DeFi liquidity: lessons from trading across 100+dApps (Keyrock at EthCC)

Source: https://www.youtube.com/watch?v=5rNiU3xCCe8

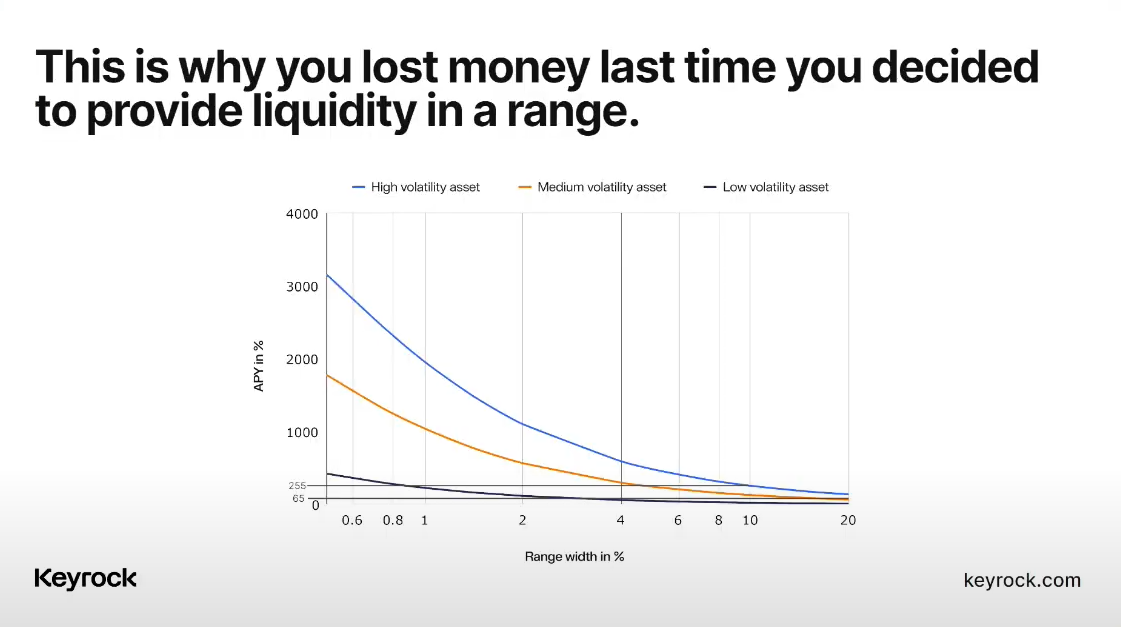

The real-life of providing liquidity in a range (19:30)

Many users don't understand the true risk-adjusted returns when providing liquidity. It's often difficult to break even due to impermanent loss.

Juan (the speaker) presents a simple strategy of providing liquidity within a range and rebalancing when the price moves out of that range.

The graph above shows the required APY to break even for different range widths and asset volatilities.

Examples of break-even points:

- For a highly volatile asset like PEPE, a 10% range requires at least 250% annualized returns in fees to break even.

- For ETH (medium volatility), a 20% range needs 65% annualized returns to break even.

Tighter ranges require even higher returns, sometimes in the thousands of percent.

Overcoming the compute constraints (22:30)

