MakerDAO and Aave in a domestic dispute

Source : https://www.youtube.com/watch?v=Fek0r9atgow

Ethena takes in Ethereum (ETH) and other crypto assets, creates a one-to-one short position on centralized exchanges, resulting in a delta-neutral position.

This means that as the price of ETH goes up or down, the derivative trades on the backend keep the overall position's profit and loss flat.

Ethena is used to farm the funding rate, which is the fee paid by traders to keep their positions open. This funding rate is then passed back as yield to USDe, Ethena's stablecoin, and sUSDe (for staked USDE), their vault.

Thanks to this, current yields for sUSDe are about 35% APY.

Ethena has grown to over $1 billion in size and is expected to reach $4-5 billion as it matures

However, Ethena's growth has had rippling effects across the DeFi industry, prompting discussions and actions from other projects like MakerDAO and Aave.

MakerDAO's Billion bet on Ethena

Some context (2:20)

Not a joke: @MakerDAO considering allocating up to $600m DAI into sUSDe and USDe via @MorphoLabs with possibility to go up to $1 billion

— Seraphim (@MacroMate8) April 1, 2024

Ethena TVL growth is on track with internal expectationshttps://t.co/kKEhPoDwQm pic.twitter.com/F1QP1xPBFW

6:40

MakerDAO, the DAI stablecoin issuer, has proposed integrating with Ethena by allowing users to borrow DAI against USDe and sUSDe.

This proposal aims to allocate up to $1 billion in DAI to Ethena-related vaults.

Aave's response (03:26)

1B $DAI

— Marc “Chainsaw” Zeller 👻 🦇🔊 (@lemiscate) April 2, 2024

- minted out of thin air (20% of whole supply)

-into a non-battle tested protocol

-with zero risk mitigation

-weak oracles in less than a month

-for asset hyper sensible to market conditions

is the definition of reckless

Will propose LTV reduction of DAI in Aave today

16:40

Aave, the leading liquidity protocol in DeFi, thinks Ethena is not mature enough yet to allocate so much money.

So the Aave Chan Initiative is discussing about cutting the loan-to-value (LTV) ratio for DAI borrowed to zero across all Aave deployments, which means no future DAI depositors and borrowers would be able to use the protocol.

The concerns

Bad debt risks (06:05)

PaperImperium explains that the DAI being minted (created) through this integration is not immediately circulated. It goes into Morpho vaults first, and only enters circulation when someone posts the collateral token (USDe or sUSDe) to borrow against it.

But Marc sees a problem : if the value of USDe or sUSDe drops faster than the ability to liquidate the collateral, MakerDAO could end up with bad debt.

Furthermore, some of the MakerDAO credit lines have very high leverage (94% LTV ratio = x20 leverage). If Ethena's yield goes below the Dai Savings Rate (DSR) yield, users will deleverage massive positions, which add bad debt risks.

PaperImperium doesn't think this would happen, since the liquidation process in Morpho vaults is hardcoded at $1. The only way liquidations would occur is if the interest rate accrued to a point where the loan crosses the liquidation threshold.

Lack of Due Diligence (09:20)

However, PaperImperium and Marc both agree about the rushed process and incomplete due diligence, including a lack of published technical and legal risk assessments, especially for such a large integration (up to $1 billion in DAI proposed).

As many parties have financial ties to Ethena, it is difficult to find impartial opinions and risk assessments.

PaperImperium calls for a pause and a more thorough evaluation process, involving independent risk assessments and governance discussions, before proceeding with such a large-scale integration.

As Aave is looking for a second risk assessments provider, Marc expects that providers competing for this slot will use this proposal as a showcase in their current proposal to get onboarded

Did MakerDAO governance became centralized ? (13:20)

There are several points suggesting that MakerDAO's governance has become centralized :

- The proposition to increase the cap for Morpho from $100 million to $1 billion was the fastest (2 weeks) that any product has been onboarded. A decentralized governance process can't go that fast

- Absence of necessary risk assessments (technical, legal, and financial) before onboarding new products, which was a standard practice in the past.

