History Suggests LSTs, Not RWAs, Will Be DeFi's Treasuries

Source : https://www.youtube.com/watch?v=MoWoeswytFw

Manuel Rincon Cruz is the founder of Poolside. He is also a financial historian, and he's been asked to provide a counterweight to the narrative surrounding real-world assets (RWAs) and the future by talking about liquid staking.

This talk is in two parts :

- History of government debt

- History of liquid staking

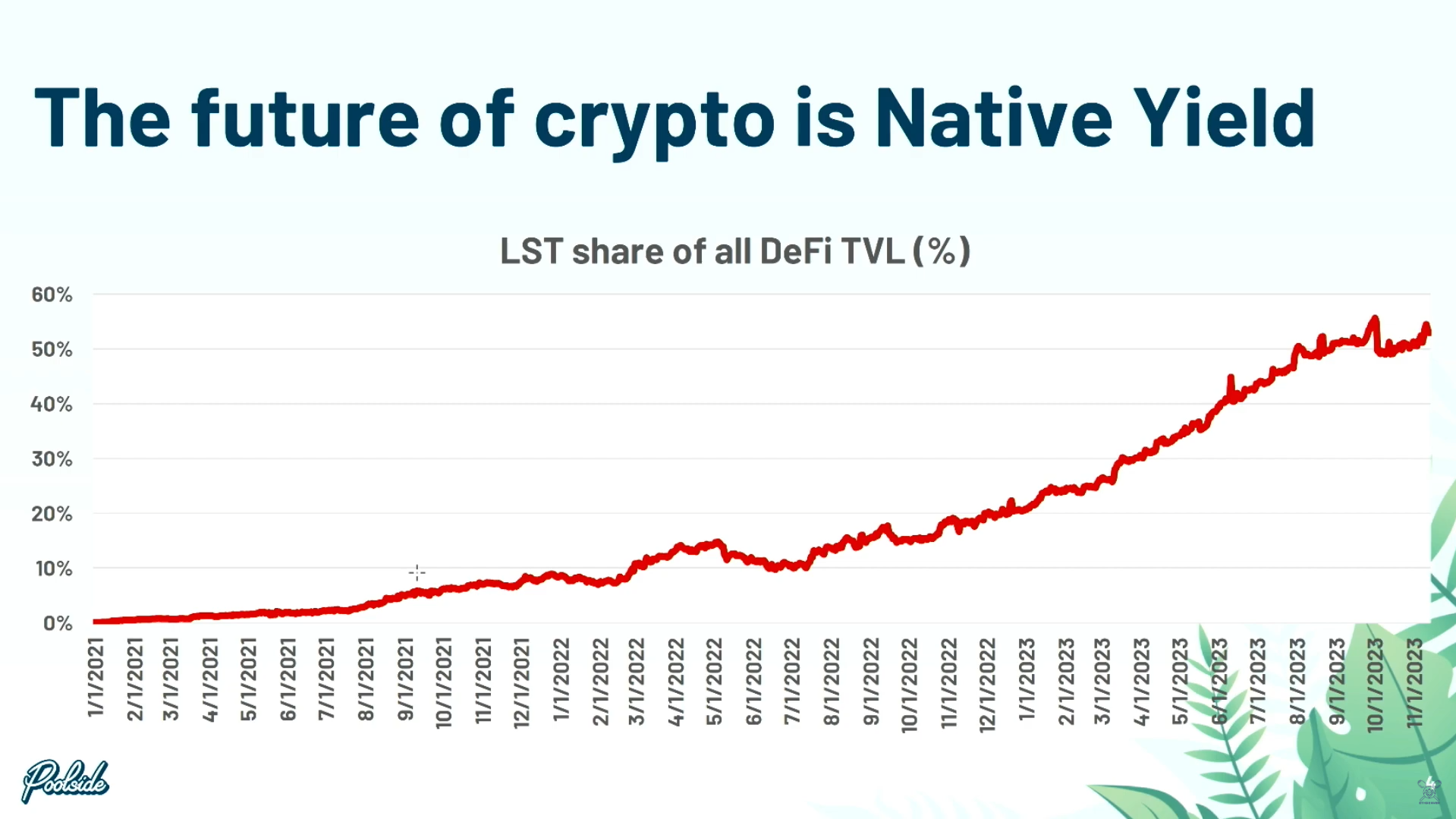

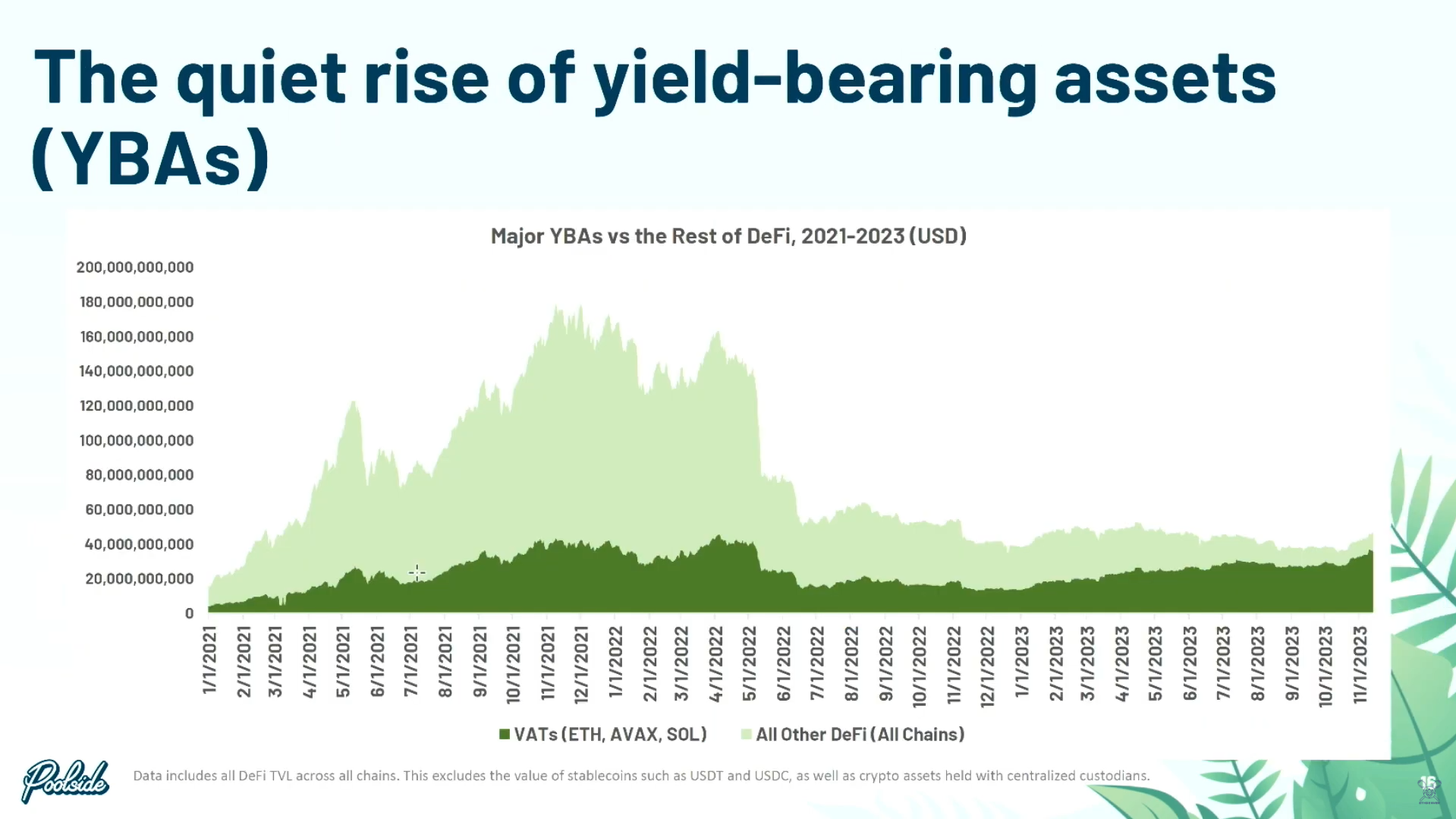

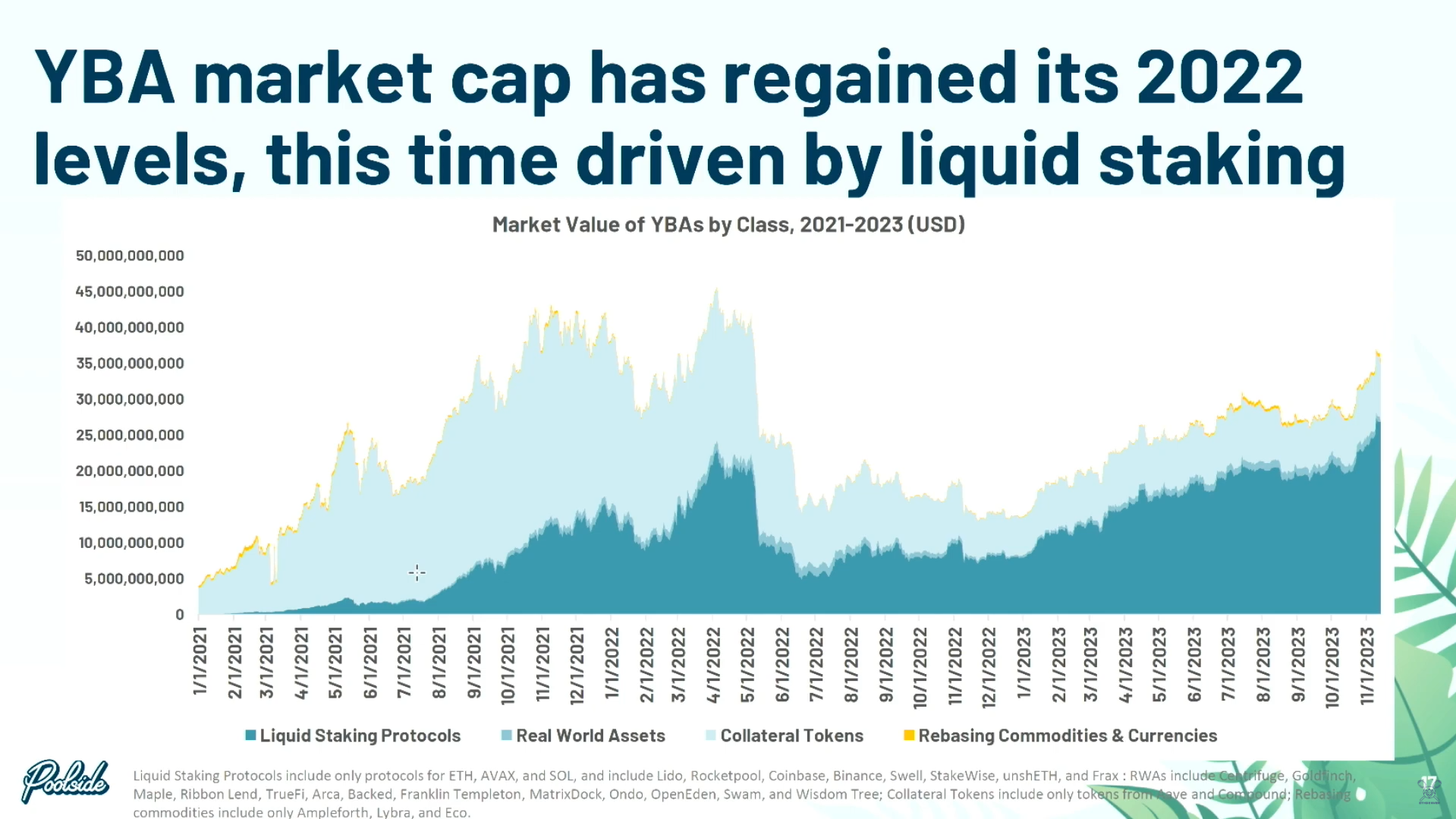

The main idea of his talk is "the future of crypto is native yield", as liquid staking tokens (LSTs) have grown from 0.1% of the total value locked in DeFi in 2021 to over 60% currently.

So LSTs are likely to become "Crypto Treasuries".

