Liquity V2 Codebase release

Source: https://www.youtube.com/watch?v=QxqINWx-87Q

Liquity V2 (5:00)

The Liquity V2 codebase is now publicly available on GitHub (with a very long README)

The main innovation is "user set rates" for their stablecoin. Liquity V2 uses a redemption mechanism from V1, updated to allow users to order themselves for redemptions based on the rate they're paying

The more interests they pay, the more they protect themselves from redemptions

V1 was popular but its economics don't work in current market conditions. V2 aims to provide an upgraded economic base

The code is not finalized yet. The code has gone through one audit. Additional audits and formal verifications are starting soon, and a bug bounty program will be launched later. But Liquity V2 is likely to be launched in November

Forking & Licences (8:35)

Liquity V2 uses the Business Source License, similar to Uniswap V3/V4, Aave, or Morpho

The licensed code published by the project is Open Source, but if you want to reuse this code for commercial purposes, you need a license (which can be obtained via a contract) for a given period (3 years for Liquity V2)

About 10 teams are already planning to fork Liquity V2's codebase. These teams will help stimulate usage of V2 on Mainnet, and they'll also help build liquidity across DeFi, both on and off Mainnet

Many L2s and other networks are interested, as they want to create stablecoins backed by ETH or other liquid assets, including gas tokens from other L1s (potentially Solana though not finalized, the focus is on major L2s)

Forking teams will communicate value back to the core Liquidity ecosystem, so BSL solves a common issue where original protocols don't benefit from forks

Liquidity V1 was one of the most forked protocols in DeFi, alongside Uniswap and Olympus. But those forks were trying to "kill" Liquity rather than build with it, and that was detrimental for users. BSL incites builders to grow the pîe instead of keeping the pie for themselves.

