How to get a DeFi Mortgage today? (PWNDAO at EthCC)

Source: https://www.youtube.com/watch?v=CvNgsmVPHhc

Storytime

Josef (the speaker) became aware of cryptocurrency around 2011-2012, and initially just saw it as "magic internet money" without caring about the decentralization values.

Discovered Ethereum in 2015, which got him interested in the technological revolution and decentralized paradigm.

Became a Solidity developer and auditor, eventually joining the Ethereum Foundation for 4 years.

Decided to fully embrace the "crypto native" lifestyle, getting paid in ETH and living off crypto.

As he got older, Josef wanted to diversify and get a mortgage to buy a house but didn't want to fully give up his crypto-based lifestyle.

He faced issues with banks closing his international accounts due to crypto-related transactions.

When applying for a mortgage, the bank representatives laughed at his crypto-denominated income and rejected his application outright.

To get approved for a mortgage, Josef switched his contract to traditional fiat-based employment. He also started converting some of his crypto holdings to fiat to deposit in his bank account.

Even after going through the above steps, when Josef applied for the mortgage, the bank added a new checkbox on the KYC form asking about crypto exposure.

Despite providing all the documentation, the bank rejected his mortgage.

Definition of mortgage (6:00)

Mortgage means a "debt pledge" - the debt disappears upon repayment or default.

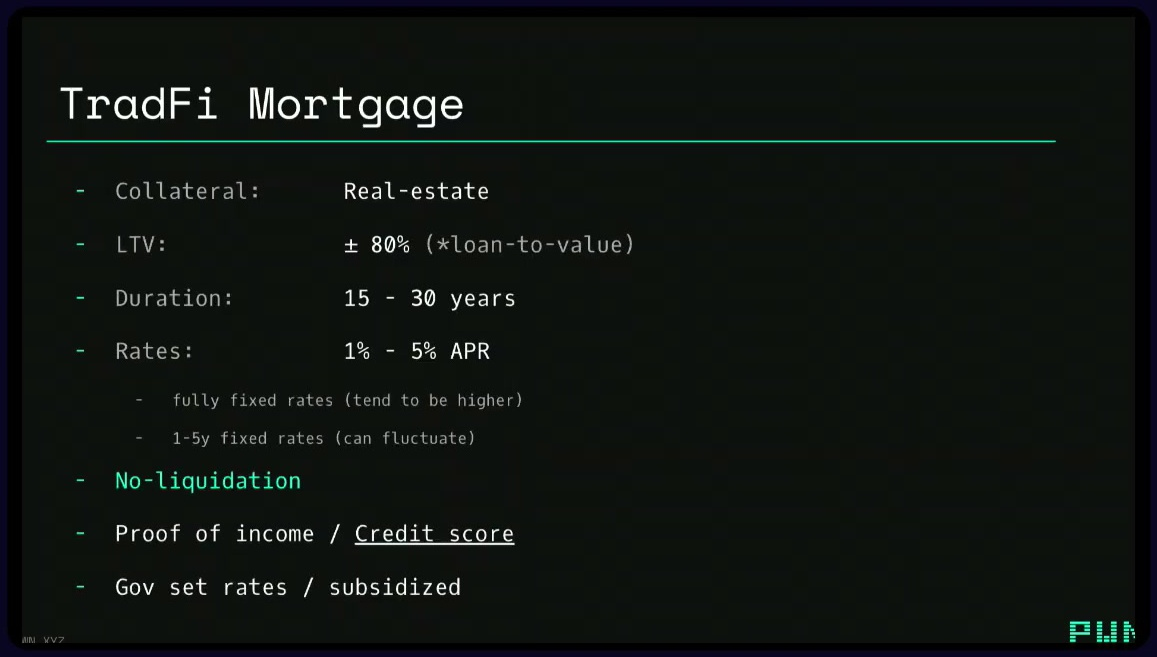

Typical mortgage structure:

