Leviathan News : Liquity V2

Source : https://www.youtube.com/watch?v=msfW9KI4-lI

Stablecoins news

The stablecoins market (4:30)

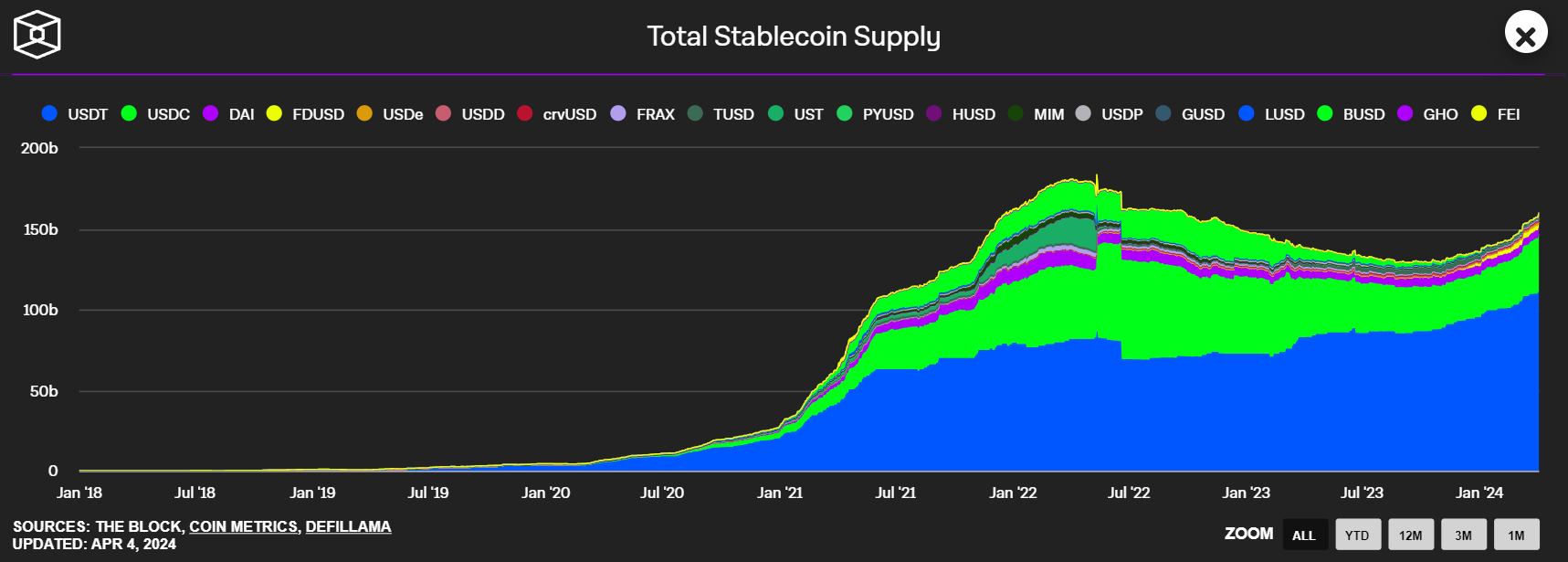

Total stablecoin market cap dropped from around $180 billion to $129 billion after the FTX collapse but has recovered to $156 billion currently

Growth is expected to continue, eclipsing the previous $180 billion high, aided by regulations like the upcoming US stablecoin bill, and networks like Solana and Rollups with cheaper transaction costs.

Tron's USDT saw significant usage when Ethereum gas fees were very high, but now Tron faces serious competition.

USD dominates as the reserve currency, while Euro and other fiat-backed stablecoins lag due to real-world usage patterns.

