DeFi Towards Financial Empowerment

Source : https://www.youtube.com/watch?v=0wzX7evAGPE

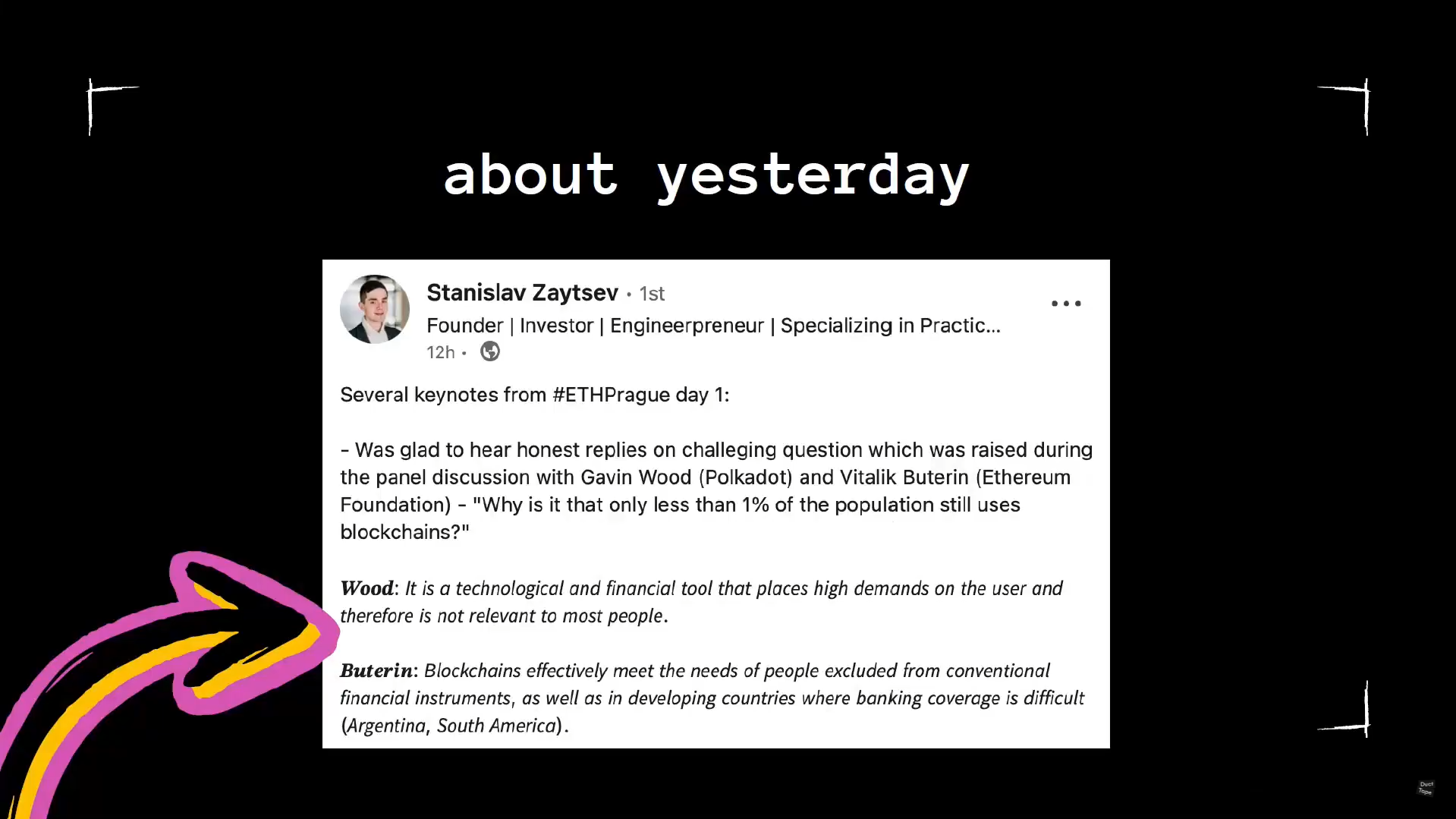

Despite the promise of blockchain and DeFi for financial inclusion, adoption remains extremely low. Less than 1% of the population uses blockchain, and even fewer people use DeFi

A quote from LinkedIn suggests this is because DeFi is a technological and financial tool with high demands on users, making it too complicated for most people to adopt

There is a disconnect between the original vision of blockchain/DeFi for financial inclusion and the current reality.

One presentation highlighted the promise of blockchain for creating an alternative financial system with no undue exclusion

However, another presentation simply had a questioning emoji, indicating a lack of answers on whether this promise has been fulfilled

The key question is : How can DeFi be revamped to truly achieve financial inclusion and empowerment ?