- There is a lack of transparency and inclusiveness in the decision-making process, with deals seemingly made behind closed doors before being presentedto the governance forum according to PaperImperium.

- The governance process appears to be dominated by a single delegate (Rune Christensen) holding 90% of voting power according to PaperImperium, leading to a dependance.

- Lack of opposition and debate within the governance process. Having no opposition in governance contradict the principles of a decentralized autonomous organization (DAO).

- DAdvisoor notices that MakerDAO's decision-making has become less decentralized and more concentrated over the past 6-9 months.

While MakerDAO itself is a decentralized protocol, the decision-making process is seen as increasingly centralized.

Risk management

Risk assessments shift (26:30)

The credit line increased from $100 million to $600 million (and potentially $1 billion) overnight, was unexpected and unprecedented.

This rapid growth raises doubts about the predictability of the MakerDAO protocol, which was previously seen as a conservative and risk-averse protocol.

The assumption that MakerDAO was a conservative protocol in terms of risk management is no longer valid due to the aggressive increase in the credit line. This prompted a reaction from Aave as a risk management measure.

The reaction from Aave is not a "war" against MakerDAO, as the protocol as DAI is a collateral asset and a revenue source for Aave. This is rather a response to manage the changed risk profile :

- The decision to hard-code the price oracle for the Morpho/Ethena asset to $1 raises concerns, as similar practices have led to issues in the past (e.g., with Compound and Radiant Capital).

- There is a need for proper risk assessments, including legal and financial due diligence, which seems to be lacking in the current situation.

Aave Chan Initiative doesn't want Aave to be exposed to those risks.

Handling liquidations (32:45)

There are doubts about whether the existing market liquidity can handle any major events or liquidations resulting from such a large credit line.

