Leviathan News : Dyad and QiDAO

Source : https://www.youtube.com/watch?v=VNgIJYIRmGE

QiDAO Update

The MAI depeg (1:00)

QiDAO is a stablecoin issuer that has the particularity of being able to create stablecoins on multiple blockchains, and was affected by the Multichain bridge hack on Fantom.

The hack caused bad debt for QiDAO, and its stablecoin called "MAI" depegged and dropped to $0.80.

After the hack, all chains voted to stop bridges between chains in order to freeze exposure to the bad debt coming from Fantom.

The QiDAO team did not have the majority of governance tokens (since their QI tokens were also stolen), so important decisions have to go through a community vote.

After months of discussion, it was decided to take a chain-by-chain approach to repeg MAI. Some chains like Ethereum were not very exposed and MAI was already repegged at $0.99 on this network.

In parallel, several measures were adopted to restabilize MAI:

- Limits on transfers between chains

- Stability pool for liquidations

- Use 50% of protocol revenue to buy back MAI

- Pause borrowing on networks where MAI is depegged

- Deploy QiDAO on other Layer 2s to increase revenue

QiDAO hopes to repeg MAI in Q1/Q2 2024 and eliminate bad debt by end of 2024 to resume growth.

QiDAO is optimistic (7:30)

Demand for stablecoins and leverage is restarting, which is positive for the stablecoin industry and crypto in general.

According to Benjamin from QiDAO, the protocol has one of the lowest capital costs in the stablecoin sector, which is between 0 and 2% depending on the blockchain. In other words, as soon as fees are above 2%, QiDAO is profitable.

Interest rates are blursed (9:30)

The rise in interest rates is both a blessing and a curse for stablecoins

😇It allows QiDAO to increase its revenue and repeg MAI faster

👿Protocols are forced to adapt to the average market interest rate, otherwise they become less competitive

Offering an interest rate below the competition proves detrimental to the business model of stablecoins, as users make carry trades

The goal is to profit from the difference in interest rates.

An example of this problem is Liquity which charges no interest rate, so users sell their LUSD for sDAI.

Another example : the GHO stablecoin offered a lower interest rate than the competition at launch. Users sold their GHO for sDAI to the point where GHO depegged. By raising interest rates, GHO's peg was partially restored.

Dyad Update

Joey Roth (Dyad) entered the chat (13:00)

Stablecoins have shown they are a real product-market fit in crypto, on par with trading. They are useful for many DeFi use cases, and also as payments.

However, there are still problems with unit economics in the stablecoin industry in general :

Centralized stablecoin issuers like USDC or USDT keep the returns on assets held in their reserves while issuing 1$ stablecoins. Tether made several billion dollars in net profit over 2023, but only Tether employees get those profits.

Decentralized stablecoins allow users to become their own central bank and benefit from this activity, but these stablecoins cost more than $1 to produce and maintain, limiting their growth compared to centralized issuers.

Dyad's response to these issues (17:15)

New stablecoin designs like Dyad are trying to solve these problems.

Dyad is based on a Collateralized Debt Position ("CDP") system. A position on Dyad is called a "note" which confers "Kerosene" tokens to issue DYAD stablecoins from excess collateral.

This allows re-collateralizing unused collateral and improving capital efficiency closer to that of centralized stables like USDC/USDT.

Dyad's bet is to outperform centralized stables once they integrate a wider variety of collateral.

The Kerosene token (21:00)

After Terra's collapse, people are no longer really motivated by stablecoins with endogenous collateral.

Dyad's Kerosene token is an hybrid between endogenous and exogenous collateral, and it's value is determined by the amount of exogenous collateral relative to debt in the system.

Example : The stablecoins from Terra (UST) were backed with LUNA tokens, so UST is entirely dependent on Terra

Exogenous: coming from entities outside the protocol

Example : Liquity issues its stablecoins from ETH, which is completely external to the Liquity protocol (it can harness as much ETH as we want, and continues to exist with or without it)

In other words, Kerosene does not provide additional collateral to the system, but allows reusing existing collateral (in the same way as a mortgage) to increase capital efficiency.