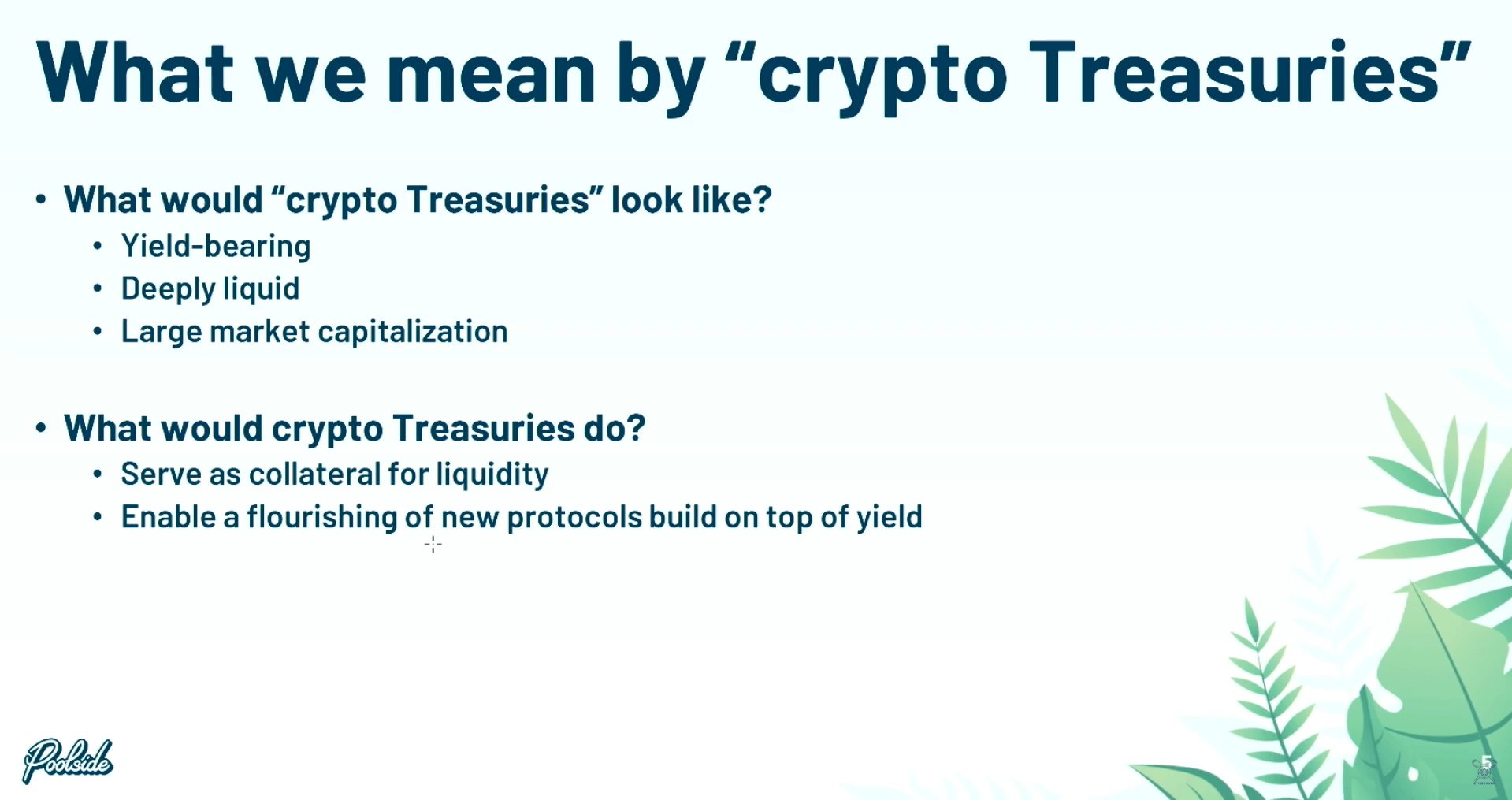

Crypto treasuries refer to yield-bearing assets with deep liquidity and a huge market cap. These assets are important because they can serve as collateral for other financial institutions and protocols, and their native yield allows for the creation of new financial services/protocols built on top of them.

History of governement debt

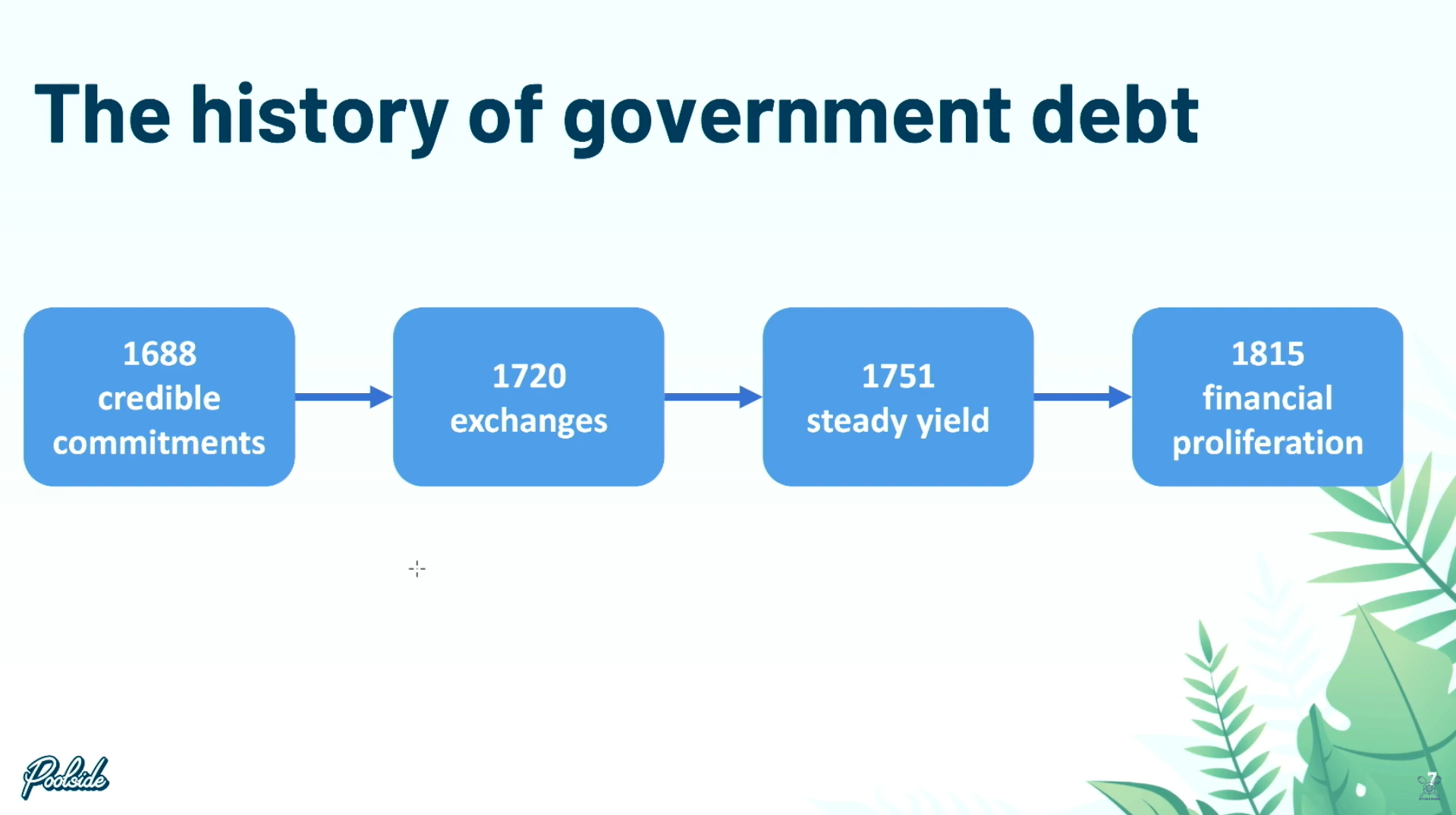

We need to highlight four important milestones in the development of government debt as a fundamental part of today's financial system.