Euro stablecoins (11:00)

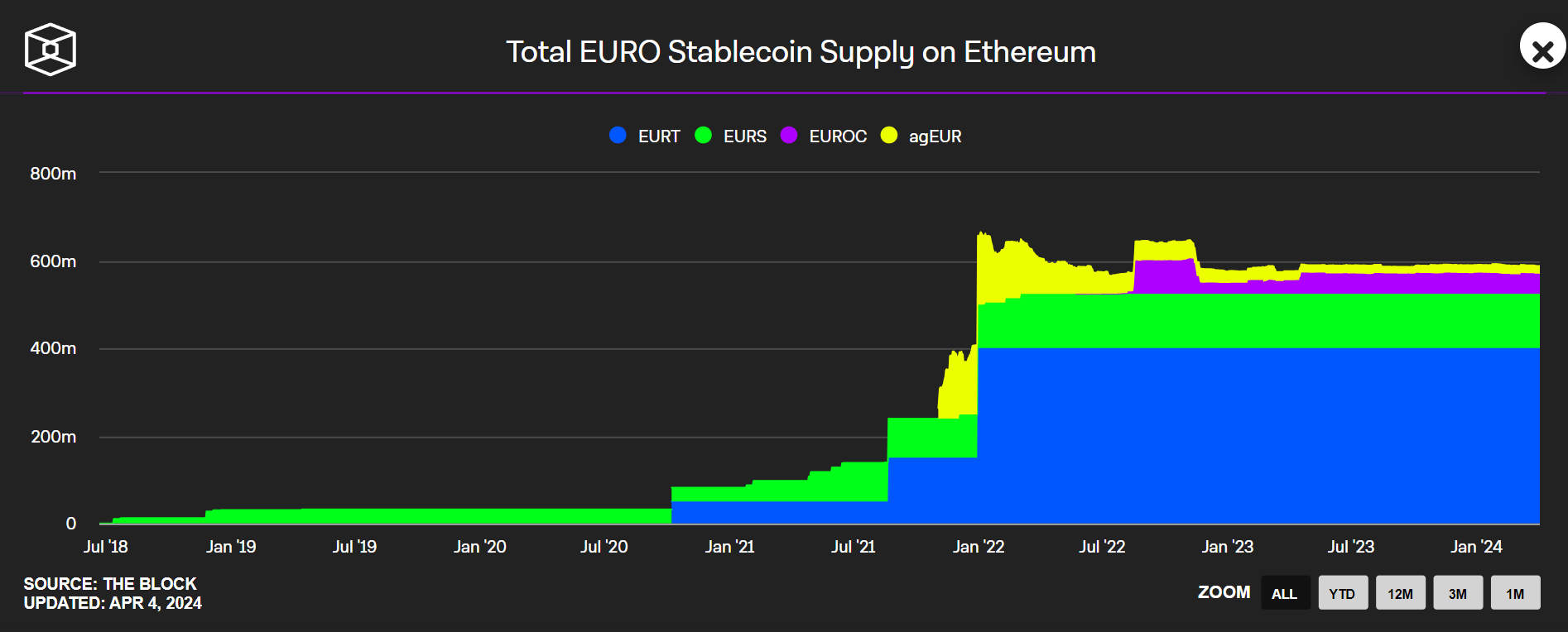

Euro stablecoin supply has been flat around 600 million for a couple of years

Reasons for the lagging Euro supply compared to USD :

- USD is the pricing currency for most commodities globally

- Sanctions tend to happen in USD, reducing Euro's diversification appeal

- Lack of real-world usage for stablecoins in Euros so far

Growth in Euro, Yen, and Chinese stablecoins could indicate increasing real-world adoption.

Agora Dollar (36:00)

We are thrilled to announce that we have raised a $12 million Seed round, led by @dragonfly_xyz.

— Agora (@AgoraDollar) April 2, 2024

Agora is building next-generation payments and asset infrastructure for the transmission of value on blockchain-based rails.https://t.co/c9FWXGrtEI

Agora plans to position itself as a "public good" stablecoin by sharing interest income with partners through income-sharing contracts

Stablecoins will be backed by safe and liquid assets like bank deposits, T-bills, and overnight reverse repos (considered best for daily liquidity)

Agora aims to leverage the current scrutiny on Tether and the potential IPO of USDC to gain market share

Agora is backed among others by Drake Evans (Frax core developer), Nick van Neck (son of investment management veteran Jan Vanek)

The project raised $12 million in pre-seed funding from investors like Dragonfly, General Catalyst, and Robot Ventures

That said, Agora will face competition from established stablecoins like USDT and USDC, which currently dominate the market. Success will depend on attracting a significant user base and adoption by exchanges, market makers, and other institutions

Furthermore, the stablecoin market is becoming increasingly competitive, with various new projects emerging

Is the stablecoin market still open ? (39:30)

According to the speakers, the stablecoin market is still wide open, and it's uncertain who will emerge as the biggest player in the next 2-5 years

USDT (Tether) may retain its dominance in the East due to the "Lindy effect" and user trust, but the West is unlikely to adopt it

There's a lot of room for innovative models to gain market share.