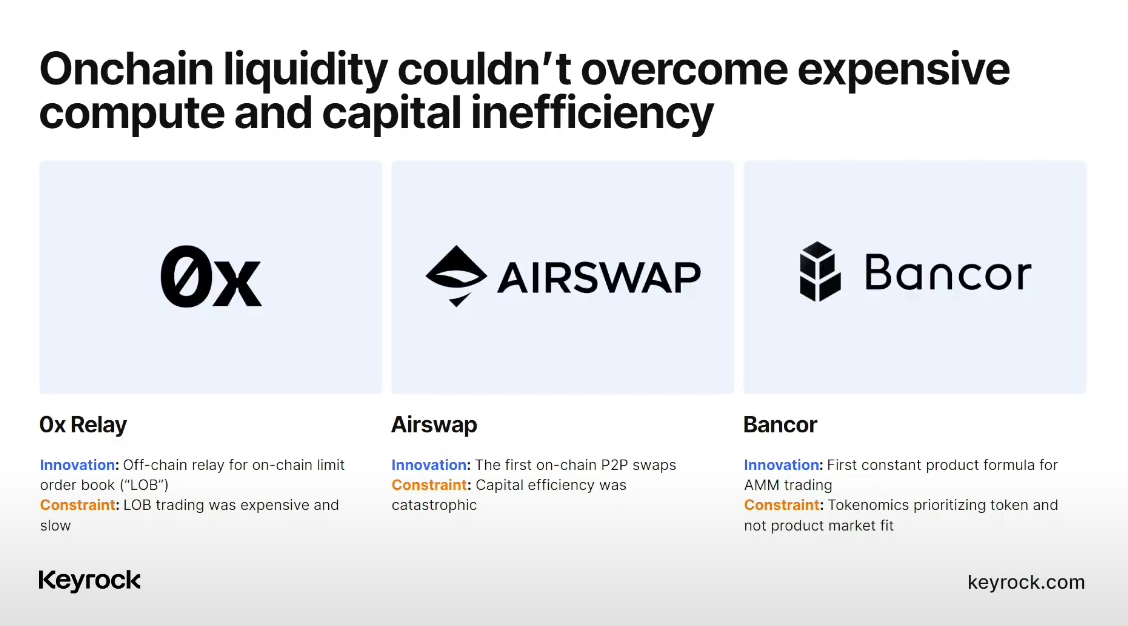

First-generation on-chain order books were tested but proved unusable due to high gas costs and inefficient order repositioning.

A workaround involving transaction expiry was attempted, but the minimum 30-second expiry time led to worse pricing and hindered adoption.

Automated Market Maker (AMM) pools were introduced but had problems with impermanent loss and misaligned focus on investors rather than product-market fit.

Intent-based trading (similar to Request for Quote in traditional finance) was explored but faced capital efficiency issues.

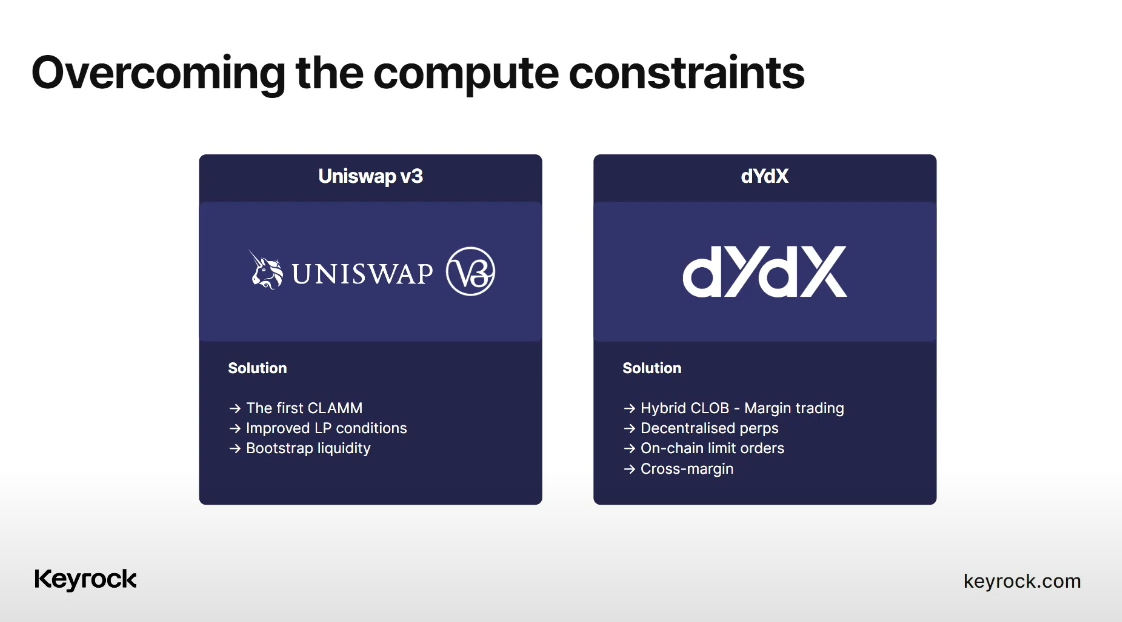

But there were breakthroughs in DeFi:

- Uniswap overcame compute constraints with V3, becoming the first successful protocol in this regard.

