How to decentralize intents (Paraswap at EthCC)

Source: https://www.youtube.com/watch?v=ACMkkodHWcU

In 2020, talks focused on explaining why people should care about DeFi.

Now, DeFi is mainstream, and discussions are about improving it further.

What are intents?

Protocols like CoWswap or Across are often used in the DeFi community, but few people know what intent-based protocols are.

Mounir (the speaker) explains intent-based protocols with real-world examples:

- Coffee analogy: rather than make a coffee ourselves and follow every step, we can ask a barista to make the coffee for us.

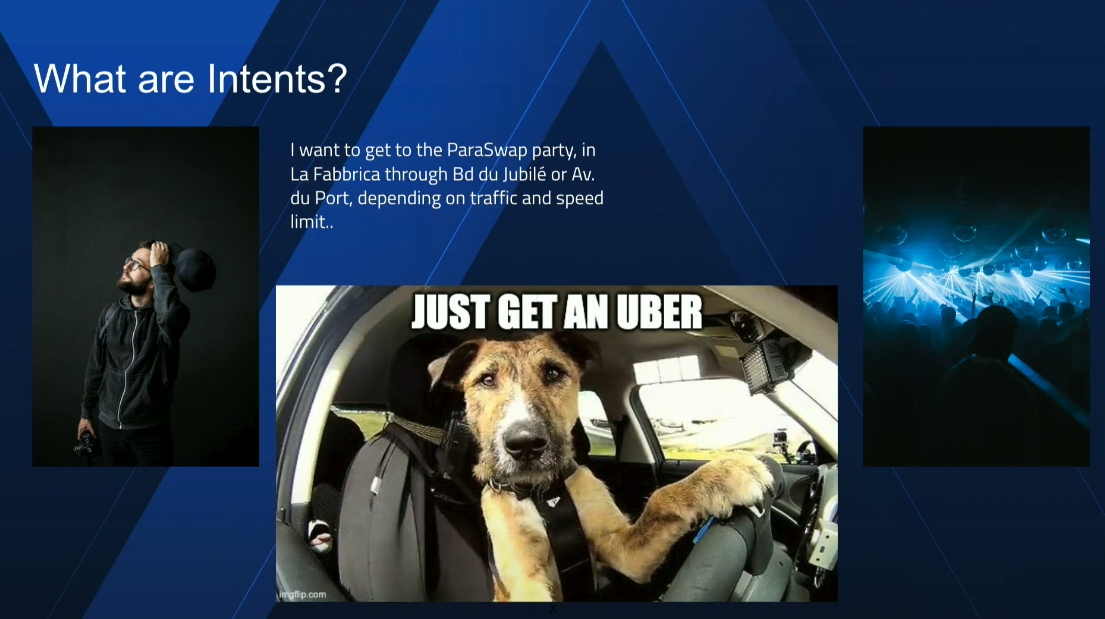

- Transportation analogy: when going to a party, people express the intent to get from point A to B. Rather than evaluating the best routes and using every means of transport, we can use Uber, input the destination address, and get there.

Intent-based protocols are the middleware that allows users to get what they want.