- Collateral: real estate

- Loan-to-Value (LTV) ratio: usually around 80%

- Duration: 15-30 years

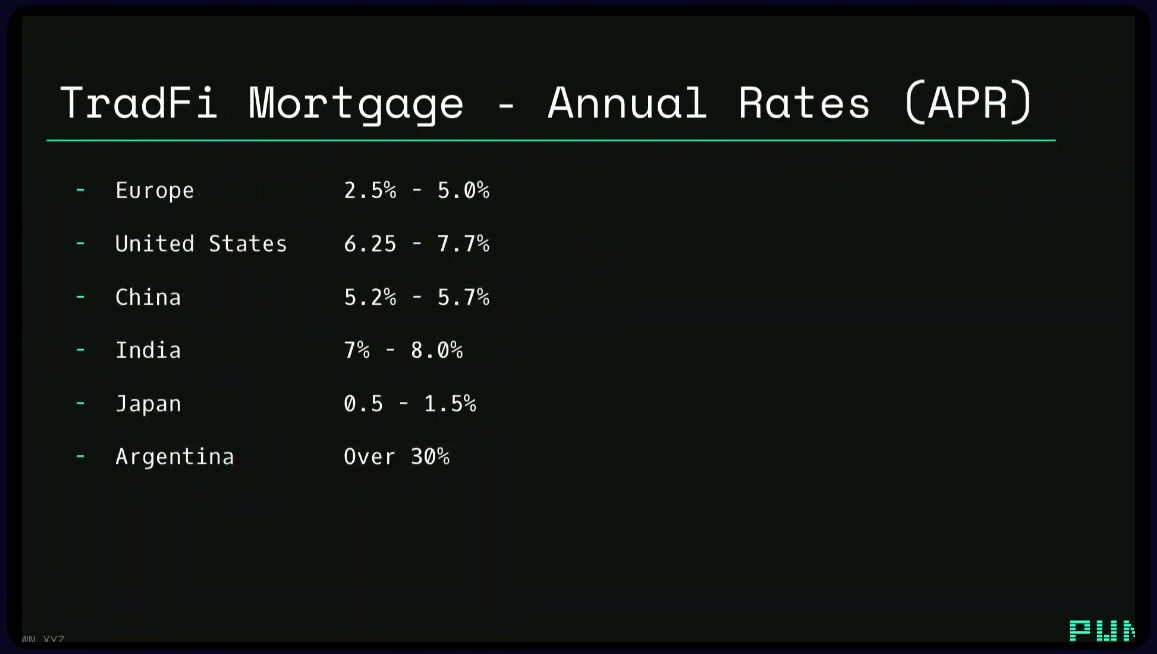

- Interest rates: 1-5% annually, can be fixed or variable

Mortgages usually require proof of income or credit score, and they are often subsidized by governments to keep rates relatively low

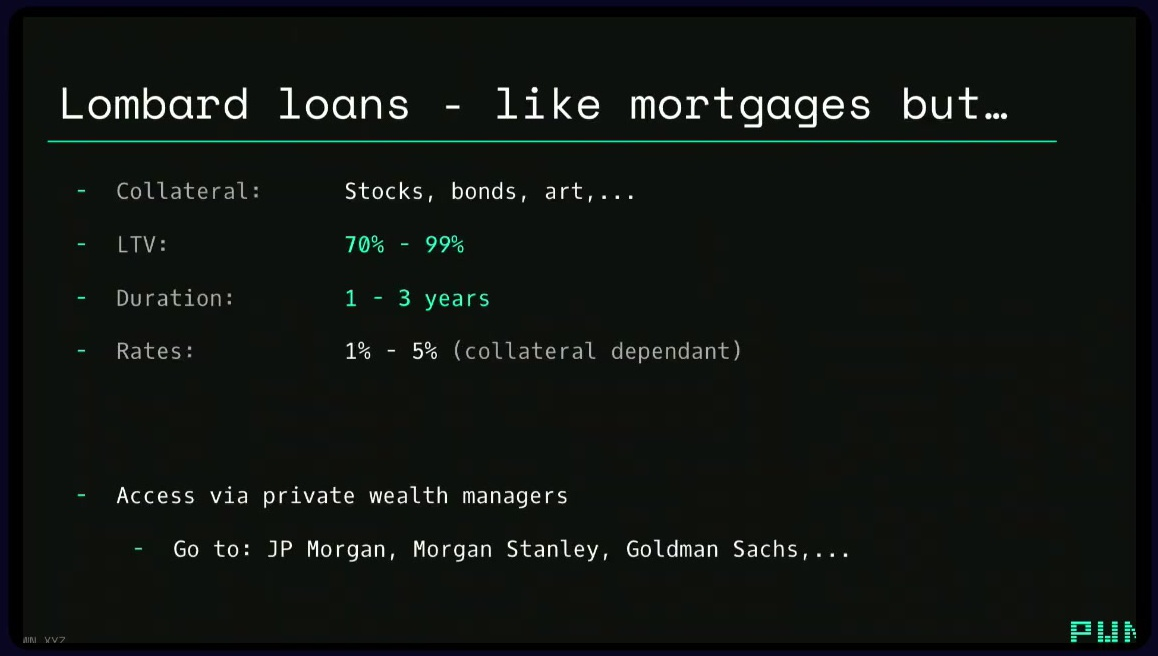

Lombard Loans are similar to mortgages but used for other asset classes like stocks, bonds, or art.