- Dydx introduced the concept of Hybrid books, moving to compute off-chain to solve efficiency problems.

These developments proved that building on-chain liquidity was possible, sparking further innovation.

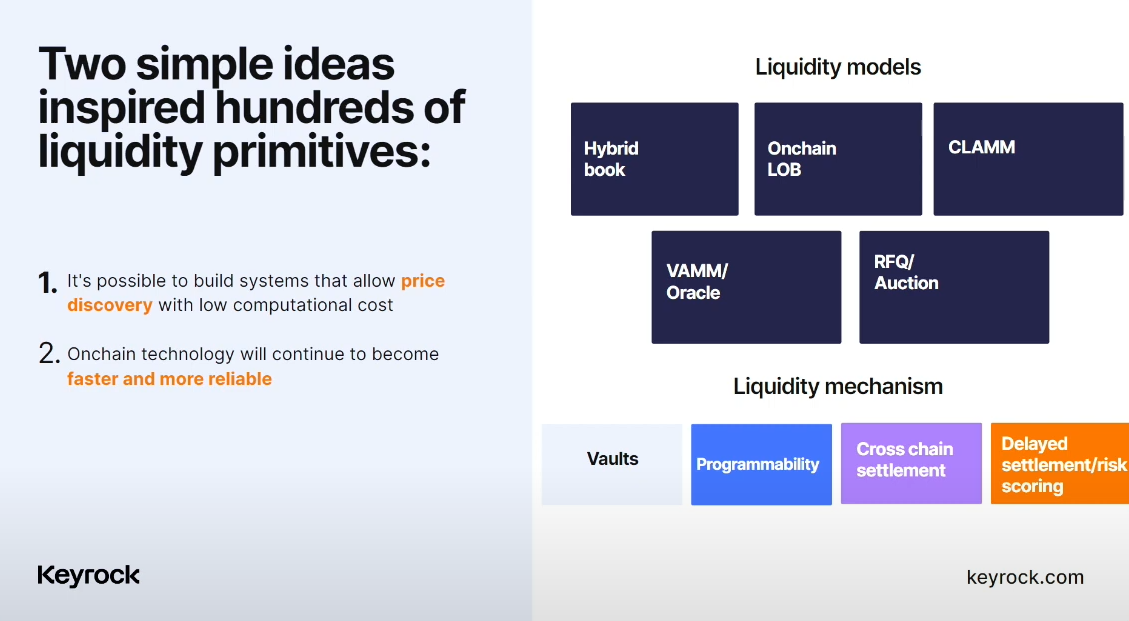

Founders began developing protocols focused on efficient price discovery and low computational cost.

Some builders anticipated improvements in blockchain speed and capacity, planning for more complex on-chain operations:

- Hybrid books and functional on-chain order books emerged.

- Concentrated liquidity AMMs were developed.

- Virtual AMMs were introduced, allowing trading based on external price feeds.

Protocols differentiated themselves through various features:

- Vaults to abstract complexity for users

- Integration of programmability, including within limit orders

- Cross-chain settlement technology

- Concepts of delayed settlement for improved capital efficiency

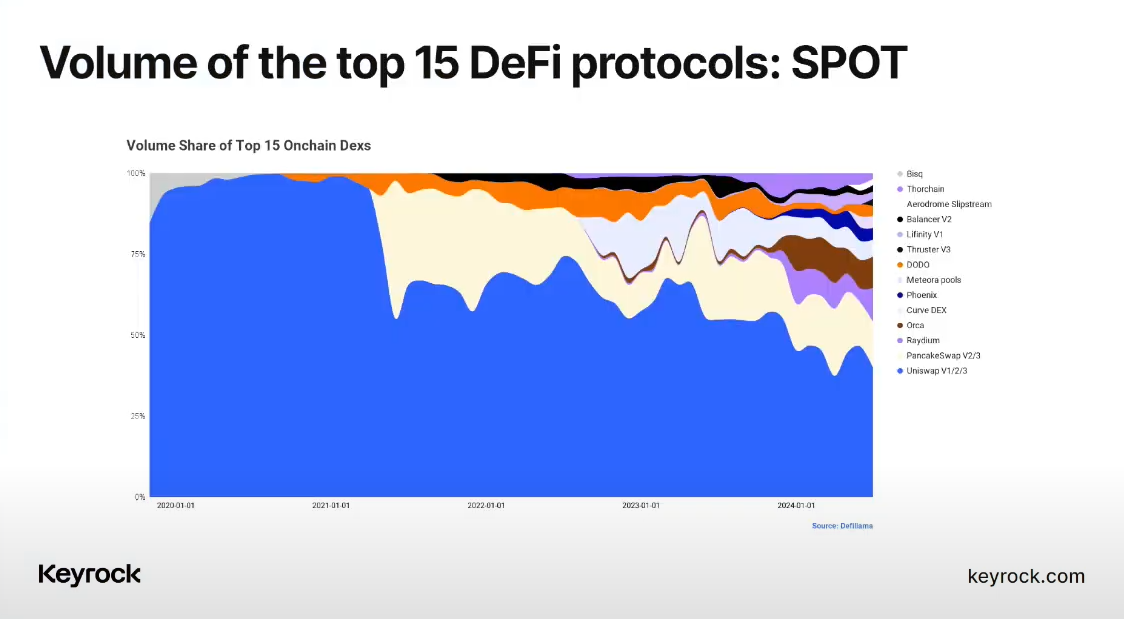

DEX Trends (27:40)

Spot swaps were initially dominated by Uniswap pools, and evolved to include more diverse competitors with similar approaches but slight differentiations

80-90% of liquidity in spot markets still executes against pools. Phoenix, an order book on Solana, is the highest-ranking non-pool option (at 6th place), likely due to Solana's lower computational costs

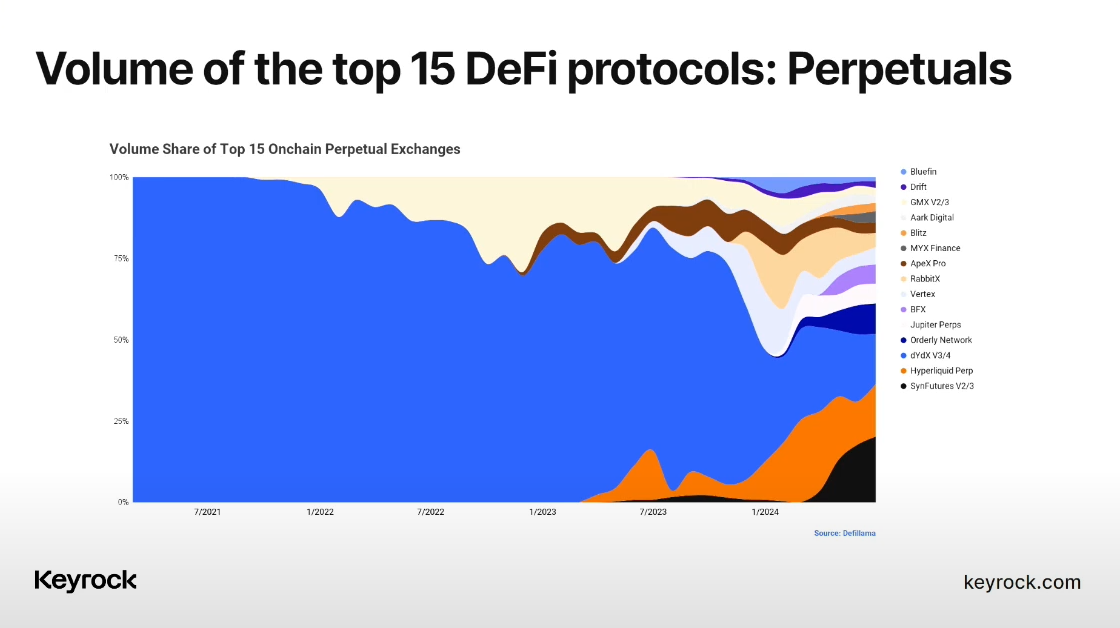

Perpetual (Perps) swaps trends are more complex and less straightforward than spot markets

