MEV in fixed gas price blockchains

Source : https://www.youtube.com/watch?v=QCKbSYG7fz0

Introduction

The research was about "maximum extractable value" (MEV) in the Terra Classic blockchain, which has a fixed gas price for transactions.

Most MEV research has looked at the Ethereum blockchain, where validators can set different gas prices to prioritize certain transactions.

But Facundo & Elaine (the authors) think that because Terra Classic has a fixed transaction fee, the dynamics and opportunities for MEV are different than in Ethereum. This research studies theses differences.

Objectives (1:15)

- Study how arbitrage (taking advantage of price differences) works differently in Terra Classic compared to other chains.

- Understand what strategies block producers use to maximize profits given Terra Classic's fixed fees.

- Study the timing-related patterns of arbitrage opportunities in Terra Classic.

With the following dataset :

Arbitrage (2:10)

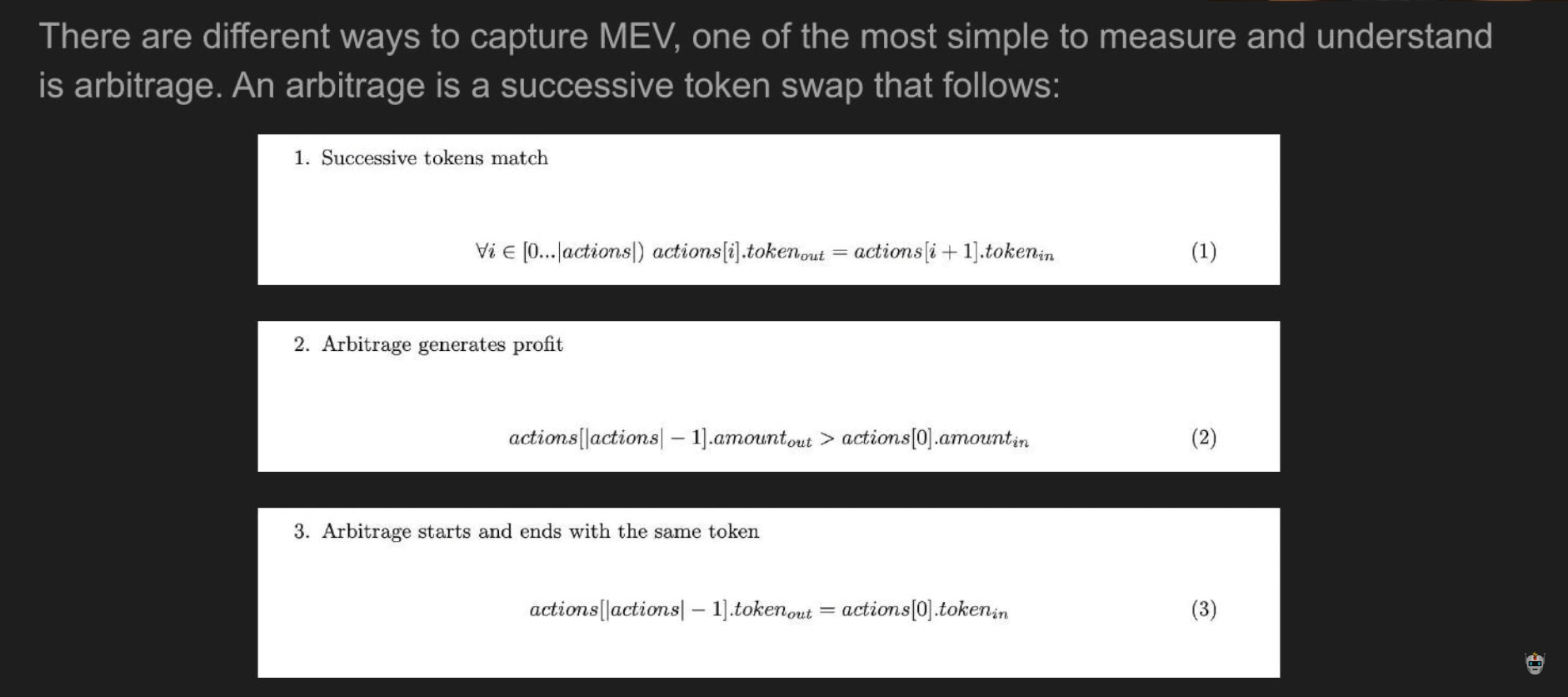

After getting data on Terra Classic's transactions, they decided to focus on arbitrage transactions that involve token swaps that: (1) Start and end with the same token, (2) Generate a profit, and (3) Involve the same tokens in the same order.