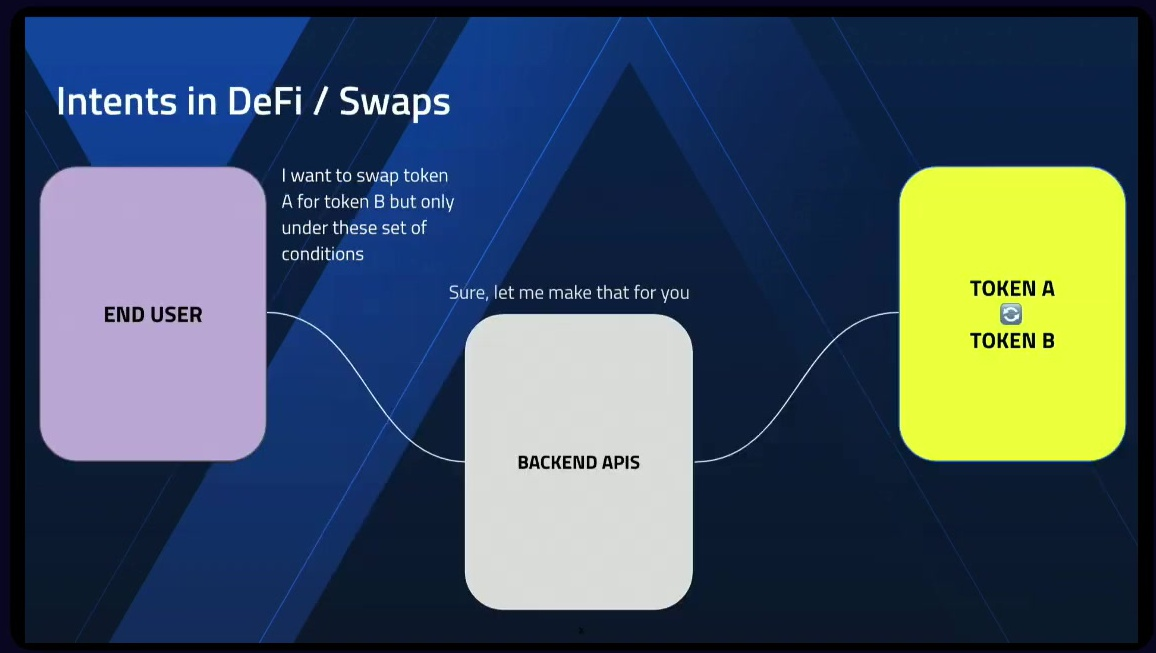

Intents in DeFi / swaps (3:00)

How swap-based protocols work:

- Have a front end for user interaction

- Use a backend system for price provision

- Users submit transactions themselves

- Users bear responsibility for gas settings, transaction monitoring, and costs of failed transactions

How Intent-based protocols work:

- Also have a backend service providing indicative (not final) prices

- Utilize a network of "solvers" who compete for order flow

- Aim to beat the indicative price and provide optimal execution

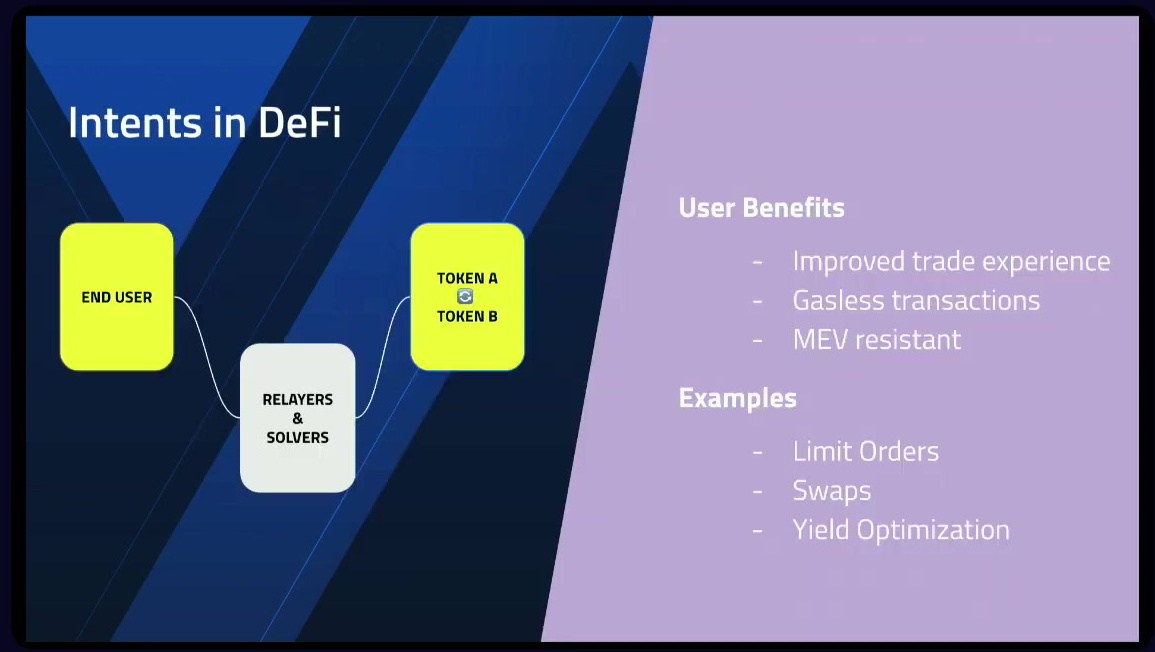

Benefits of intent-based protocols:

- Improved trading experience: Users express what they want, and protocol handles the execution

- No need for users to worry about gas costs

- MEV (Maximum Extractable Value) resistance by design

- Multiple use cases like swaps, limit orders, yield optimization, liquidity providing, etc.

Unfortunately, intent-based protocols become a central point of failure, as most existing products rely on centralized backend APIs.

