Decentralized stablecoins frens

Source : https://www.youtube.com/watch?v=TFruMoKRk3A

The DeFi collective

Introduction (3:00)

Tokenbrice has been involved in DeFi for around 5-6 years. He's known for his blog with deep dives into DeFi protocols

Maximizing decentralization and resilience in DeFi protocols is important, as it creates an ethically superior and transparent finance system compared to traditional finance

So he teamed up with other convinced people to launch the DeFi Collective in October 2023 :

- A Swiss nonprofit association

- Core expertise is liquidity management

- Uses its own on-chain assets to deploy into resilient protocols

- Supports growth of resilient protocols mostly for liquidity but also through other means

"We use DeFi to better DeFi" TDC

Decentralized front-ends (7:00)

98% of users use a frontend to interact with DeFi protocols. The thing is, frontends can be attacked by hackers or shut down because of censorship

So TDC plans to create an app allowing users to use a local frontend to solve those problems.

Brice acknowledges it's taking longer than hoped, but remains a priority.

Need for people to promote genuine DeFi (8:30)

Fully decentralized protocols need assistance to grow and gain wide adoption, so DeFi Collective expands into verticals like liquidity management, front-end hosting, incentive distribution, triggering contract functions

The objective is to provide these supporting services without relying on the protocol teams

But the decentralized magic doesn't happen automatically, people are needed to facilitate it. Fortunaltely, team is getting bigger as the collective expands

The protocol guidelines (10:00)

TDC provided a standardized evaluation of a protocol's decentralization level, as this is currently lacking in the industry beyond tech audits or specific reviews. There are 3 tiers of decentralization :

- Genuine DeFi (top tier) - Truly decentralized protocol

- Monitoring - Some centralization vectors, but credible strategy to decentralize

- On-Chain CeFi - Centralization vectors with no real decentralization strategy

Protocol reviews are coming up to put the guidelines into practice and explain why a protocol qualifies for a given decentralization tier

95% of the review is purely technical, but there is also a review about ethics/behaviors like transparency

There will be updates for guidelines :

- Considering separate technical and "mindset/impact" guidelines

- Technical review focuses on decentralization vectors

Protocols evaluations (14:00)

TDC is targeting a bandwidth of 2-3 protocol evaluations per month, starting with protocols already being supported by the Collective

A long-term goal is for the evaluation process to eventually spin-off into an independent entity funded/supported by DeFi Collective :

- There is currently a lack of comprehensive, user-friendly decentralization analysis in the industry

- Audits review code but require context to serve as real indicators

- Making evaluation reports public serves an educational purpose, countering "YouTube gurus", but public evaluation is more of a side effect and not the primary purpose

Systemic vs peripheral features (18:30)

Systemic features are the Core protocol functions (swapping for a DEX, lend/borrow for a money market). Features deemed "systemic" will have zero tolerance for centralization

"Peripheral" functions may allow some controlled centralization vectors. Example: DEX swapping/LP is systemic, rewards are peripheral

TDC's growth (20:00)

TDC started in October 2023 with $1.3 million donated by 6 "chads" with no strings attached (Liquity, Maverick, Polygon Labs, Blueprint, Redacted Cartel, Diva)

All the protocols described above areactually supporting the Collective

Assets have grown to around $4 million through DeFi strategies mainly oriented about stablecoins. Growth occurred despite recent market downturn

This is a nonprofit structure with no compensation requirements from supported protocols. Therefore, resources are not infinite, so need to prioritize the most decentralized projects

Selecting a crypto-friendly jurisdiction (22:30)

TDC is based in Zug, Switzerland, after researching different jurisdictions. Switzerland has been chosen for providing most legal/tax answers for TDC's DeFi activities

TDC has Swiss legal experts board to navigate laws and ensure compliance. The first fiscal year ending in December 2024 and will provide more clarity

- Transparency about paying taxes despite non-profit model

- Founding donations from respected DeFi projects/entities

fETH/LUSD launch

fETH/LUSD pool launch on Velodrome (27:30)

LUSD from Liquity v1 is seen as one of the most decentralized stablecoins and will likely be used as benchmark by DeFi Collective's guidelines

On the other side, fETH from f(x) Protocol is seen as the most "ETH native" stablecoin. Although it maintains 10% exposure to ETH volatility, it is more stable long-term than most fiat currencies

To support the two decentralized stablecoins, there will be a Velodrome pool dedicated to fETH/LUSD.

