Growing onchain Forex markets in DeFi (Angle at EthCC)

Source: https://www.youtube.com/watch?v=dEjrdCMF9cA

Introduction

Angle is a decentralized stablecoin protocol that operates two stablecoins - a euro stablecoin and a recently launched USD stablecoin, and has a TVL (Total Value Locked) of around $50 million.

Angle's primary focus is on expanding the horizons for on-chain Forex (foreign exchange) markets.

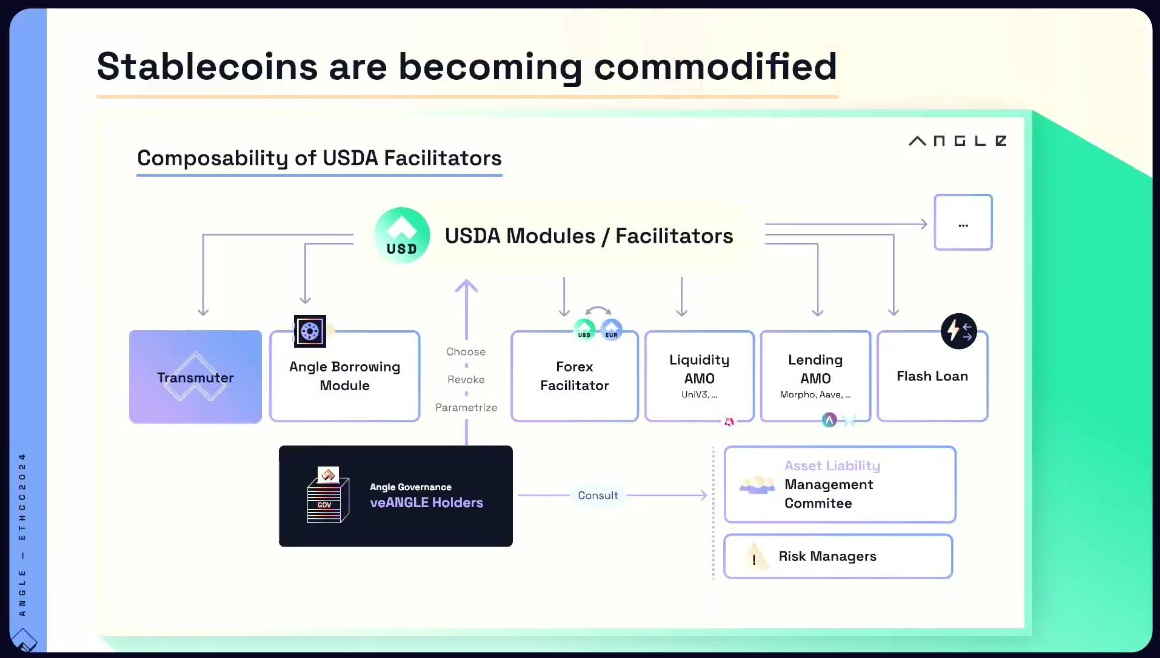

Stablecoins are becoming increasingly commodified, as the underlying technology (modules) is becoming common across many projects.