Structure:

- Loan-to-value ratios can be higher, up to 100% for certain assets

- Shorter durations, like 6 months to 3 years

- Lower interest rates compared to mortgages

- Obtained from private wealth management firms

Cryptonative loans are typically Millennials or Gen Z with significant crypto holdings.

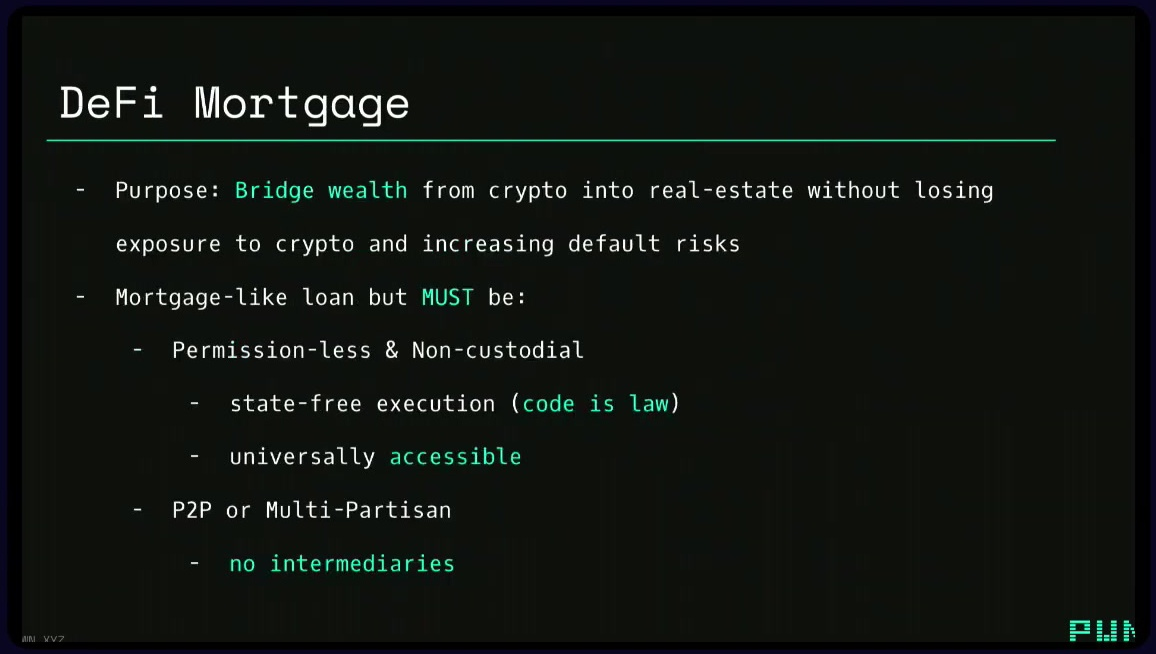

The DeFi mortgage aims to bridge wealth from crypto into real estate without losing crypto exposure or increasing default risk.

It must be permissionless, non-custodial, state-free (code is law), and universally accessible, without intermediaries.

How to get a mortgage? (11:30)