Financial inclusion

What is financial inclusion ? (2:25)

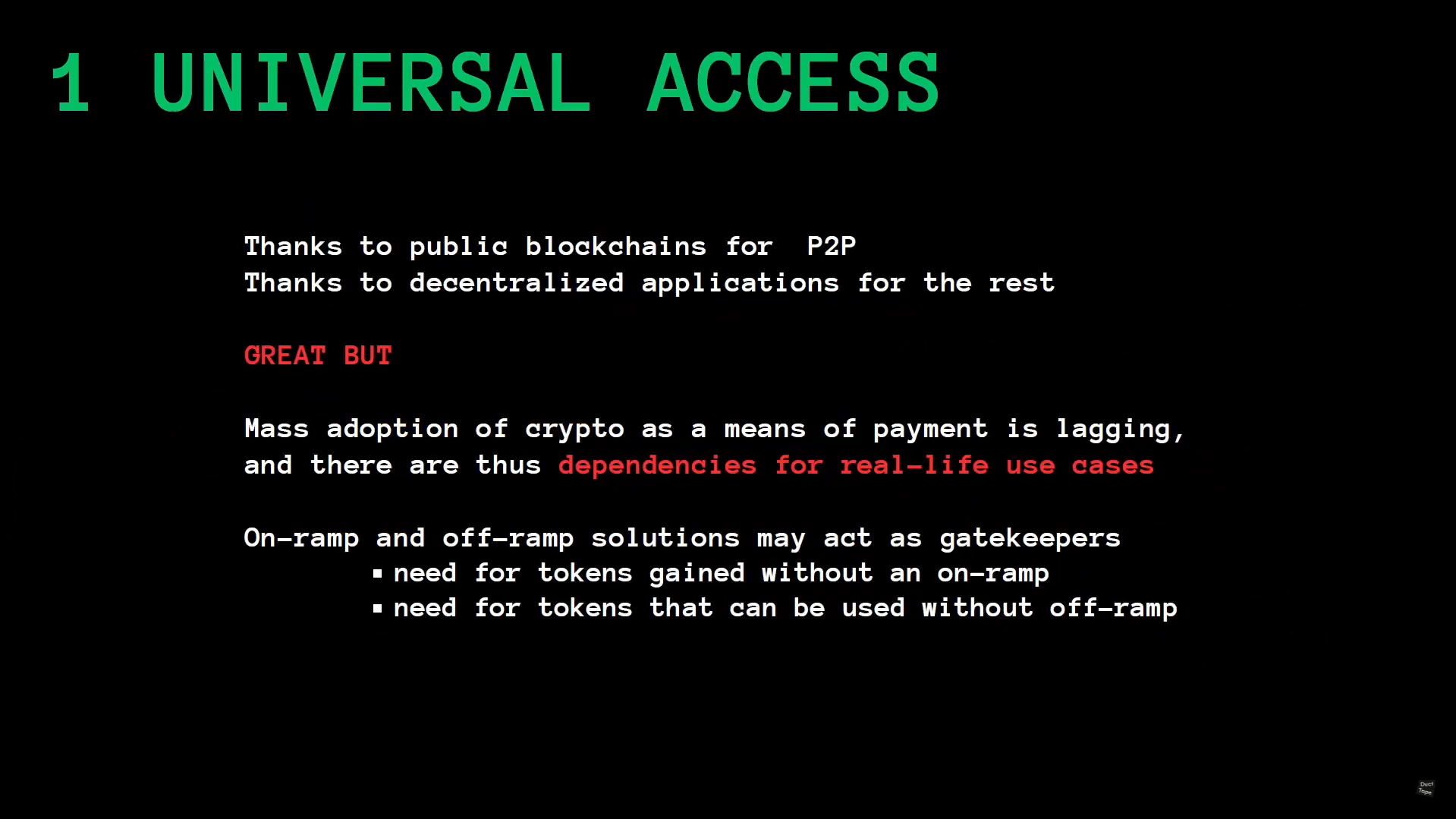

Universal access (2:55)

Decentralized Finance (DeFi) promises universal access through public blockchains and decentralized applications. However, mass adoption of crypto as a means of payment is still lagging

For real-life use cases, on-ramp and off-ramp solutions are often needed (e.g., converting fiat to crypto and vice versa), and people face issues without them