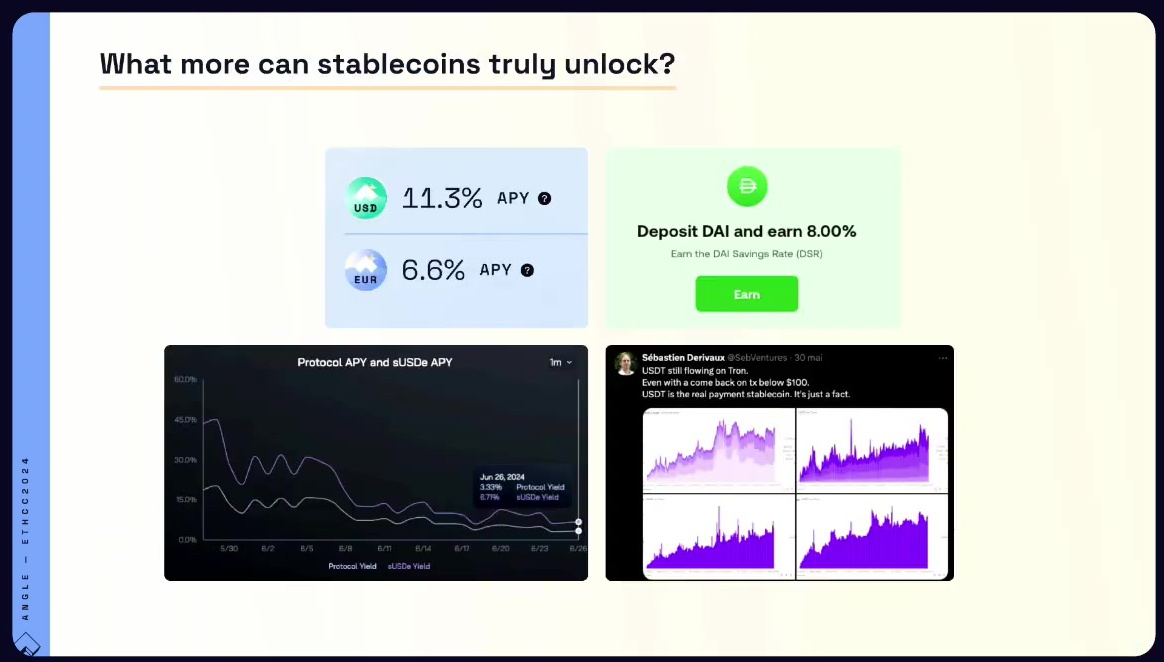

This raises the question of what additional value can be unlocked with stablecoins beyond the common use cases like yield and payments.

The promise of stablecoins revolutionizing global payments and remittances has not yet been fully realized:

- Long transfer times

- High remittance fees

- Lack of transparency in Forex markets.

Existing attempts to provide Forex services on-chain, such as by fintech companies like BVNK and Fipto, still rely on centralized components and do not offer true on-chain atomic settlement.

