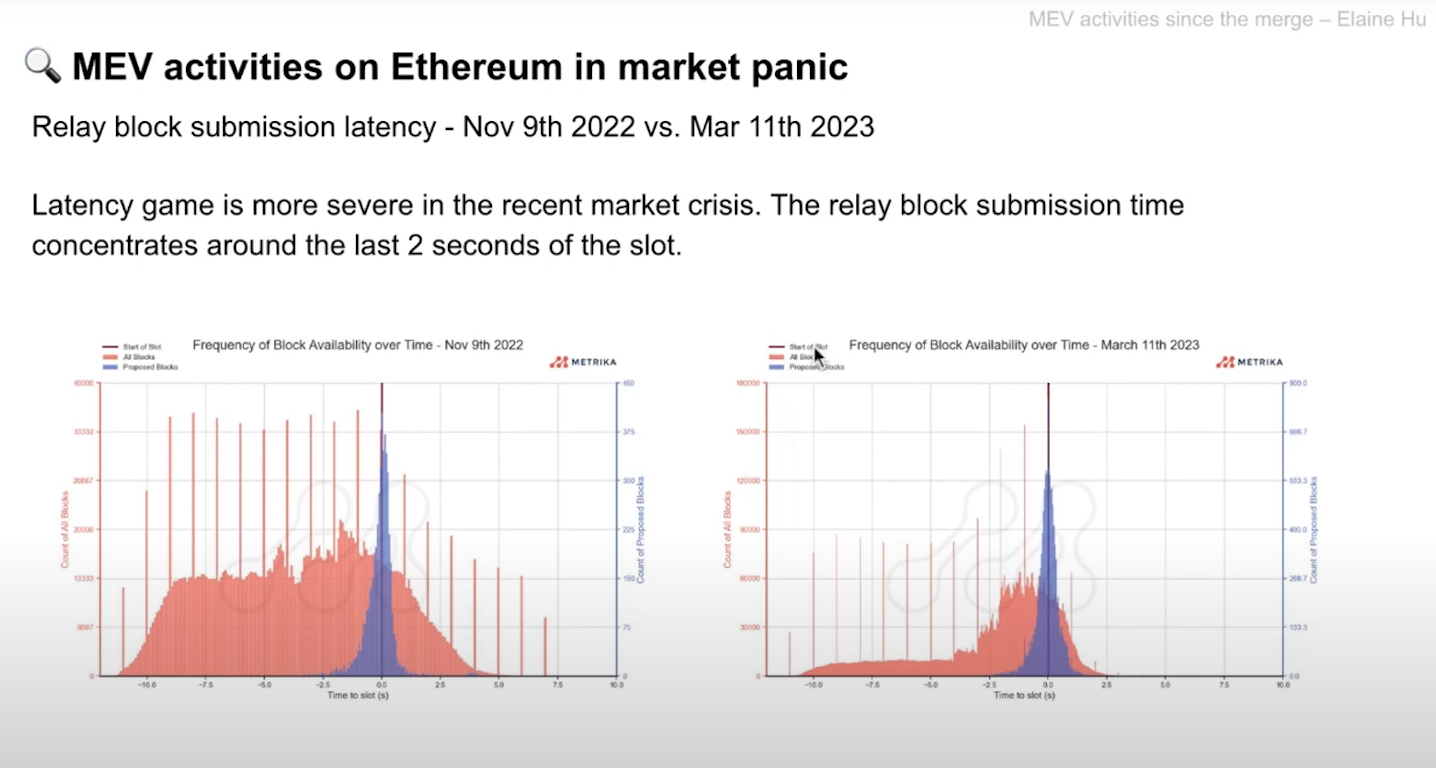

Latency analysis (17:00)

Both FTX and SVB events show a similar pattern to overall latency trends. However, if we compare with latency before the merge, the latency gain is more severe, with most blocks submitted in the last two seconds.

The increased severity of latency gain may be due to relay and builder competition for landing blocks, and not necessarily related to market panic.

