Leviathan News : government at war with open source

Source : https://www.youtube.com/watch?v=Fr78JirSbeA

The Tornado Cash Case

The government is bypassing the free speech argument. They argue that the Tornado Cash ecosystem components (protocol, UI, governance, token) were packaged together as a "service" with an agreement to commit crimes.

This is another dangerous aspect of the indictment, as it links together independent components that have no control over each other.

Composability is potentially the most important case in crypto and DeFi. If composability is considered as a "service", It sets a precedent that developers could be liable for third-party use of their software years into the future

The stakes are high, as it involves criminal charges and imprisonment, and sets a precedent for future cases.

Tornado Cash devs must not be criminally liable (7:30)

The developers separated the protocol from the interface, meaning the code would continue to function even if the front-end interface was shut down.

The developers burned the private key, so they had no control over the protocol once it was deployed, and could not prevent sanctioned entities from using it.

The government needs to prove willful violation, which means showing the developers knew their conduct would result in a sanctions violation, but this is not present in the indictment.

In other software cases involving sanctions, the defendants had directly marketed the software to sanctioned entities, which is not the case here.

Holding developers responsible for any potential misuse of their technology by third parties is an insane expansion of the law and sets an impossible standard. For example, infrastructure providers like Ethereum validators can be criminally liable if sanctioned entity uses the network.

Government must prove a centralized actor (15:45)

A parallel is drawn to the government's previous crackdown on unlicensed offshore Forex brokerages :

Forex brokerages in the 1990s-2000s were centralized entities with management teams implementing compliance procedures. The government successfully shut down hundreds of unlicensed FX shops.

Tornado Cash is different as it is decentralized code without a managing controller or active team. The government needs to prove that there was a centralized actor responsible for Tornado Cash's conduct.

Targeting chokepoints instead of code (18:00)

This case is a bellwether for how the industry moves forward regarding sanctions and First Amendment rights.

The desirable outcome may be to focus on chokepoints rather than targeting the code itself.

Targeting Tornado's code = Targeting SWIFT's code

The SWIFT system is software and a messaging service, similar to Tornado Cash. The burden is on financial institutions connected to SWIFT to prevent sanctioned entities from using it.

When SWIFT was used for crimes, the government pursued the bad actors, not the operators or developers of SWIFT. Crypto should be held to the same standards as traditional finance, with liability on the bad actors, not developers.

Why it matters (21:10)

- This is a global issue that extends beyond just the US, impacting human rights and liberties worldwide, because of the extraterritorial pursuit of individuals by the U.S. government, which could infringe on rights globally

- It could set a precedent for going after creators of technology in other industries if their products are later misused, even inadvertently (e.g. PDF software used by sanctioned entities)

- It threatens the core benefits of blockchain technology : anonymity and global transferability, combining cash-like privacy with electronic transactions

- It represents the government's attempt to make the blockchain/Web3 industry extremely inhospitable in the US, acting in concert across regulators

- It has existential implications for blockchain itself, as the government's desired outcome would make the technology illegal

The government may only be satisfied with private blockchains under its control, and the Tornado Cash case represents the "final boss" compared to other regulatory issues around blockchain.

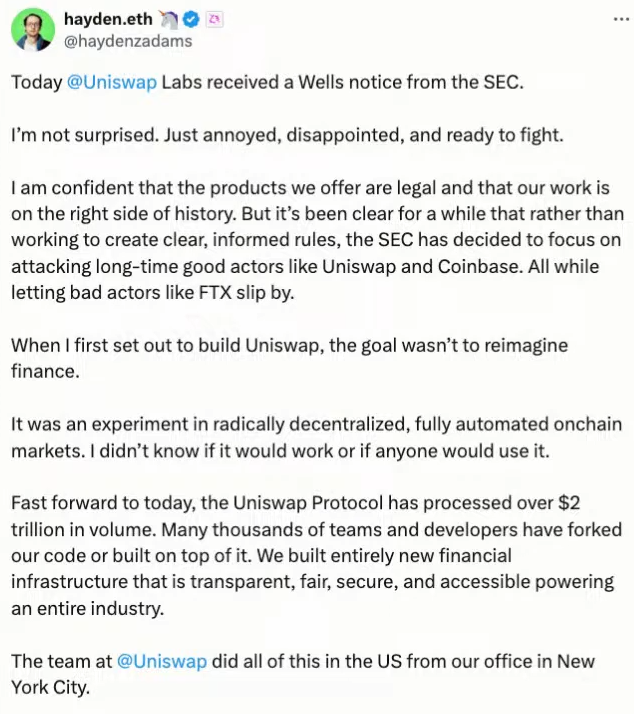

The Uniswap Labs Case

For context, Uniswap Labs recieved a Wells notice from the Securites and Exchange Commission (SEC) 👇

Points of Optimism (30:20)

This case has similarities to the government's attempt to ban and criminalize open-source encryption software like PGP in the 1990s. The courts eventually ruled that publishing open-source encryption code is protected by the First Amendment, even if it could be used by sanctioned entities

The case is currently before Judge Failla, who has demonstrated a nuanced understanding of blockchain technology in previous cases.

In that case, she carefully separated the different components of the Uniswap ecosystem (token creators, UI, protocol) in her analysis. Her technological expertise could be a positive factor in this case as well.

Political influence (33:40)

The upcoming elections could lead to a change in administration and shift how crypto is regulated going forward.

There might be pressure on the current administration (SEC Chair Gensler) to take actions or establish positions on crypto regulations before a potential change in leadership. However, it's difficult to speculate on the motivations and how much they care about their successors continuing their actions.