Credible commitments (2:20)

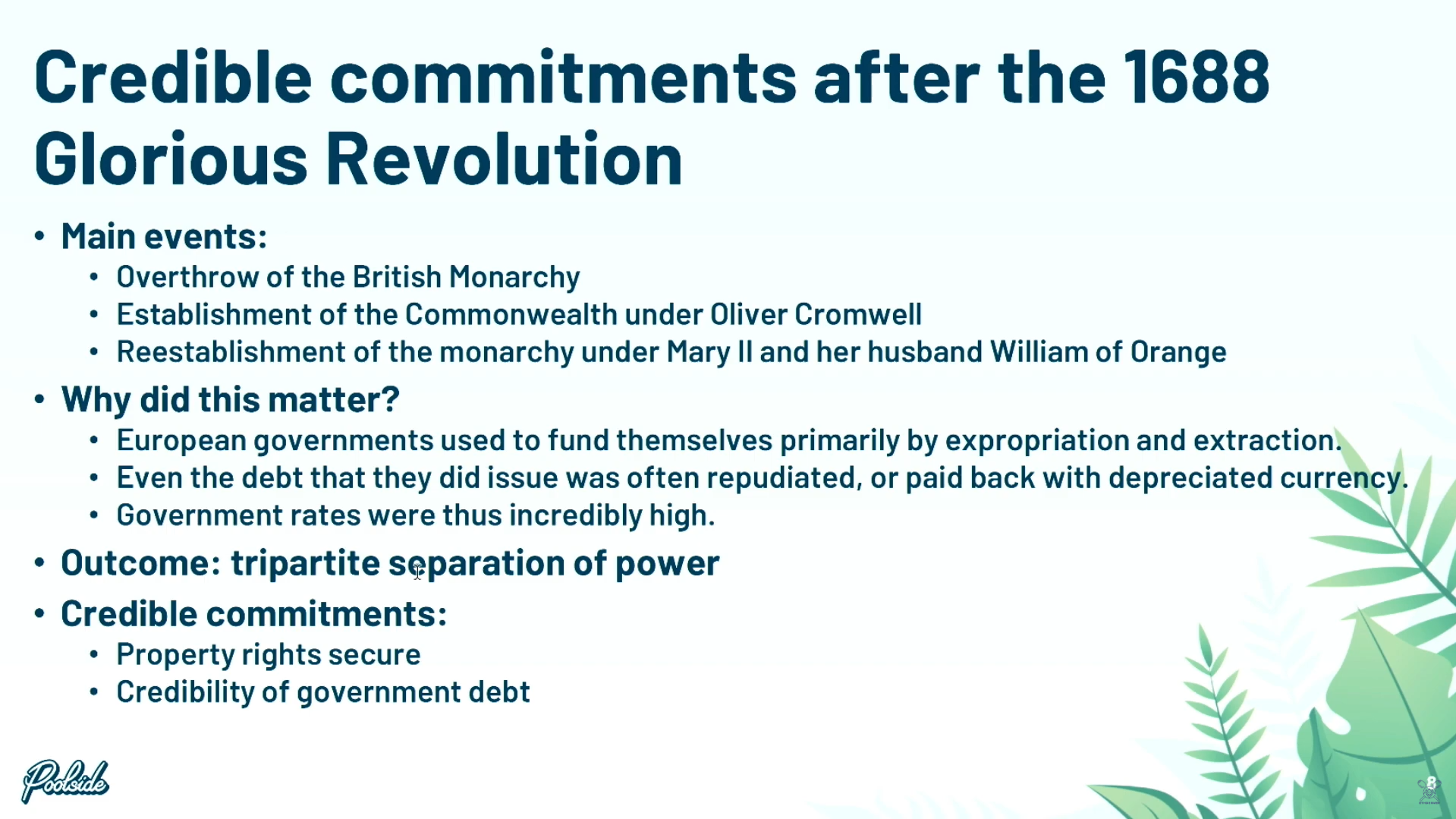

Credible Commitments (1688) : Before this, governments funded themselves through confiscation and coerced lending.

The Glorious Revolution in Britain established a constitutional order that secured property rights, allowing the government to issue debt that lenders trusted would be repaid. This made government debt a "risk-free" asset for the first time.

Creation of exchanges (3:45)