MEV activites in recent market panic

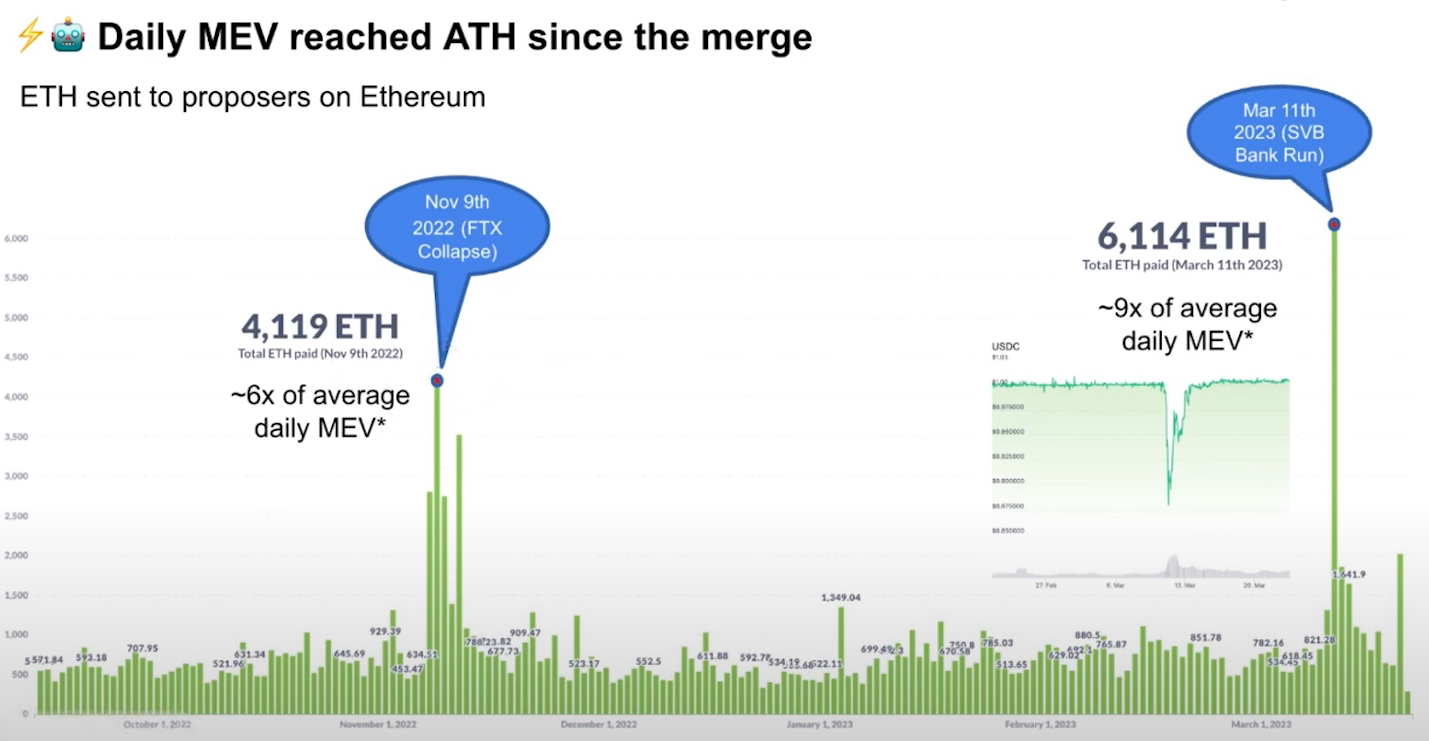

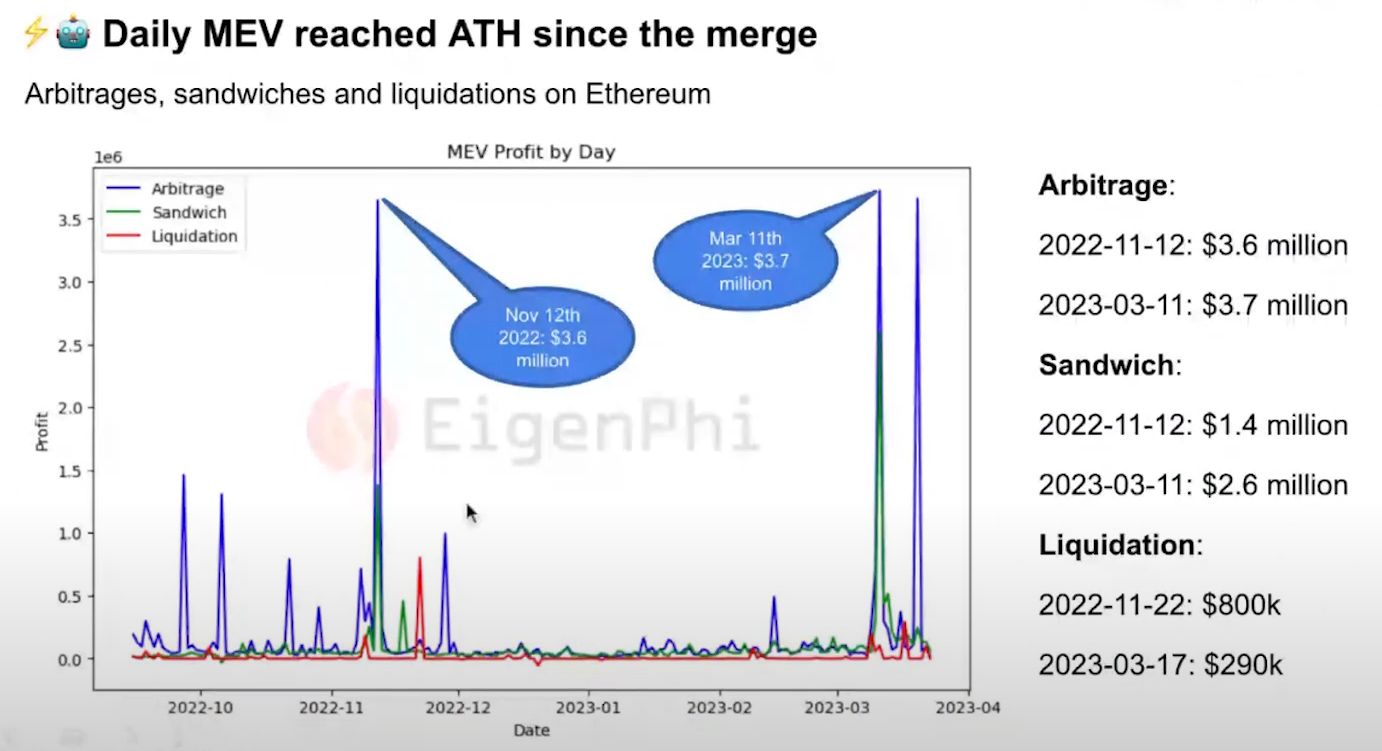

Daily MEV All-Time Highs (9:30)

Both FTX and SVB bank run made a all-time high for daily MEV

- Arbitrage accounts for a considerable share of MEV in both events (volatility = arbitrage opportunity)

- SVB bank run led to the USDC depeg, which has enabled sandwich attacks in addition to arbitrage and reach a higher all-time high than FTX collapse

How to look into MEV activities (12:00)