If the backend goes down, the entire protocol becomes unusable

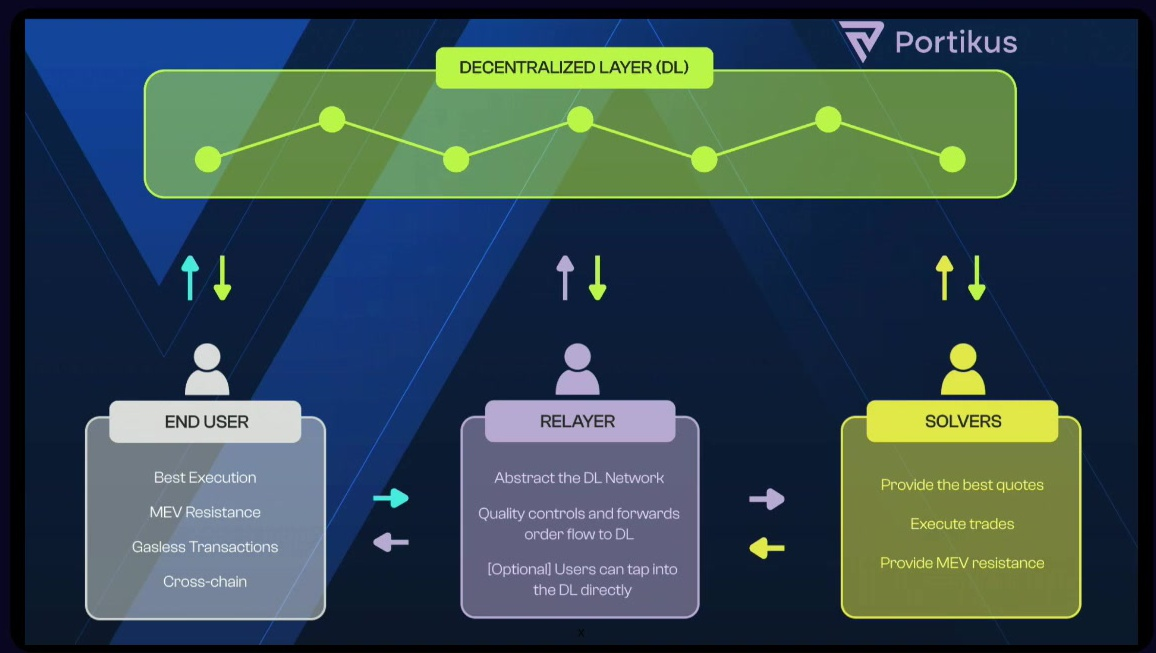

A possible solution is to build a Decentralized Layer (DL) for intent-based protocols, where users can interact directly with it.

The goal here is to make the centralized relayer optional, and there's also a possibility for a network of relayers or dApp-specific relayers.

Benefits of the Decentralized Layer approach:

- Makes the intent-based protocol truly decentralized

- Ensures the system is permissionless, censorship-resistant, and unstoppable

In other words, the decentralized layer makes it genuine DeFi.

