DYAD VI kickoff

Source: https://x.com/0xDYAD/status/1850975733444985142

Dyad Introduction

Dyad is a decentralized stablecoin that improves upon the basic Collateralized Debt Position (CDP) design.

CDPs often struggle to compete with centralized stablecoins because centralized stables, with off-chain collateral (like T-bills), are not prone to the same volatility and over-collateralization requirements.

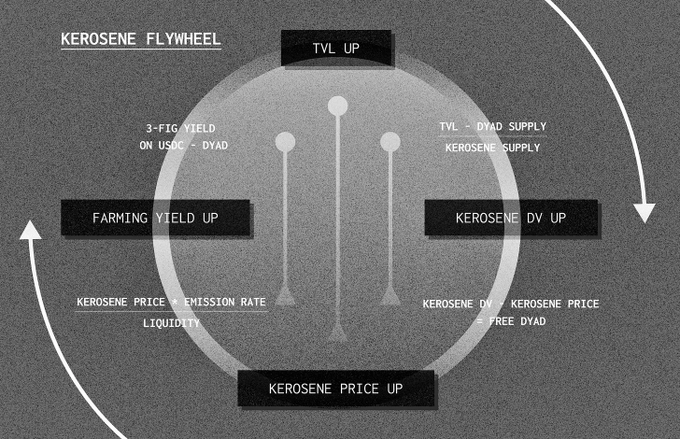

So, Dyad's main improvement is efficiency. Efficiency refers to the amount of exogenous collateral needed for each minted stablecoin, and Dyad tokenized the surplus (in the form of Kerosene) to improve that capital efficiency.

In Dyad, the surplus collateral (Total Value Locked or TVL minus the total debt) is tokenized into a second token called Kerosene.

Kerosene is tokens representing the right to mint Dyad against a portion of the system’s excess collateral, enabling participants to access this surplus more efficiently.

Upcoming changes

The initial flywheel looked like this, but it was flawed because there was misalignment of interests with Kerosene emissions.

In the old system, kerosene is sent directly to the user’s wallet when claimed. Users can then decide to either sell it or deposit it into their note.

This created a dilemma for users: they might hesitate to deposit kerosene into their note due to potential XP slashing (a reduction in their experience points) if they withdraw it too early, leading some to just hold or sell it.

Under the new system, kerosene earned from providing liquidity is deposited directly into the note that earned it by default, removing the decision of whether to keep it in the wallet or deposit it.

Users are still free to withdraw kerosene from their notes and sell it, but doing so will slash their XP. XP is slashed proportionally to the amount of kerosene withdrawn.

Dyad team doesn't want to integrate locking mechanisms. Although kerosene is automatically deposited into the note, it is never locked, and users can withdraw it at any time, albeit with XP consequences.

Impact of the new system on Kerosene

While the changes won’t completely stop users from selling kerosene, they create a strong incentive to accumulate and hold kerosene rather than sell it

Even users with smaller LP sizes or lower initial XP can climb the leaderboard by simply not withdrawing their kerosene, benefiting from the relative XP reduction of others.

Impact of the new system on Notes

Dyad has an Over-the-Counter (OTC) market for Notes which has some activity (100 ETH of volume on OpenSea for note sales), but most current notes are basic, with little or no XP, kerosene, or deposited collateral.

With the upcoming changes, stats like Kerosene or XP will be taken into account for estimating a Note's price.

Users looking for liquidity can sell their entire note (including the kerosene and XP) on the marketplace, rather than just withdrawing kerosene and getting the XP slashed.

Improved marketplace

The marketplace will be improved to display relevant metrics such as:

- A note’s XP boost.

- The size of the liquidity pool (LP) position associated with the note.

- The current market price of kerosene.

So we can see the exact yield we can expect from purchasing a Note.

Kerosene distribution

In the beginning, Kerosene emissions were claimed through Merkl, but Merkl isn't that reliable:

- Kerosene is sent directly to the user’s wallet when claimed

- Emissions were not always carried out on time

- Monitoring yields is a mess

So the team will make 2 plays:

- Create their staking contract that will display every Note’s total APR in the UI

- Create Curve pools for DYAD

Introduction of XP halvings

Every six weeks, the XP balances across the system will be cut in half. The halving creates a time decay effect on XP, giving a freshness premium to newly earned XP and preventing XP from accumulating indefinitely.

The halving mechanism will not affect the APR of users’ staked liquidity pool tokens. For example, if a user is earning 100% APR on their Dyad-wrapped M (Smart M) Curve pool LP tokens, their yield will remain the same post-halving

M^0 x Dyad

What is M^0?

M^0 is designed as a decentralized stablecoin based on real-world assets, specifically T-bills. That stablecoin is over-collateralized by short-duration T-bills stored in Special Purpose Vehicles (SPVs).

The protocol operates with a multi-issuer model, meaning multiple entities can mint M^0 through governance approval, similar to MakerDAO’s original vision but using T-bills instead of ETH as collateral.

Features

- Fully immutable protocol

- Daily on-chain attestations of reserves through a validator network

- Yield-bearing stablecoin for certain use cases, but not rebasing by default

Jacob emphasizes that a yield-bearing stablecoin is not suitable for payments, as it complicates integration with smart contracts and is less useful for day-to-day transactions.

Rebasing and Smart M

For savings use cases, M^0 can be made rebasing for whitelisted addresses, allowing specific users to earn yield.

For DeFi use cases, M^0 uses a wrapped version (rebranded as Smart M), which converts the rebasing yield into a claim function.

The Smart M token allows protocols, such as Dyad, to redirect the yield from T-bills inside a liquidity pool to specific uses.

Partnership with Dyad

M^0 and Dyad are seen as complementary projects. M^0 provides stability through T-bills, and Dyad’s system focuses on volatile collateral

The integration between Dyad and M^0 allows Dyad to tap into the yield generated by T-bills in the Curve pool, offering additional revenue.

The M^0 yield will initially be used to kick off sDYAD, which is single-sided Dyad staking. This feature has been under discussion for a while and is now being introduced.

Questions and answers

Does the USDC-DYAD pair on Uniswap V3 continue to get rewards on Merkl?

Yes. The team plans to taper down rewards for that pool over time, but nothing will change immediately.

The new Smart M-Dyad pool on Curve is being added using a new staking contract, but this doesn't affect the existing Merkl rewards.

Merkl has been crucial for Dyad’s growth, helping them reach their current TVL (Total Value Locked), but the system needed something more tailored to Dyad’s specific requirements.

Is the staking engine open source?

The new staking engine is fully open source, with all details available on GitHub.

In the last space, the Ignition system was announced, and now there are XP halvings. Are they two different components or is one replacing the other?

Ignition creates an issue where XP earned months ago has the same impact on yield bonuses as XP earned recently, leading to XP compounding in a way that deter new participants.

The six-week halving system is being introduced as a solution to this issue, as it encourages continued engagement.