DeFi : From Apps to Primitives

Source : https://www.youtube.com/watch?v=_cCwx5zaz1I

Once a user or a protocol has integrated with a particular blockchain or platform, it becomes more challenging and costly to switch to a different ecosystem.

In DeFi, a strong brand serves as a proxy for the longevity, security, and trustworthiness of an asset or protocol. If a DeFi protocol has been around for a long time, with a substantial amount of total value locked (TVL), it builds a strong brand that signals to users that it is likely safe and has not been exploited so far.

DeFi creates a self-reinforcing network effect. Just like in traditional markets, liquidity providers (LPs) on decentralized exchanges (DEXs) want to be present on the DEX with the highest trading volume, while traders want to use the DEX with the most LPs and liquidity.

Successful DeFi protocols should aim to "sink in the stack" meaning they should focus on becoming foundational infrastructure (DeFi infra) for their specific vertical, rather than remaining as standalone DeFi applications.

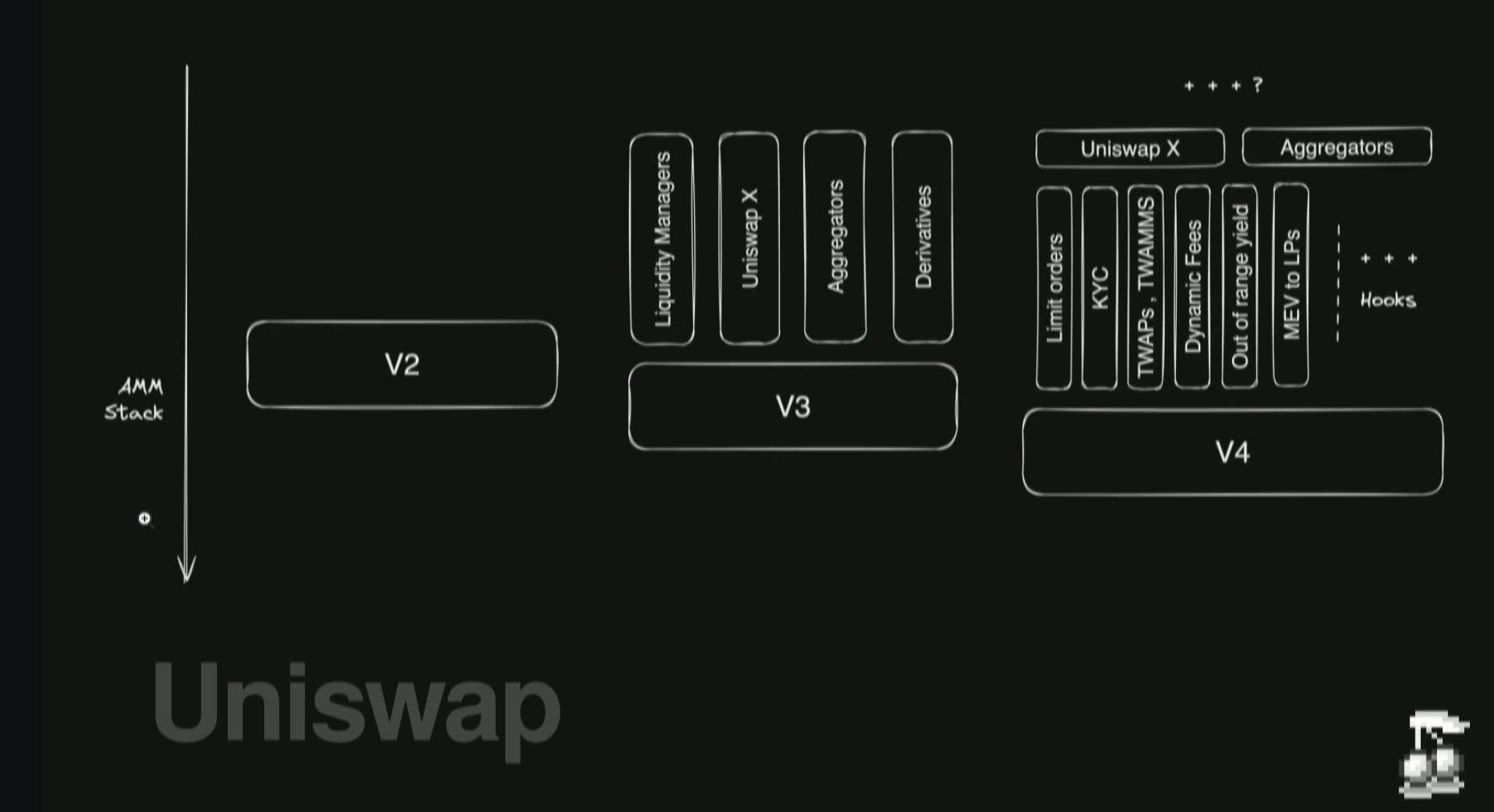

Uniswap (1:45)

Uniswap V2 was a relatively simple application primarily focused on providing liquidity pools for token swapping and yield farming.

With Uniswap V3, it has already started to move down the DeFi stack, becoming more of an infrastructure layer :

- Emergence of various protocols and projects built on top of Uniswap V3, such as liquidity managers (Arrakis, Kamino, Ichi...)

- Attempts to build derivative protocols that utilize the LP positions in Uniswap V3 as base assets

Uniswap V4 represents a significant step towards becoming a true DeFi infrastructure layer rather than just an application, especially with the "hooks"

The idea behind hooks is to enable developers and projects that previously would have built separate DEXes or DEX designs to instead contribute their ideas and innovations directly on top of Uniswap V4.

UniswapX, a separate intitative announced alongside Uniswap V4, will likely be a primary interface through which users interact with the underlying Uniswap V4 infrastructure.