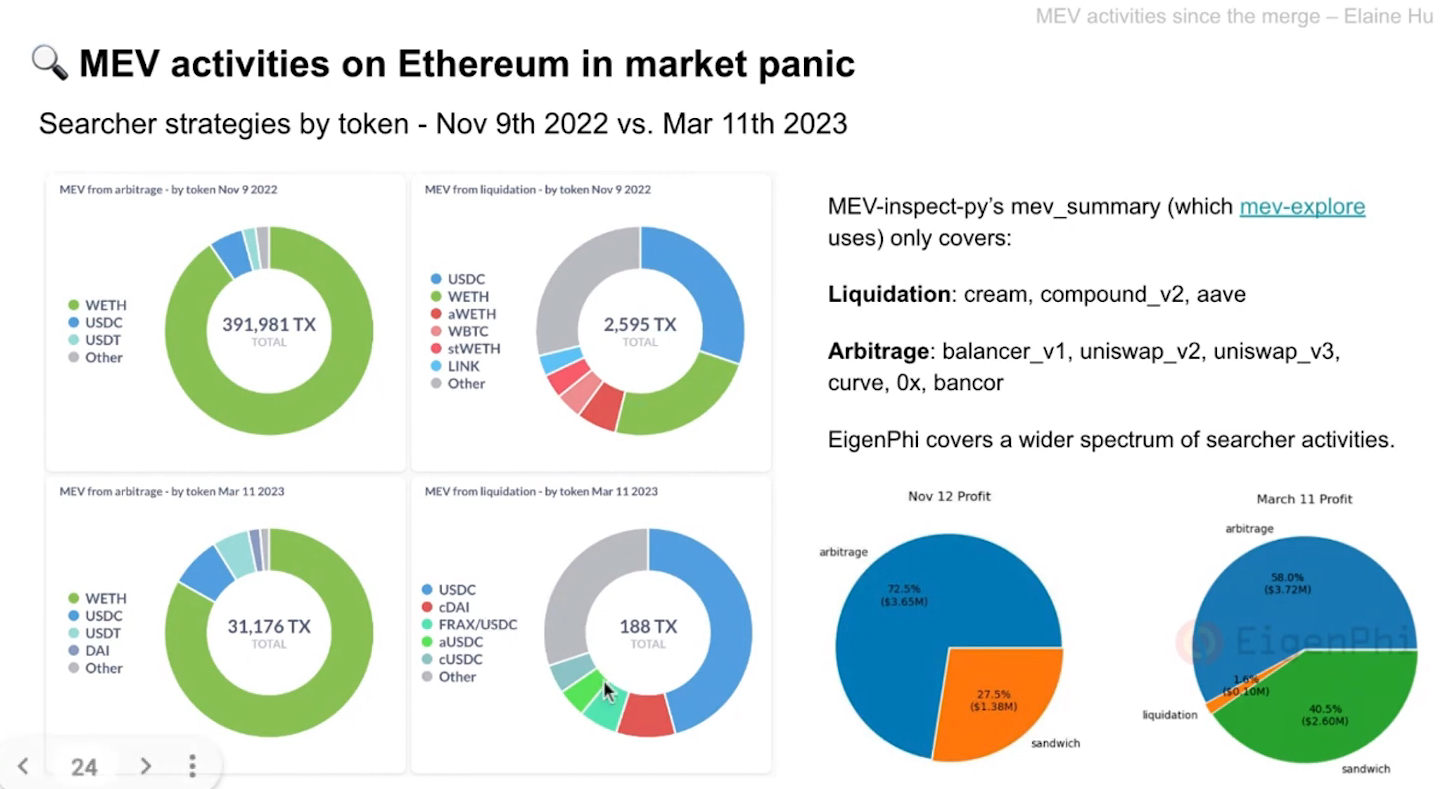

Look into two of the highest MEV Days on Ethereum recently :

- Total ETH paid to proposers on Ethereum

- Top builder VS Others by ETH paid & Number of blocks proposed

- Latency in block submission

Compare into cross-chain MEV strategies :

- Arbitrage tokens, chains and protocols

- Arbitrage strategy paths

- Arbitrage Profits

MEV in Uniswap & Curve (15:00)

Most arbitrages happened on Uniswap V2 and V3 during FTX collapse. However, there was an increase in arbing on the Curve stablecoin pool during SVB collapse.

Curve pool's increase in arbitrage activity is expected as the recent event was not highly correlated with liquidation events.