Why Velodrome ?(29:30)

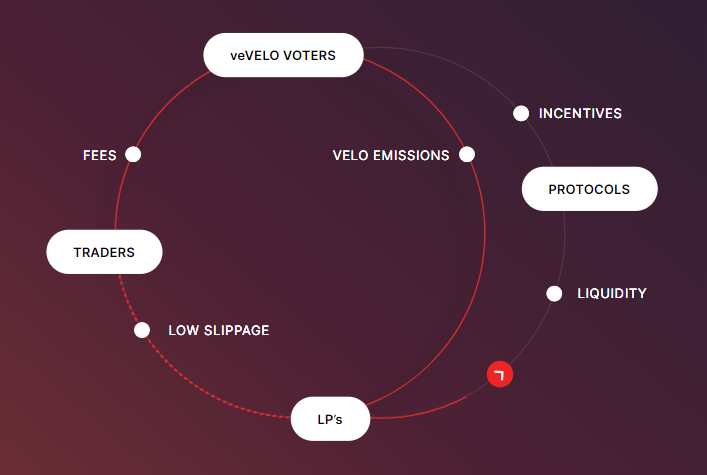

Velodrome was chosen because it has an interesting dynamic, thanks to the gauge voting mechanism inspired by Curve :

- veVELO token holders can vote to allocate emissions to pools

- Liquidity providers are rewarded in VELO emissions

- Liquidity pools' revenues (fees + incentives) are distributed to their voters

This allows projects to sustainably incentivize their pools cost-effectively

Furthermore, they added concentrated liquidity pools with "Slipstream" which are beneficial for "loosely-pegged tokens" like fETH, as we can put wider ticks to accommodate volatility

The Concentrated Liquidity (CL) feature (35:00)

We can use diffrent "CL" levels to define tick spacing/concentration. This is similar to Uniswap V3 for providing liquidity in ranges :

- CL1 is for tight pegs like stablecoins

- Higher CL numbers like CL50 have wider ticks, suitable for more volatile assets

Displayed APRs (37:30)

When providing liquidity on Velodrome, APRs represent emissions rewards, not trading fees (Trading fees APRs are for veVELO voters). That said, they can appear very high as emissions are paid per liquidity tick

We can choose to get fees directly with votes without knowing how much we will get, or we can get a more predictable revenue in VELO by providing liquidity.

The yield strategy (40:30)

LPs need to consider fETH's volatility exposure when setting concentration ranges. Wider ranges reduce impermanent loss risk but lower potential emissions rewards

Early on, there may not be arbitrage keeping fETH pegged, allowing very high yields.

Liquity V2

Liquity v2 (43:00)