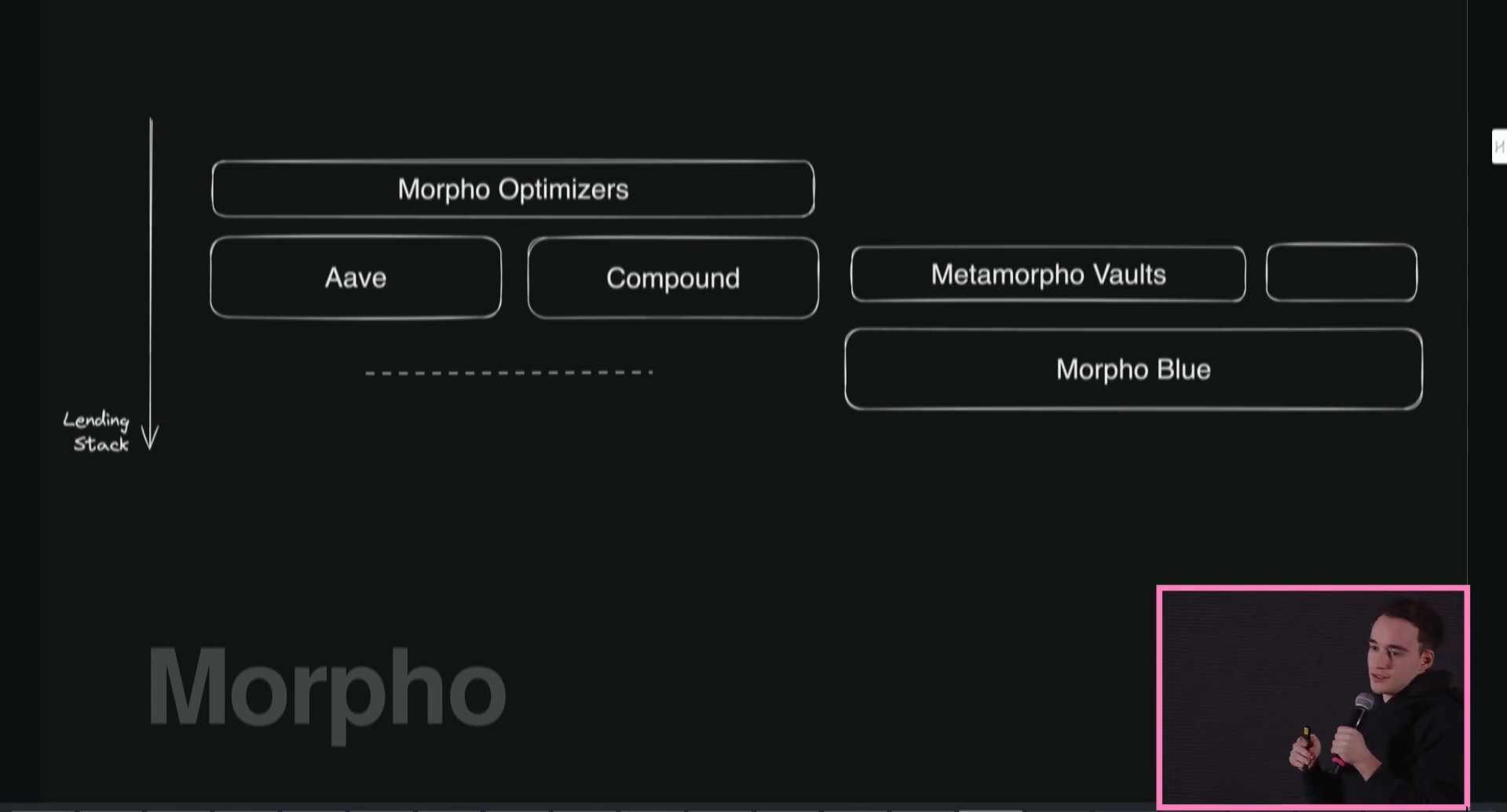

Morpho (4:10)

Initially, Morpho started as a simple application built on top of existing lending protocols like Aave and Compound.

However, as a standalone application, Morpho's growth and potential were inherently limited by the underlying protocols it was built upon, such as the total value locked (TVL) in Aave and Compound.

So they launched "Morpho Blue", which is designed to be a lending primitive, positioning itself at a lower level in the DeFi stack.

The key aspect of Morpho Blue is its simplicity, with a low number of code lines, making it easier for other developers and projects to build upon.

By positioning Morpho Blue as a lending primitive, Morpho aims to become a crucial infrastructure layer within the lending ecosystem, enabling other projects and developers to easily create and customize lending markets and applications on top of it.