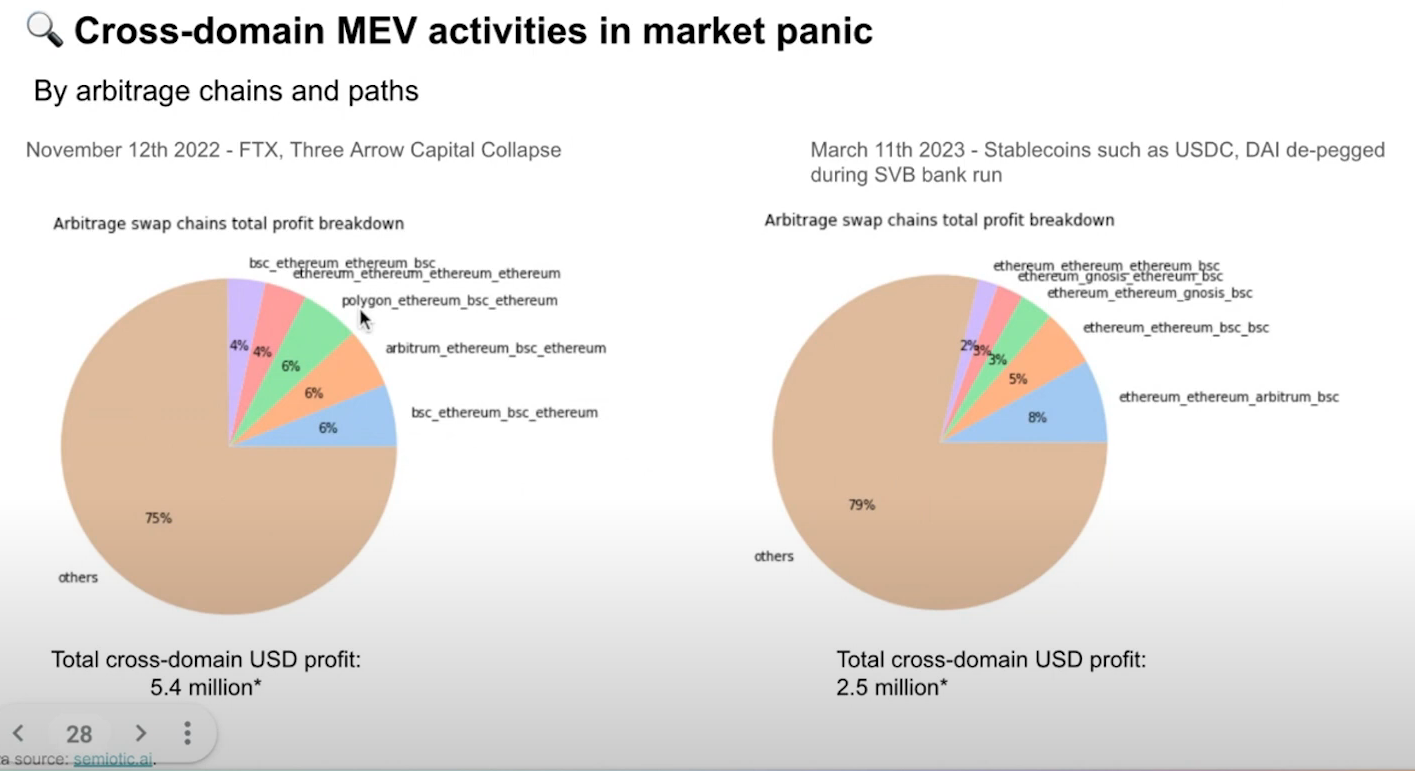

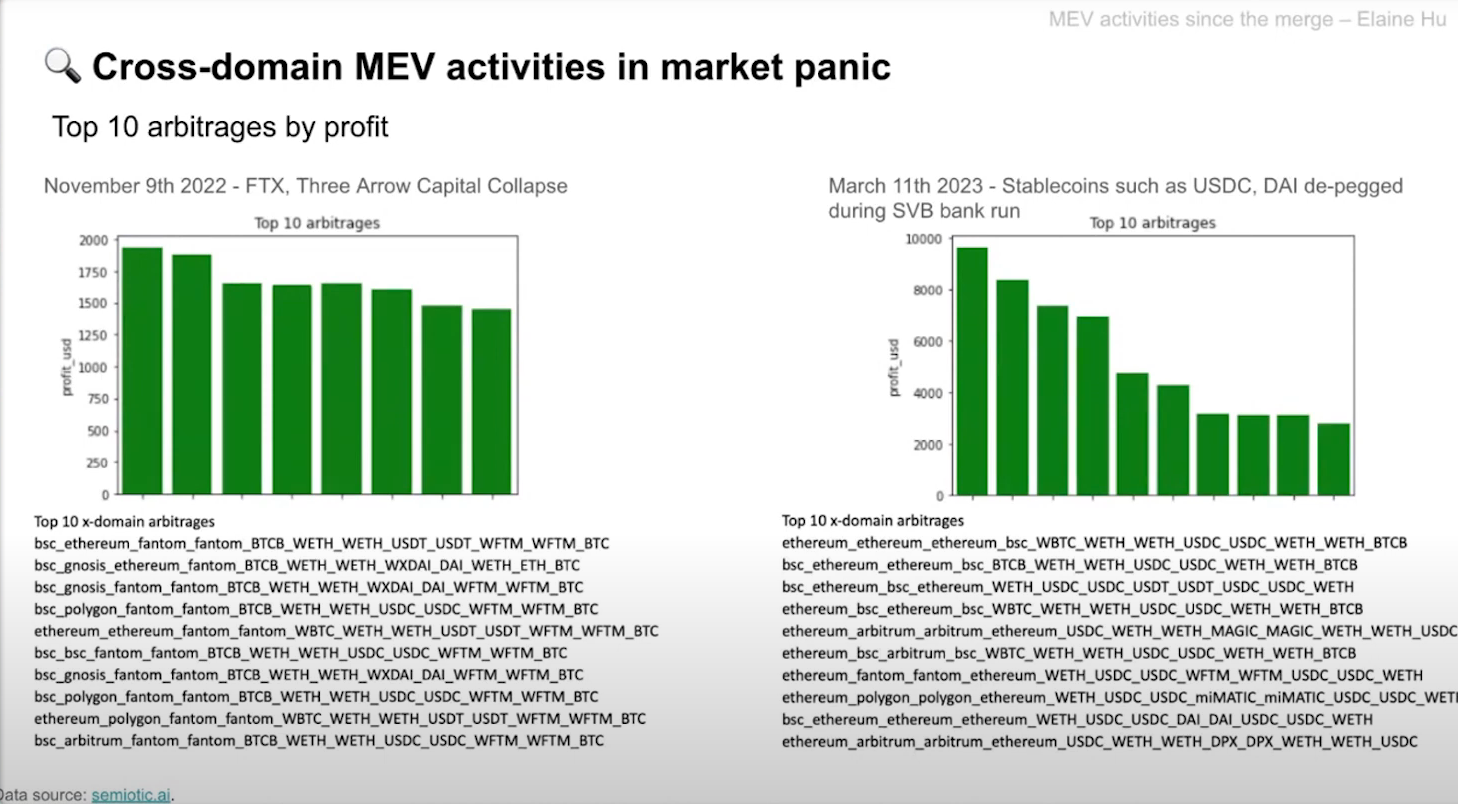

Cross-domain Arbitrage activites (18:15)

Most arbitrage opportunities occur between stablecoins, Bitcoin, Ethereum, and other major tokens.

In november, Polygon and Abritrum were observed. But since March, Ethereum and BSC are the most frequently arbed chains.

About Top 10 arbitrages bu profit, inaccuracies may exist due to missing arbitrage opportunities or data.

Summary points (20:45)

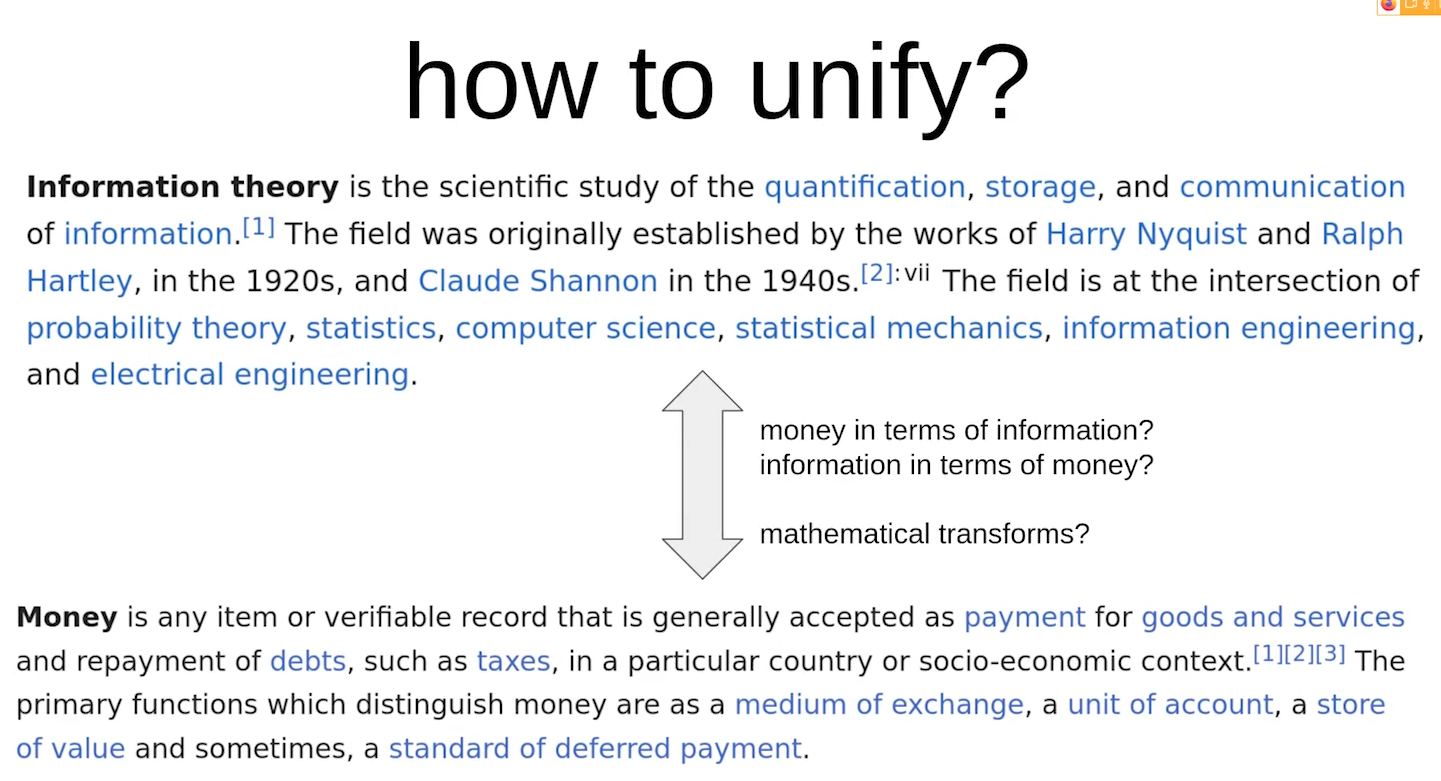

How to marry information and money

Some context (1:00)

- On one side, we have information based fields of studies (entropy, storage, cryptography, privacy...)