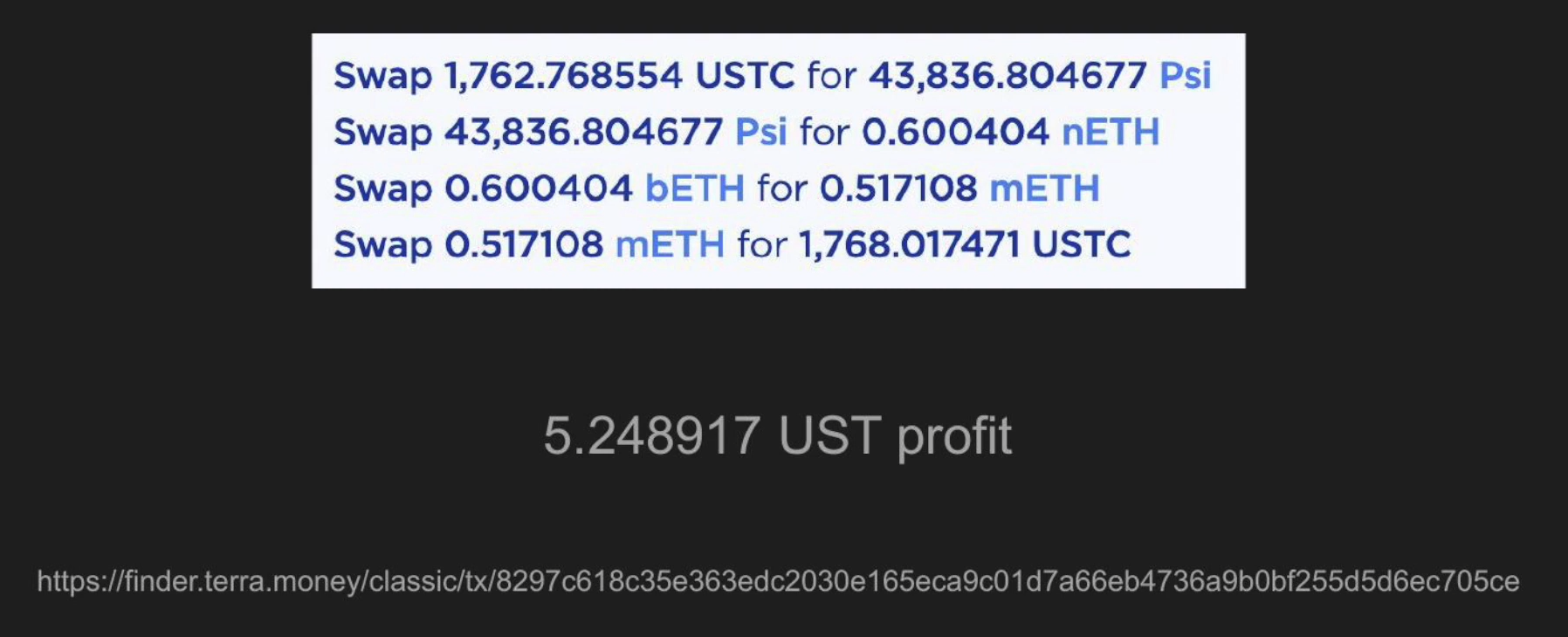

For example, if one transaction started by swapping UST to Token A, Token A to Token B, and then back to UST at the end - and made a 5.2 UST profit, then they considered it arbitrage.