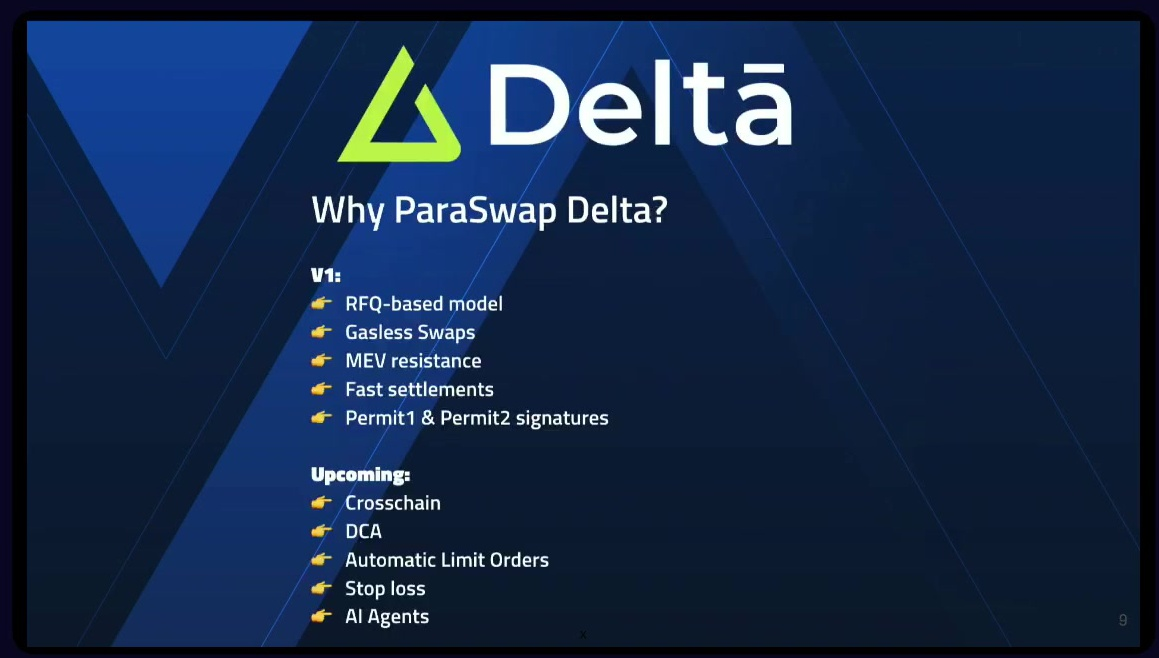

Introducing Paraswap Delta (7:00)

Paraswap Delta is a new intent-based protocol built on Portikus. It aims to provide effective decentralization and modularity

Design philosophy:

- Opinionated design favoring RFQ (Request-for-Quote) model over batch auctions

- Focus on immediate execution to meet user expectations

- Emphasis on simplicity: users care about buying/selling tokens, not technical details

Upcoming features:

- Cross-chain functionality, as it is seen as the future of DeFi. It aims to mimic the simplicity of centralized exchanges (like Binance, Coinbase). Mounir expects it to become standard in 2-3 years

- Advanced trading features like Limit orders, Dollar-Cost Averaging (DCA) or Stop-loss orders

- AI agents as potential solvers, as they would potentially outperform traditional statistical models and human-designed algorithms

Many users still prefer centralized platforms due to their simplicity. ParaSwap Delta aims to bring CeFi-like features to DeFi in a decentralized manner

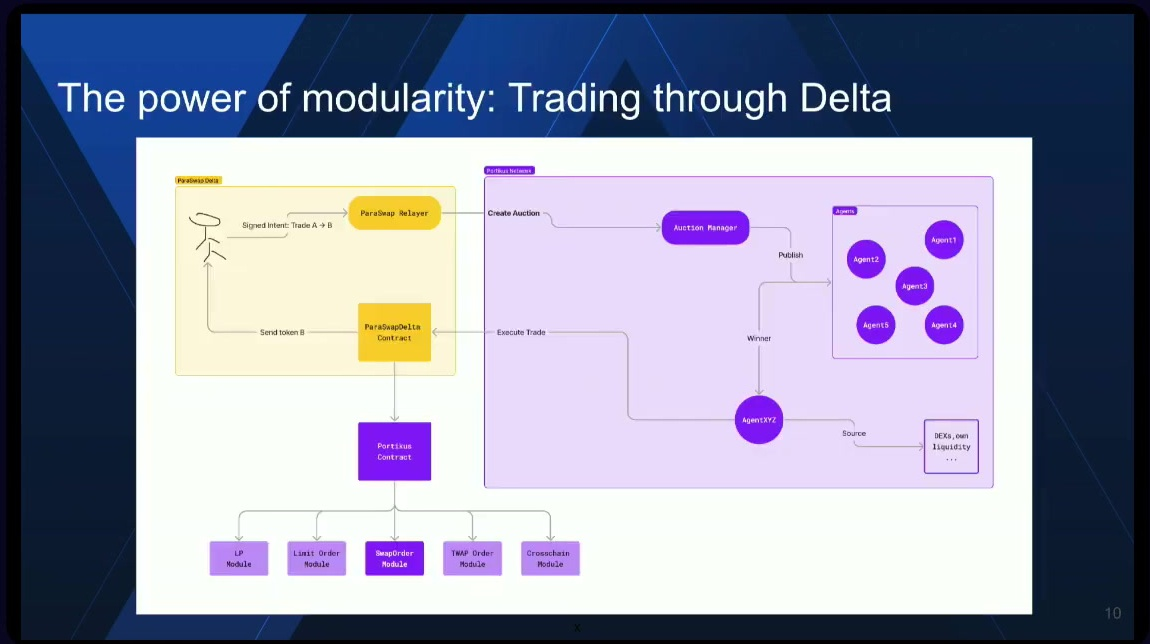

Trading through Delta (9:50)

ParaSwap Delta architecture includes a relayer that can run independently or as part of a network

This relayer uses a settlement contract for transaction abstraction and can utilize existing relayers or build its network.