It started with dYdX and lots of evolutions happened:

- Virtual AMMs (e.g., GMX) as computationally efficient alternatives to order books

- Full on-chain order books (e.g., Hyperliquid) emerging in early 2023 as blockchains became faster

- Cross-chain settlement layers (e.g., Orderly)

- Newer versions of VAE (Virtual Automated Market Maker) models (e.g., Aark)

- Intent-based trading platforms (e.g., Drift)

There is a greater diversity in models compared to spot markets. Order books seem to be the predominant model, but not conclusively superior:

- Pool-based models (without order books) appear able to compete on price quality

- Full on-chain order books are becoming competitive with centralized matching agents

Uniswap v3-like pools may not be effective for derivatives, e.g. Perpetual Protocol which implemented the Uniswap v3 model for perpetuals. It initially held about 20% market share and eventually went out of fashion.

That said, there are ongoing uncertainties. It's unclear if pool-based models can maintain long-term competitiveness with order books in perps, nor if full on-chain order books can consistently compete with centralized matching agents, though blockchain improvements are making this more feasible.

Anyway, both spot and perps markets show a trend towards increased diversity in liquidity models.

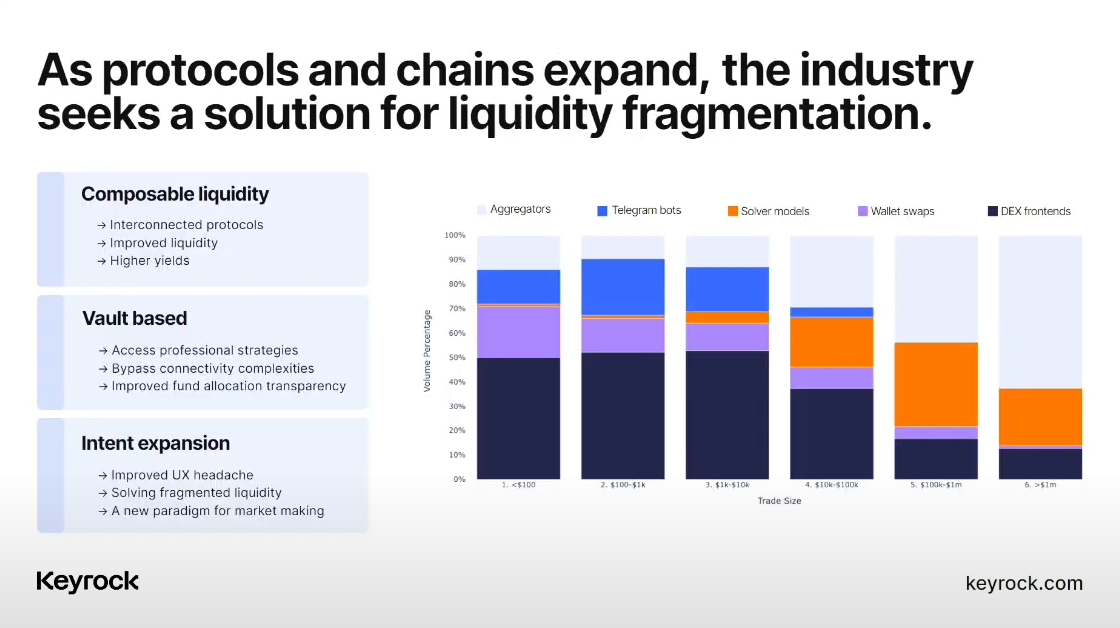

Liquidity fragmentation (31:15)

The proliferation of different liquidity models and blockchain networks has led to significant market fragmentation. This fragmentation is seen as a key challenge to be addressed in the next market cycle.

