Fyde x Liquity

Source : https://twitter.com/LiquityProtocol/status/1777337968375505000

What is Fyde ? (3:00)

In one sentence, Fyde is an AI treasury management service

In crypto, users often hold concentrated positions in one token (e.g., 95% portfolio in one asset). The problems are that there's not enough liquidity to exit large token positions, and there's no risk management.

Fyde allows users to deposit their tokens into a vault and receive a token representing broad market exposure of all the assets involved

- Fyde has a whitelist filter and uses AI/Machine Learning for risk analysis of the assets in the vault

- The treasury token has liquidity provided via bonding curves to have ample liquidity across market conditions.

In other words, instead of manually rebalancing multiple tokens, users can just hold a liquid treasury token, so they can get diversified exposure easily

Since the launch in January, Fyde's vault has outperformed Ethereum in terms of downside protection and upside participation

How the vault works (9:20)

Fyde uses network analysis and machine learning to parameterize the risk of different tokens. This involves analyzing protocol usage, fund flows, and detecting potential issues like wash trading or centralization

Higher-risk tokens are given lower concentration in the vault, while lower-risk tokens get higher weight

Fyde has built a simulation engine using EVM in Rust (REVM) to model different market environments. Machine learning agents interact with the simulated protocol to find optimal trading paths and strategies, and how to rebalance the portfolio weightings

Different strategies may be used in bull vs. bear markets to reduce volatility and maximize returns. For example, rebalancing into ETH or underweight tokens during particular market conditions

Even with audits and filtering, smart contract risk cannot be eliminated entirely. So pattern recognition software is used to continuously monitor tokens for anomalous behavior or increased risk

If issues are detected, tokens can be quarantined or paused to prevent exploits or abuse

Fyde's token incentives (16:40)

The biggest incentive currently is participating in Fyde's upcoming airdrop. Users who stake their Treasury tokens on Fyde's website will earn points/allocation for the airdrop

Around 300 stakers are already earning airdrop points, but more can still join before Q2 airdrop (deadline around May)

After the token generation event (TGE), Fyde plans to incentivize deposits of underweighted tokens like LQTY/LUSD. Users depositing underweight tokens will likely receive positive incentives/yields

Slippage-free swaps (20:45)

Fyde will also enable slippage-free swaps between tokens, by incentivizing users to take trades to facilitate rebalancing. Somehow, Fyde crowdsources rebalancing as an "incentivized arbitrage" service

This is powerful as trying to trade large amounts on AMMs currently results in high slippage costs. Slippage-free swaps promote liquidity and trading volume for all tokens in the vault