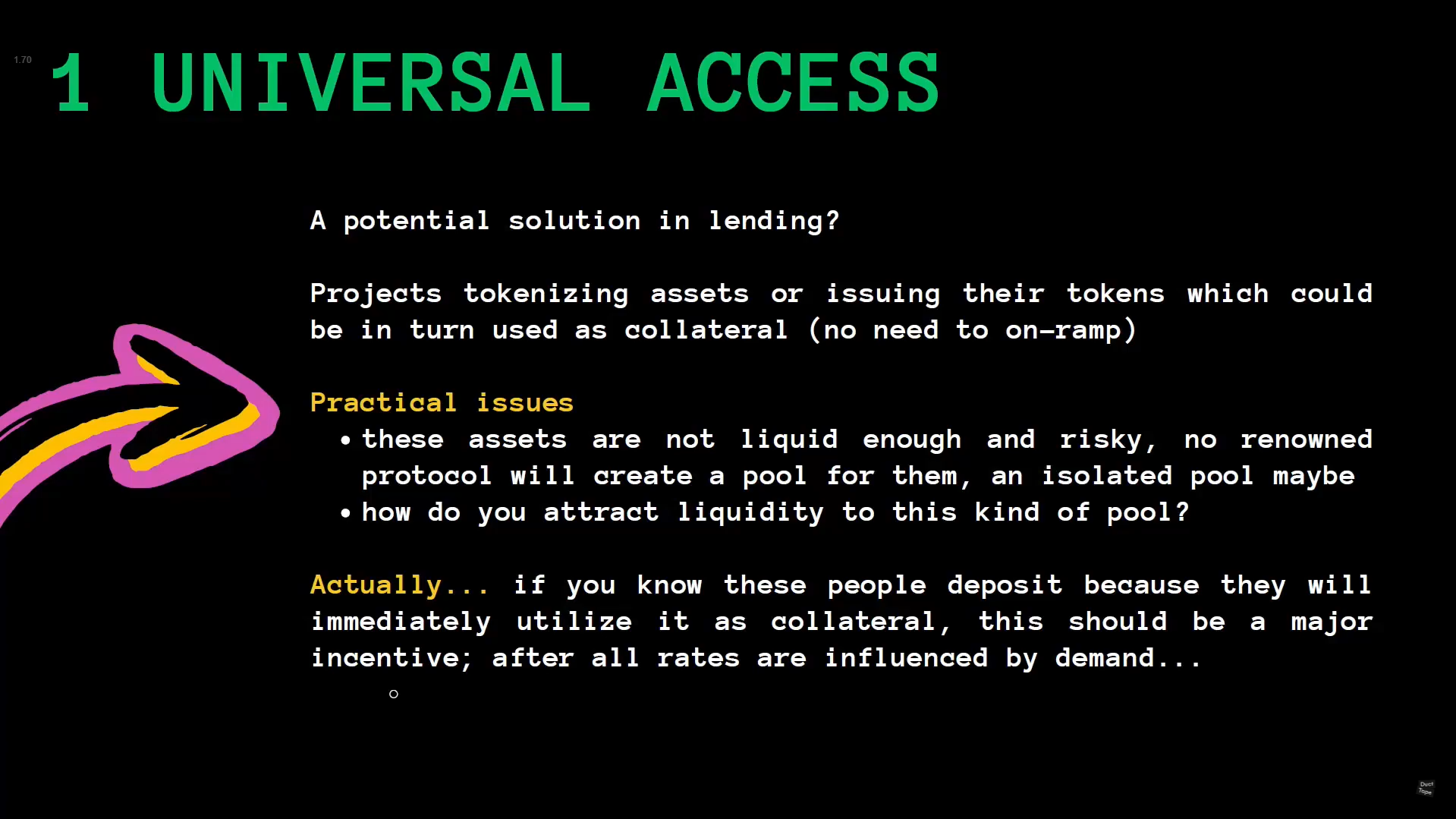

A potential solution could be tokenizing real-world assets (e.g., crops) and using them as collateral to borrow stablecoins. But there are practical challenges :

- Who will create liquidity pools for these tokenized assets?

- Tokenized assets may be considered risky, leading to low liquidity

The core issue is how to create a sustainable system that provides access to liquidity without the need for on-ramp/off-ramp solutions. Tokenizing real-world assets and using them as collateral is a potential approach, but it requires solving the liquidity problem and managing risks associated with these assets