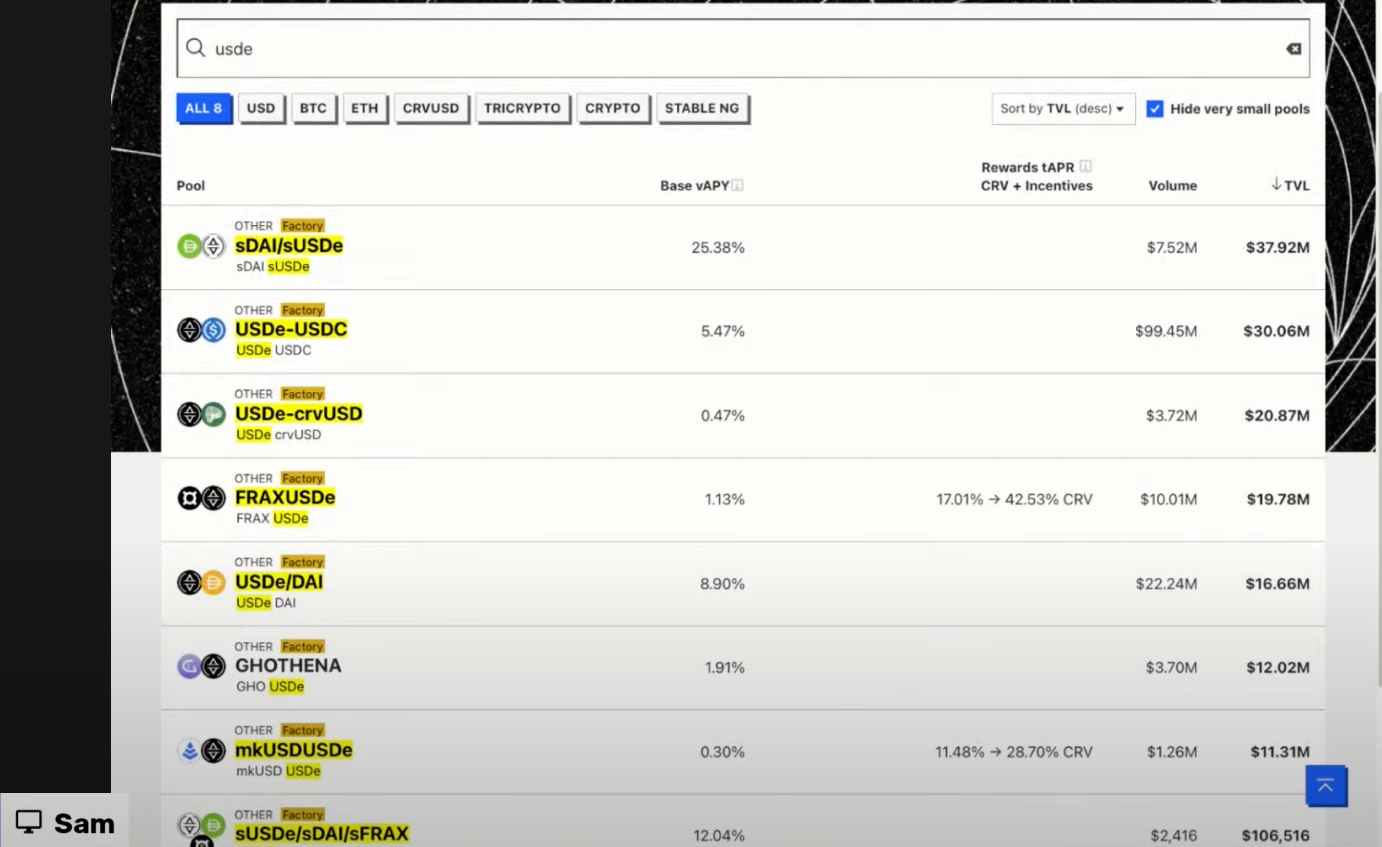

For example, we have $37 million in staked USD liquidity on Curve. it is questionable whether the market dynamics can handle any major event or liquidations.

MakerDAO's safety module holds around $500 million, whereas the credit line reached $600 millions. It may not be large enough to handle the risk associated with the current credit line size.

ACI's reaction was a warning (37:00)

Some DAOs can exert influence and send a signal to others by threatening to withdraw support if they go reckless. That's what happened last days.

Marc recognizes that ACI's reaction was aggressive. No bridge has been burned and can roll back if the speed of growth is slower.

However, it was important to draw the line, as there were already depegs because of insolvency :

- Angle was chasing a 1% higher yield on Euler compared to Aave, which ended up putting their funds at risk on Euler. When Euler whas hacked, the agEUR stablecoin depegged.

- Jarvis deposited 30% of their funds into Midas protocol. When Midas depegged and lost peg by 10-15%, a significant portion of Jarvis' funds got stuck and depegged

Wat now ?

Slowing Down the Credit Line Growth (42:30)

Marc suggests that they should take 6 months to grow the credit line. This would allow time to adapt risk parameters and ensure user safety on platforms like Aave.

PaperImperium prefers 6 weeks. The money/yields are available now, so protocols want to capture it quickly, and MakerDAO currently take 6 days to grow

Maker's Transition to a Hedge Fund (44:20)

Maker being a “hedge fund now” is not a particularly nuanced take imo

— Seraphim (@MacroMate8) April 2, 2024

Maker been allocating to different yield bearing assets for years, from Lido’s stETH to tokenised bills

When the bull market begins, you need to stay competitive either by:

1. Letting people mint DAI with… https://t.co/mfwiIpTpCF

44:05

Sam tells there are some calls saying that MakerDAO is a hedge fund now. PaperImperium thinks this is a joke :

- There is no actual hedging involved, it's an actively managed asset allocation strategy

- Poor track record of picking winners, with some small defaults

- Marc also thinks this is a joke as MakerDAO went from being too conservative (85% of DAI supply in low yield) to being overly risky now

Ending

DAI Supply and Market Share (47:00)

