Maverick V2 (The Edge Podcast)

Source : https://www.youtube.com/watch?v=JK5rLWypUxU

Maverick V2 introduction

Maverick v2 is #ComingVerySoon ⚡️

— Maverick Protocol (@mavprotocol) April 24, 2024

Unveiling 4 innovations Maverick v2 is bringing to DeFi:

🟣Lowest-gas concentrated liquidity AMM

🟣AI-DEX via Programmable Pools

🟣veFlywheel with MAV emissions

🟣 Any-Token ve-Factory

👇Follow the thread to get a sneak peak at DeFi’s new… pic.twitter.com/Gt5G1NgTLH

Maverick V1 overview (5:28)

Maverick V1 is just a pure AMM where Liquidity providers (LPs) have the ability to create liquidity positions that move with price.

LPs can customize the price conditions for liquidity movement when creating a pool, so they can maximize the volume they can capture

Some pools on Maverick V1 have more daily volume than their TVL. In other words, all assets in a pool are swapped more than once a day

Previously, LPs had to go through off-chain mechanisms to adjust their liquidity position dynamically with the price. On Maverick, everything in on-chain

Reduce the fees to win (7:20)

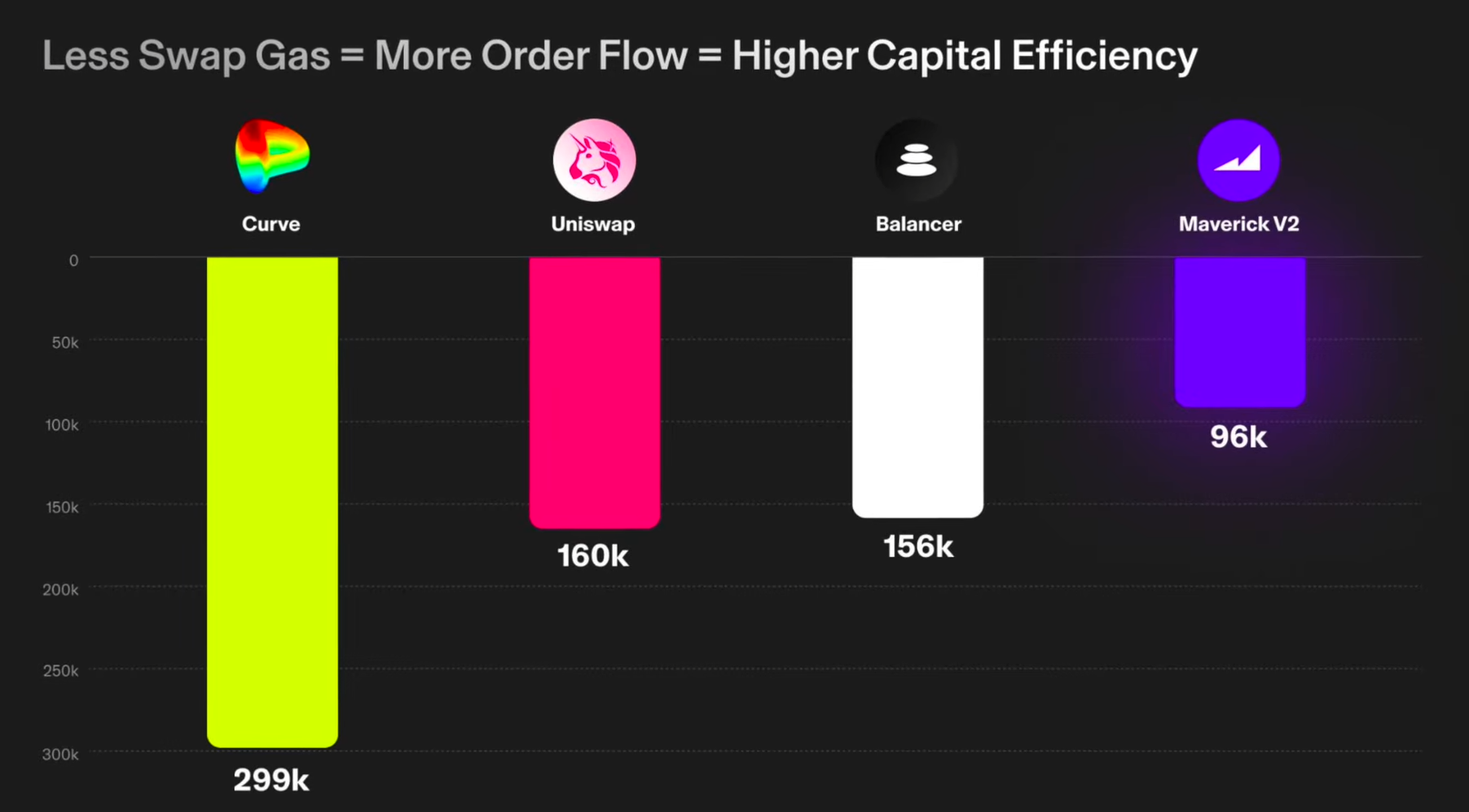

Swappers and DEX aggregators prioritize DEXs with the lowest overall cost (swap fees + gas fees)

On Maverick V1, we can create pools with 0.002% swap fees, so there's more room for improvement on gas fees.