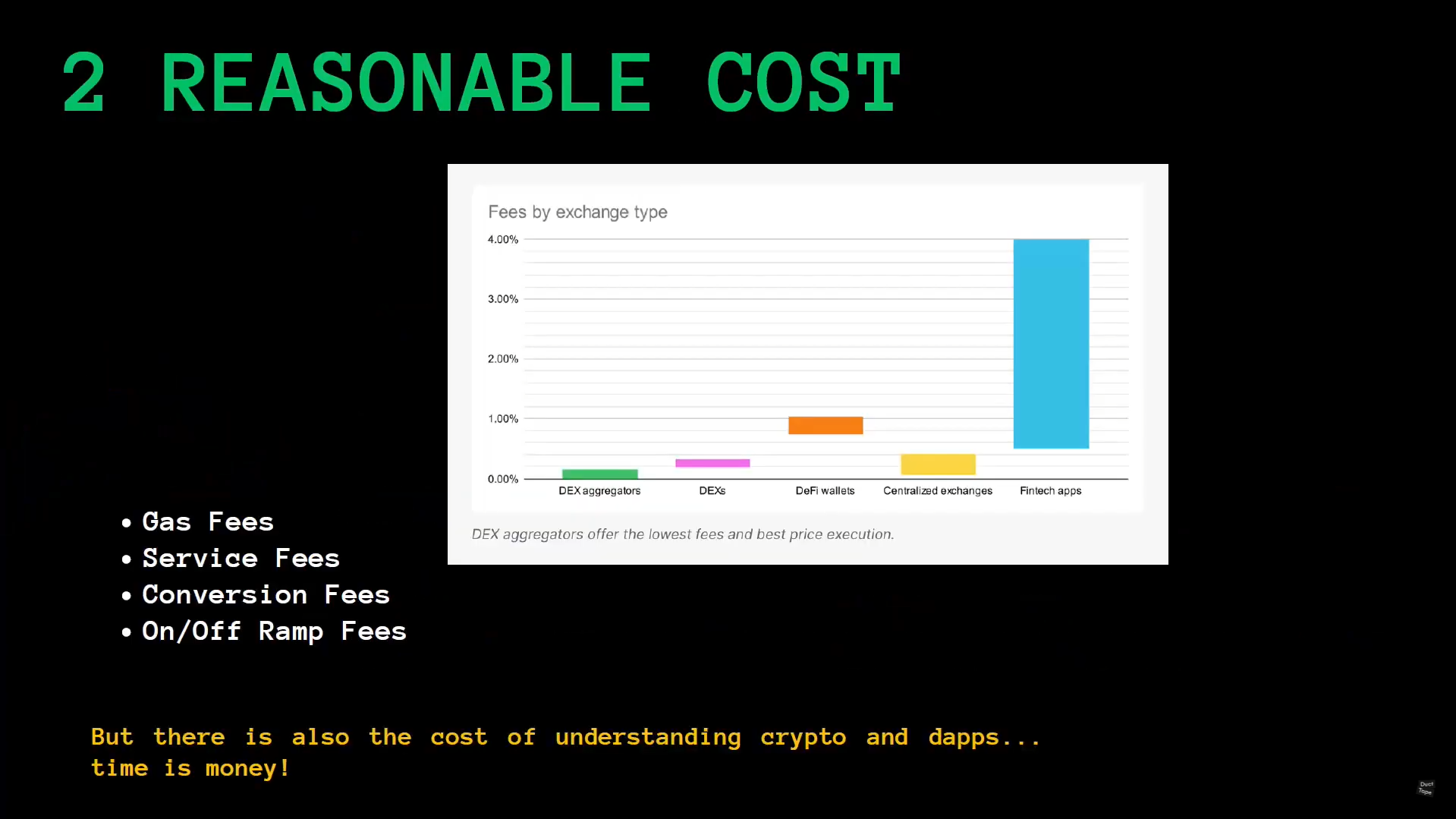

Reasonable (5:30)

Fintech apps for buying crypto (e.g. Revolut, SwissBorg) tend to have high fees. DeFi has lower fees compared to fintech apps, but still has various fees:

- Gas fees (can add up with many transactions)

- Service fees (e.g. swap fees, transaction fees)

- Conversion fees (if converting between assets)

- On-ramp and off-ramp fees

Furthermore, there is a time and effort cost to understand and use the applications