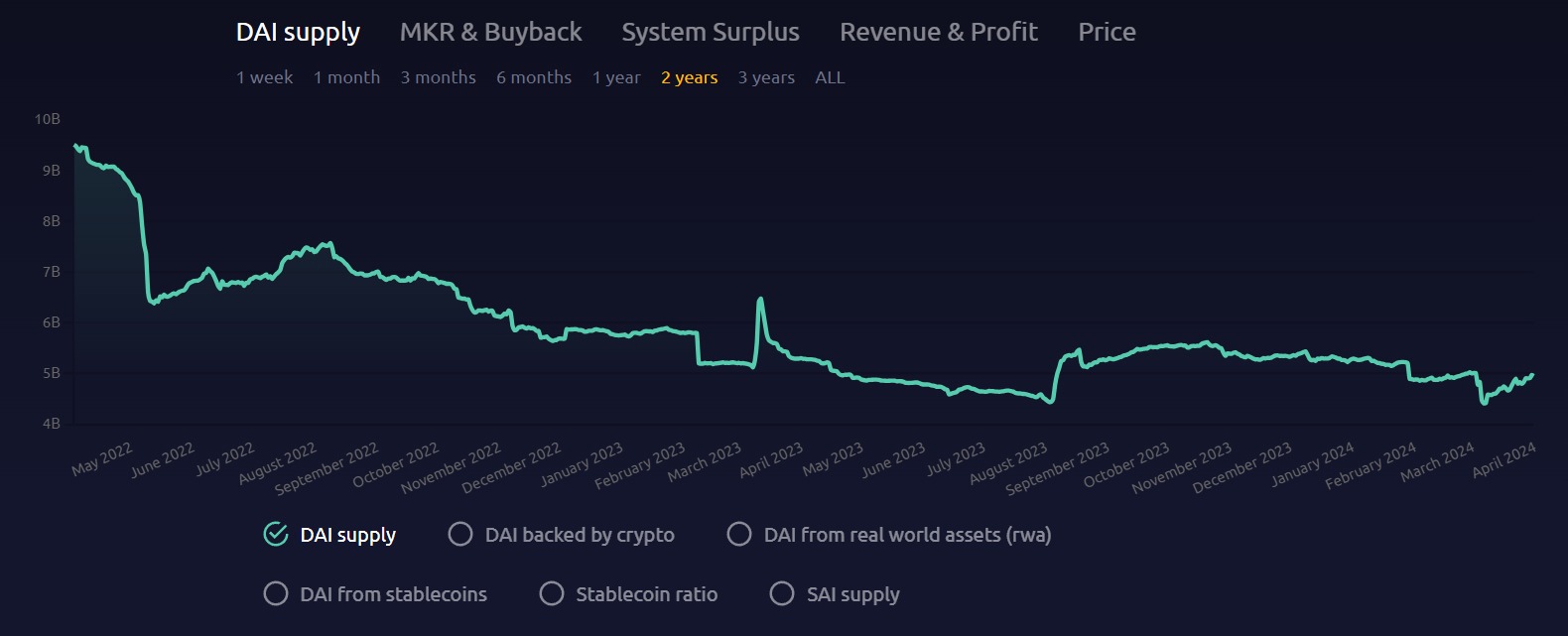

Over the past two years, the total supply of DAI stablecoin has contracted significantly, dropping from around $9.5 billion in April 2022 to around $4.9 billion currently.

DAI has lost market share, while other stablecoins like Tether (USDT) have maintained their share, and USDC has seen growth.

The Ethena proposal allowing yield chasing and leverage could help revive DAI adoption

But the growth has to slow down in order to evaluate risks, and Maker's past ability to navigate blow ups doesn't guarantee safety with Ethena's $1B+ size

Call for active participation (49:27)

There hasn't been much commentary yet on the proposal forums, so users are invited to express themselves. Governance discussions also have built-in cooldown periods to avoid rash decisions. As decentralized organizations, open discourse from all is valuable.

There are differing opinions on the governance approach taken for this proposal. For example TokenLogic would like to reduce the LTV instead of bringing it to zero.