Everything is MEV

Source : https://www.youtube.com/watch?v=kcmEPvfrTGc&list=PLRHMe0bxkuemFG5hPu9pc87gnlE1iYkKZ

MEV is a property of consensus

MEV is the most important design consideration in blockchain. It encompasses block rewards, gas fees, protocol rewards, and other financial incentives

Thinking about MEV holistically allows understanding the interactions between protocols

MEV is unavoidable, so breaking up with it is not an option. We must contend with MEV whether we like it or not, and should be considered in all major blockchain verticals

MEV is everywhere

MEV is the reward for progressing consensus (block rewards, gas fees). Additional value can be extracted by block builders

Misaligned incentives lead to centralization due to increasing returns to scale

Teams compete to capture MEV opportunities like arbitrage and sandwiching

Misaligned incentives entrench 1-2 dominant trading teams

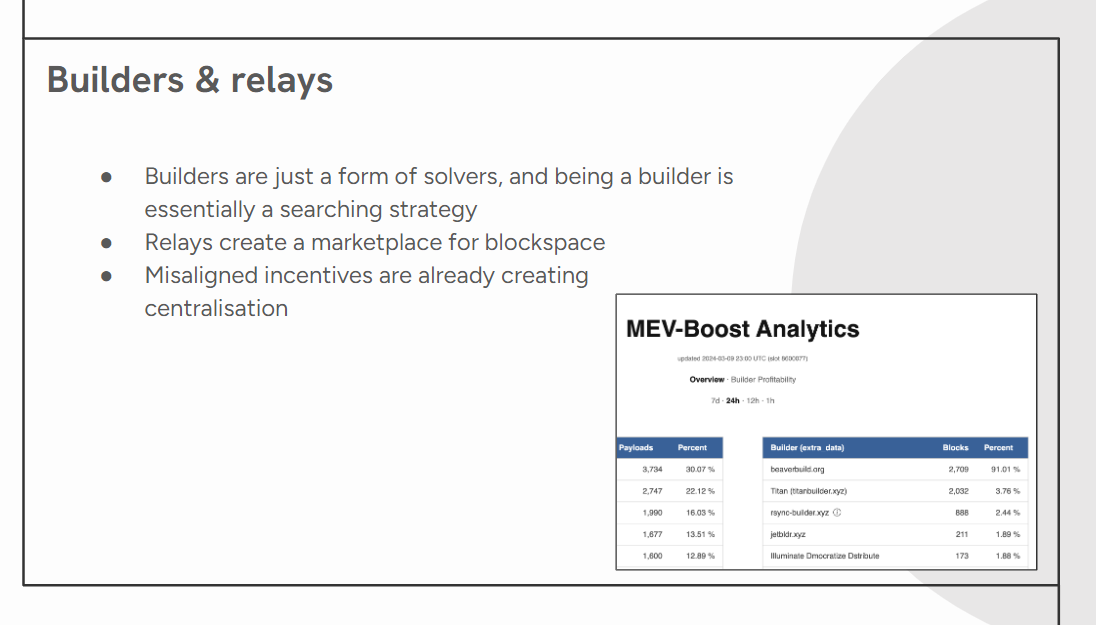

Relay markets coordinate orderflow

Relay are already centralizing the block production

Key source of extractable MEV comes from off-chain price discovery

Experiments like Batch auctions, dynamic fees, better oracles are done to reduce the risk, but the best way to internalize MEV for LPs/users is not found yet.