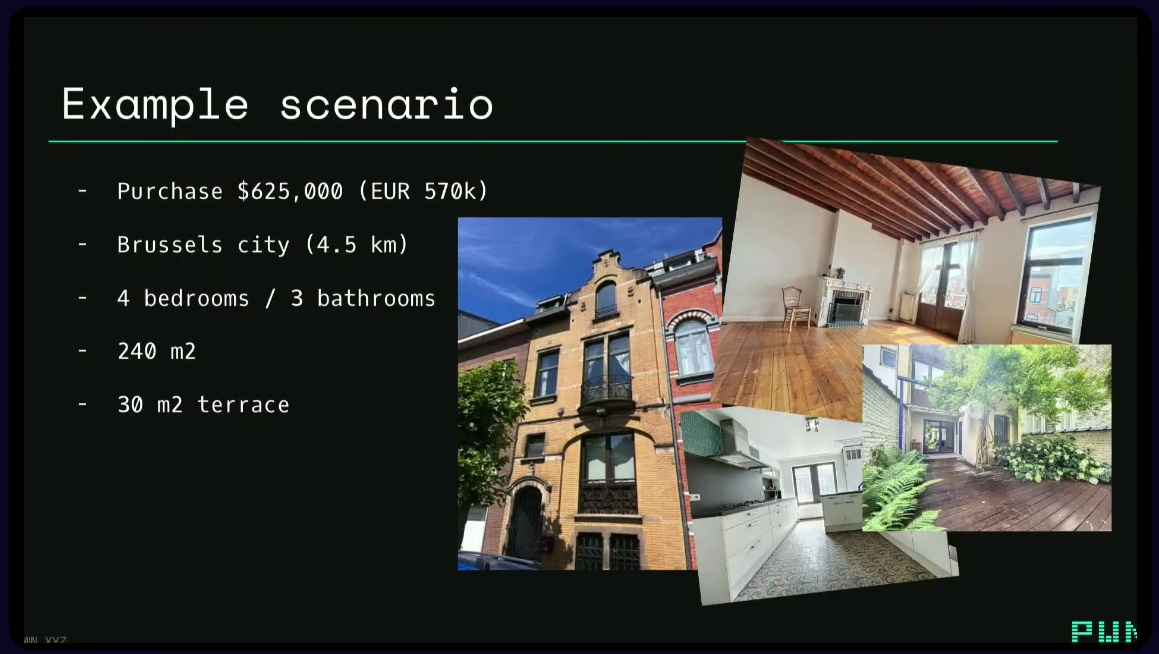

Let's suppose we've made it with 500 ETH, and looking to purchase a property in Brussels for €570,000 (around $625,000).

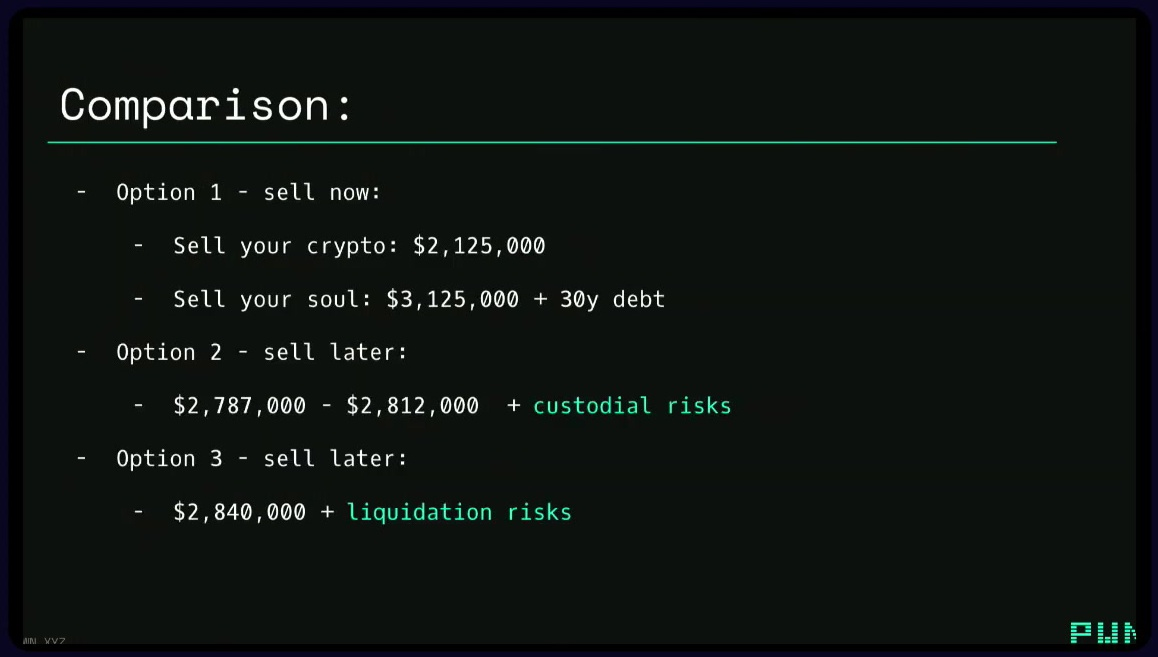

Get a trad mortgage

- Sell half the ETH (250 ETH) to cover the property cost and taxes (estimated 20% capital gains tax).

- Get a 30-year mortgage at 5% interest, paying around $3,000 per month.

If the remaining 250 ETH doubles in value, the net worth would still be over $3 million.