Impact of low yields on stablecoins (42:20)

If yields on safe assets like T-bills go down to 1-2% again, users may seek higher leverage and venture further out on the risk curve for yield

This could lead to more experimentation with on-chain protocols and potentially risky assets backing stablecoins

However, during the COVID period when rates were near zero, there was high demand for stablecoins used for leverage trading

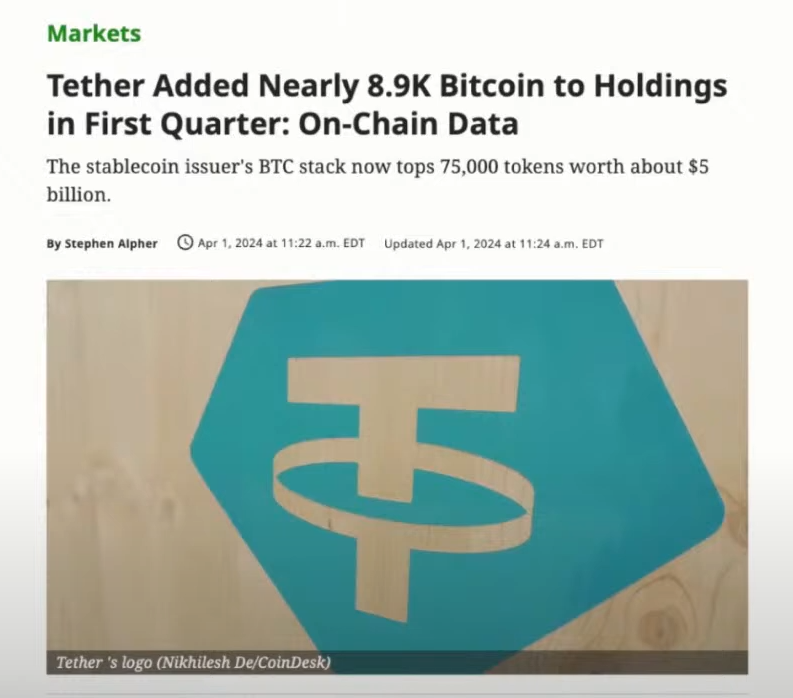

Tether invests $5 billions in BTC (44:00)

Tether seems to be hedging against potential negative yields by accumulating a large BTC reserve (around $5 billion worth)

If yields turn negative, stablecoin issuers may have to move further out on the risk curve to maintain profitability, which could complicate "real-world asset" (RWA) plays

Tether's lean operations (around 30 employees) may give them an advantage in maintaining profitability during low-yield environments

Rise of Ethena

What to think about Ethena's growth ? (13:30)