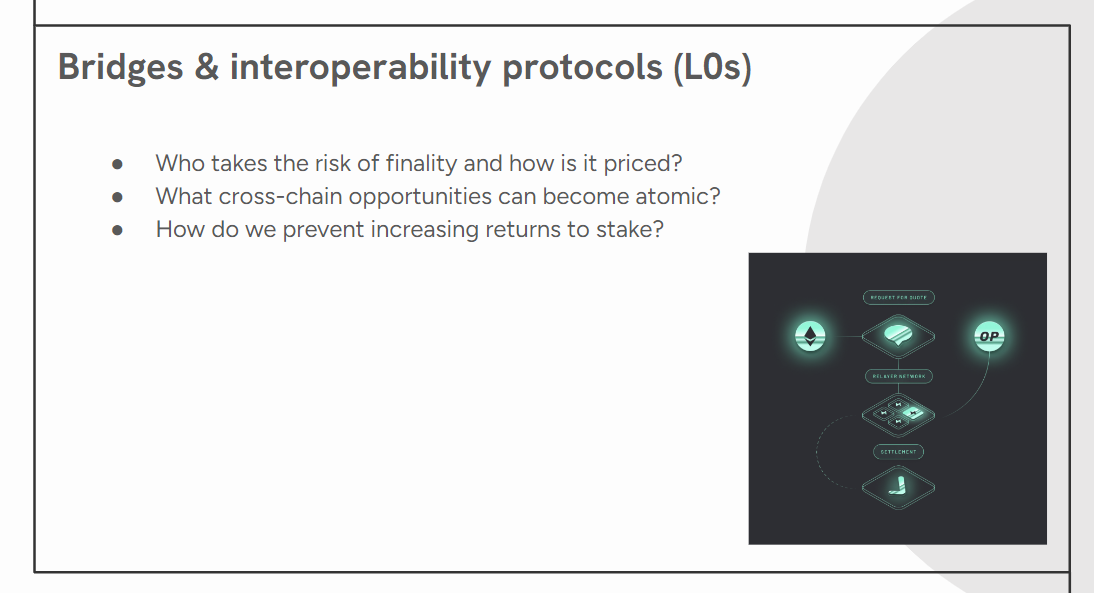

Validating multiple chains creates MEV opportunities

Misaligned incentives lead to centralization of stake

User intents are a major MEV source, so wallets & RPC providers are in good position to capture it

Misaligned incentives lead to sub-optimal order flow/execution

There is MEV in distributing value from aggregated intents/order flow

Focus should be on effective intent solving, not overcomplicating intent expression

Oracle updates create MEV from liquidations

There is an open question on internalizing this MEV VS Protocol absorption

MEV rewards can accrue to staking rewards or separate token.

MEV has the right of life and death over stablecoins.

Design goal is harnessing good MEV, reducing toxic MEV extraction

Design protocols which are MEV-Aware

Macro Analysis (7:00)

"show me the incentives, I'll show you the outcomes". Analyze supply chain/market flows to understand barriers, edges, power dynamics

Understanding Edges in MEV markets :

- Capital - e.g. bidding away entire arbitrage opportunities requires large capital

- Engineering - low latency systems, experience/development resources

- Alpha - rare informational edge/insight into future market conditions

- Business Development - deals for preferential access/flow

Commoditizing Complementary Roles, e.g. Flashbots auction commoditized atomic searchers/builders

Analyzing Dependencies :

- In middle layers, growth depends on permissions from other parties

- Are they motivated to help you grow or commoditize you ?

- Are you solving real problems they care about ?

Micro Analysis (10:45)

Blockchain protocols are repeated games with players, rules, incentives, strategies and equilibriums. We need to analyze these game elements to understand protocol dynamics

Players in blockchains are searchers, solvers, builders, market makers, users, protocols, relays, validators

Rules of the game are defined in code (smart contracts, clients) and socially enforced norms

Strategies and Equilibriums:

- Resulting strategies may differ from intent, look for dominant strategy

- Dominant strategy equilibrium = when everyone plays dominant strategy

- Nash equilibrium = no incentive for anyone to change strategy

Examples :

- Prisoners' dilemma dominant strategy is to defect/snitch

- On Polygon, dominant strategy may be to spam as much as possible

Create good games (13:00)

Reward desired behavior, punish undesired behavior. We have to create clear incentives for what we want people to do, and not to rely solely on social consensus when money is at stake

Assign roles that leverage strengths. Give players jobs they are well-suited for (like using solvers to outsource finality risk)

Edges/moats are inevitable. We cannot create an edgeless game, so we must consider barriers to entry these edges will create

No one is good/bad, we are all rational. People will try to exploit incentives for their benefit, and we must expect adversaries like hackers and opportunistic searchers

Design for the future state when you launch, and not just present

Deliberate on MEV creation and distribution. Which users deserve MEV ? What is a "fair" distribution ?

Manage optics for market and regulators. Fraud/ponzi or bad activities can undermine an otherwise well-executed project

In one sentence, MEV is the core incentive and blockchain protocols are just games