- On the other side we have economics attempting to model human interactions (cryptocurrency, MEV-time auctions...)

Our objective is to try to marry these two disparate fields with a single unifying set of abstractions that'll make both able to talk to each other better

There are similarities (2:15)

Between information and money, there are similarities. For example, quantification plays a crucial role in both domains.

Phil suggests that a clean mathematical transform is needed to unify reasoning about money and information theory. This idea is not original tho, we'll see that many people have been working on it.

So, what's the point ? (4:00)

The key to unify information and money lies in both MEV and privacy primitives. That will allow us to use both information and money to create the best systems for users.

Lessons from the past

Mechanism design (4:30)

Mechanism design is a field in economics and game theory started in 1960s, that takes an objectives-first approach to designing economic mechanisms or incentives, toward desired objectives, in strategic settings, where players act rationally. It already aimed to address decision-making based on information silos.

In mechanism design, The aggregation of information into a single output is crucial.

Voting is ducked (5:15)

A theorem from 1973 and 1975 focuses on the problem of allocation and decision-making based on voting systems. They highlight three undesirable properties that create tension in voting systems :

- Dictatorial rule : One voter's input completely determines the outcome of the vote

- Limit the possible outcomes : Restricting choices to only two alternatives is seen as limiting

- Tactical voting : Voters prefer play according to a model of what other people are playing (aka "Metagame") than their own preference

Somehow, all voting is subject to incentives, and votes will never be truthful...

Money as a primitive (7:15)

...But by adding money, more complex mechanisms like auctions can be built, surpassing traditional social choice theory results.

This result underpins the fundamental mechanism design studies : Money serves as a powerful primitive in mechanism design, enabling broader possibilities beyond pure voting or information elicitation.

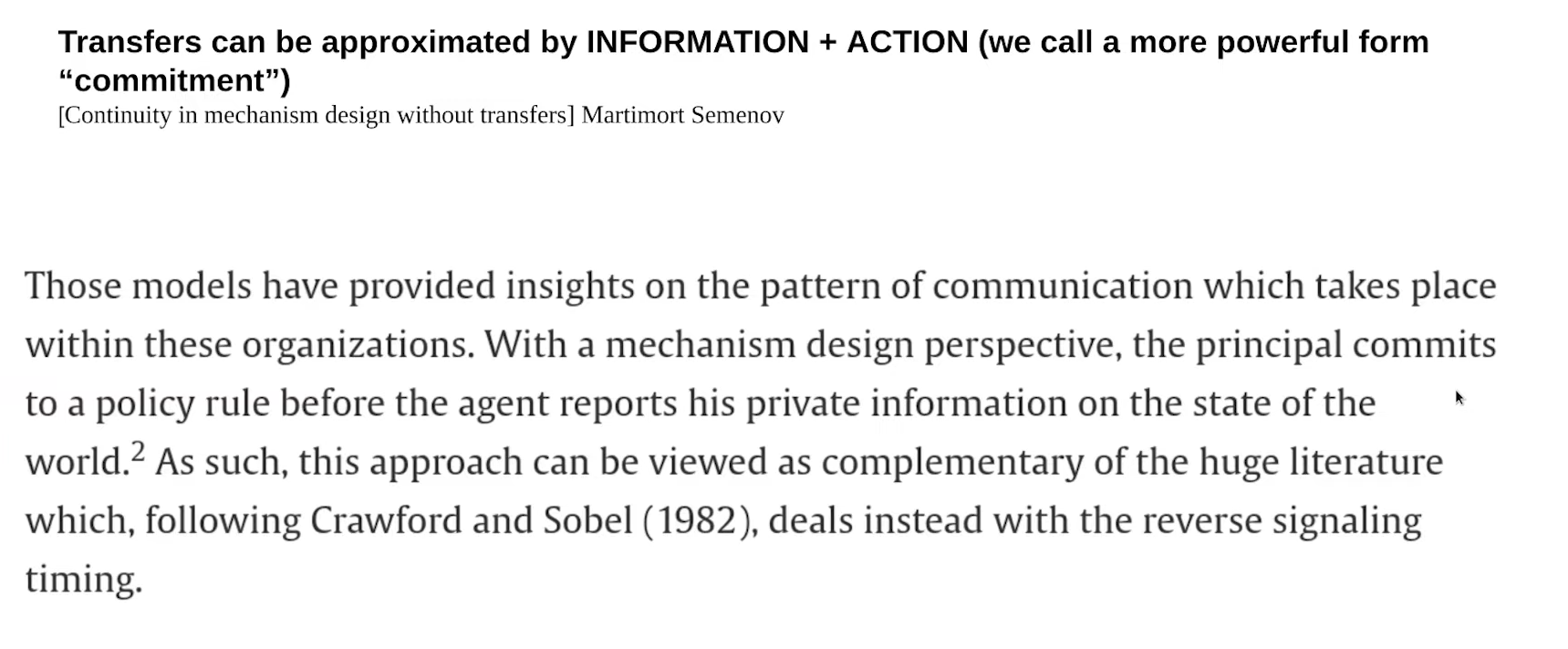

Alternatives to money (8:00)

In 80s and 90s, we began to question Money as a primitive : In many contexts, these monetary transfers simply aren't available but we still want to solve mechanism design problems

So we started to explore alternative models that achieve similar results as money without relying solely on monetary transfers.

We actually found that even in the absence of actual monetary transfers, these can be approximated by "commitment" (information + action)

By having agents commit to a rule and providing private information that aligns with this commitment, many desirable properties can still be achieved without relying on money.