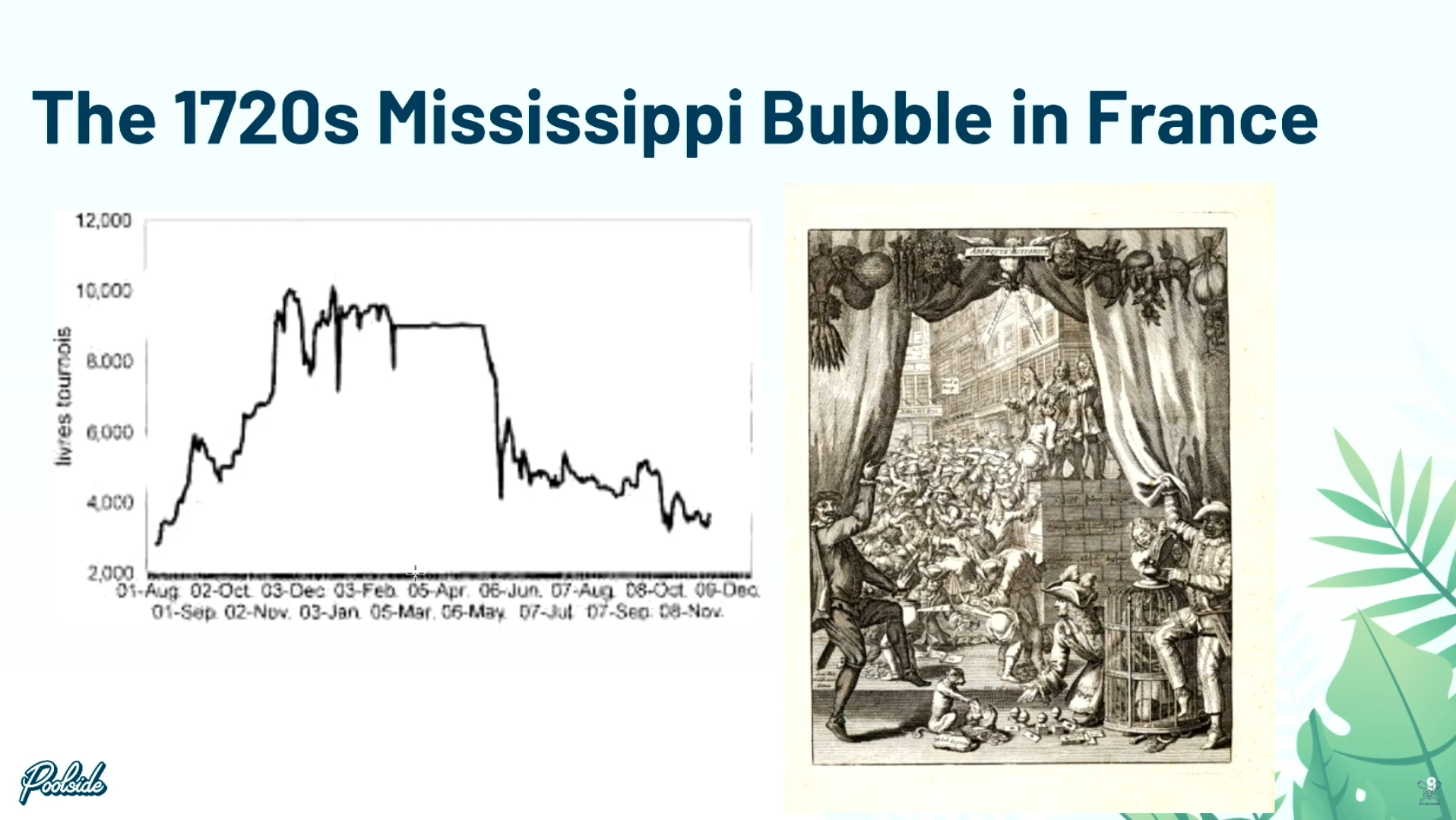

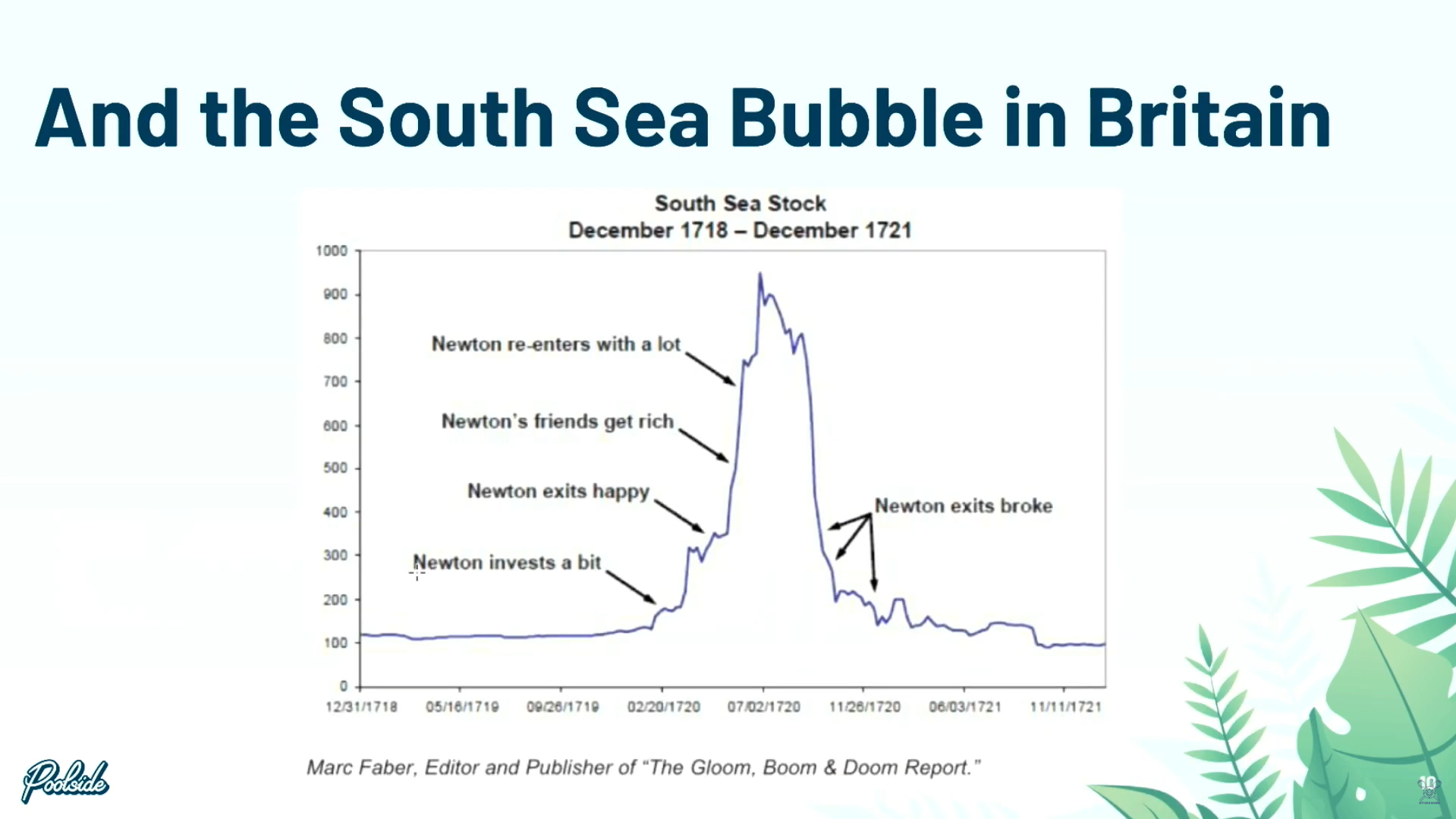

Creation of Exchanges happened during two famous financial bubbles in the 1720s, with the Mississippi Company bubble in France and the South Sea Bubble in Britain.

These events saw the birth of speculative trading and the use of the term "shitcoin" to describe overvalued assets.

After bubbles explosion (4:55)

France essentially banned all financial markets after their Mississippi Company bubble.

In contrast, while Britain passed the "Bubble Act" restricting issuance of company stocks, they left the markets open.

So hundreds of companies ended up issuing unregistered securities that traded for 100 years in these semi-legal markets in London.

Consolidating annuities (6:00)

Those unregistered securities allowed Britain to develop deep expertise in creating, pricing and operating financial markets during this period.