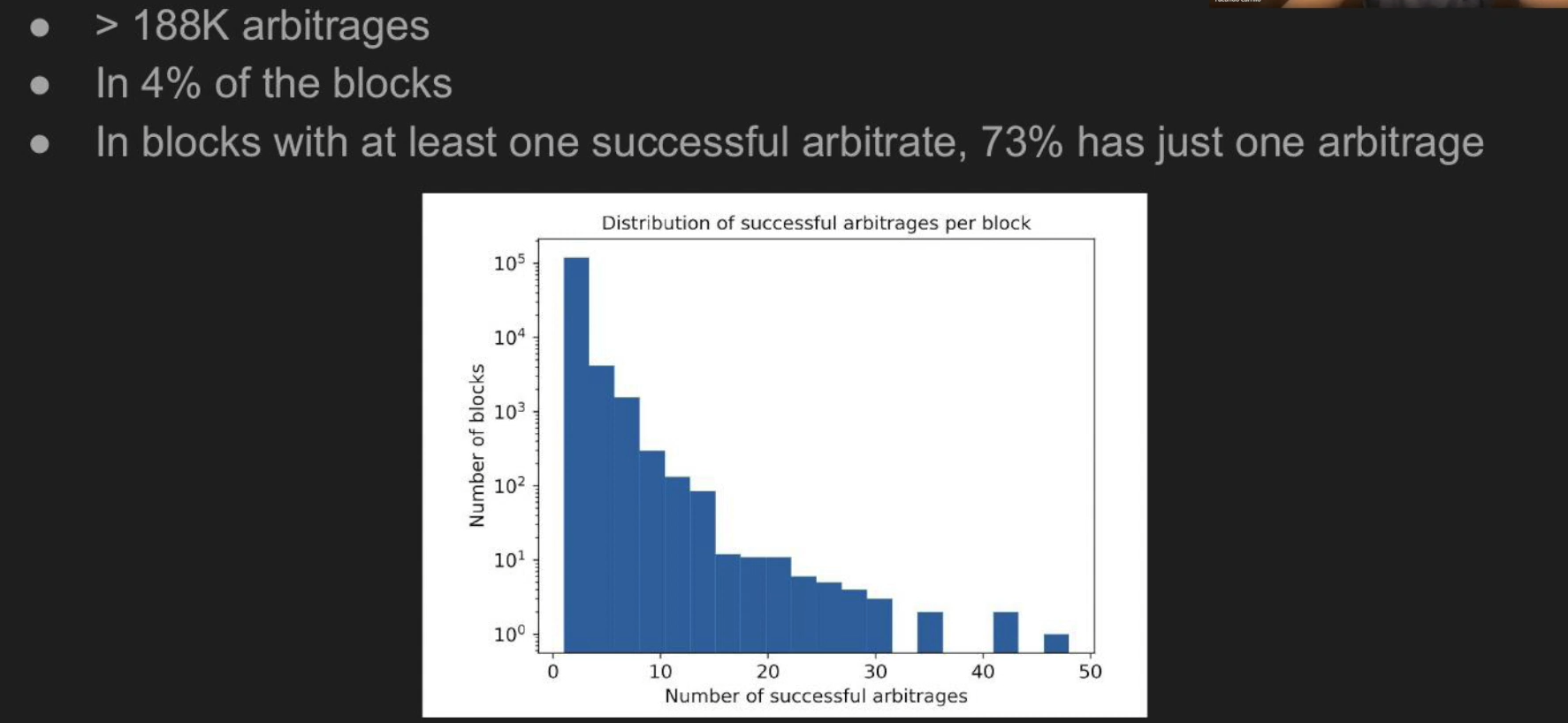

They found over 188,000 such arbitrage transactions in the data:

- 4% of blocks had at least one arbitrage transaction

- 73% of blocks with arbitrage had only one transaction, but some blocks had a huge number