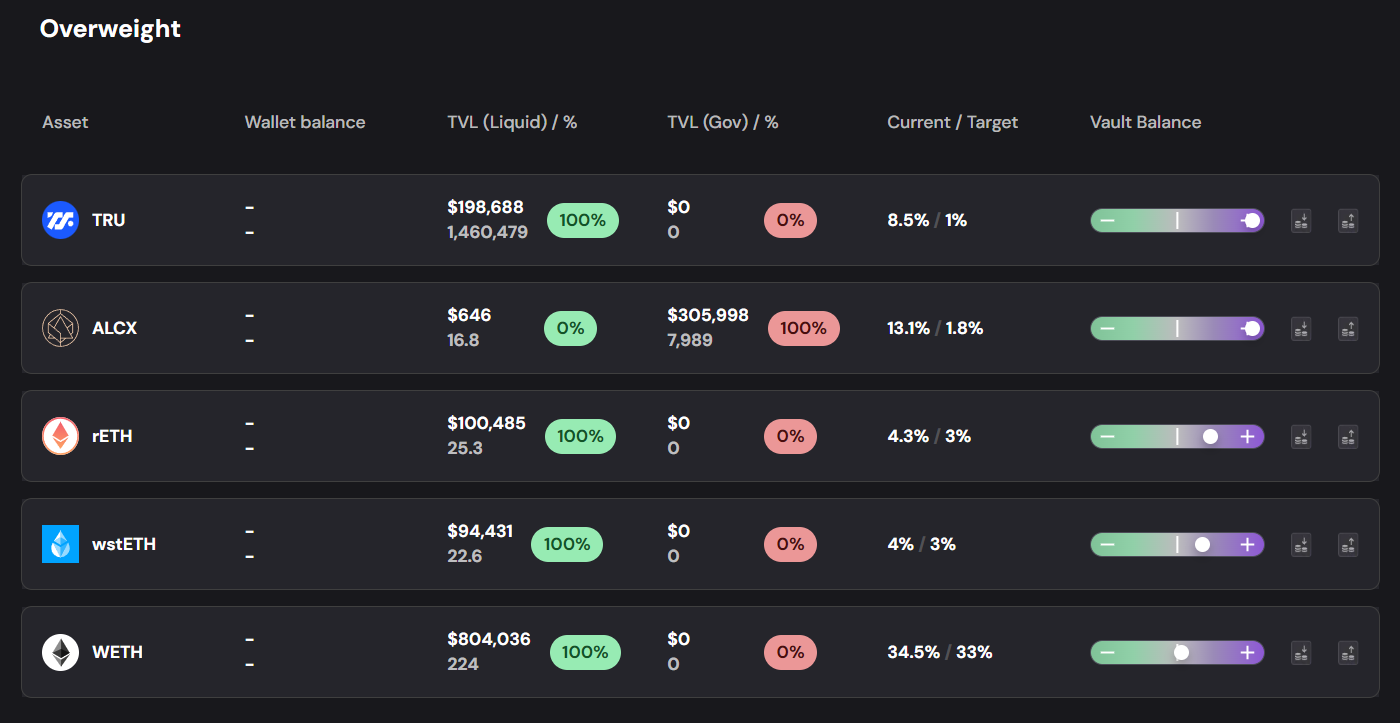

Solving the concentration risks (23:15)

Many DAOs and protocols are stuck holding mainly their own governance token, leading to excessive concentration risk. Traditionally, portfolio managers would advise diversifying, but there are governance disincentives to selling tokens.

To solve this problem, Fyde can create personal custodial contracts :

- Fyde's vault acts like an "endowment strategy" by holding a diversified core allocation (30-50%) of low-volatility assets

- When depositing tokens, users can choose to retain full governance rights

This prevents excessive governance token distribution and potential hostile takeovers

Next steps (27:30)

For now, Fyde is focused on protocols, DAOs, core teams, whales, and founders holding concentrated token positions. In the future, they will target regular users who want a hassle-free way to grow their crypto holdings over time

Fyde launched a "restaking aggregator product" recently, which allows users to deposit ETH and get access to higher airdrop tiers across multiple restaking platforms. This simplifies participation in airdrops while saving on gas fees

The major milestone for Fyde is the Token Generation Event in May. Several things are planned after TGE :

The first one is the Layer 2 expansion. Fyde recognizes the importance of Layer 2 scaling for DeFi. Unfortunately, it's not possible to pull off on OP stack due to technical limitations

Fyde is a "communial trove" which sends money from the Layer 2 and back. On Optimistic Rollups, we have to wait 7 days to bridge transactions. So only Validity Rollups work for Fyde.

Later in 2024, Fyde will offer services to optimize liquidity for other protocol tokens, as they will use their simulation engines to model ideal liquidity positions (Uni v3, Curve, Balancer, etc.)

To finish, Fyde is interested in including Liquity V2 in their vault once it launches (targeted for Q3 2024).

Fyde's token model (35:30)

Their model have 2 tokens : Treasury token (TRSY) and Governance token (FYDE)

Treasury token represents the diversified portfolio allocation in Fyde's vault 👇

More info here : https://docs.fyde.fi/overview/protocol-mechanics

Governance token has other properties :

- Revenue distribution to holders. Revenue sources include withdrawal fees, imbalance penalties

- Holders can use the fees to acquire liquidity for the TRSY token. This provides deeper liquidity pools for users to trade/exit TRSY positions

Future of DeFi Lending (38:50)

Bojan sees two approaches emerging for lending : Centralized (embracing RWAs) vs. Decentralized

Liquity aims to stay true to decentralization principles of DeFi. But it's hard to promote DeFi if it's less efficient than centralized alternatives.

Actually, Liquity is not interested about allowing all crypto to be lent. They're way more interested about global DeFi lending rates and borrowing dynamics

According to Bojan, Liquity V2's key innovation (user-set interest rates) has the potential to improve DeFi lending as a whole

Opportunities (41:45)

Andrey recommends visiting fyde.fi to check out their two products :

- The Liquid Vault for portfolio diversification and liquidity

- The Restaking Aggregator for participating in multiple restaking platform airdrops

Restaking Aggregator Benefits :

- Allows one-click deposit of ETH to participate across platforms like EigenLayer, Renko, Swell, Puffer, etc.

- Unlocks higher airdrop tiers by pooling deposits together

- Generates yield from restaking, to be integrated with main Liquid Vault later

Fyde is creating solutions for problems/needs they faced themselves. The Liquid Vault solves token concentration and portfolio management issues, and the Restaking Aggregator simplifies airdrop hunting and yield farming efforts

There are opportunities for Liquity Users : they can deposit LQTY and LUSD into Fyde's Liquid Vault, and gain exposure to Fyde's diversified portfolio and upcoming airdrop