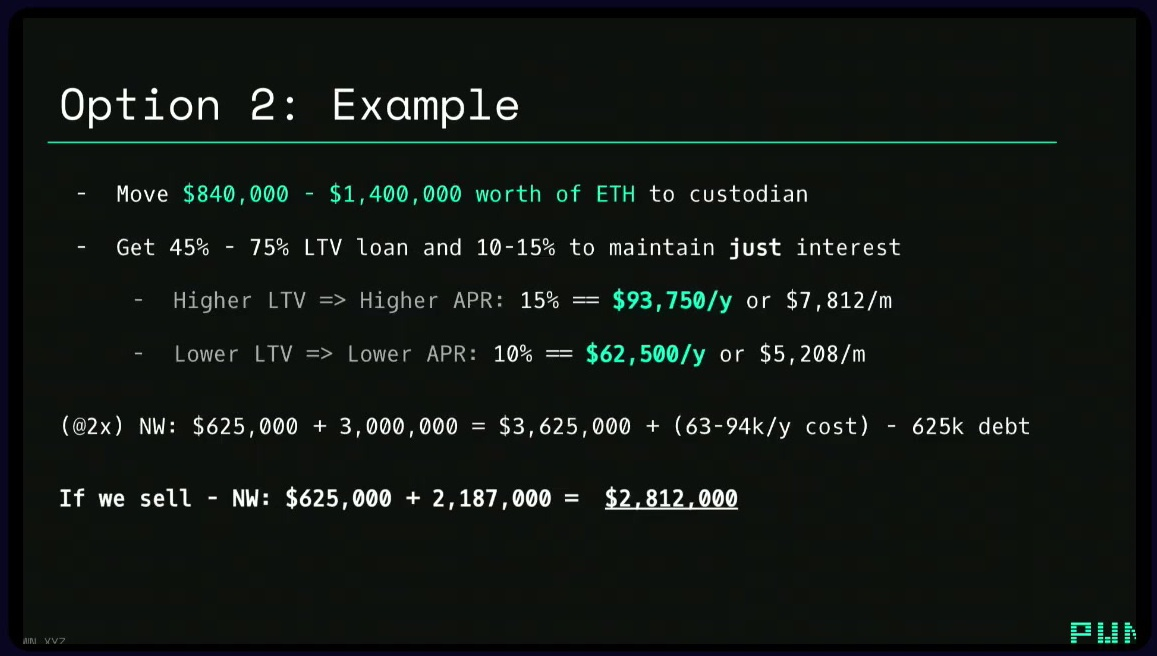

Lombard Loan

- Obtain a 6-12 month Lombard loan (crypto-backed loan) from a custodial provider like Bitcoin Suisse or Milo.

- The loan-to-value ratio would be around 50%, with interest rates of 2-12% APR.

This allows keeping the crypto exposure but introduces custodial risk.