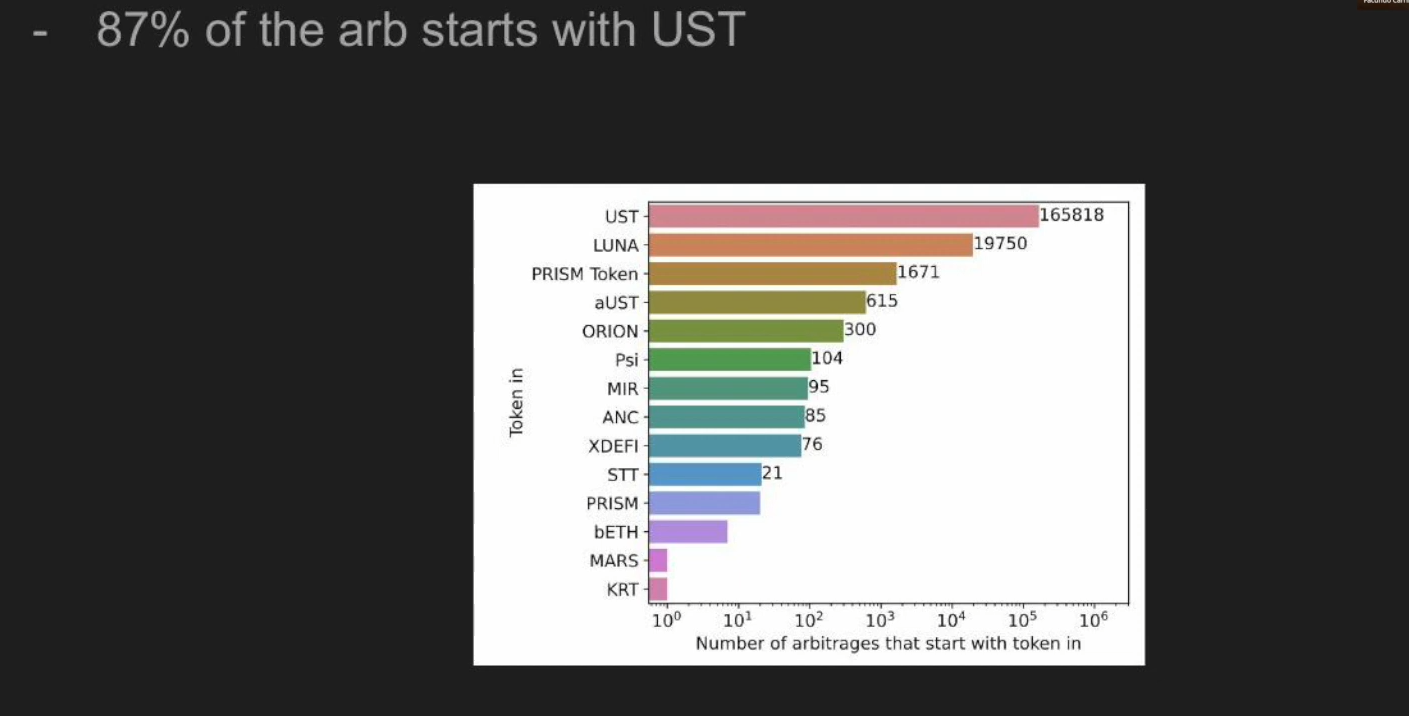

- 87% started and ended with the UST stablecoin

- The median amount of money used was around $998

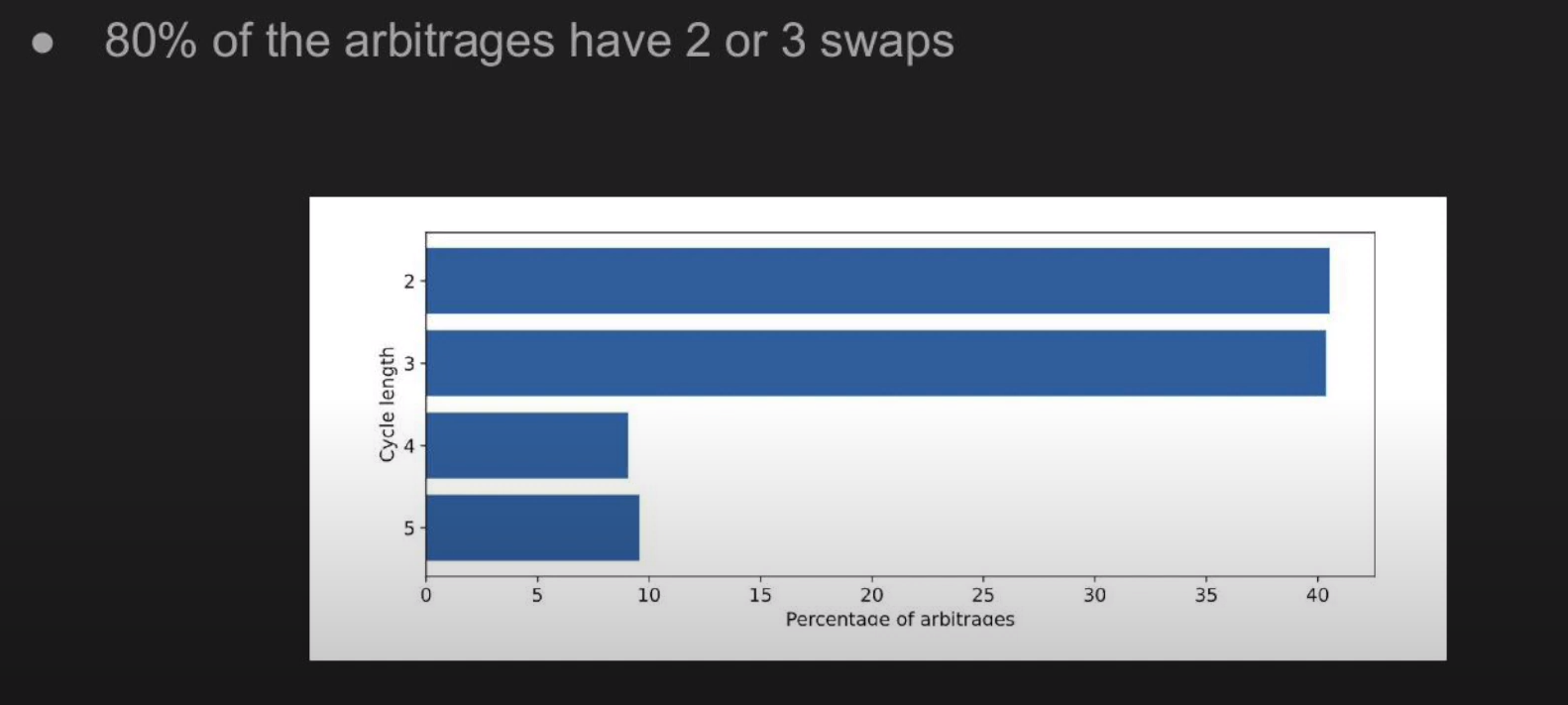

- 80% only involved 2 or 3 swaps between tokens

Inferring searchers (3:20)