The government may use the specter of terrorism to justify tighter financial surveillance and crypto regulations, as seen in the Tornado Cash case. While technical arguments around free speech and privacy exist, many may prioritize national security when "terrorism" is invoked.

Even if the SEC files a case against Uniswap soon, substantive decisions may not come until after the next administration due to the legal process timeline.

Claims against Uniswap Labs (37:40)

The Wells notice itself does not reveal the specific violations that will be claimed. Alex highlights these three areas as potential claims the SEC could pursue :

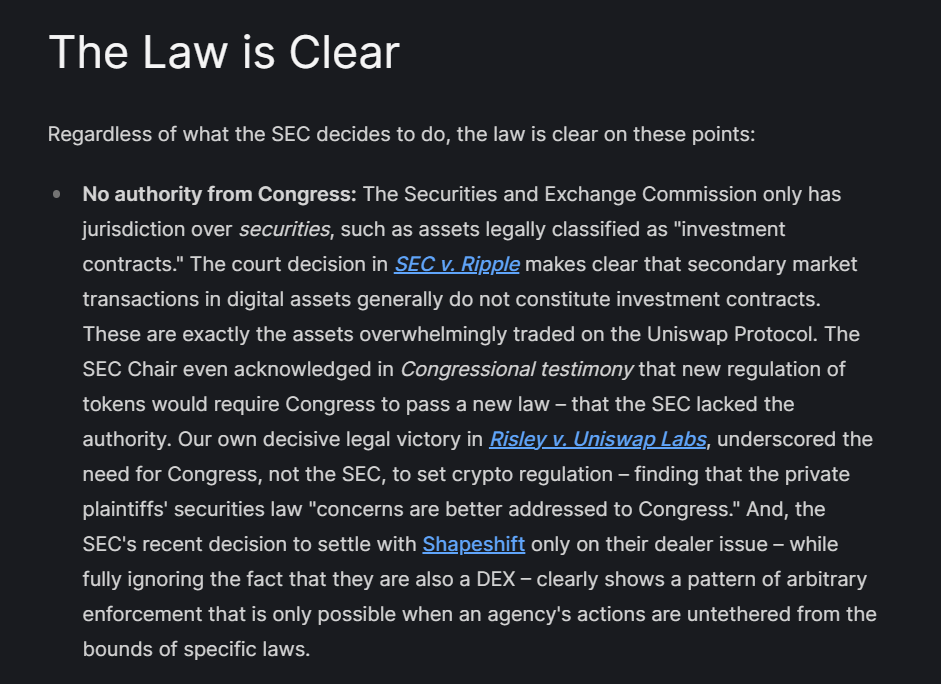

- Uniswap operating as an unregistered securities exchange. This is seen as the major claim everyone is anticipating, and this may be the hardest case for the government to make

- UNI token constituting an unregistered securities issuance/investment contract. The government has a relatively strong argument here, as there are securities-like elements to how the UNI token was issued/structured

- Uniswap Labs acting as an unregistered investment advisor under the Investment Advisers Act. This theory was recently rejected in the Coinbase wallet case, but the SEC may try to make this argument again despite the precedent

Will Uniswap win or not ? (41:05)

Arguments for Uniswap

- Congress and the SEC lack authority over assets classified as commodities like BTC and ETH, which are not securities

- The Uniswap protocol, web app, and wallet do not meet legal definitions of securities exchange or brokers

- The Automated Market Maker (AMM) contracts are immutable and not controlled by Uniswap Labs, making it difficult to classify as an exchange

- Uniswap Labs has taken measures like blacklisting certain tokens on the front-end to avoid securities concerns

Arguments for the SEC

- Many crypto projects, including Uniswap, issued tokens to raise capital, which could be seen as an investment contract/securities offering

- The distribution of UNI tokens to insiders like Hayden Adams could be viewed as profits from an unregistered securities offering, subject to disgorgement

- While the AMM contracts are immutable, the front-end interface could potentially be classified as an exchange/broker

- The SEC may prefer ambiguity and a settlement rather than risk losing key issues like whether AMMs are exchanges

Potential Settlement

- Uniswap insiders may want to settle to avoid personal liability and protect their UNI token holdings/wealth

- The SEC may prefer to maintain ambiguity on core issues like whether AMMs are securities exchanges

- The EOS case with Block.one resulted in a relatively small $24M settlement despite $4B raised

The Multi-Year scenario (56:10)

There is a possibility that the case could drag on for years, similar to the ongoing Ripple case against the SEC.

The duration may depend on the ideology and stance of the next SEC administration - a crypto-friendly one may seek a settlement, while a hardliner may want to make a point and fight it out.

There is a suggestion that the crypto community should be proactive in advocating for Uniswap, rather than being passive or reactive.

Tactics like contacting representatives and applying public pressure could potentially influence the outcome.

Is code law ? (1:01:50)

You are once again reminded that you all have a moral duty to *never* hire any attorney currently working for the SEC crypto enforcement division after they try to move to the other side

— laurence (dubai variant) (@functi0nZer0) April 10, 2024

Their experience counts for nought, their credibility laughable, their knowledge void

As regulatory challenges increase in the US, there is an understanding of why builders may want to operate outside the US to avoid such issues.

Being fully anonymous is seen as having advantages and being simpler in many ways, but there are cases that challenge this perspective :

- The Richard Heart case is considered important for addressing extraterritorial issues and clarifying how to build offshore, outside US jurisdiction.

- The Avi Eisenberg case raises critical questions about intent, liability, and the nature of on-chain loans in DeFi protocols.

Peter Van Valkenburgh's perspective is that while code can powerfully regulate individuals, it should be democratically accountable like regular law.

Anyway, the question is still open...