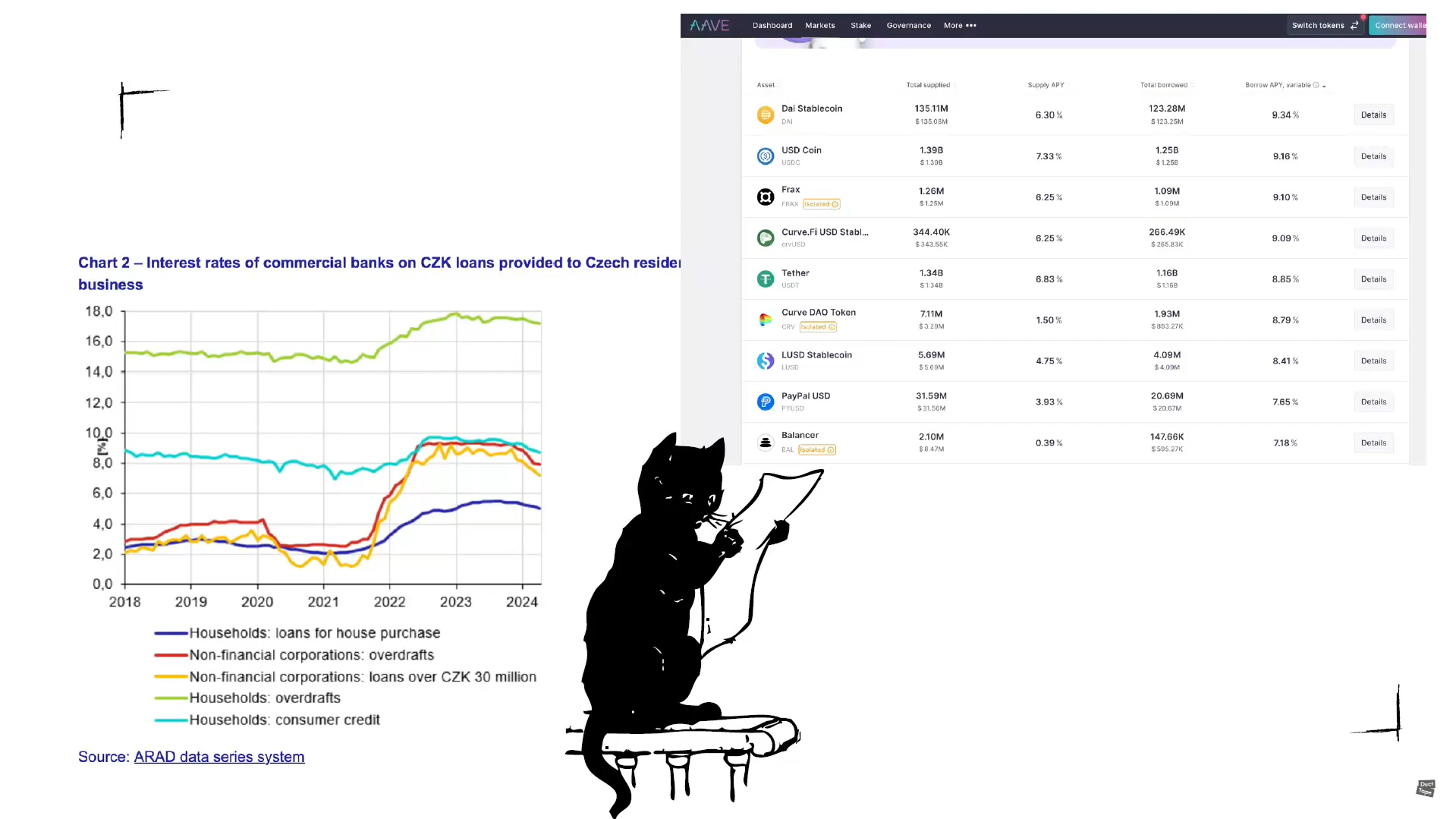

For consumer loans in the Czech Republic, banks charge around 8% interest rate. On Aave, the interest rate for borrowing USDC is around 9%.

The cost of using DeFi can be justified for some assets, as their borrowing rates can even be lower than traditional finance rates.

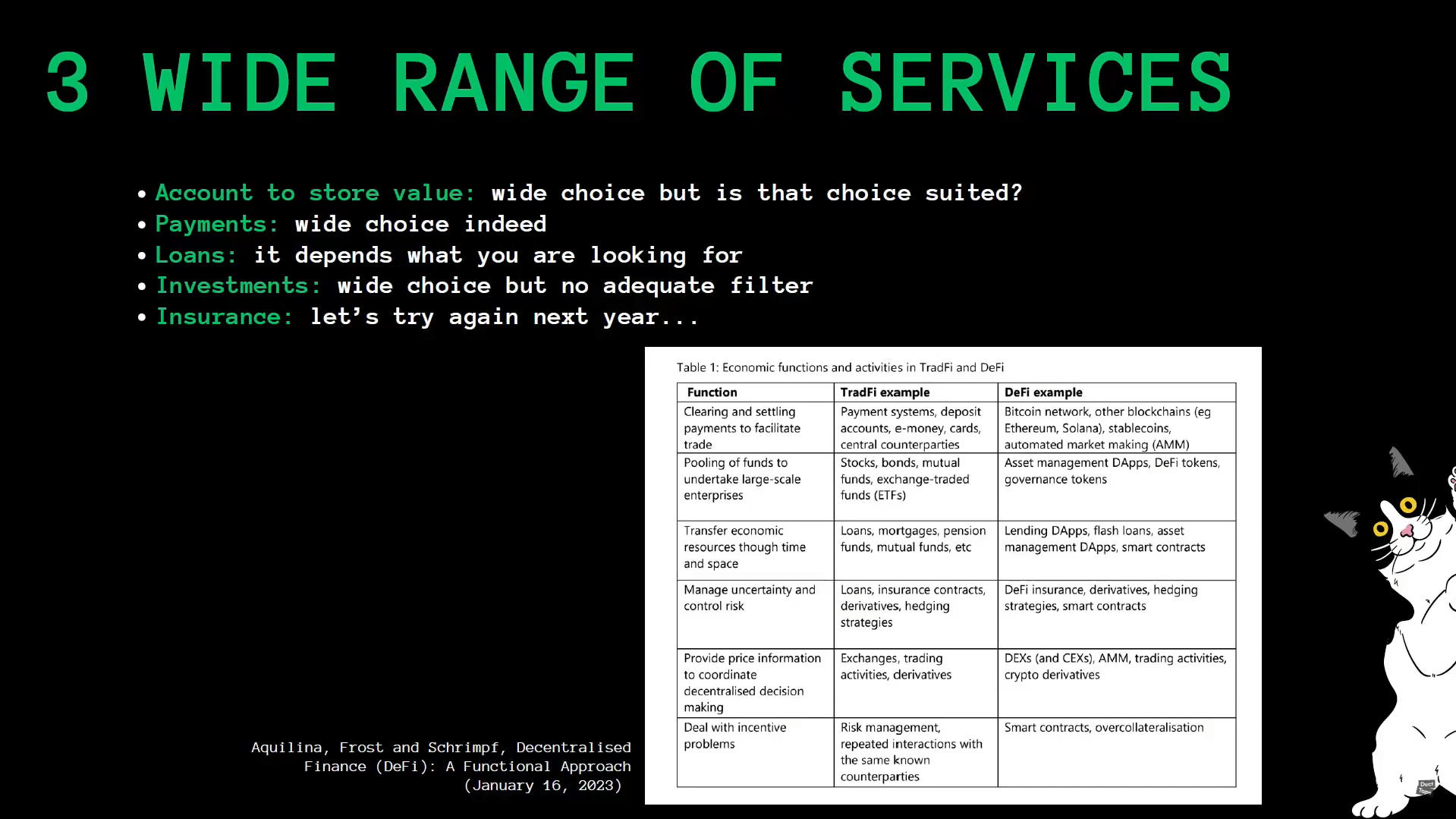

Wide range of services (7:20)