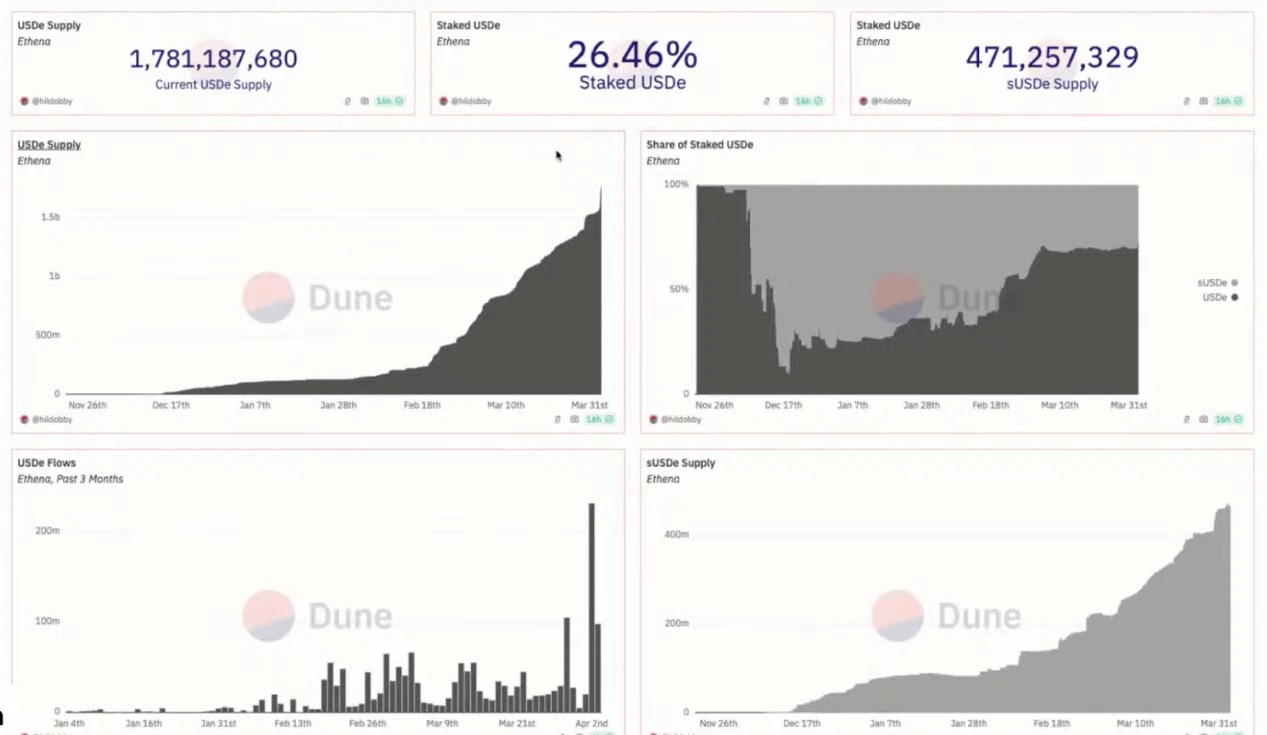

The growth is legit

The basis trade (lending dollars to earn yield on crypto assets) is a common and well-understood trading strategy among experienced traders.

The high yields currently seen have precedent, such as during the 2021 bull run when funding rates for basis trades reached 50%

Ethena's model is different from Terra/LUNA, as it has actual backing and is not solely reliant on an algorithmic stablecoin peg

The risks are shared across different parties (funds, market makers, DeFi investors) who have invested in Ethena, suggesting they believe the risks are manageable

Ethena currently only operates on Ethereum pairs, and can expand to the larger Bitcoin market and traditional futures markets for additional liquidity and risk management

The growth is a problem

A significant portion of funds being held on centralized exchanges, introducing counterparty risks

The rapid growth and scale of Ethena could amplify risks if it reaches hundreds of billions in size

The founder's tweet suggesting it's not a stablecoin, despite having "USDe" in its name, creates confusion about its positioning and perception as a stablecoin

Potential "death spiral" where negative funding rates force selling of the stablecoin, causing dislocation from the ETH price and further exacerbating negative funding

Neutral points

Negative funding is a feature, not a bug, according to Ethena's team, and they expect it to occur at times

The legal aspects and claims process in case of blow-ups or issues with market makers are not entirely clear

There are decentralized alternatives like f(x) from AladdinDAO that offer a similar product but in a more decentralized manner

Ethena is an experiment, and it's good to see such experiments play out in the market

Will Ethena impact the market ? (27:55)

Ethena will impact the market

If Ethena brings in significant short interest that wouldn't otherwise be there, it could make it relatively cheaper to go long on Ether compared to Bitcoin

As Ethena scales up to $10-20 billion in open interest across ETH, BTC, and CME futures markets, it could start to affect the dynamics

In a prolonged bull market, Ethena's open interest could grow to hundreds of billions, becoming a significant force

There are concerns about stablecoins like Ethena having to venture into riskier assets like long-term bonds or exotic assets during periods of high demand for stablecoins