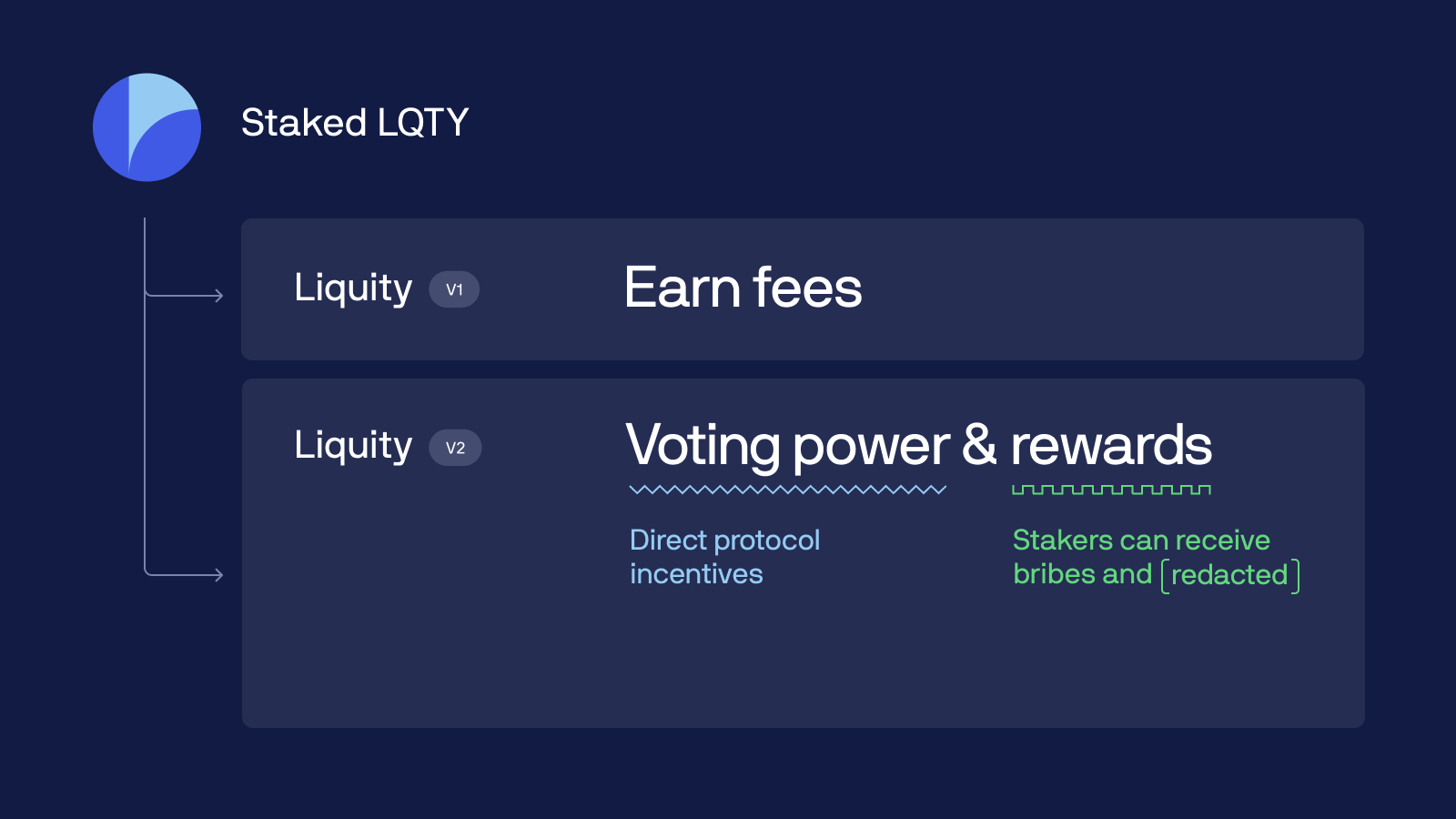

LQTY voting power (13:00)

- 75% of interest paid goes into a "stability pool" to keep the protocol stable during liquidations.

- 25% of the borrowing revenues (subject to change based on audits/testing) are directed into protocol incentives.

Every week, LQTY stakes must vote to direct the protocol incentives to different "initiatives".r

The initiatives can be directed toward providing liquidity on decentralized exchanges, building new DEXes, or other entities (e.g. the DeFi Collective)

The earlier LQTY holders stake, the more voting power they accrue per LQTY staked.

Liquity V2 also introduces a "bribing" mechanism, where the addresses willing to receive the BOLD token rewards can "bribe" LQTY voters to direct the rewards to them.

Canto's situation (19:00)

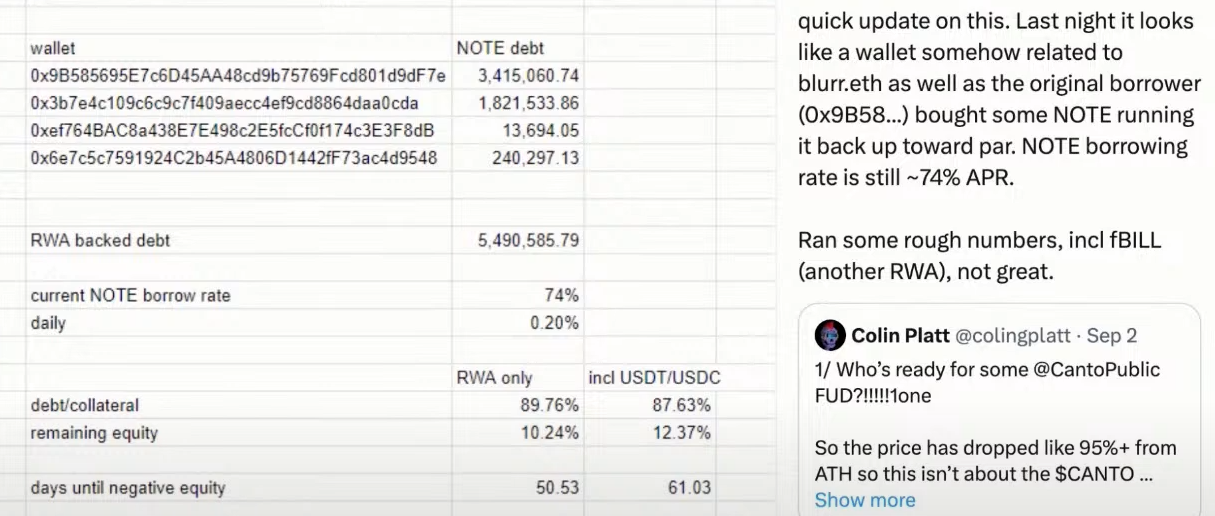

NOTE, the native stablecoin on the Canto blockchain, has issues. A single user has taken out a massive loan on the Canto lending platform:

- Deposited $3.6 million of USYC as collateral.

- Borrowed NOTE tokens against this collateral.

- This single position accounts for around 25-40% of the total TVL (Total Value Locked) on Canto.

The problem is that Canto's total value locked (TVL) has declined significantly from around $50 million to only $11 million. Over 50% of Canto's current TVL, around $6.2 million, is now concentrated in the Canto Lending protocol.

Complication: Since NOTE is an RWA-backed stablecoin, there is a whitelist of approved accounts that can repay or liquidate the position

In theory, users should be able to go through this whitelisting process and then liquidate the underwater RWA positions, such as the $14,000 one mentioned.

However, the low liquidity of the Canto token has allowed the peg to be brought back up to $1, likely by the holders of these RWA positions trying to avoid a collapse.

The RWA debt is accruing interest at less than 5%, while the Canto token is accruing over 70% interest, suggesting more Canto tokens are being minted than there is backing for.

Potential solutions (27:30)

To pay back the loans backed by the Canto RWA positions, users would need to use the Canto token (NOTE), but the liquidity for NOTE is very low.

Alternatively, users could try to bring in other stablecoins like USDC or USDT, mint NOTE with those, and use the NOTE to pay off the loans. However, this would still leave them stuck holding the illiquid NOTE tokens.

The RWA loans on Canto Lending can go up to 99% loan-to-value (LTV), meaning the amount owed is almost the full value of the collateral. This, combined with the 70% interest rate on NOTE, makes the situation very risky.

Some users have tried to intervene and buy up NOTE to push the peg back to $1, but this has not yet resolved the underlying liquidity issues

Broader Markets (30:30)

Canto's total value locked (TVL) has declined so much that it is now ranked #90 among Layer 1 and Layer 2 networks, right behind Bitcoin Cash and Waves.

The decline in Canto's TVL ranking suggests it is nearing the "graveyard" of Layer 1 networks with less than $20-$100 million in TVL, which are struggling to maintain relevance.

Canto's fate is similar to Secret Network, which had its architecture based on the now-vulnerable SGX chips, leading to concerns about the network's long-term viability.

The top 10 blockchain networks dominate the TVL landscape, with the remaining networks seeing a significant drop-off in TVL after that.

Some newer networks like Sui, Aptos, and Stacks have seen notable TVL increases of 36-75% in the past month, suggesting potential growth areas.

Canto is in trouble, Liquity would prevent that (33:35)

Canto's situation shows that insiders don't know how to handle the mess they're in, whereas this could be avoided.

If Canto had instead just minted their stablecoin on Ethereum and used USDC, they would not be in the current precarious situation.

In Liquity V2, there is a minimum "last trove" (collateral position) that must remain, even if everything else is liquidated

Colin (the guest) suggests the situation will likely require a "wind down" one way or another, potentially involving new economics or liquidity mechanisms for the NOTE token to resolve the over-collateralization and illiquidity issues.

DAdvisoor enters the chat (36:45)

When a protocol becomes too small, it becomes more dependent on human trust, which is the case with Canto as it winds down.

Colin expressed hope that the people now tasked with cleaning up the Canto mess can do so, and that users can ultimately wind down their positions in this "experiment" that no longer seems viable in its current form.

Colin discovered the strange behavior with the NotePad token on Canto through a random ping from someone involved in the Canto ecosystem early on. He used DeFi Llama to investigate further and found the large RWA positions.

Euler V2 is live