Basic services needed : accounts, payments, loans, investments, insurance. DeFi has many non-custodial wallets, but they may not be user-friendly for non-crypto-savvy individuals

Payments and loans are available, but loan use cases may not match real-life needs, Investments lack proper risk filters & often based on recommendations, and insurance solutions are still limited

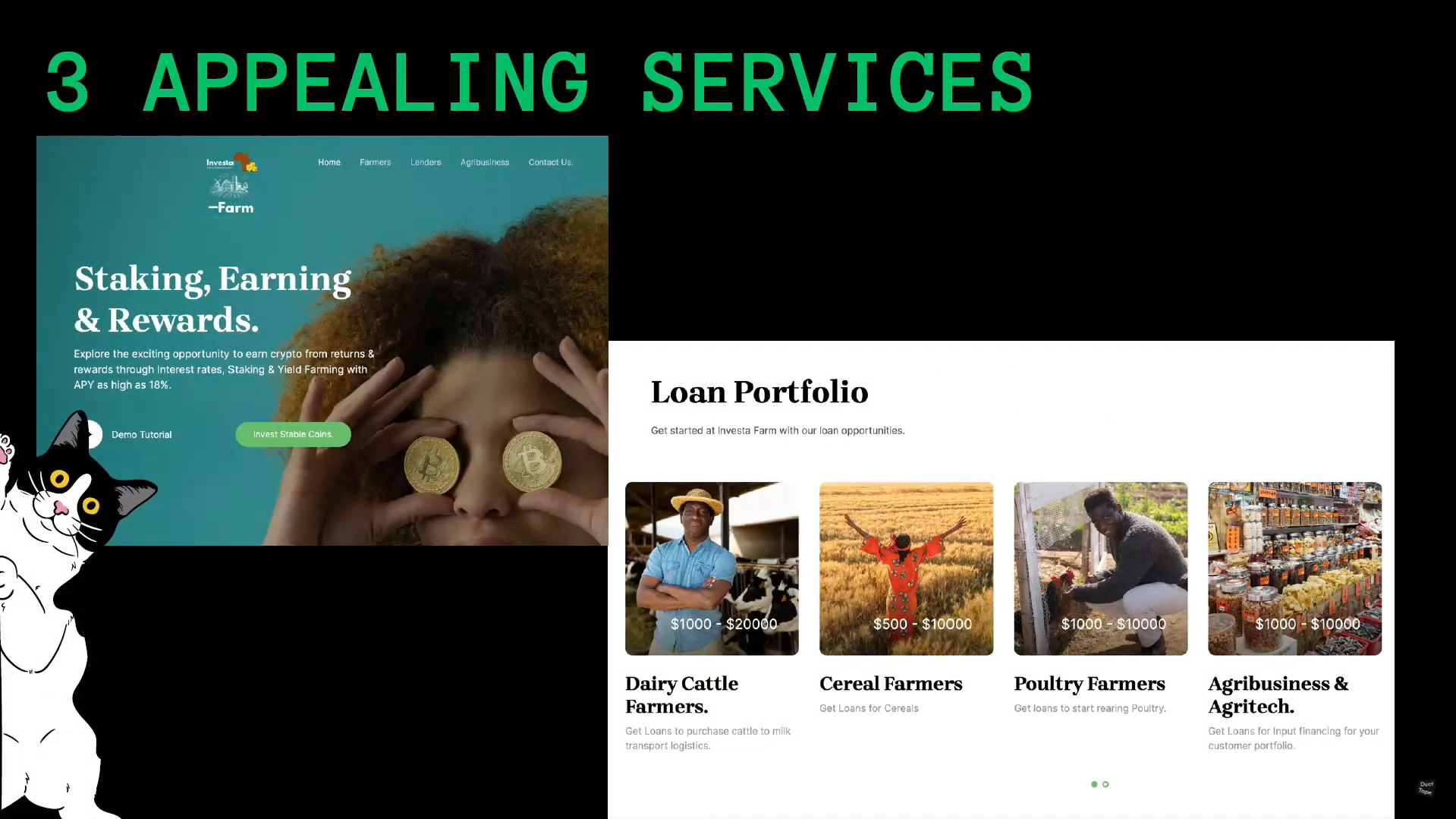

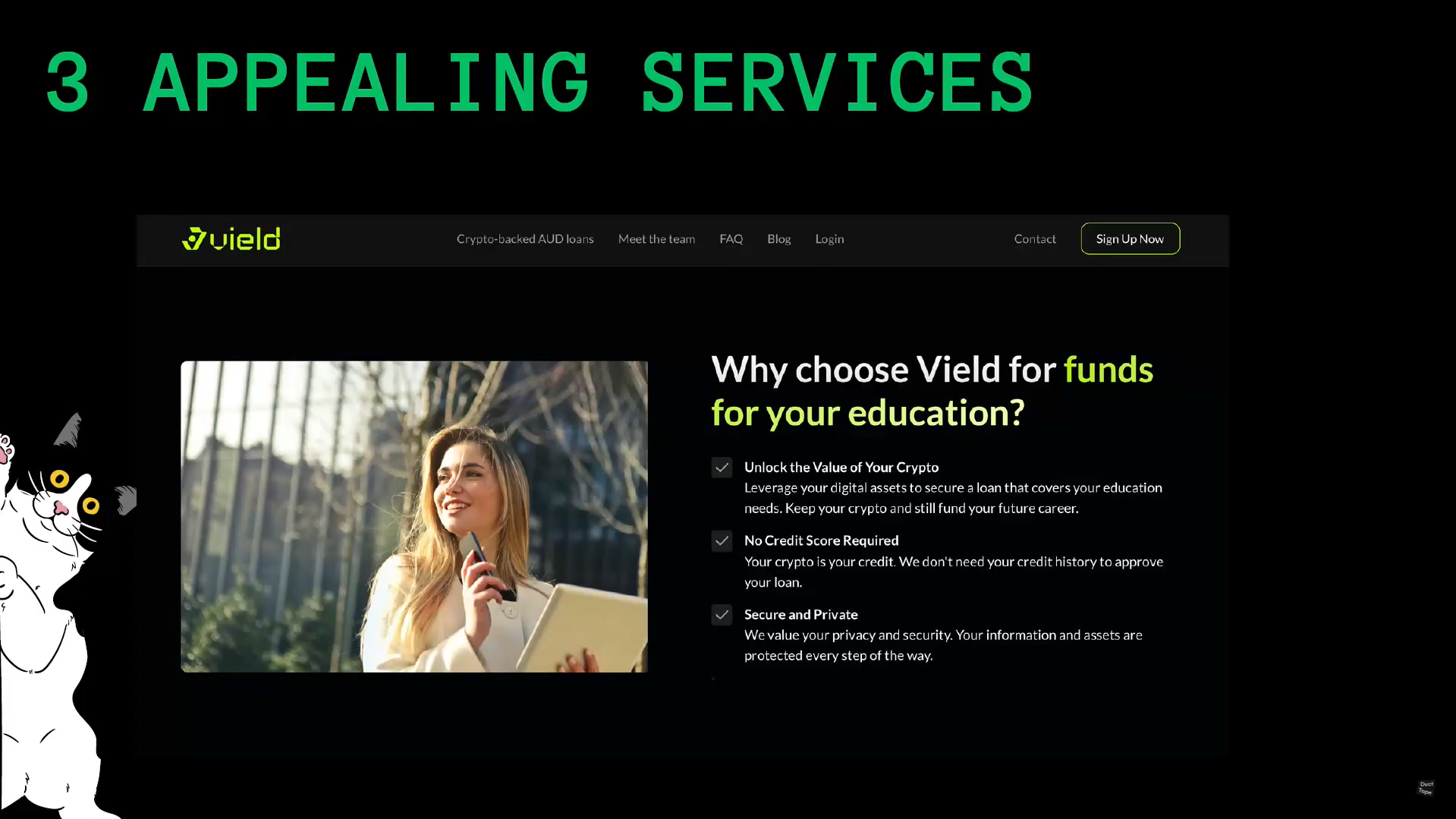

Appealing services (8:35)

DeFi services need to be appealing and match real-life use cases. We need clear value propositions (what's in it for me ?)

Example : Lending protocols are mostly used for trading rather than real-life financing needs.

The thing is, DeFi lending protocols can offer higher yields for supplying assets but aren't seen as a savings alternative yet

DeFi services should be equal or better than traditional finance:

- Efficiency

- 24/7 availability

- Transparency

But users need crypto literacy and capability to understand the processes.

Sound & sustainable (12:10)

Risks in the DeFi space :

- No central authority (double-edged sword)

- No one to turn to for help or solutions if things go wrong

- Risk of code exploits by third parties, replacing the risk of centralized manipulations

Financial inclusion is great, but not anymore if users have limited savings and lose everything in DeFi. People may perceive centralized systems as safer, even if they carry different risks

There is a balance between decentralization, security, and user protection, and we must strike the right balance.

How can we revamp DeFi ?

Think long term (14:00)

Current DeFi is focused on serving the DeFi community and chasing Total Value Locked (TVL), rather than reaching broader audiences and promoting financial inclusion.

Protocols cannot focus on both small wallets and whales/institutional investors simultaneously.