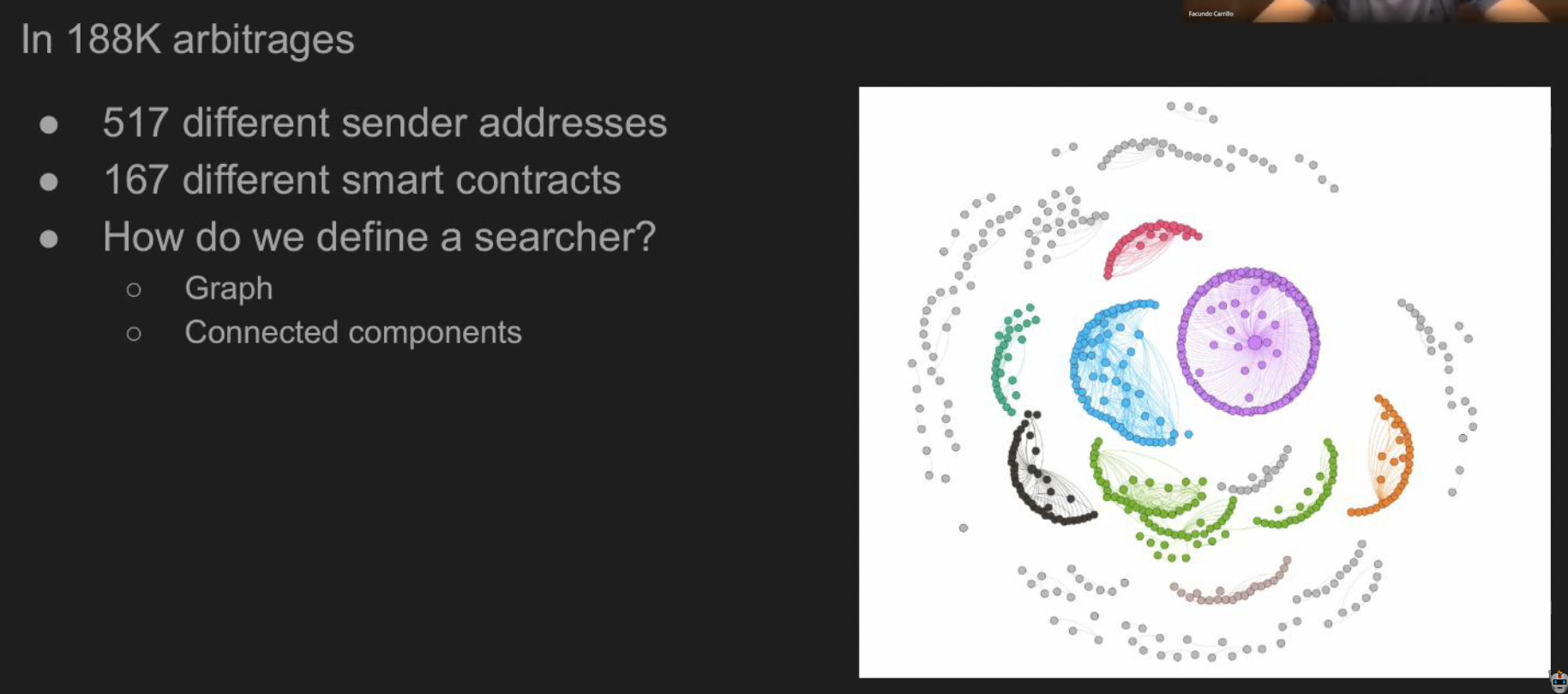

The transactions came from 517 different sender addresses and 167 different smart contracts. To try to link addresses and contracts owned by the same person/group, they created a graph network. If a sender address interacted with or used a specific contract, they drew an edge between the two.

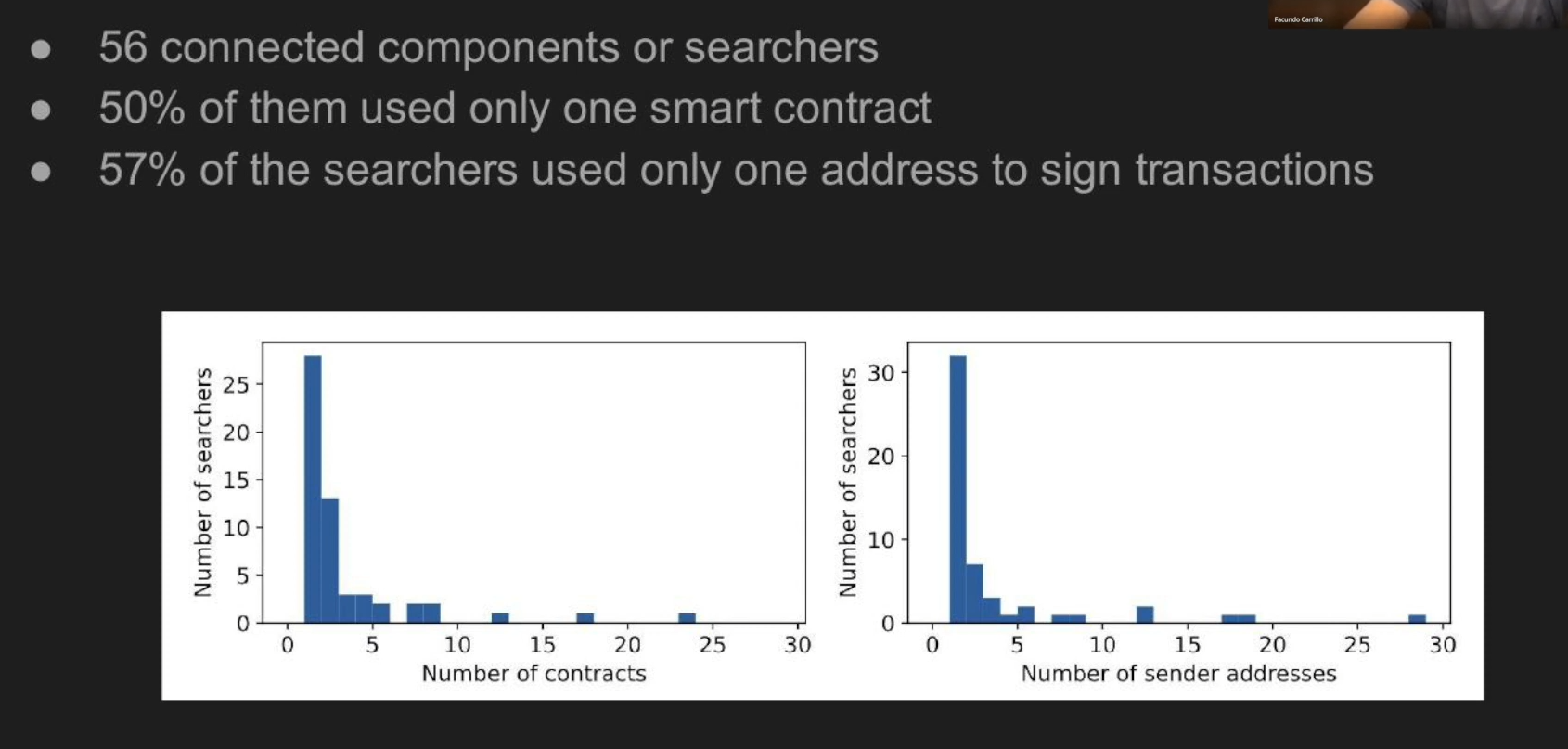

Using this graph, they identified 56 connected groups they call "searchers." Half of the groups used only 1 smart contract and 57% used only 1 address to send transactions.