Three core primitives are expected to impact future development:

- Composability of Liquidity: Strong value proposition of virtual AMMs over traditional order books.

- Vault-based: Potential for order books to become composable through the use of vaults, and bypass complexities (example: Elixir protocol)

- Expansion of Intent-Based Trading: growing in importance, especially for larger trade sizes.

For smaller trade sizes ($1 to $10,000), direct trading on exchanges remains predominant.

For larger trade sizes, intent-based or solver-based trading accounts for a significant portion (30-40%) of volume.

Intent-based trading demonstrates the ability to compete on pricing, especially for larger trades where liquidity is harder to access.

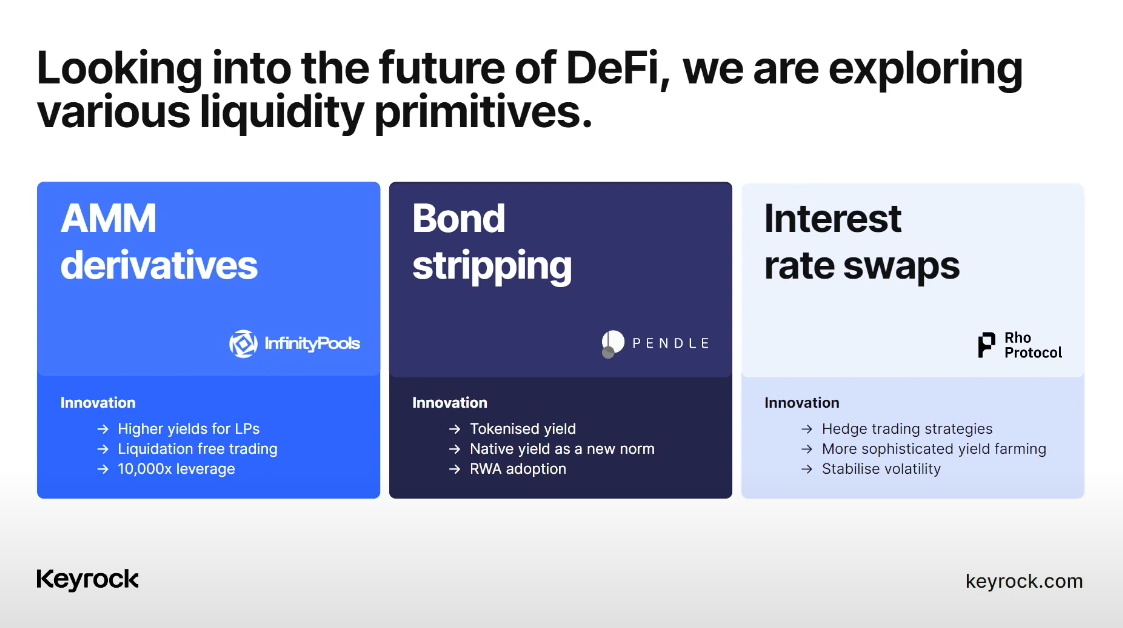

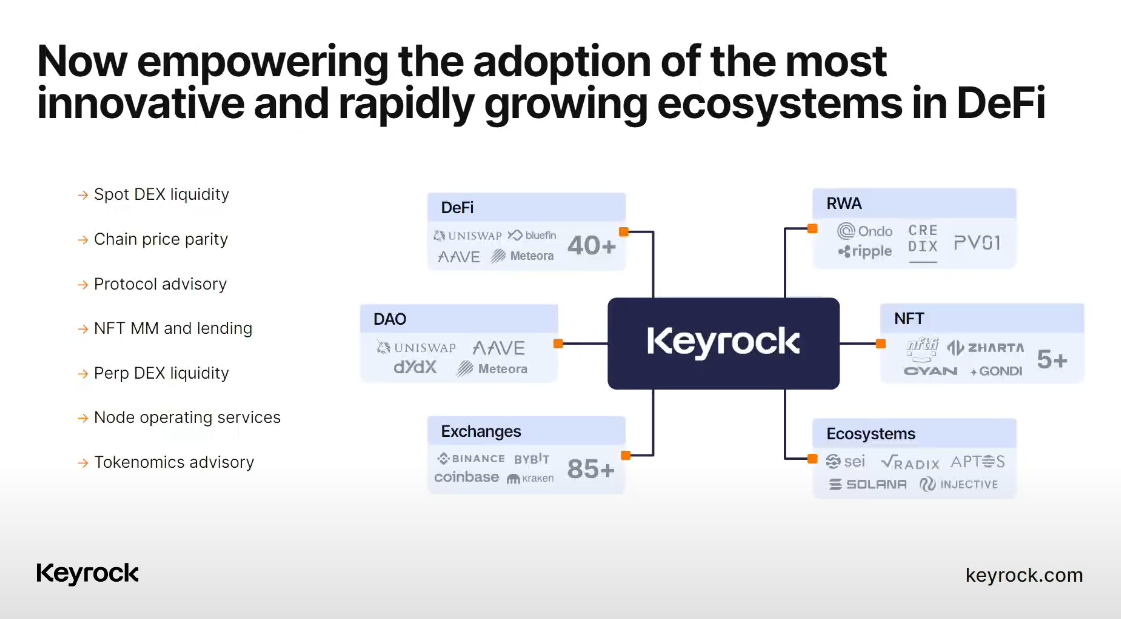

Keyrock is exploring various liquidity primitives:

AMM Derivatives

AMM Derivatives involve building derivative markets (perpetuals or options) on top of AMM liquidity positions

Examples of protocols working on this: Infinity Pools, Panoptic, Blackwing

Seen as potentially triggering great value for traders

Bond Stripping

Started with Pendle, but is considered to be in its early stages

Examples: Pendle, Spectra, Possum Portals

There is potential for significant value unlock when connected with real-world assets on-chain, and importance increases when combined with interest rate swaps

Interest Rate Swaps

Interest Rate swaps are seen as crucial for bringing traditional financial products on-chain. Rho Protocol is working in this field

Importance of Interest Rate Swaps in DeFi:

- Could enable more flexible borrowing options in protocols like Aave

- Potential to offer users a choice between variable and fixed rates for loans

- Crucial for stability, predictability of cash flows, and returns for on-chain native companies

Vision for DeFi's Future