Required changes are not that big (15:55)

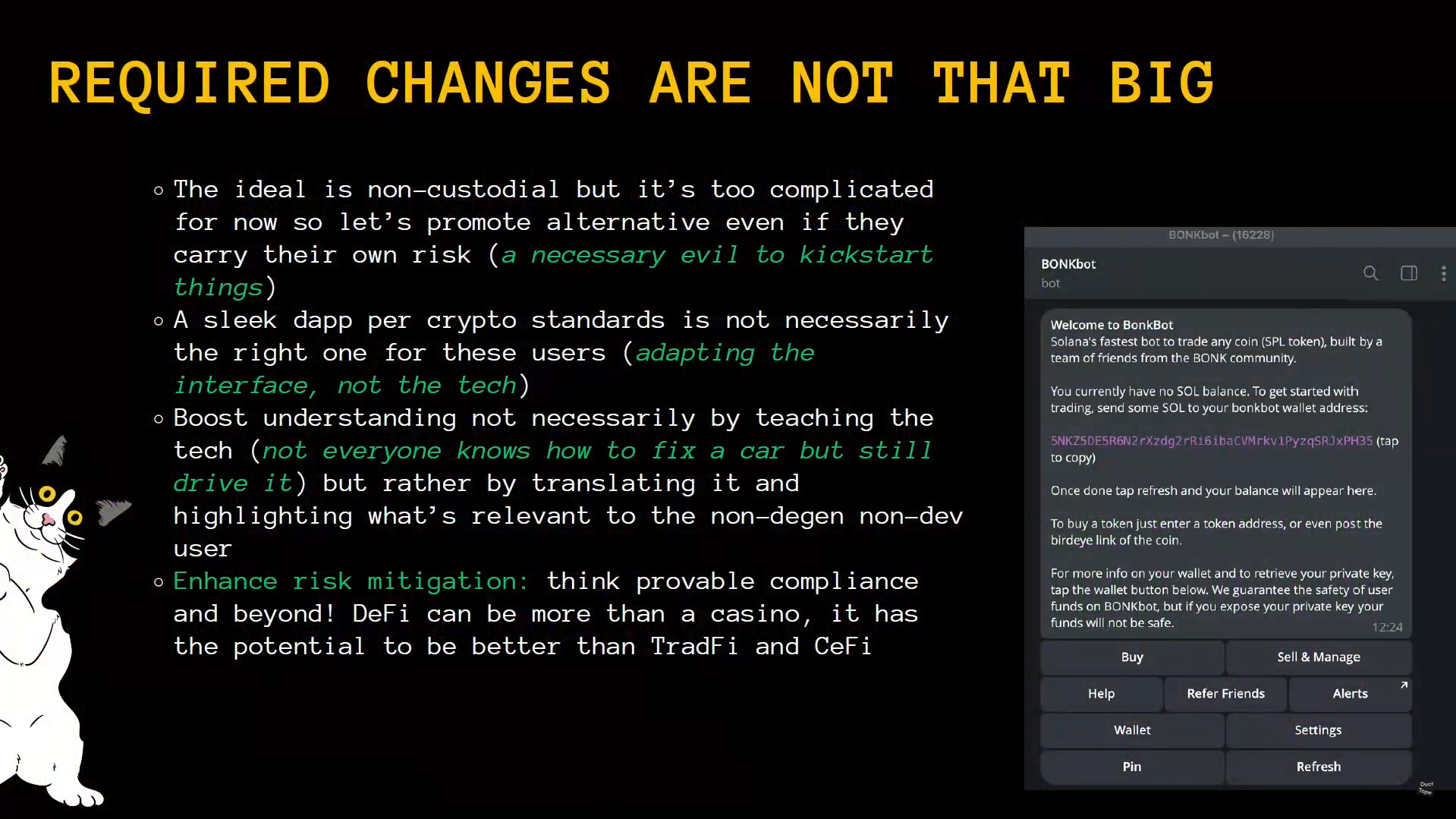

- Promote alternative means of access beyond non-custodial wallets, such as Telegram bots, as a "necessary evil" to kickstart adoption.

- Develop simpler, one-click solutions tailored to the needs of financially underserved populations, rather than complicated DApps.

- Enhance understanding by providing relevant information, similar to how people use cars or computers without knowing how to fix them.

- Implement provable compliance, where the code itself enforces regulations and consumer protection measures.

The required changes for DeFi to become more accessible and impactful are not as drastic as they may seem.

A 1inch for impact ? (19:20)

Idea of building a "one-inch for impact" platform focused on financial inclusion :

- Aggregate existing DeFi protocols into a single interface tailored for underserved populations.

- Cater to different needs, such as simple interest-earning opportunities or active trading, while providing risk awareness and understanding.

A "DeFi on rails" approach could cater to these different demographics and promote broader adoption.

Questions & Answers

How are you thinking about under collateralized lending and where does it fit into your legal framework of things ? (21:20)

Under-collateralized lending has potential to mimic traditional finance without exclusion using technologies like ZK proofs and oracles. However, it still excludes those who don't have any assets to provide as collateral.

Over-collateralized lending may be better as it allows lending if you have enough on-chain assets. Smooth liquidations could be enabled by allowing proof of off-chain collateral to prevent immediate liquidation.

Do you think it's even possible to have this kind of platform in the future from the legal perspective ? Especially considering the issues Ethereum ETF faced with staking (23:55)

There is a problem in the upcoming year regarding the legal definition of DeFi, especially in the EU. The EU has excluded "fully decentralized protocols" as DeFi, but a standard definition is lacking.

Some jurisdictions like Switzerland are more accommodating for DeFi platforms.

One approach could be aggregating only quality DeFi projects with clear legal structures and opinions to navigate regulatory constraints.