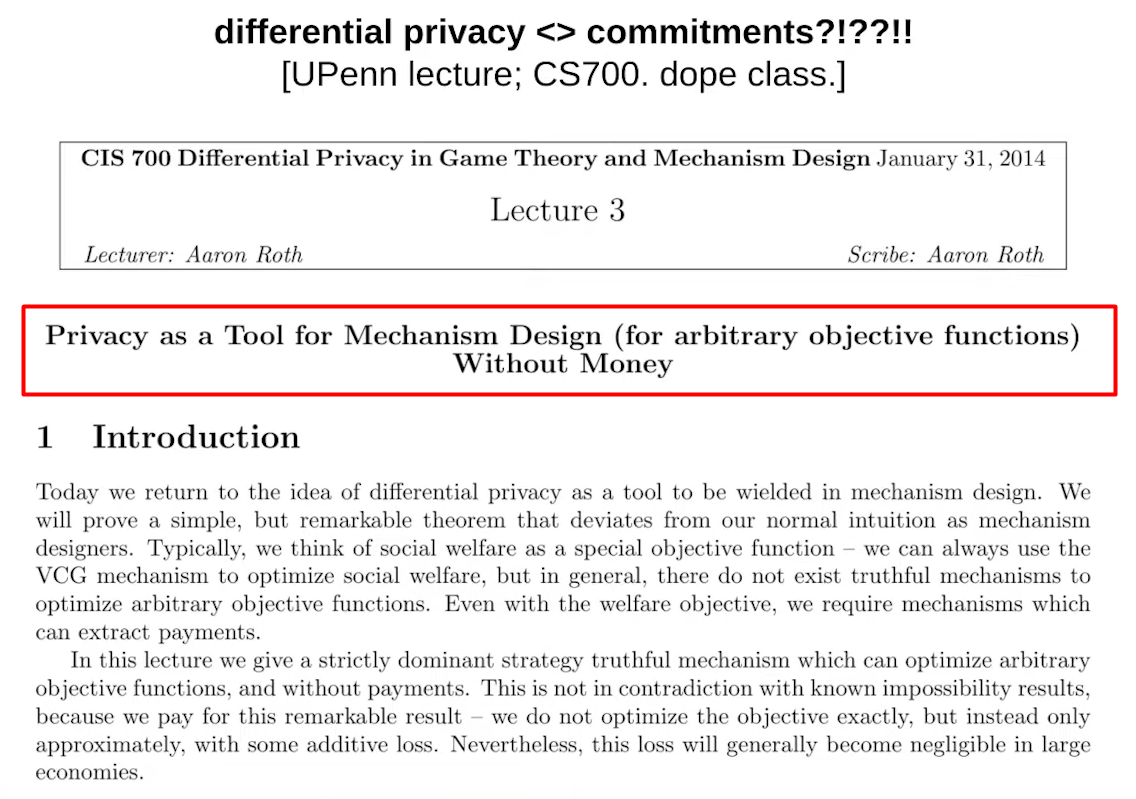

Differential Privacy in Mechanism Design (10:30)

By incorporating differentially correct outputs and differentially private inputs, it becomes possible to achieve a new class of mechanisms that were previously not feasible without differential privacy.

Information theory serves as a framework that connects various fields such as mechanism design, privacy, economics, and money.

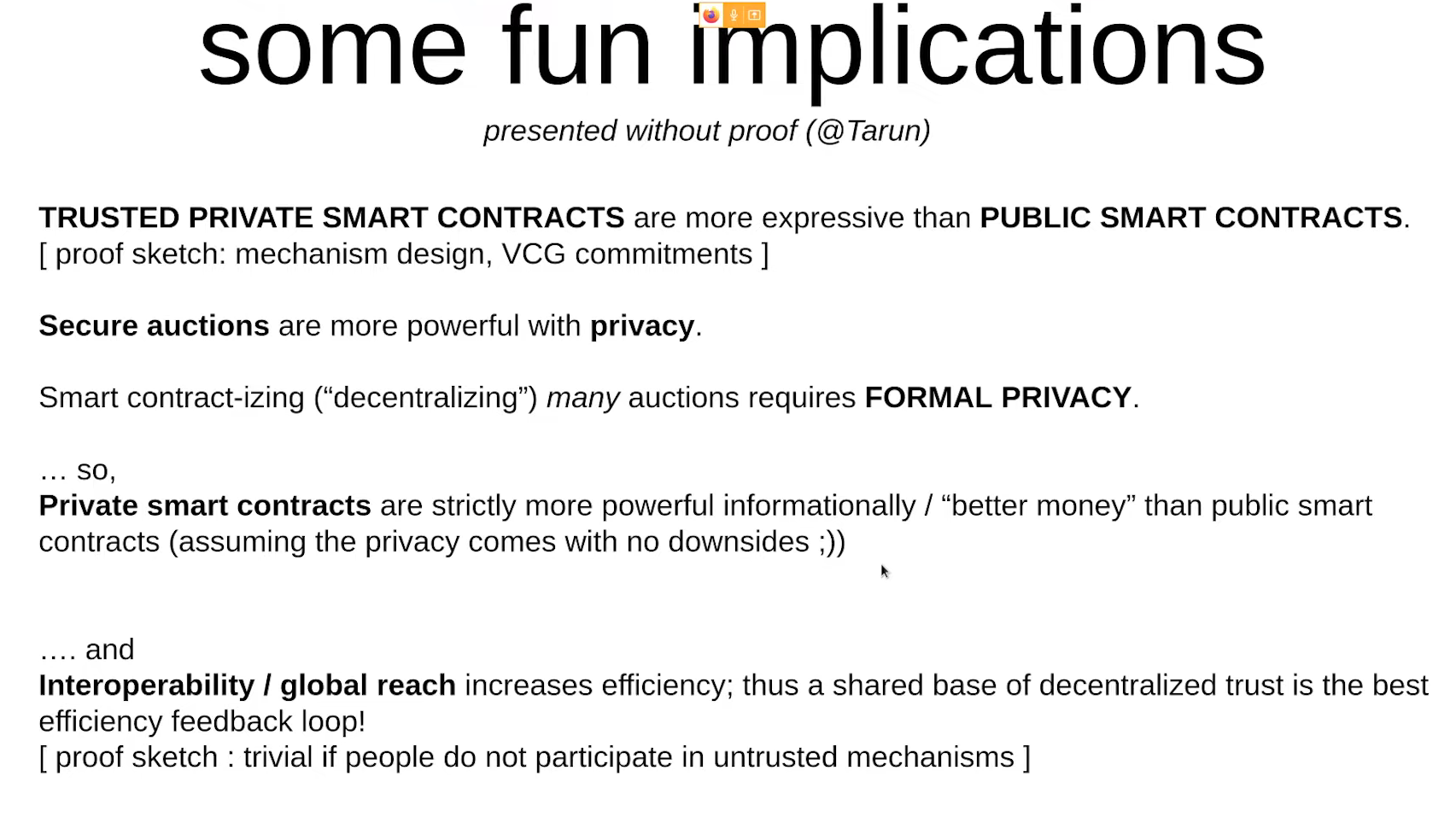

So, in a mechanism design sense, the "right" kind of commitment or Privacy is indistinguishable from money !

A practical implication : trusted private smart contracts (12:00)

Advantages

- Trusted private smart contracts provide more options for approximating properties of money

- They enable the construction of more efficient auctions and mechanisms compared to those relying solely on public transfers.

Limitations

- It's very difficult to imagine building it securely without centralization

- The absence of trustless privacy leads to externalities

Solving privacy challenges

Crypto already has transfers, transfers are trustless but privacy is not, and many mechanisms require trust. From here, we face a gray zone :

- What are the limits of decentralized trust ?

- How can we formulate an abstraction boundary to trust ?

- What do we gain by solving privacy ?