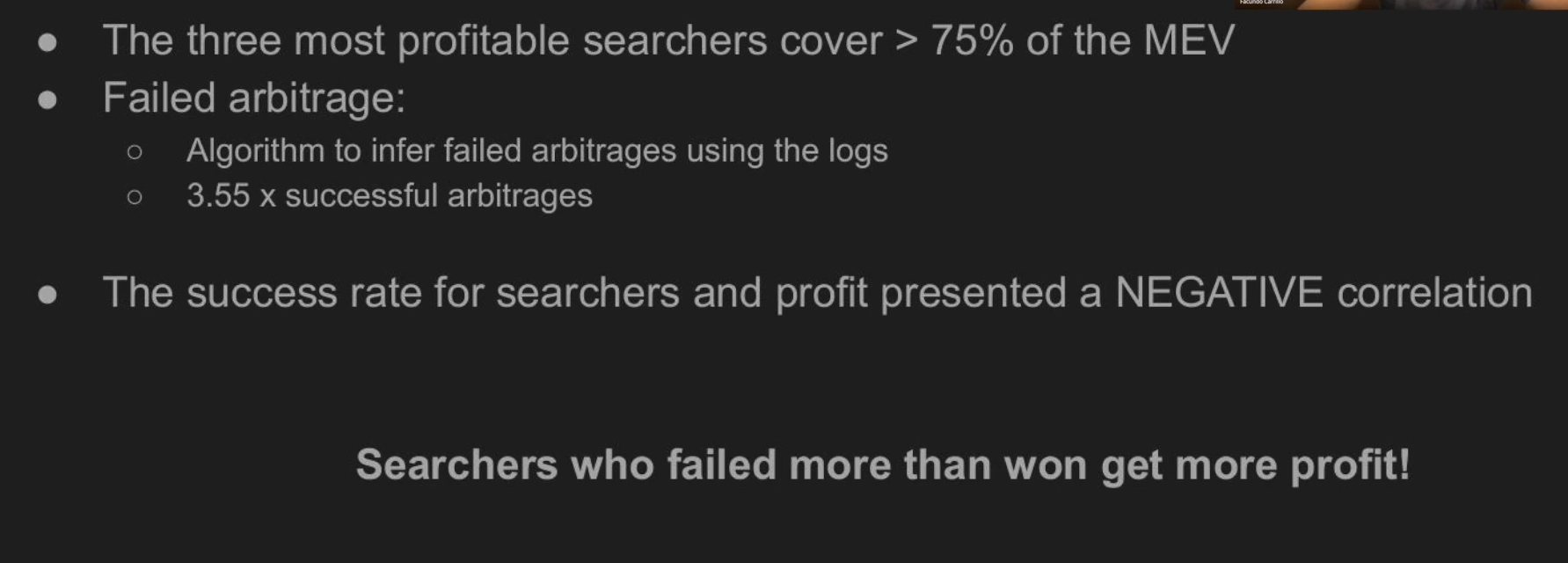

They found the 3 biggest / most profitable groups made over 75% of the total profits from arbitrage. So a small number of big players dominate the arbitrage opportunities.

Why did some searchers perform better ? (4:30)

They analyzed the failed transaction rates - meaning when a searcher tried to do arbitrage but wasn't successful and lost money.

Across all searchers, there were 3.55 failed transactions for every 1 successful profit-making transaction.

But surprisingly, the most profitable searchers actually had WAY higher failed transaction rates. So even though they failed a lot, searchers earn giant profits when they succeeded.

Why did searchers who failed more get more profit ? (5:10)

This seemed confusing at first. But after more analysis, we can figure out why:

The key was that profitable searchers would send many repeated transactions in the same block. In other words, they resend the same arbitrage transaction multiple times.

On average, the most profitable searchers had very high "rates of repeated transactions index (RRTI)" : out of all their transactions, a large % were repeats of another transaction in the same block.

Why did searchers with higher RRTI perform better ? (5:40)

Terra Classic processes transactions "first-in-first-out (FIFO)", so to win an arbitrage opportunity, you need to get your transaction in the queue first. Furthermore, there's no gas pricing to jump the queue with fixed gas fees.

Hence, the most profitable searchers raise their odds of getting top queue priority by blasting variants of the same transaction from different sources

Even though it leads to more failed transactions, it lets them snap up the best arbitrage deals the fastest, that's why they dominate the profits.

Time experiment (6:10)

There is another experiment with the following hypothesis that the physical location of the "searchers" impacted their arbitrage success.