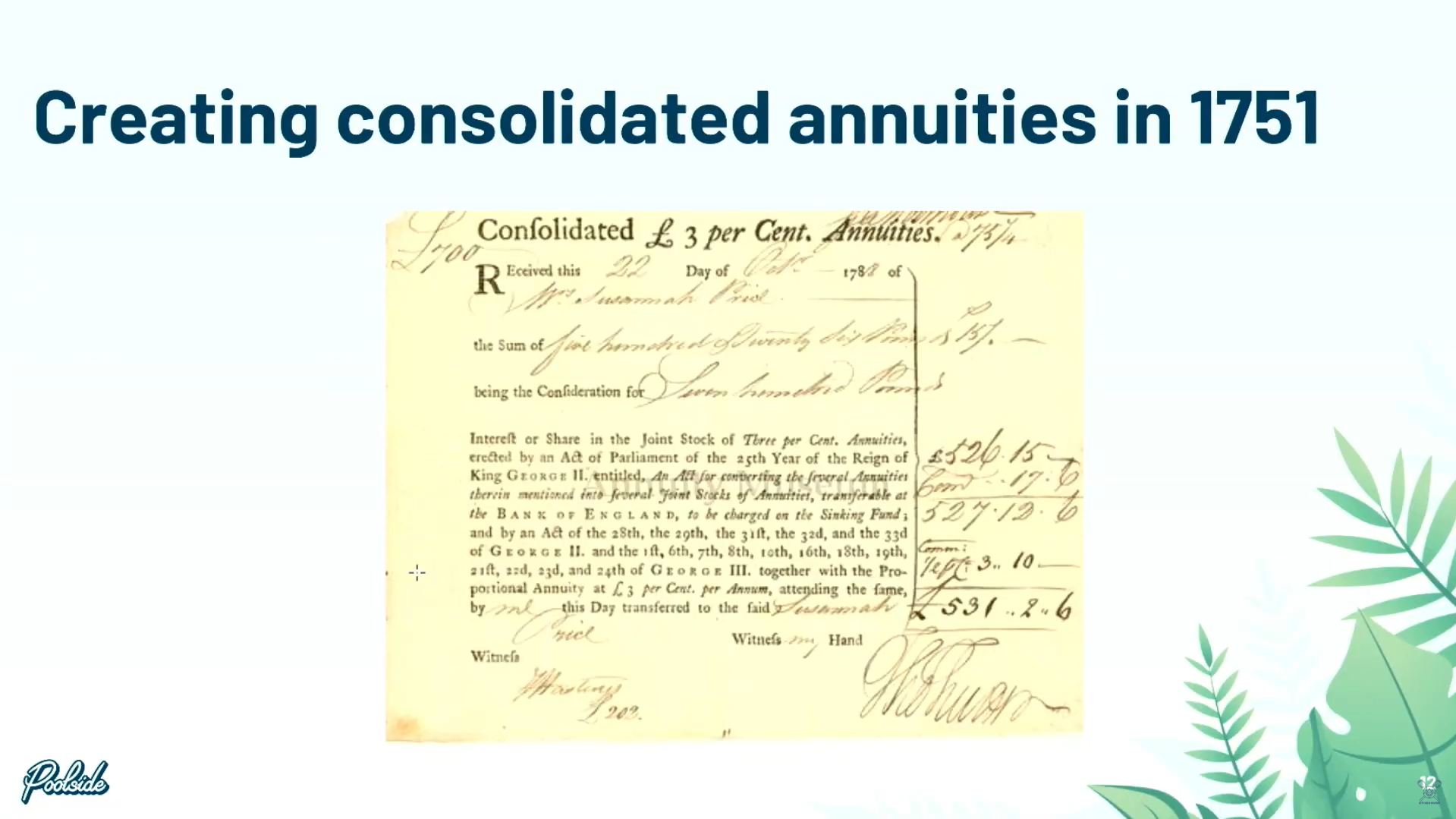

The government also experimented with new ways to raise funds, like lottery bonds. But the innovation that succeeded was the "Consolidated Annuity" or "Consol" - a perpetual 3% yielding bond, introduced in 1751.

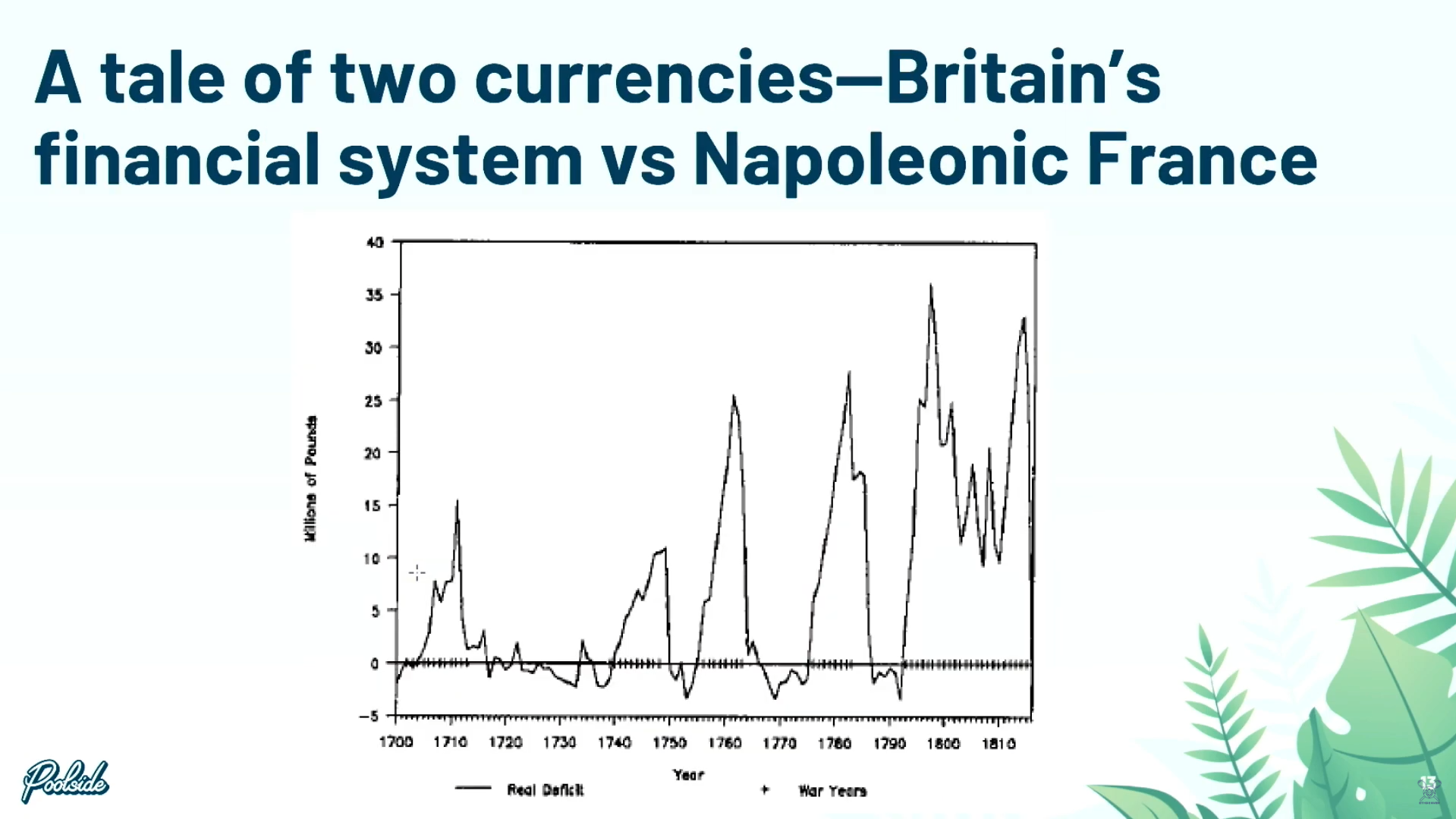

A tale of two currencies (6:30)

These consols became crucial during the Napoleonic Wars. As explained in "A Tale of Two Currencies", Napoleon had to finance wars through taxation as no one wanted French debt.