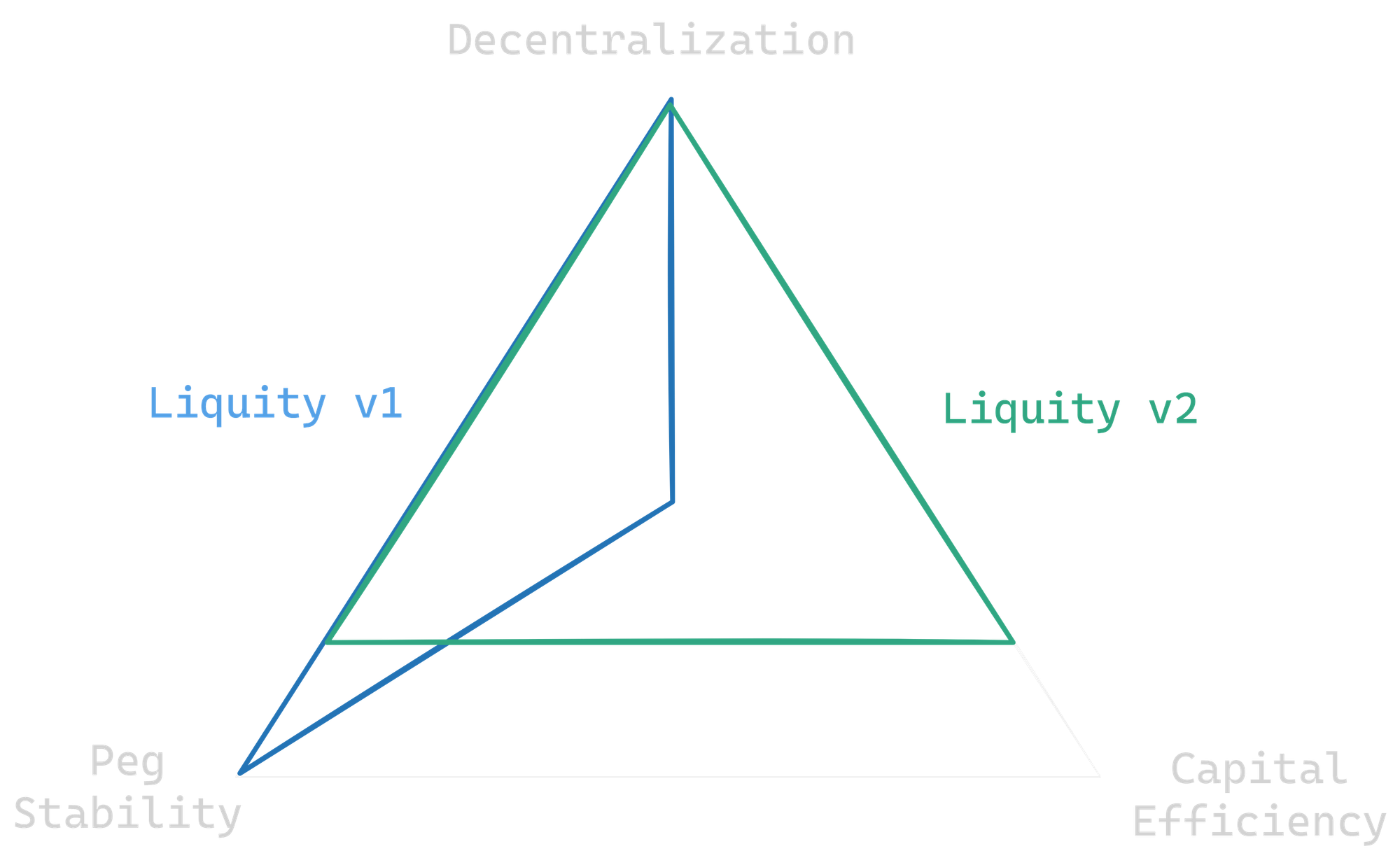

Liquity V2 is scheduled for Q3 2024. The issued stablecoin will be called "BOLD" with a new contract address, and no direct impact on existing LUSD pools

Liquity V2's goal is to provide an alternative stablecoin option, backed by Liquid staking tokens. It allows different risk profiles compared to ETH-backed original LUSD

User-set interest rates (44:30)

In Liquity V2, users must choose the interest rates they pay to issue BOLD, and users with the lowest interest rates are redeemed

There will be a concept of delegating interest rate selection to specialized entities. TDC will be one of them, positioning as a conservative delegatee (higher interest rates for minimum redeem risk)

Cyrille thinks this could enable new strategies/services, but also introduce MEV extraction. Brice isn't sure there will be MEV extraction, but it is very likely that delegatees charge a "service fee".

In Liquity V1, MEV extraction is possible as redeeming users take money from the least collateralized troves when LUSD is underpegged

But it is still unclear if rate adjustments are instantaneous or have a delay. We need technical details about timing of rate adjustments.

f(x) Protocol

fETH > USD > EUR (53:00)

Although fETH is relatively new, Cyrille mentions that fETH handles inflation better than strict USD-pegged stablecoins

- For European users, fETH's volatility is lower than USD volatility against the Euro. That makes fETH more convenient as a stablecoin for Euro-based expenditures

- It has value accrual over time. fETH's price has increased from around $1.05 to $1.06 since launch

The team behind f(x) Protocol (56:30)

The team is AladdinDAO, which have already built Concentrator and CLever before :

- Concentrator, a yield aggregator allowing compounding into other yield-bearing tokens

- Clever, which provides liquidation-free leverage on CVX tokens from Convex. There's a protocol built upon CLever called "Asymmetry", automating the CLever leverage and yield compounding process

Those projects were built for the Curve ecosystem, but f(x) Protocol is for a wider audience.

The core team is pseudonymous and has been working together for a couple of years. Users are encouraged to do their own research and read the documentation to learn more about the team and their work.

The ALD Token (1:03:30)

ALD is AladdinDAO's native token :

- AladdinDAO owns 30% of all their protocol tokens (Concentrator, CLever, f(x))

- Maximum supply of ALD was supposed to be 1 billion tokens. Recently, a proposal passed to reduce the supply to around 150 million tokens, which is the current circulating supply.

- Currently, ALD does not receive any revenue from the underlying protocol tokens.

There is a suggestion about creating a dashboard to show AladdinDAO's holdings.

There are discussions within the DAO about creating a new version of ALD with specific revenue-sharing mechanics. However, nothing has been finalized yet

DAdvisoor advises people interested in Aladdin DAO to participate in the community