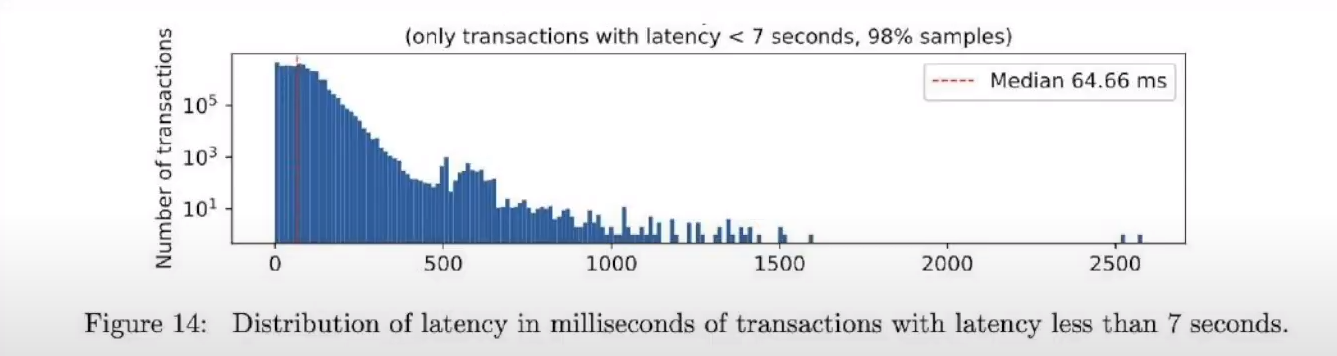

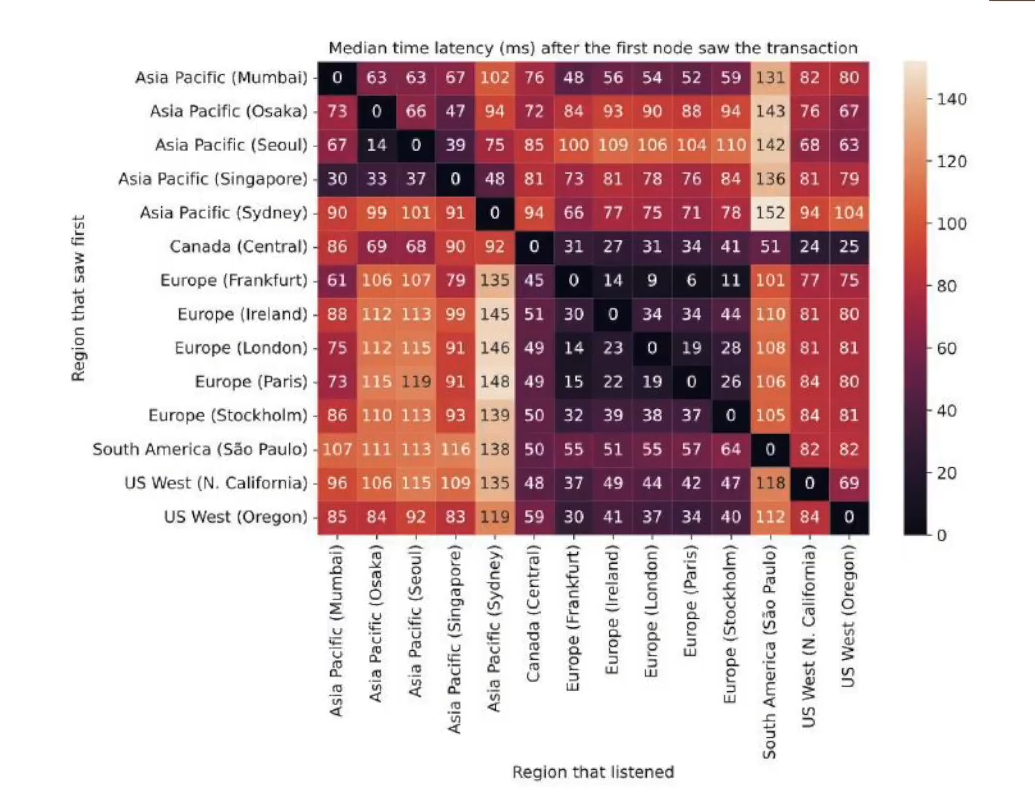

So we use 84 modified Terra nodes set up across 14 different geographic regions on Amazon Web Services, and record exactly when each node received every Terra transaction to annotate which global region was the first to receive each transaction.