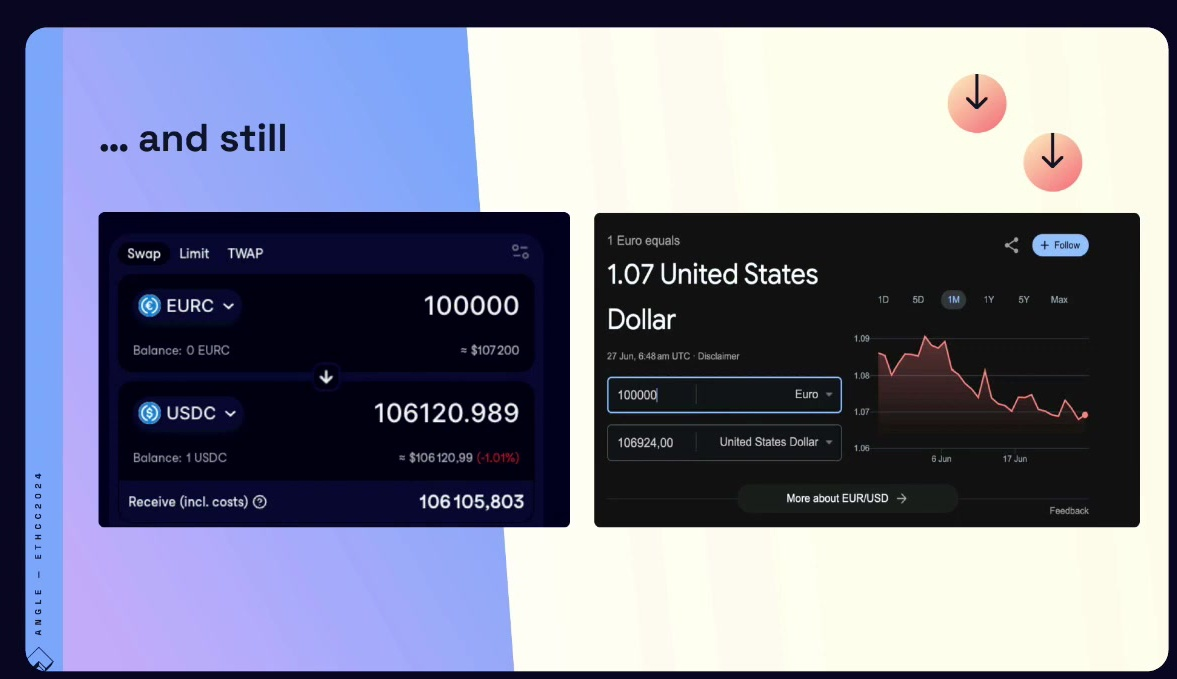

But still, spreads and discrepancies between on-chain Forex rates and off-chain Forex rates are still too wide.

There is a need to leverage stablecoins and blockchain technology to improve the on-chain Forex market and provide better cross-border payment solutions.

Deeper forex markets onchain (5:25)

Beyond just deep liquidity, there are other key requirements:

- Seamless on-ramps and off-ramps to enable easy conversion between fiat and digital currencies (Monerium)

- Abstraction of the wallet experience through tools like Paymasters to improve usability.

- Invisible integration with traditional payment systems.

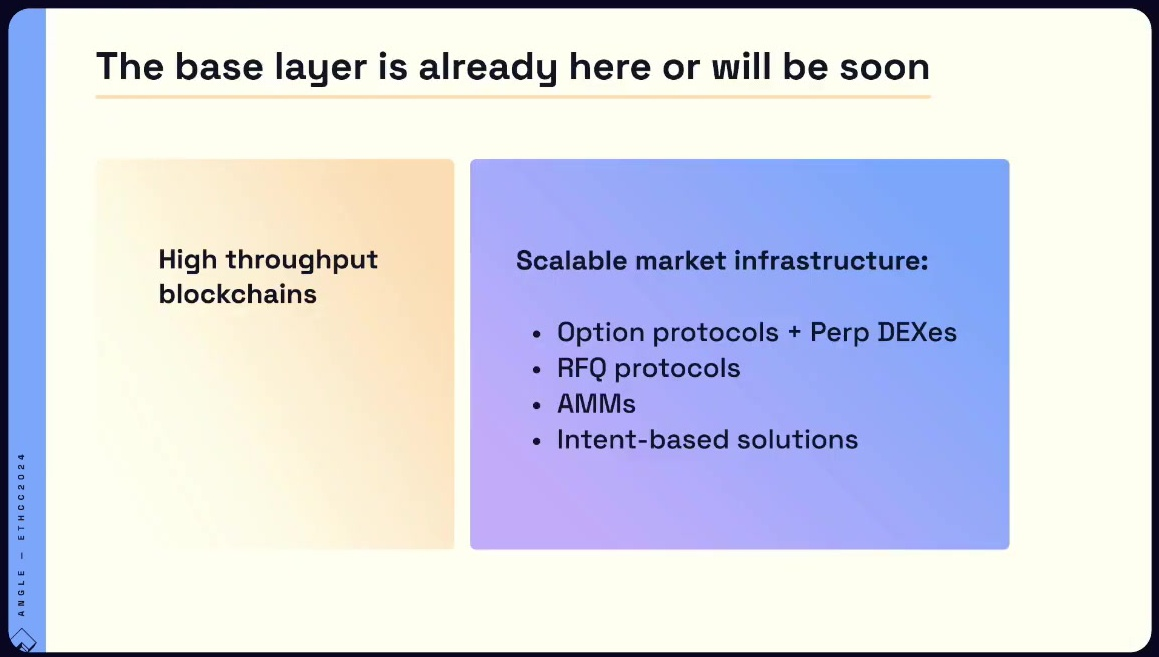

The progress is here. High-throughput blockchains can support the volume and flow of Forex trading. In addition, scalable market infrastructures like AMMs (Automated Market Makers), intent-based solutions, and RFQ (Request for Quote) protocols are already available.