Ethena won't impact the market

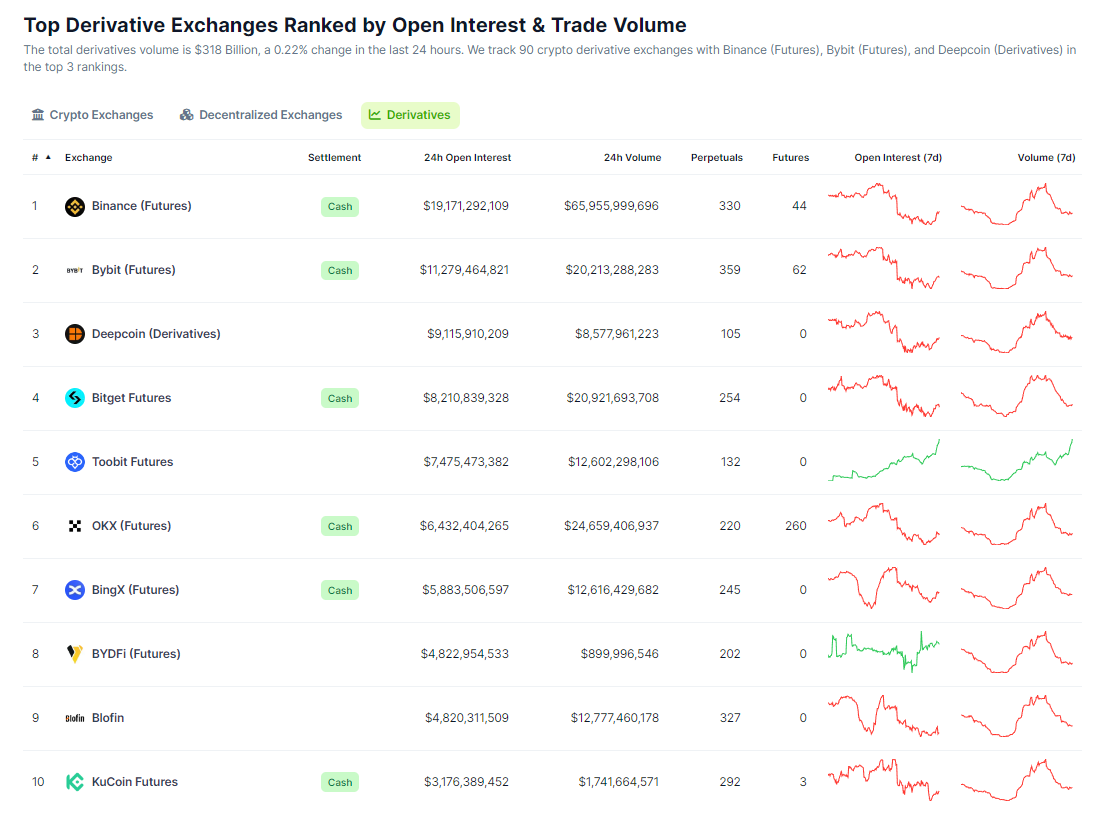

Currently, Ethena's $2 billion open interest is relatively small compared to major exchanges like Binance ($20 billion OI) and Bybit ($11 billion OI)

The total open interest across exchanges is estimated at $30-40 billion, and Ethena could potentially take 10-25% of that without much impact

Previously, funding rates (cost of leverage) were as low as 5% for an extended period, indicating lower demand for leverage

Funding rates and yields on Ethena are expected to revert to lower levels

Liquity V2

Liquity V2 features (46:25)

Liquity v2: Enhancing the borrowing experience

— Liquity (@LiquityProtocol) April 3, 2024

Liquity v2's introduction of user-set interest rates brings an innovative approach to immutable, governance minimized protocols that are better adapted for more versatile market conditions ⚖️

But that's not all; let’s take a quick… pic.twitter.com/POwvNCelfU

User-Set Interest Rates

- Allows users to set their own interest rates for borrowing, similar to maker and taker rates in trading order books.

- Creates a decentralized, crowdsourced market for borrowing rates.

- Rates can adapt to market conditions, providing more stability than rates chosen by an algorithm/governance.

Removal of Recovery Mode

- Loans can go up to 91% LTV without the risk of being shut down.

- Recovery mode was a feature in Liquity V1, but after research, the team figured out Liquity doesn't need it.