But Britain could issue massive amounts of the credible, yield-bearing consols to finance their war efforts and subsidize allies fighting Napoleon across decades.

After the wars, this large stockpile of 3% yielding consols became collateral enabling a new financial system - providing capital for banks, insurance firms and facilitating commercial lending/activity across Europe.

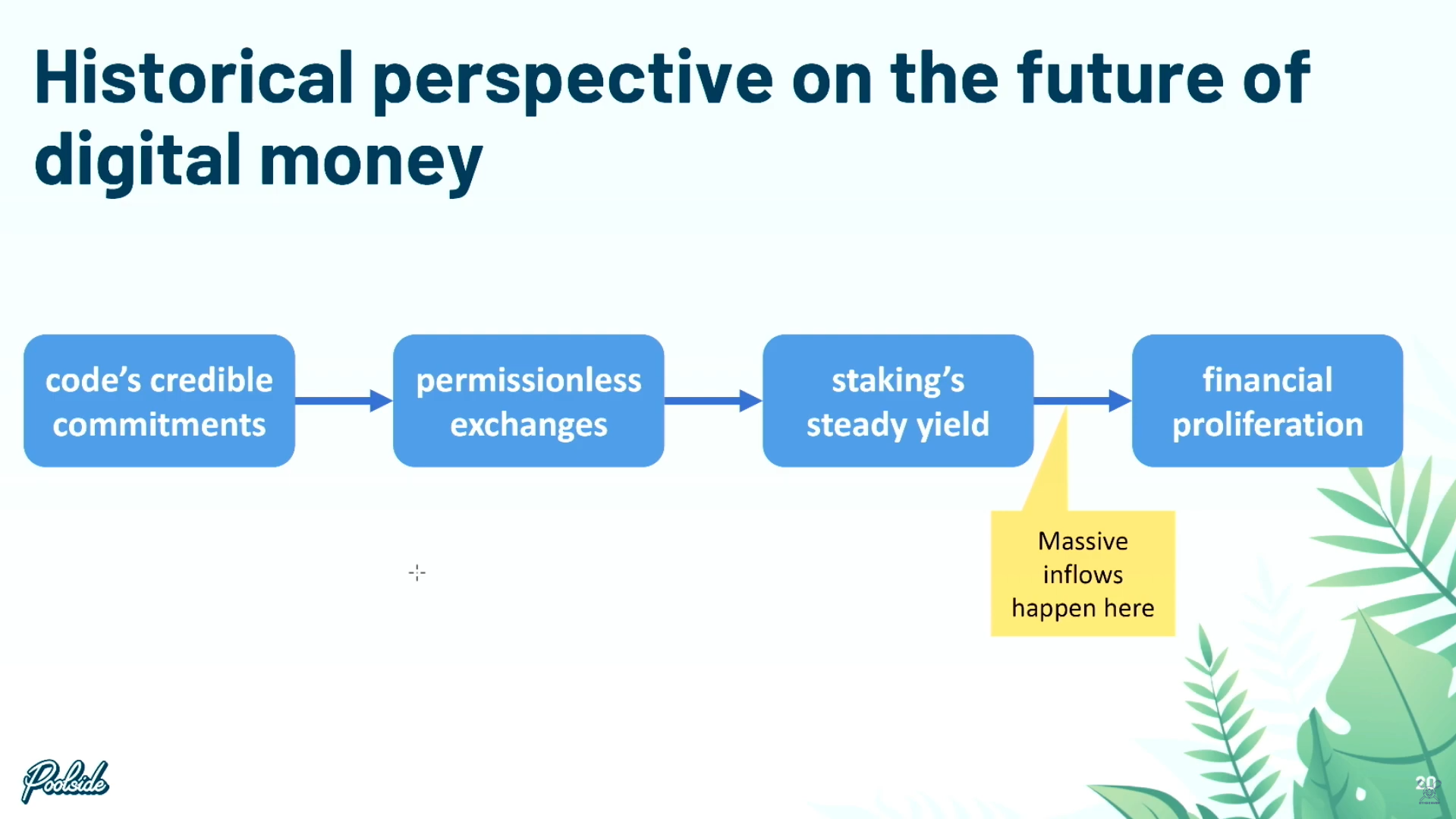

The key innovation was having a "native yield" asset (the 3% consols) that provided a stable return but could also be used as collateral and fuel broader financial proliferation.