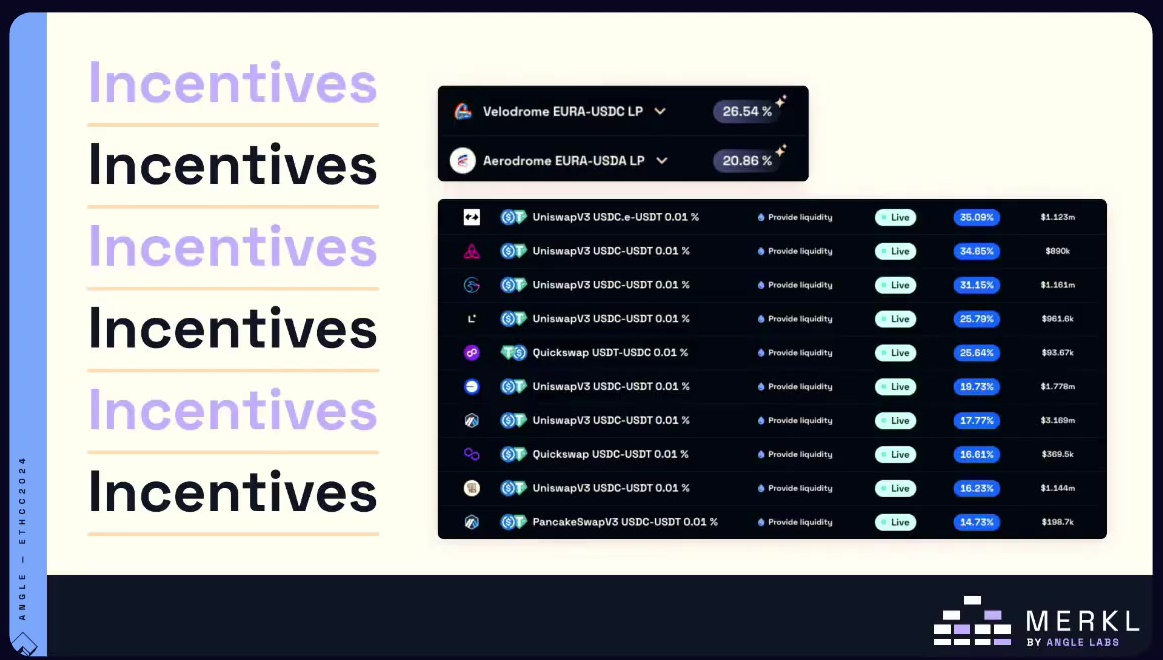

The problem is, that incentivizing market makers to provide liquidity is difficult, as the cost of capital for Forex or stablecoin-to-stablecoin liquidity is very high (around 20% APR on UniV4).

A potential solution is statistical arbitrage. Currently, there is a lack of holders of both USD and EUR stablecoins, leading to significant discrepancies between on-chain and off-chain Forex rates.

Exploiting these price discrepancies through statistical arbitrage can help deepen the on-chain Forex markets as a starting point.

As a stablecoin protocol, ANGLE's mission is to build structural products beyond short-term patches like statistical arbitrage.

Forex stablecoins 2.0 (9:05)

Angle's approach is to create a protocol that issues Forex stablecoins (e.g., EUR, USD, CAD) backed by other major fiat currencies like USDC, with a built-in exchange facility.

The issue of seamless local on-ramps and off-ramps would still not be fully solved, as having everything backed by a single fiat currency like USDC would limit the ability to integrate with banking partners worldwide.