- Emphasis on bringing traditional financial products (like mortgages) into the DeFi space

- Focus on providing more options and flexibility to users in lending and borrowing

- Keyrock believes in the necessity of on-chain interest rate markets for the maturation of the DeFi ecosystem

Questions & Answers (37:30)

What exactly is a solver model in the chart example?

The solver model refers to a type of UI for trading. It includes systems like MetaMask that source liquidity in the backend. MetaMask now uses AirSwap as a backend, which is resolver-based

Users might not know how liquidity is sourced when using these UIs. A subset of executions from various front-ends could be using intent-based approaches

Do you have any insights on the types of tokens trading on the Telegram bots? Are they all meme tokens or some high-value tokens?

Juan admitted to not knowing about this, as it's not an area where they are very active.

With L2s coming about, where do you see the evolution of spot liquidity? Do you see it moving more toward aggregation on L1?

The fragmentation of liquidity is a significant problem, especially on Ethereum. Increasing fragmentation across L2s may drive people away from liquidity pool provisioning (Uniswap style)

It's difficult to make money providing liquidity without sufficient fees (sometimes requiring 200-300% annualized returns)

Currently, providing liquidity outside of Arbitrum or Base is likely to result in losses

Given the adverse selection problem of AMMs plus fragmentation, where do you think it will go?

Juan likes the model of the Orderly Network, which uses a network approach with a settlement layer connected to an exchange.

This model allows users from various chains (including Solana and NEAR) to access the exchange

The central matching engine nets out most trades before bridging, reducing the amount of cross-chain transfers needed. This approach is seen as potentially addressing some of the fragmentation issues