One-Click Leverage

- Allows users to easily create leveraged positions within the protocol.

- Optimized for lower gas costs compared to using external protocols.

Transferable Troves (NFTs)

- Troves (vaults) are represented as NFTs, allowing them to be transferred between addresses.

- Addresses a pain point for large users and custodians who previously couldn't move troves.

- Users can have multiple troves per address.

- Troves can potentially be bridged to other networks or Layer 2 solutions, like regular NFTs.

Delegation of Interest Rates

- Separates the interest rate setting from the collateral, allowing delegation to third parties or smart contracts (TDC eagers to become a delegate)

- Enables potential services or derivatives around interest rate management.

Protocol-Incentivized Liquidity

- Liquity will offer incentives for providing liquidity for the BOLD stablecoin.

- Users can earn rewards in BOLD by providing liquidity in addition to swap fees.

- This is designed to facilitate innovation and strategies around liquidity provision.

Auto-Compounding Strategies

- The protocol aims to enable composability for auto-compounding strategies.

- Users may be able to compound their earnings into different tokens or liquidity pools, beyond just the stability pool.

- Third-party protocols or services could build auto-compounding strategies on top of Liquity.

Immutability and Security

- The protocol is designed to be immutable, so they want to ensure thorough testing and security checks with multiple rounds of audits

- The development timeline is focused on security over rushing to launch quickly.

Liquity's Approach to Collateral Types (1:02:20)

Liquity V2 is initially focusing on a narrow set of collateral types, rather than supporting a wide range like LRTs (Liquid Staked Tokens).

LRTs provide higher yields but have a significantly smaller market at the moment, and liquidity is necessary for critical mechanisms like liquidations.

The rationale is to prioritize innovating on the mechanism types.

In bulk

Aye Prowl Fuuls Daeiy ! (0:00)

Have you ever seen a crypto millionaire and thought “Damn, that was all luck!”

— CoW DAO | MEV Blocker & CoW Swap (@CoWSwap) April 1, 2024

Wish you could get lucky the same way?

Well now you can.

Introducing "I'm feeling lucky ☘️" – the newest innovation from CoW Swap.

Try it here: https://t.co/GPQ8bBzNjs pic.twitter.com/l19InavdFs

CoWswap made a "feeling lucky" button, for those who, well...Feel lucky. This is the most left curve product out there, and this is great !

Unfortunately, this feature was up for a day, and then disappeared

Another dumb but interesting take :

at the Costco Hot Dog as Stablecoin part of the cycle— https://t.co/k4fA9zVlBB pic.twitter.com/5UQFKy96IW

— 𝚍𝚊𝚛𝚔𝚜𝚝𝚊𝚛 (@jarroddicker) April 2, 2024

It's a meme coin based on the famously cheap $1.50 Costco hot dog, so its value should theoretically be $1.50. It currently has a $64 million market cap, suggesting significant interest and potential for further growth like other meme coins

The "meme" factor can generate significant interest and adoption. But the only fundamental behind the memecoins is the joke. As a user, the question is : shall we bet on a joke ?

Things can get exponential (34:00)

Colin remembers having this presentation where he said a $20 billion bitcoin market cap was nothing to shake a stick at.

Today, $65 billion are in Bitcoin spot ETFs within just a few months and we only have $180 billions in stablecoins.

And if things continue, and there's nothing to say they will, we can start getting to what would look like a Wall street scale as these things get set up

Some immutable protocols (58:50)

Colin namedropped some immutable protocols :

- Liquity V1

- Uniswap

- Ajna

- The DAO from 2016

- Tornado Cash (although it has a governance token)

Curve (specifically the veCRV token) may not be entirely immutable due to the potential for governance votes.

Truly immutable code without any governance process is rare and challenging to achieve long-term.

Leviathan Points (1:04:25)

Leviathan introduces the "Squid" token (Leviathan points) to incentivize on-chain activity and community engagement.

Ideas included rewarding users for registering Ethereum addresses, minting content (e.g., on Pods Media), boosting the Telegram channel, and participating in other activities.

The goal is to explore ways to incentivize and gamify community involvement using the on-chain Squid token.