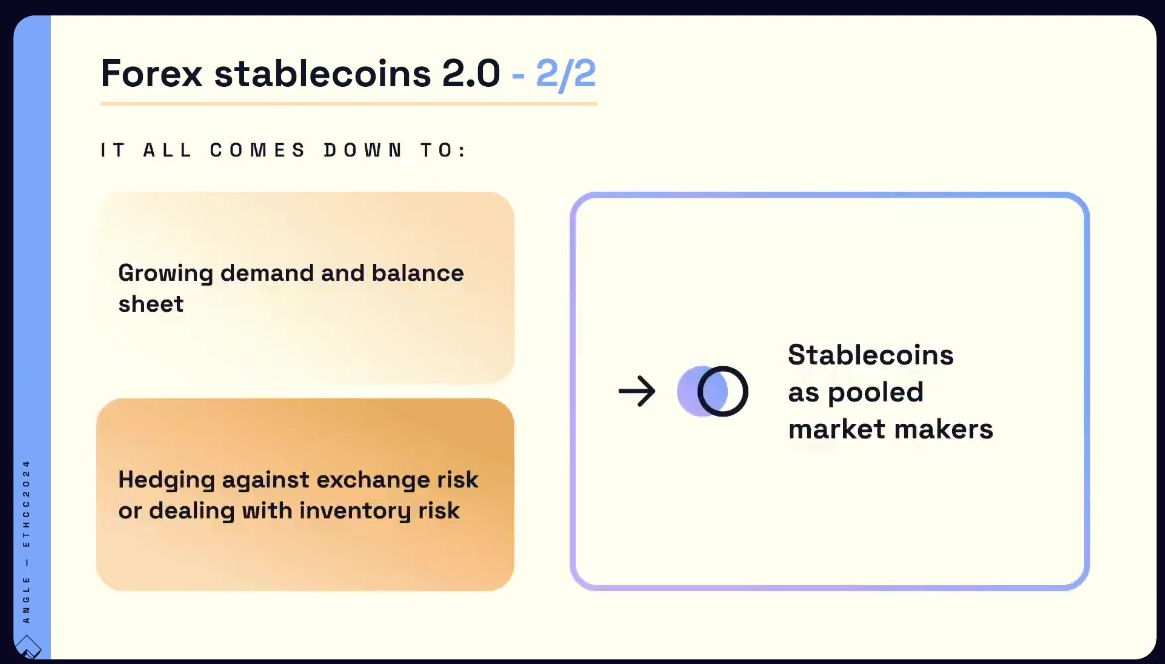

Pablo (the speaker) suggests that stablecoins can be seen as a form of pool-based market makers, where the stablecoin protocol takes on the role of managing the inventory risk and ensuring smooth price execution.

The main advantage of a dedicated stablecoin system is the ability to attract capital through incentives and potentially benefit from user "stickiness" if they hold the stablecoins without off-ramping.

The main drawback is increased regulatory risks and the complexity of managing a stablecoin backed by multiple fiat currencies and derivatives.

What next (12:50)

We need for local stablecoins (e.g., EUR, USD, CAD) to facilitate seamless cross-border payments using blockchain rails.

Pablo is confident that the necessary infrastructure, such as UniV4 hooks, order book DEXes, and abstraction tools, will arrive in the next few years to enable robust on-chain Forex markets.

There is currently an opportunity for arbitrage due to the discrepancies between on-chain and off-chain Forex rates, and surprisingly, market makers are not systematically exploiting this.

The key to expanding the on-chain Forex horizon is more industry alignment and buy-in. As long as Forex is not seen as a "hot" area in the industry, there will be a lack of builders and focus on this use case.

For on-chain Forex to become a more grassroots phenomenon, there is no "magical formula" - it will require sustained effort and collaboration across the industry.

Pablo has hope that in 10 years, the industry will be able to look back and say they've built an infrastructure that truly improves the state of finance, beyond just the "closed loop of DeFi."