How notes and Kerosene work on Dyad (37:30)

On Dyad, notes are in the form of NFTs, which are called "dNFTs". To incentivize liquidity sustainably, the longer you hold the note, the more kerosene it earns you.

The presence of Kerosene in the note also increases the note's value on the secondary market : a note with more seniority provides more Kerosene tokens, so is better valued.

In parallel, Dyad chooses not to have a governance token and gives one vote to the user who owns a note. The more notes we own, the more voting power we have.

The problem with older stablecoins is that there is a conflict of interest between users issuing stablecoins and users holding governance tokens. Dyad tries to converge those interests in a way which you must have "skin in the game" to be able to vote.

The concept of "Risk Premium"

What is the risk premium ? (26:00)

The risk premium is the yield or price differential between a risky asset and a risk-free asset.

For example:

- Government bonds are considered risk-free. If you buy a government bond that pays 2%/year, that's the risk-free rate.

- Corporate bonds pay 5%/year but are riskier.

The risk premium in our example is 3%/year to compensate the investor for taking on higher risk.

This concept of "risk premium" also applies to crypto : given that recent decentralized stablecoins are riskier by nature, they need to offer more incentives to attract investors.

For Joey, LST/LRT (Liquid Staking Token / Liquid Restaked Token) alone cannot solve the risk premium problem for CDP-based decentralized stablecoins

At the same time, maximizing capital efficiency can undermine long-term stablecoin sustainability. A balance must be struck.

Curve's example showed the importance of incentive structure (carrot and stick) that provides the necessary risk premium to attract and retain liquidity in DeFi protocols.

Being immutable = no control over risk premium (30:30)

Benjamin thinks trying to make a protocol completely immutable is illusory because the world is constantly changing. Even if we think a protocol is immutable, if the world evolves, the protocol's dynamics will change despite ourselves.

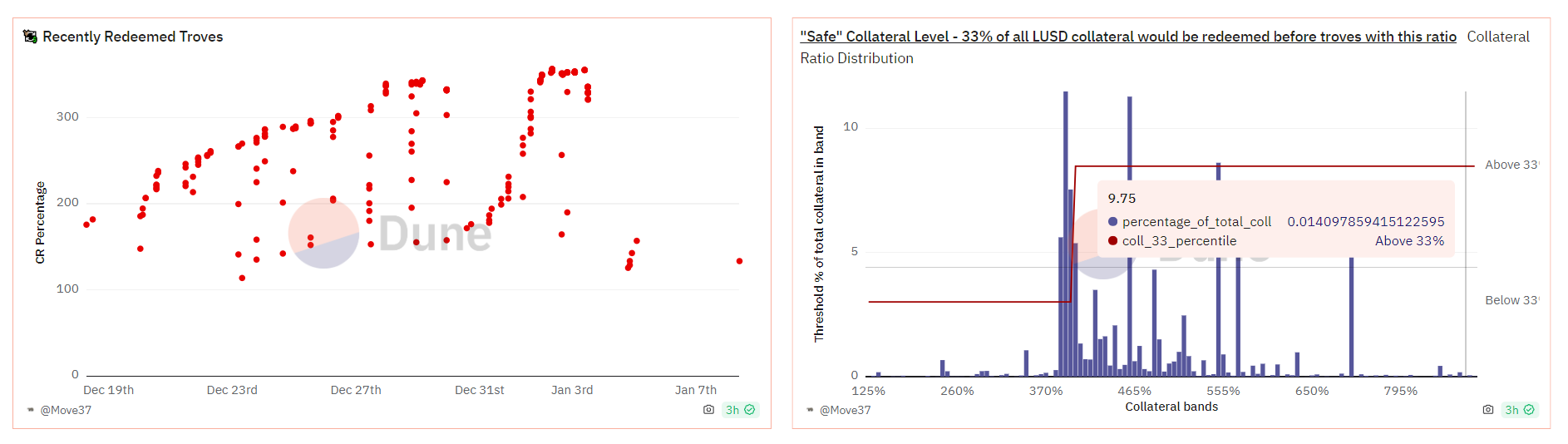

- Liquity suffered in terms of capital efficiency due to its immutable nature. At present, a 405% collateral ratio is required to be considered safe (for $1 of LUSD, $4.05 of ETH is needed)

- In contrast, Prisma, which is not immutable, was able to adjust its rates to 4%, and has an average collateral ratio of 270%

Immutability prevents adapting your risk premium.