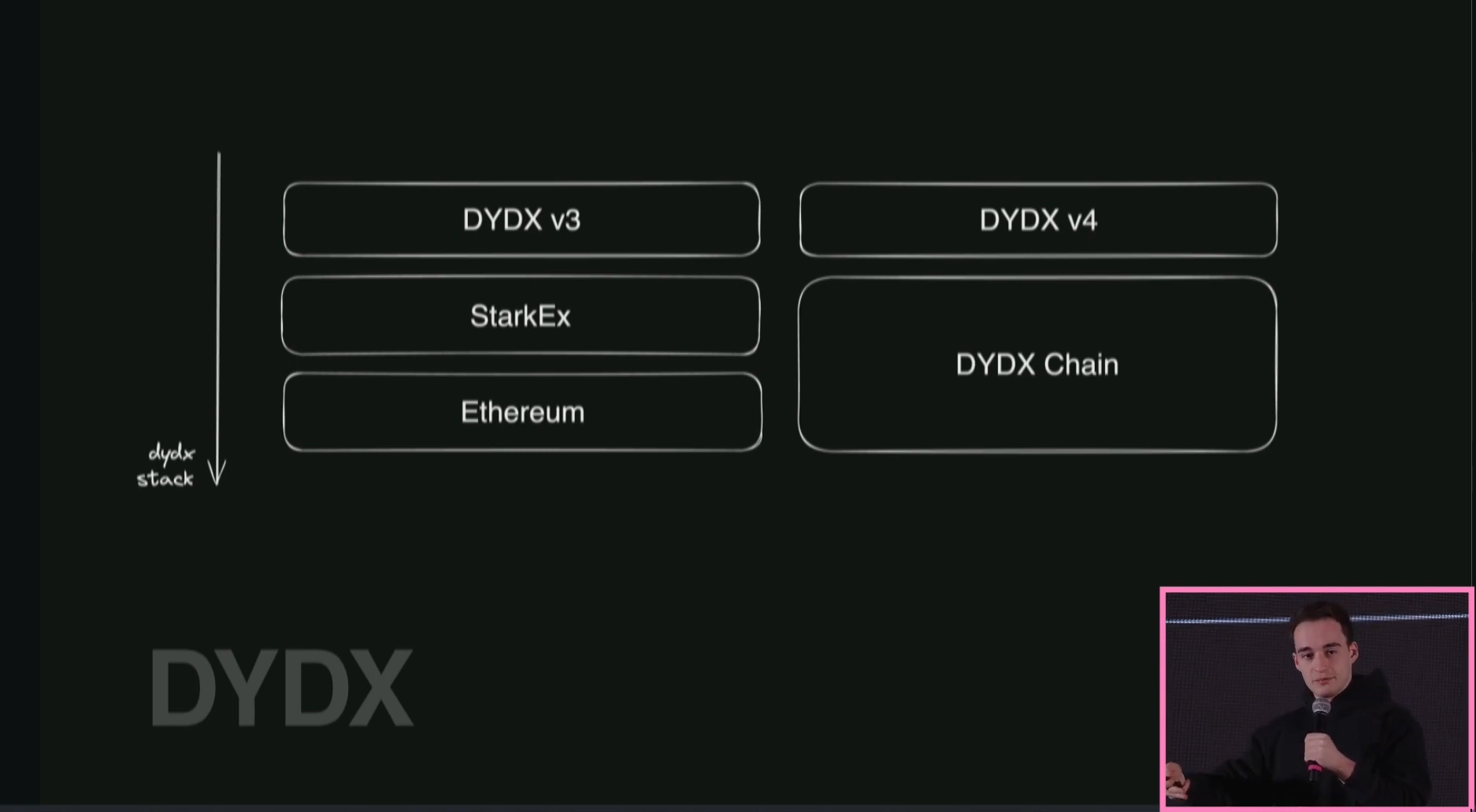

dYdX (5:40)

dYdX v3 was built on top of StarkWare's StarkEx Layer 2 solution, which itself runs on the Ethereum blockchain.

While dYdX v3 was a successful product built on this Layer 2 infrastructure, the team behind dYdX recognized the potential benefits of having its own technology stack. As a result, dYdX V4 has been launched on its own blockchain called the dYdX Chain for several resons :

- Control the entire technology stack, from the infrastructure to the applications.

- Value Capture, as they can get revenues from the protocol and Maximal Extractable Value (MEV)

- Reduce dependancies on external infrastructure platforms

Some other examples (6:45)

Maker, Synthetix, Lido and others are following the same trajectory as the protocole mentionned above.

They are transitioning from being standalone applications to becoming more foundational infrastructure layers within their respective domains.

Sink in the stack (7:10)

Two primary reasons why successful protocols are transitioning from applications to infrastructure :

- Moat Building. Having other projects and applications built on top of their infrastructure makes it harder for competitors to displace them, similar to how traditional businesses benefit from strong network effects and ecosystem lock-in.

- Value Capture. Protocols that position themselves as foundational infrastructure layers are able to capture more value within the ecosystem. This aligns with the "fat protocol" thesis, which suggests that lower-level protocols and infrastructures tend to be valued higher by the market compared to applications built on top of them

Throughout the presentation, we've seen 3 different ways to "Sink in the Stack" :

- Gradual Evolution with Uniswap : evolve from a simple decentralized exchange (DEX) application (V2) to becoming a more composable and extensible infrastructure layer (V3 and V4)

- Vertical Integration with Morpho : Morpho started as an application built on top of existing lending protocols like Aave and Compound, and the roles are reversed with Morpho blue

- Full Stack Ownership with dYdX : dYdX transitioned from being a DEX built on StarkEx to launching its own blockchain, allowing it to capture value and control the entire technology stack from the application layer down to the blockchain infrastructure.

To summarize, "sinking into the stack" is a strategic imperative for DeFi protocols to build sustainable competitive advantages and maximize value capture within the rapidly evolving DeFi ecosystem.