Swaps on Maverick V2 would need 96k gas units, which is the lowest gas fees for CLMMs (Concentrated Liquidity Market Makers). Lower transaction costs make swapping more cost-effective, especially for smaller trades

Maverick V2 has a competitive advantage by combining low swap fees and low gas fees, as DEX aggregators (e.g., Paraswap, 1inch, Odos) are more likely to route trades towards it.

With increased trade flows from aggregators, we have higher trading fees for Maverick V2 LPs

Programmable Pools

Programmable pool use cases (10:12)

- Single-sided liquidity providing : LPs can deposit only one token instead of both tokens in a trading pair

- Dynamic Fees : adjusting trading fees dynamically based on conditions (e.g., oracles, transaction data)

- KYC Pools : implementing Know Your Customer (KYC) checks for trading RWA tokens

- AI DEX : AI models can analyze on-chain and off-chain data to optimize trading parameters (e.g., fees)

- Seamless liquidation : leveraged liquidity provision can be seamlessly liquidated with programmable pools

Community is encouraged to experiment with Maverick V2 programmable pools and build custom solutions (it seems Uniswap V4 opened Pandora's box)

KYC Pools are needed for institutions (13:37)

Currently, KYC/RWA assets are primarily traded on centralized exchanges. KYC pools allow bringing these assets to decentralized platforms like AMMs

As the KYC'd user base grows, traditional financial institutions may adopt KYC pools. Institutions like BlackRock could leverage KYC pools for decentralized trading of KYC/RWA assets

Maverick protocol itself will not handle KYC processes. The programmable pools will integrate external KYC solutions/protocols to allow communities to implement their own KYC rulesets within the pools

That said, implementing KYC gateways within DeFi interfaces is a user experience challenge, as it involve signing messages and integrating with KYC provider protocols

The first AI-DEX (16:48)

Maverick contributors have academic backgrounds and experience in AI, signal processing, and information theory :

- Success in AI competitions

- Team members with PhDs in relevant fields

Maverick V1 had algorithmic liquidity movement based on price. The goal of Maverick V2 is to evolve from algorithmic to AI-driven liquidity management

Instead of manually tuning parameters, AI models can self-adjust liquidity positioning, so it can adapt to market conditions and incorporating multiple data signals

Maverick team believes it's inevitable for DeFi protocols to adopt more advanced AI algorithms, because it enables more sophisticated liquidity management and pricing mechanisms

Building for AI agent users (20:05)

The permissionless nature of DeFi enables low-barrier access for individuals to build and deploy trading bots/agents. It contrasts with regulatory barriers and silos in traditional finance

We already see active competition between bots/agents in DeFi protocols :

- Solvers and intent-based trading systems employ advanced off-chain calculations

- Bots compete to optimize transaction routing across multiple DEXs

Hence, Maverick V2 has a programmable infrastructure for AI Agents. So AI agents can abstract away complexities of DeFi for end-users without extensive DeFi knowledge.

Building bots and AI Agents will increase the competition and arbitrage activity, but it leads to positive impacts :

- Tighter spreads

- Better pricing for regular users

veFactory

Any token veFactory (24:33)

Another goal of Maverick V2 is not only to provide infrastructure beyond just liquidity pool creation, but also infrastructure for governance and incentives.

veFactory allows any project to go beyond basic fair launches for their own token :

- Ability to shape liquidity distribution and set directional fees

- Incentivize liquidity provision through boosted positions

- Redistribute trading fees to veToken stakers based on lock duration

veFactory is less beneficial for already established protocols, but ideal for projects looking to bootstrap liquidity and community.

Example with a memecoin on Farcaster : a fair launch creates liquidity pool, but lacks utility/incentives. With veFactory we can add incentives, fee distribution, staking, etc. It turns basic fair launch into a "supercharged" ecosystem

Anyone can deploy a veToken without ownership/authority, so different token communities can collaborate

Maverick veFlywheel (30:44)

Traditional ve models (e.g., Curve) continuously emit new tokens to veToken holders based on voting power. This allows early ve holders to accumulate emissions, the problem is they're not incentivized to bring utility to the DEX.

On Maverick, incentives are tied to matched incentives for specific pools. It prevents from infinitely collecting emissions just from early allocation, and Protocols/users must continuously bring new incentives to receive rewards

Rewards can be distributed in any token, not just the protocol's native token.

Directional fees (32:58)

Directional fees allow for setting different fees depending on the direction of the swap (buy or sell) for different purposes :

- Create a sell friction for meme coins by setting a higher sell fee.

- Incentive LPs to favor holding one token over another by adjusting the fees for buying or selling that token.

- Facilitating dollar cost averaging strategies by setting a very high fee for selling a particular token

In the end, directional fees provide more control and flexibility for liquidity providers. There are opportunities for builders and potentially AI agents to explore new incentive models and use cases beyond the typical forking and copy-pasting