Curve and Convex integrations (31:45)

Integration with Curve and Convex is used by some stablecoin protocols like Frax and Prisma to manage their liquidity costs.

The goal is to spend $1 of the stablecoin issuer's native token and get in exchange more than $1 in rewards in the form of liquidity thanks to votes on Curve.

Frax was getting up to $4 in Curve/Convex rewards for every $1 of FXS spent.

But this is not scalable because as TVL increases, Curve is not able to provide 3-digit annual returns on votes indefinitely.

Although Curve offers the best performance for maintaining the peg, the capital cost for liquidity rewards is too high for most stablecoin issuers.

The need to adopt Layer 2s (35:00)

Curve and Uniswap have lagged in adopting Layer 2s compared to decentralized exchanges (DEXs) that first launched on Layer 2s like Camelot on Arbitrum or Velodrome on Optimism.

As a stablecoin issuer, it is important to do Business Development with emerging L2 communities, because the absence of Curve and Uniswap opens up many opportunities for liquidity costs.

In other words, Layer 2s offers an interesting risk premium.

Designing a liquidation system

Dyad's liquidation system (41:30)

Benjamin emphasizes the importance for QiDAO to manage liquidation risk, and cross-chain risk (if a problem on one chain affects the others). He wonders how Dyad plans for these liquidation and cross-chain correlation risks.

Joey answers that Dyad has a basic liquidation system where anyone can liquidate an undercollateralized position and get the debt + 20% of the collateral.

To prevent liquidation from impacting the price, the collateral is simply transferred to another dNFT.

The 2 biggest risks for liquidations are :

- The collateral value drops too low to incentivize liquidation

- The forced selling of collateral affects its price.

In Dyad, liquidation is more about protecting against bankruptcy, while incentives aim to maintain the peg.

Liquidations are not that hard to solve, good systems like Aave and QiDAO have handled crises well. The key is avoiding the death spiral by allowing the at-risk position to be bought back before reaching the point of no return.

Examples : Terra, FTX, subprime crisis, zombie companies...

In practice there are always arbitrageurs ready to take advantage of liquidation opportunities in decentralized finance. So the system works as long as the collateral value does not completely collapse.

This is certainly a good time to create liquidation bots on Dyad...

QiDAO's liquidation system (49:20)

In QiDAO, when a user borrows a stablecoin and the value of their collateral falls below a certain threshold relative to their debt, they can be liquidated.

But QiDAO plans to offer another liquidation system, inspired by Curve's "LLAMMA" design that allows automatically buying back your position when collateral price drops too much to avoid liquidation :

- Use LP tokens (tokens that provide liquidity to given pools) as collateral.

- Allow each borrower to set their own customized "stop loss" for automatic liquidation.

- Progressively convert collateral into borrowed asset as price approaches liquidation level.

- Use decentralized exchanges to hedge price risk and facilitate liquidations.

This model is very similar to Fraxswap's BAMM.

The main problem with this design is that liquidity needs to be pulled out to fund DEXs. One solution is to use a "Peg Stability Module" where any user can deposit their issued stablecoins to be used to facilitate liquidations, and get paid when liquidations happen.

Optimizing the Peg Stability Module "PSM" (56:30)

Liquity's stability pool is an interesting PSM mechanism, but it hurts LUSD velocity (we gain in decentralisation and peg stability, but lose in capital effiency)

This could be improved by creating a predictive market on future price. Liquity V2 already works on it

Other protocols like DOLA have also adopted this model, as it allows increasing fees on borrows that go directly to stablecoin holders.

Dyad's Kerosene token can be seen as a PSM since it captures all protocol growth value and excess collateral. In parallel, Kerosene's price is set by the protocol but can trade at a premium on the secondary market.

Conversely, discount expresses the amount deducted from the normal value of an asset.