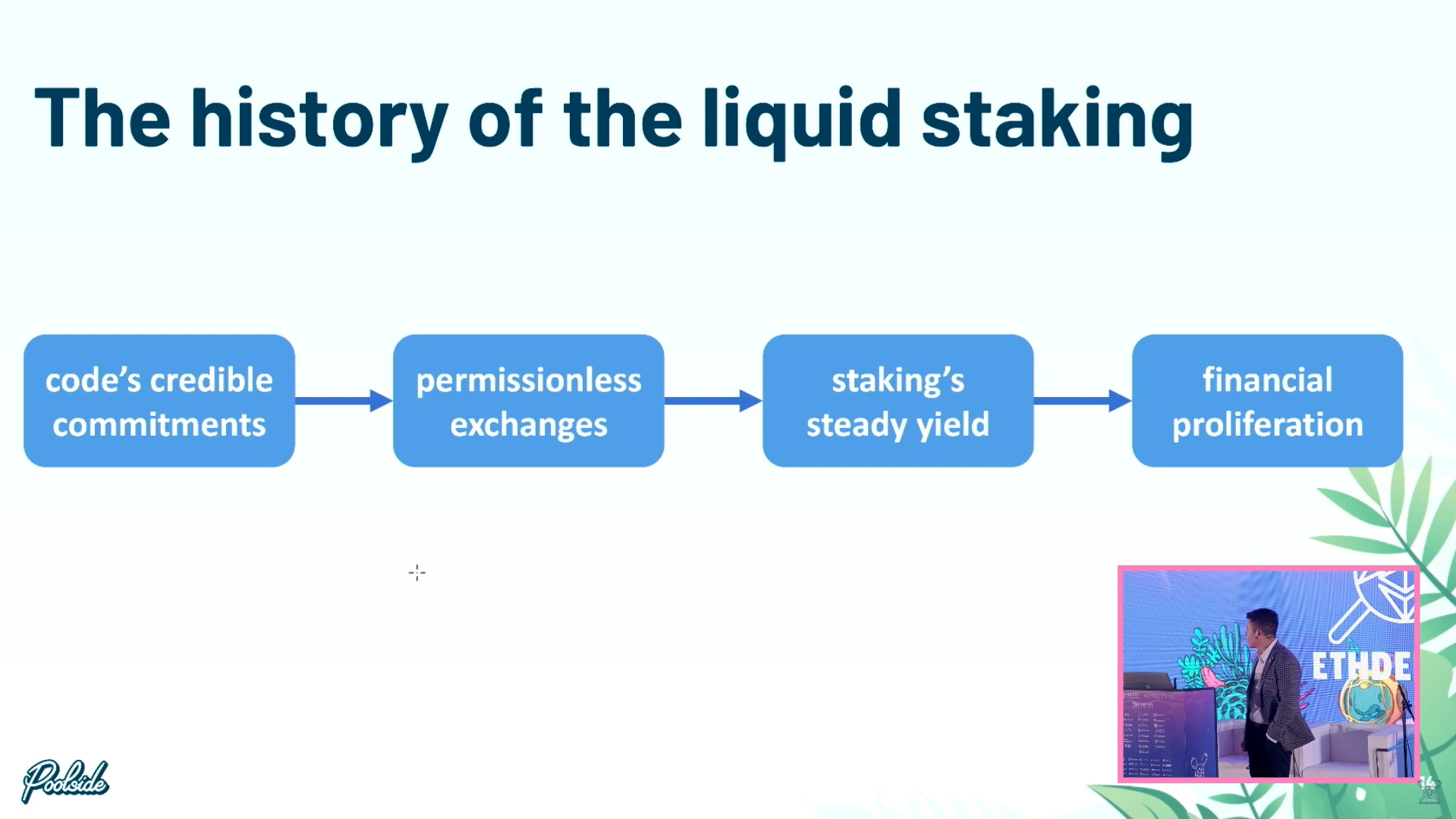

History of liquid staking (8:30)

There are parallels between the historical developments outlined and the evolution of crypto/DeFi:

- Credible commitments = Blockchains and smart contracts

- Permissionless exchanges = DEXs like Uniswap from 2020 onwards

- Native on-chain yield ≈ Liquid staking tokens providing steady "3%" yields from around 2021

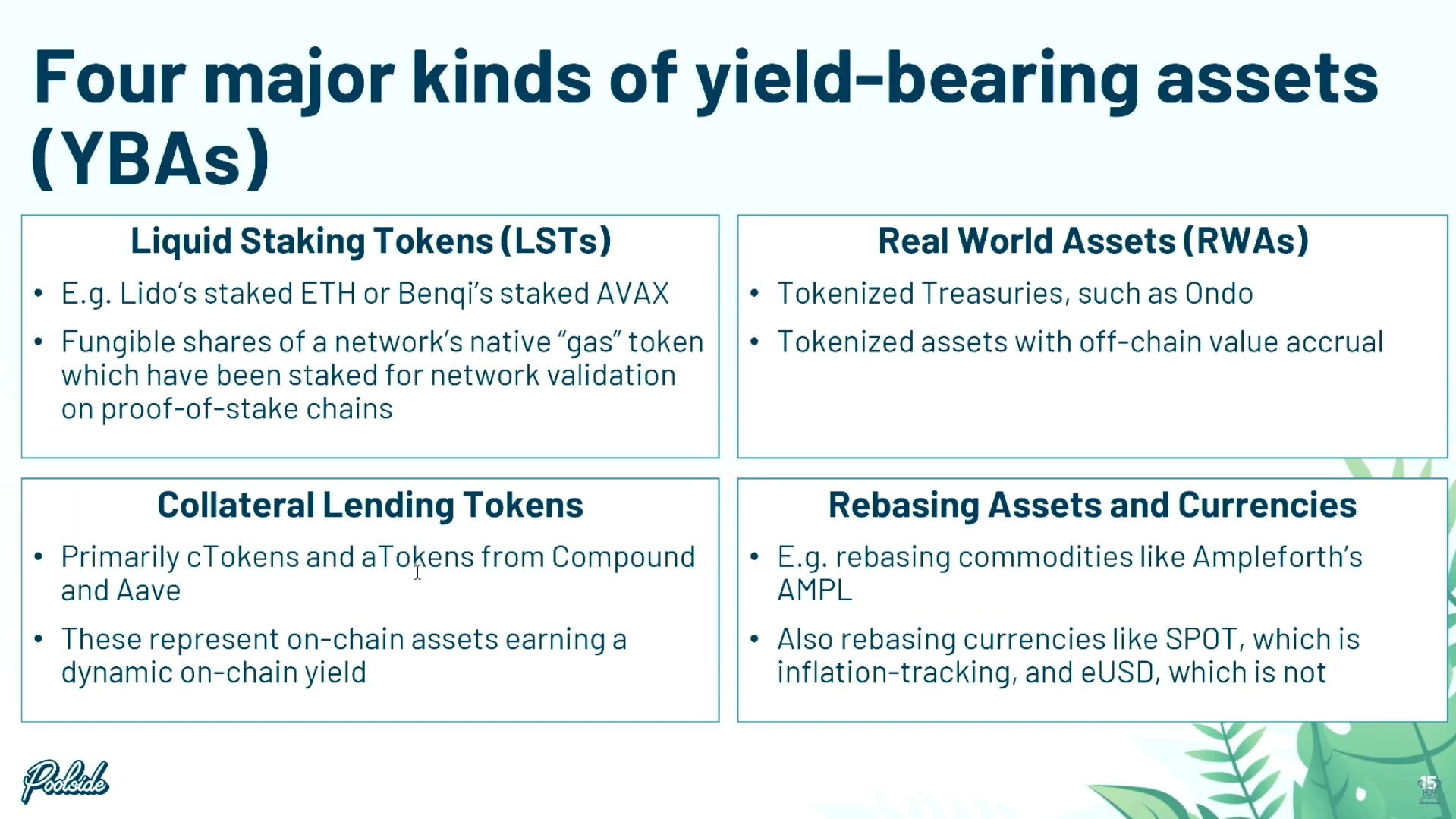

Yield-bearing assets (9:05)

4 types of yield-bearing crypto assets :

- Real-world assets (RWAs)

- Liquid staking tokens

- Collateral lending tokens (e.g. aTokens from Compound/Aave)

- Rebasing assets/currencies

The data shows liquid staking tokens now account for over 60% of all value locked in DeFi - the largest and fastest growing yield-bearing asset class. RWAs and rebasing assets are relatively insignificant in comparison.

Why not RWAs ? (10:45)

Manuel argues that liquid staking is better positioned than RWAs to be the "safe asset" collateralizing future finance :

- Code is more credible than legal contracts behind RWAs

- RWAs have massive off-chain liquidity, making it harder to build on-chain liquidity/use cases

- RWAs are still anchored to the traditional system versus native crypto assets

Historical perspective (11:50)

Manuel expects liquid staking tokens to grow massively, similar to how British consols grew during the Napoleonic Wars period, before new financial innovations/protocols get built on top.