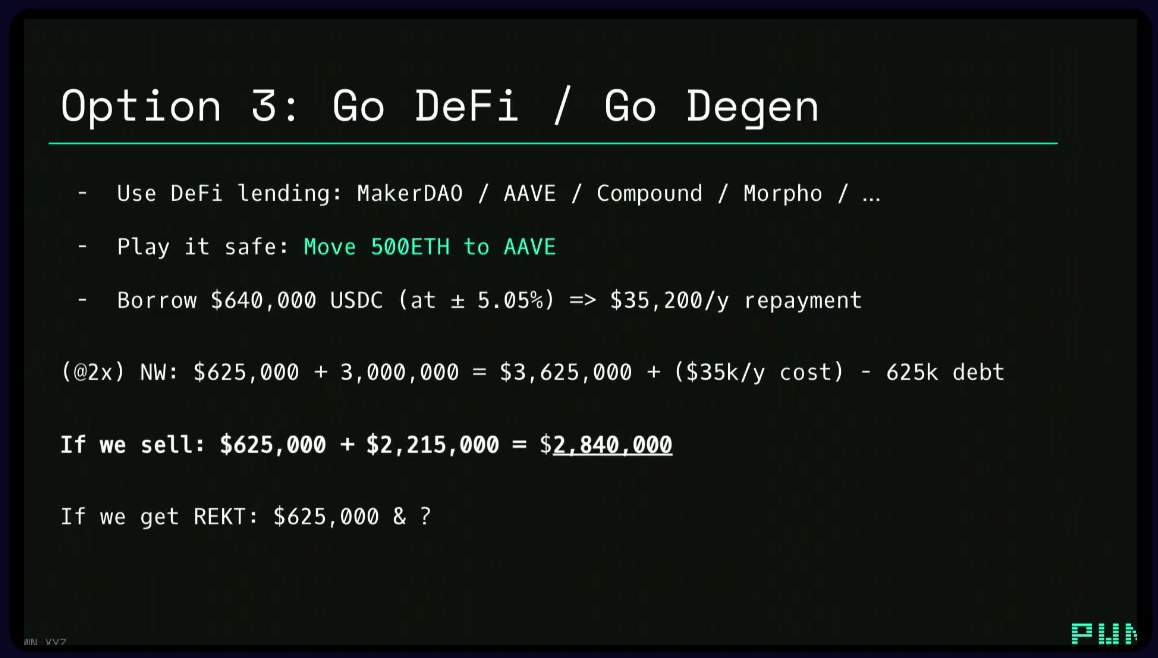

DeFi lending

- Deposit the 500 ETH into a DeFi lending platform like Aave, borrow $640,000, and use that to purchase the property.

- This would require paying around $35,000 per year in interest.

Introduces liquidation risk, but the remaining ETH could still double in value.

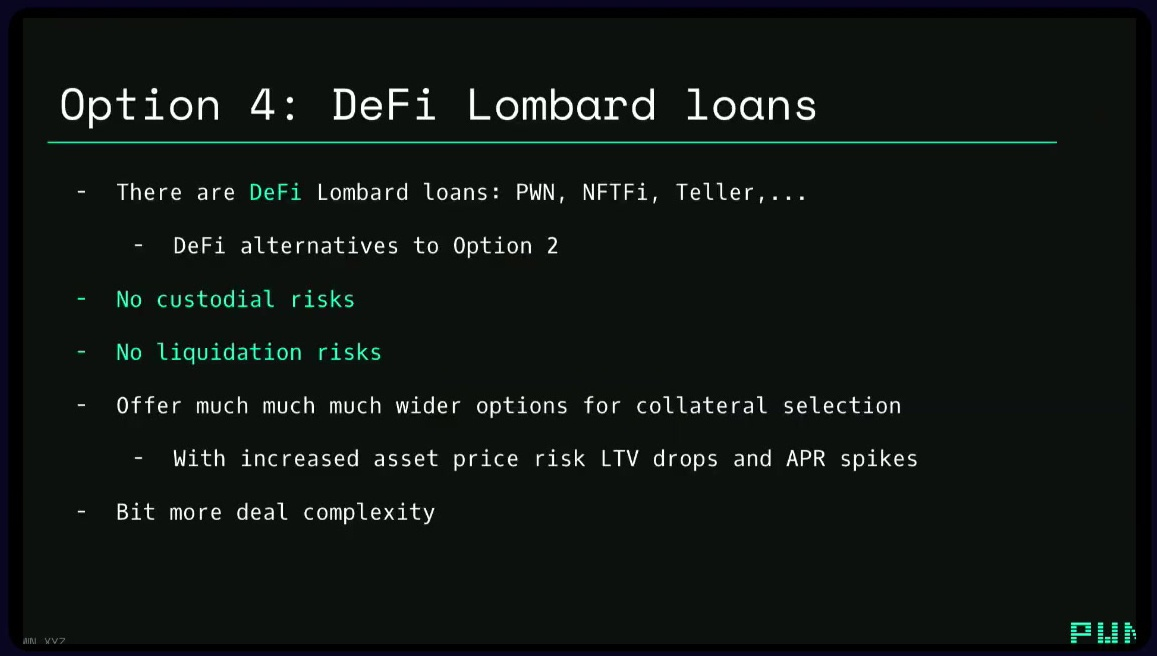

DeFi Lombard Loans

- Use decentralized Lombard loan providers like PWN or NFTFi, which offer similar terms to Option 2 but without custodial risk.

- Can use a wider variety of collateral assets beyond just Bitcoin and Ethereum.

Slightly more complex but can potentially get similar loan terms.

Tokenized Real-Estate (17:30)

Some projects are attempting to tokenize real estate, but they are still quite far from enabling mortgages backed by these tokens.

Josef believes it will eventually become more feasible, with 5-10 different projects in this space, predominantly in the U.S.