Portikus features a network of "agents" (encompassing solvers, market makers, and AI agents...) that manage auctions for user intents and select winners to execute trades

Workflow:

- User signs an intent to trade Token A for Token B

- Request sent to relayer (or directly to Portikus)

- Auction manager runs the auction and selects the winner

- Winner executes the trade

Portikus allows protocols to choose specific modules (e.g., swap, limit order, cross-chain) and is extensible to other DeFi applications (e.g., AMMs, liquidity provision).

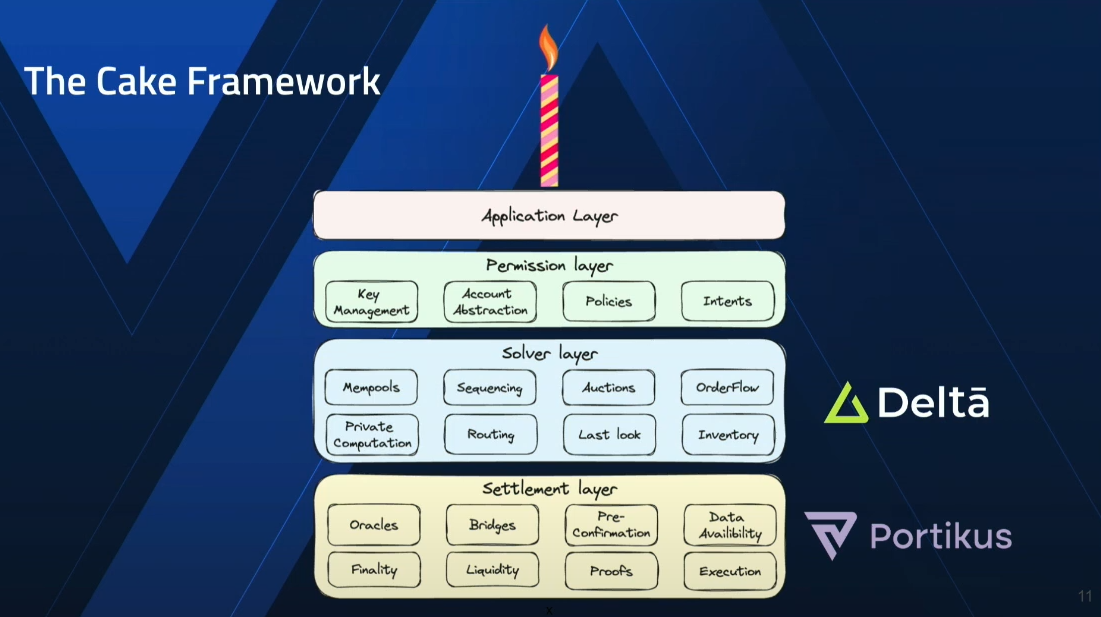

The Cake framework (12:00)

Cake Framework is a model for chain abstraction and intent design that separates the DeFi ecosystem into layers:

- Application Layer: dApps, UIs, mobile apps

- Permission Layer: wallets, EOAs

- Solver Layer (Paraswap Delta): aggregators, routing protocols, market makers

- Settlement Layer (Portikus): best execution protocols, availability layers

Portikus operates on the Settlement Layer. It aims to be a "public good" and an "app store of modules", and focuses on decentralization and modular architecture

Delta operates on the Solver Layer. It provides intent-based protocols for end users and can be used as infrastructure by other dApps.

Question & Answers (14:00)

How does monetization work for executors/solvers, considering they pay for gas fees?

Solvers and AI agents are incentivized by transaction order flow, which provides opportunities for arbitrage, back-running, and other strategies.

The quoted price to the end user includes gas fees and risk management costs. Solvers aim for statistical profitability rather than profiting on every single trade.

How is competition managed among multiple parties in ParaSwap Delta who route trades to solvers?

Initially, the main criterion for selecting a winner is price (including gas costs), but this approach may evolve to include scoring systems based on historical performance.

Scoring systems can account for factors like slippage and potential bugs in executor code.

Does intent execution have to be atomic, especially considering cross-chain scenarios?

Intent execution doesn't have to be atomic. Cross-chain protocols like Across are examples of non-atomic execution.

These protocols have built-in incentive mechanisms to ensure efficiency for users.

How can the system be faster if it involves choosing among different solvers and potentially includes cross-chain execution?

Speed is relative to the settlement layer (underlying blockchain):

- The pricing process (auction) typically takes up to a second maximum.

- Market makers generally have latencies between 100-300 milliseconds.

It's faster compared to batch auctions, which can take minutes or hours. The "fast" claim is primarily in comparison to batch auction models.

Cross-chain execution may add time, but the initial pricing process remains quick.