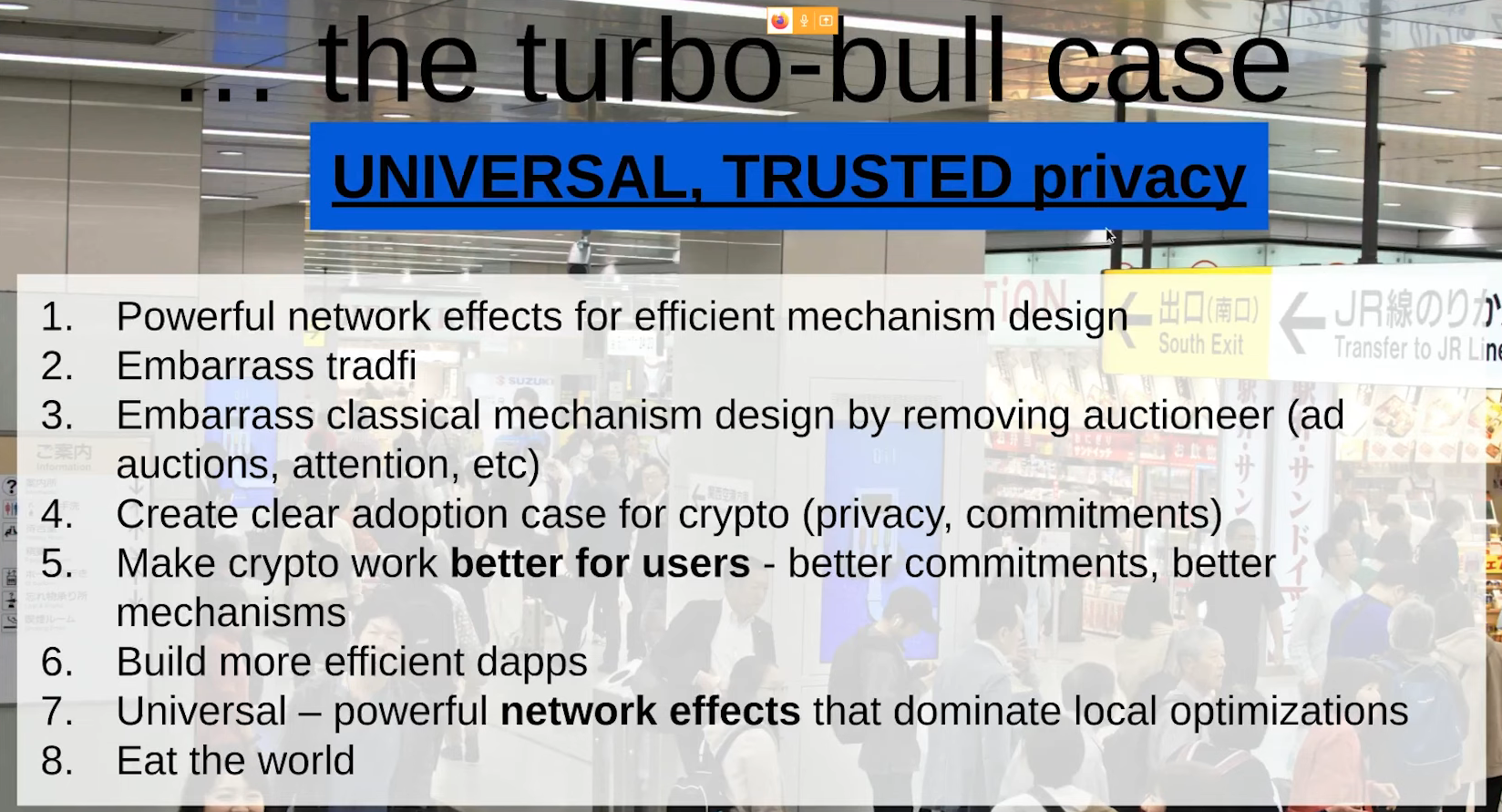

Bull case : we solve the challenges (15:00)

If a solution for universal trusted privacy is found, it would create a clear adoption case which makes crypto work better for users, and build more efficient dapps. In the end, it eats the world because TradFi could not compete against universal trusted privacy