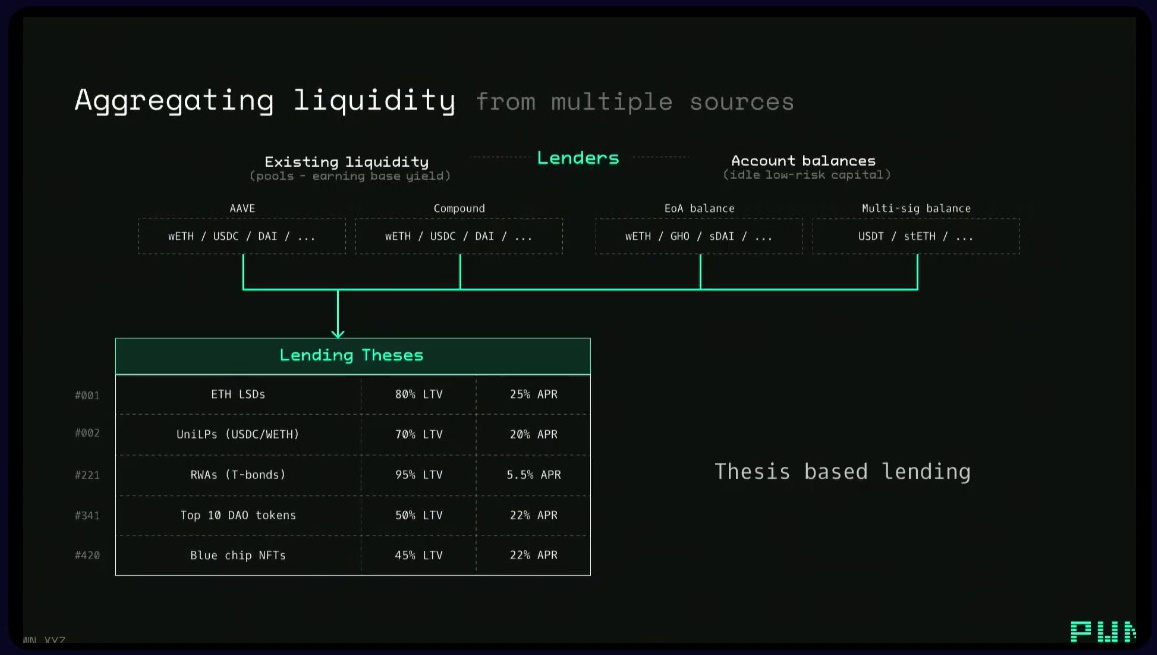

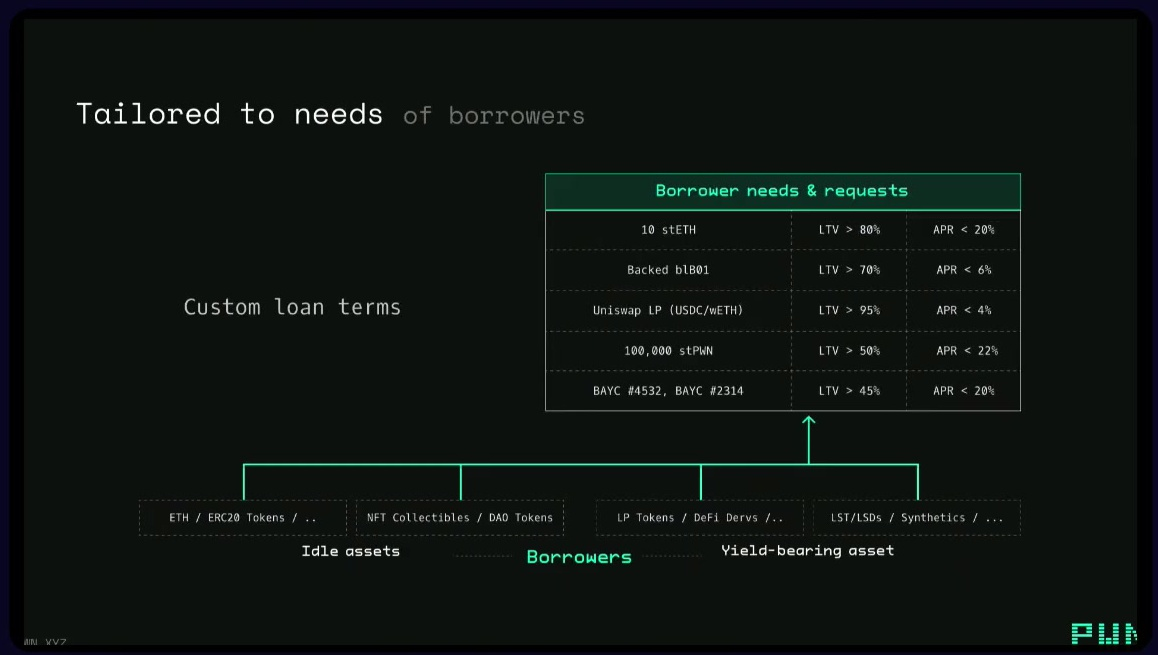

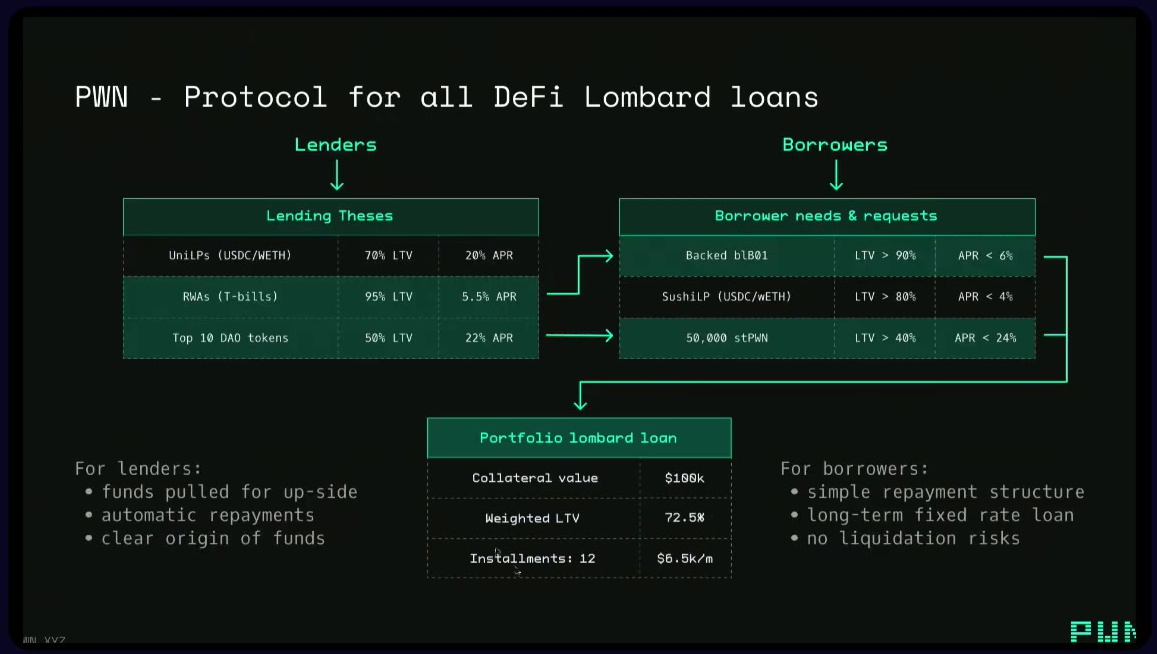

PWN is building a universal lending protocol targeting the tokenized economy as a whole:

- Lenders can commit their funds (e.g., stablecoins, DAO tokens, tokenized T-bonds) and set lending terms like loan-to-value and interest rates.

- Borrowers can bring their portfolio of assets (e.g., staked ETH, staked DAO tokens) and request a loan that matches their requirements.

- PWN can then combine multiple lending sources to create a "Portfolio Lombard Loan" for the borrower, similar to a custodial Lombard loan but without the custodial risk.

Once tokenized real estate becomes available, PWN envisions adding it as a new asset type that can be used as collateral for these Portfolio Lombard Loans.

This could increase the pool of potential lenders and make the overall process more feasible compared to traditional mortgage options.

The use cases (20:15)

DeFi mortgages are for crypto natives who don't want to sell their crypto but also don't want the liquidation risk of traditional DeFi lending.

Community housing initiatives where a group pools collateral to collectively finance a mortgage.

If someone misses a payment, only their share of the collateral is at risk, which can be taken over by another community member.

A community pools collateral to collectively finance the mortgage on a hackerspace facility.

The community pays the mortgage directly instead of renting the space.

There are already options available for crypto users to get a mortgage-like loan, such as:

- Custodial crypto-backed loans (Lombard loans) from providers like Bitcoin Suisse or Milo.

- DeFi lending platforms like Aave, which introduce liquidation risk.

- Directly selling crypto to pay for a property.

But none of these options are a perfect match for a true DeFi mortgage. DeFi Lombard loan providers like PWN offer a way to get a crypto-backed loan without the custodial risk of traditional Lombard loans.

Josef believes the crowdsourced community-based mortgage models may materialize sooner than individual DeFi mortgage solutions. The crypto community should continue to leverage the technology to showcase what's possible, paving the way for more individualized DeFi mortgage use cases in the future.