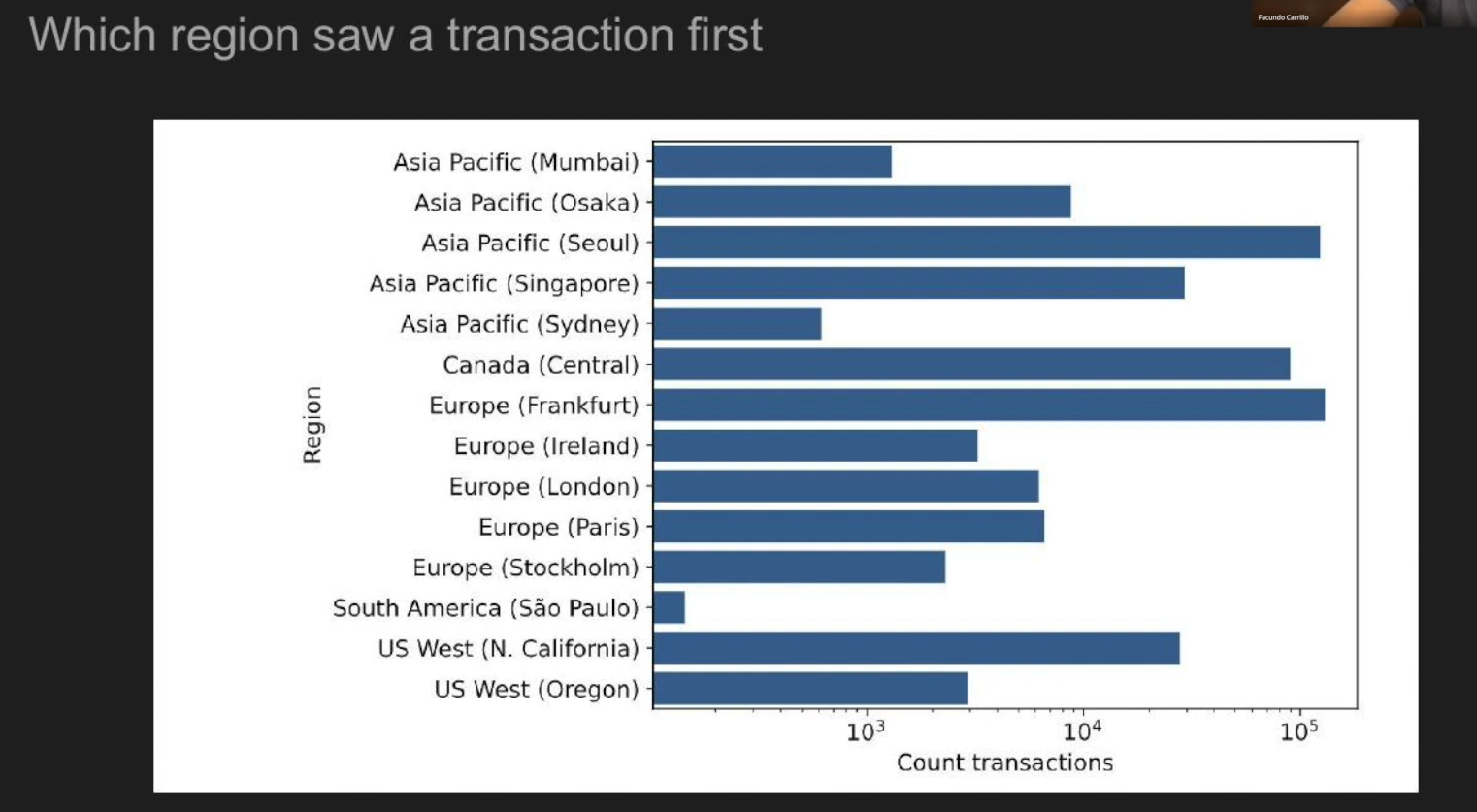

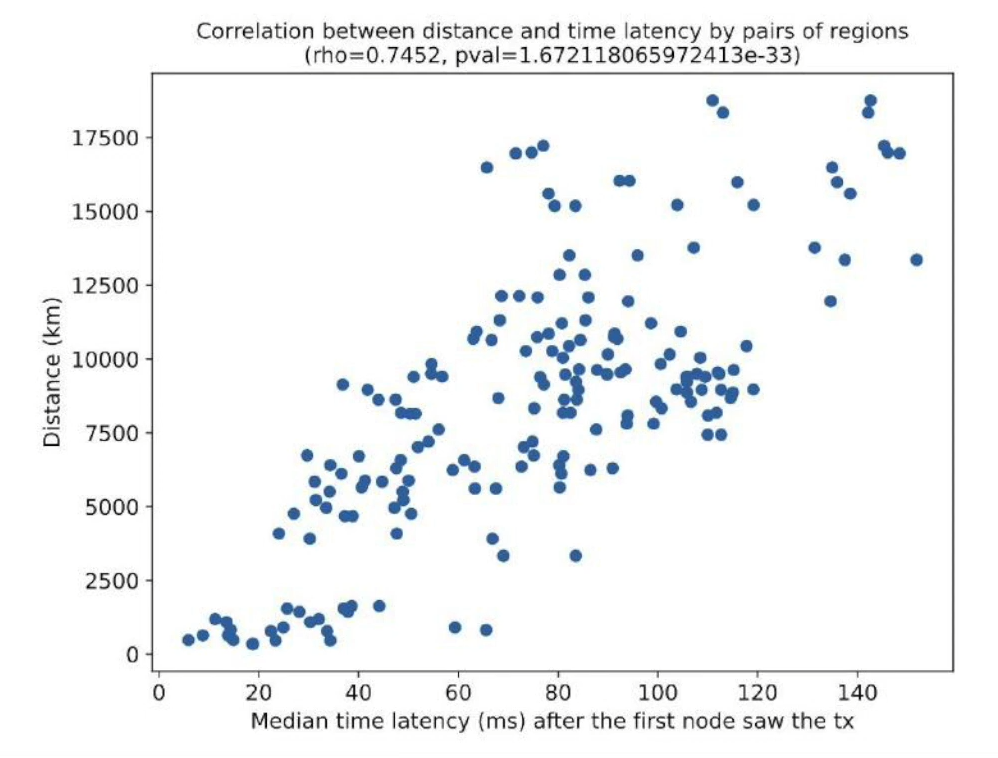

Facundo & Elaine found nodes physically closer together would receive transactions at similar times.

Specifically, he saw a direct correlation between the physical distance between regions and the average time delay before other nodes got the transaction.

The time delays ranged from 30 to 100 milliseconds depending on how far apart regions were.

This matters because with Terra's "first-in-first-out" system, even a 30 millisecond head start is hugely valuable compared to the compute time needed to actually run arbitrage calculations.

So having wide geographic coverage gave the top searchers a major speed advantage in capturing opportunities.

Conclusions (7:50)

By analyzing a blockchain with fixed transaction fees, we can find different searcher behaviors and strategies than typically seen in Ethereum

On Ethereum, bots compete in a "gas war", trying to set the optimal gas price to cut in line.

On Terra Classic, it's more like a battle of the bot-nets, with the fastest and widest coverage coming out ahead to snap up arbitrage opportunities.

This suggests the dynamics of MEV can shift based on the unique rules and properties of different blockchains. More research on alternative models can lead to a broader understanding of MEV behavior beyond just Ethereum.