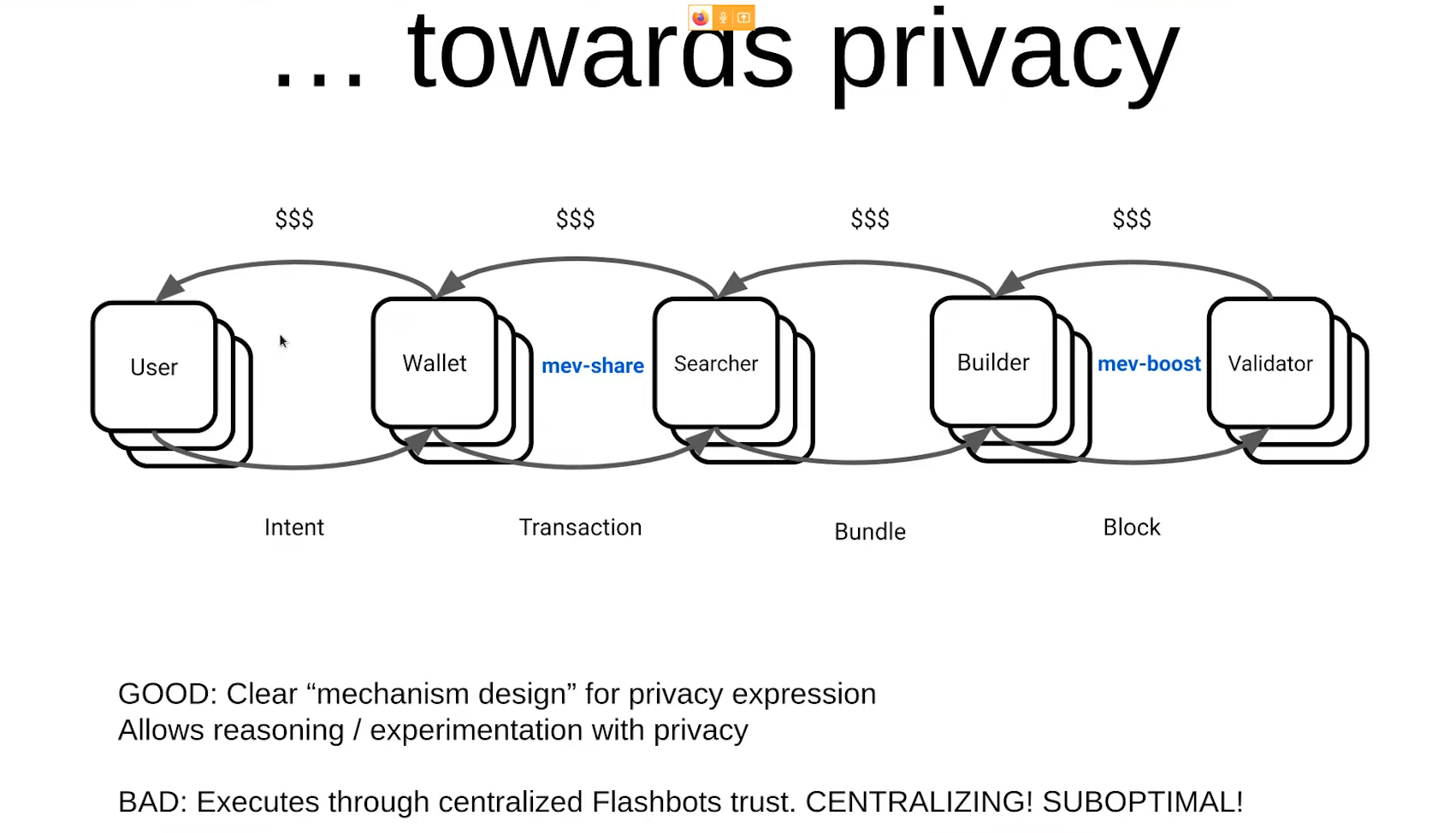

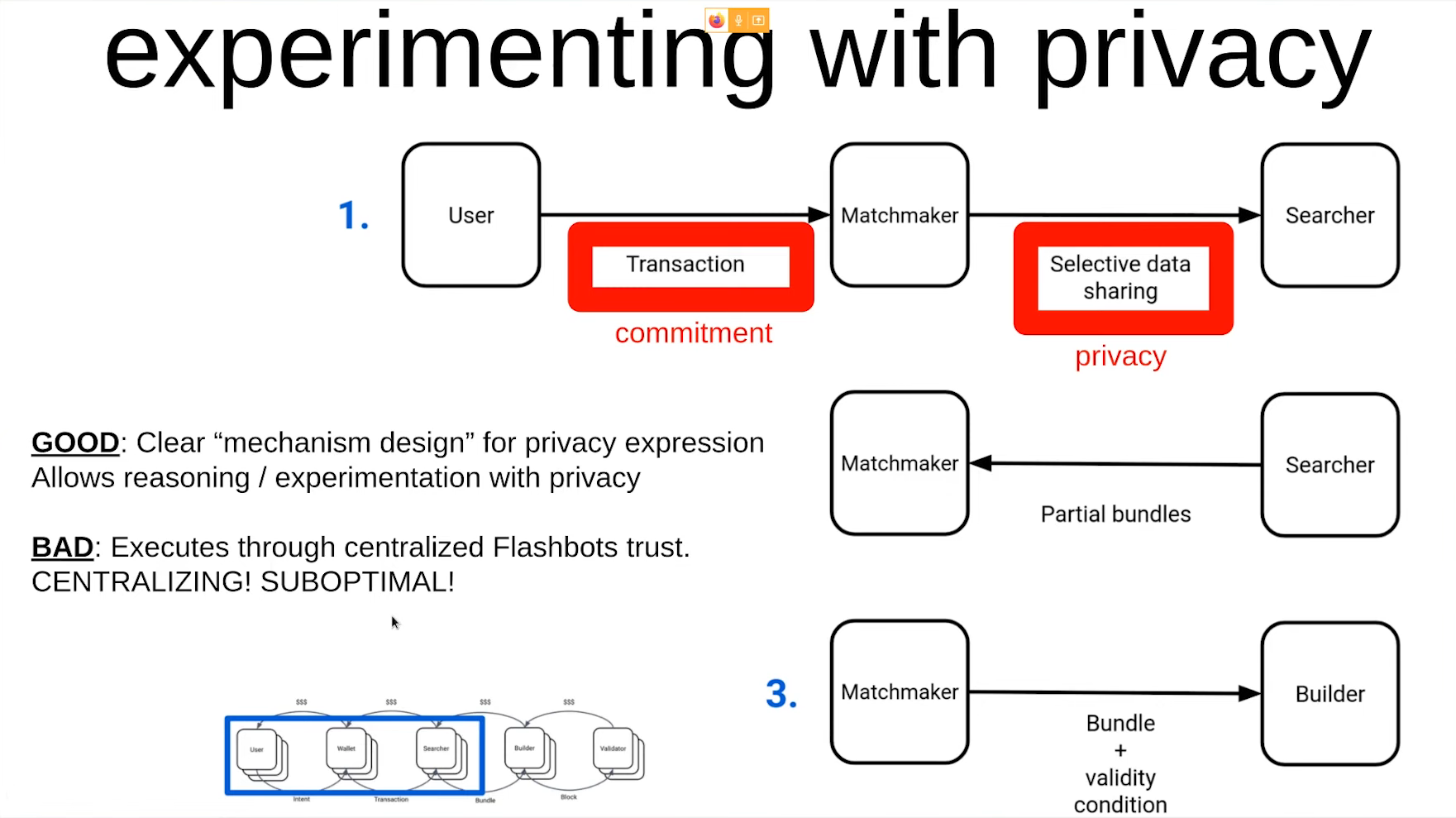

MEV supply chain (16:15)

Both mev-share and mev-boost rely on privacy to achieve efficiency, and this is possible thanks to abstraction boundaries.

However, current privacy solutions like Flashbots are centralized and suboptimal from an information theoretic and decentralized system perspective.

Project SUAVE (18:15)

SUAVE's goal is to achieve defense in depth on the boundary between ideal mechanism design and user-controlled privacy.

While Mev-share and Mev-boost serve their purpose, they are centralized and not ideal in terms of privacy. There is a need to replace these centralized solutions with more decentralized alternatives, and SUAVE seeks to become one of those.

Q&A with Jon Charbonneau

What is the practical state of Privacy Primitive based on where devlopment looks like ? (20:30)

The pressure for privacy is economically driven (so very powerful), as people want to build systems that can only be achieved with privacy, that's why mev-boost & Mev-share exist

Builder features and techniques like PBS and Danksharding are being explored to enable new classes of mechanisms through privacy and commitments.

But fundamentally, Phil doesn't think it's good enough :

- While centralized systems have been functioning adequately so far, they pose a significant centralizing pressure on our overall systems

- Adding technologies like SGX can restrict actors' actions but still rely on centralization (SGX relies on Intel)

- Committees or crypto economics also have their downsides in achieving full decentralization.

Phil emphasizes the need for a combination of techniques that maximize decentralization to counteract economic pressures

Let's say that Etereum doesn't actually end up implementing PBS (or other features). How do we decentralize that role in a better way ? (23:00)

It may not be critical for the Ethereum Foundation (EF) to push hard on implementing certain features if the community is aligned enough towards decentralization.

While EF may not be solely responsible for achieving decentralization, they should have decentralized options as a "nuclear option" if needed.

Phil suggests exploring other ways to decentralize, such as building decentralized alternatives and sharing primitives for users.