Creating a DeFi native reference rate (Liquity at EthCC)

Source: https://www.youtube.com/watch?v=6v1dKVb0LL8

Key takeaways:

- Not everyone in DeFi needs to pay the same rates

- Liquity V2 is "actually DeFi"

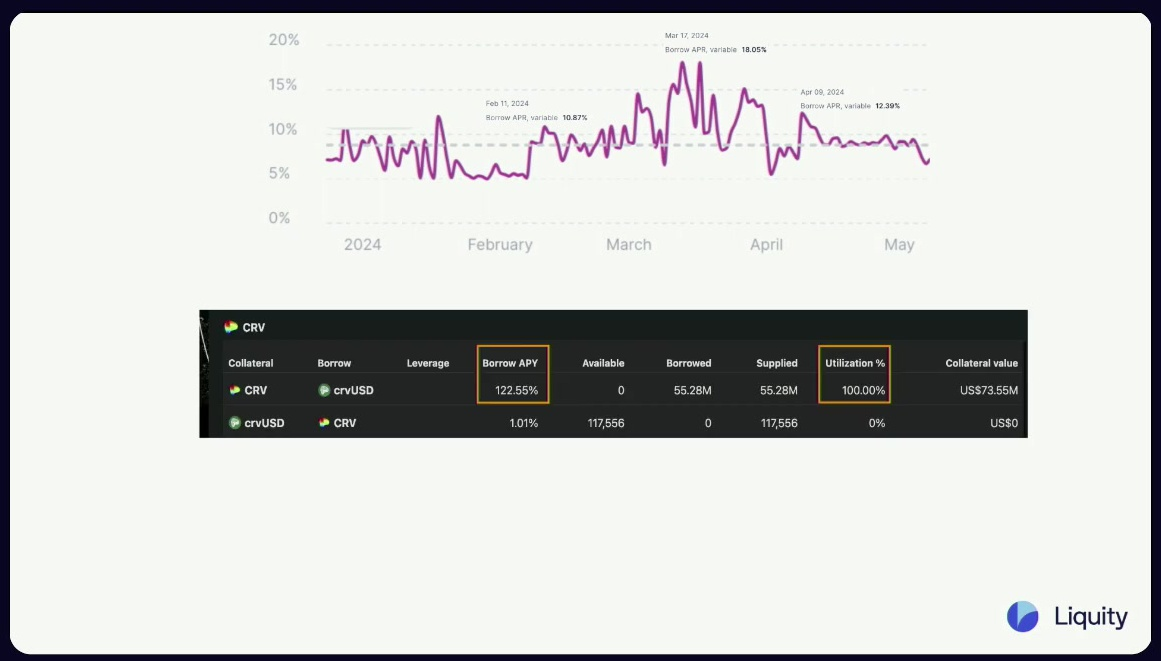

DeFi rates are unpredictable

Rates on money markets can be volatile and one-size-fits-all. Most of the time, interest rates depend on the utilization rate (borrowed tokens / lent tokens), meaning that a sudden change in utilization rate causes a sudden change in interest rates.

When utilization is high, lenders can get stuck and unable to withdraw their collateral.

Lenders on money markets receive less than what borrowers pay. In a protocol where liquidity is mutualized, even if borrowers are far fewer, they must pay all lenders.

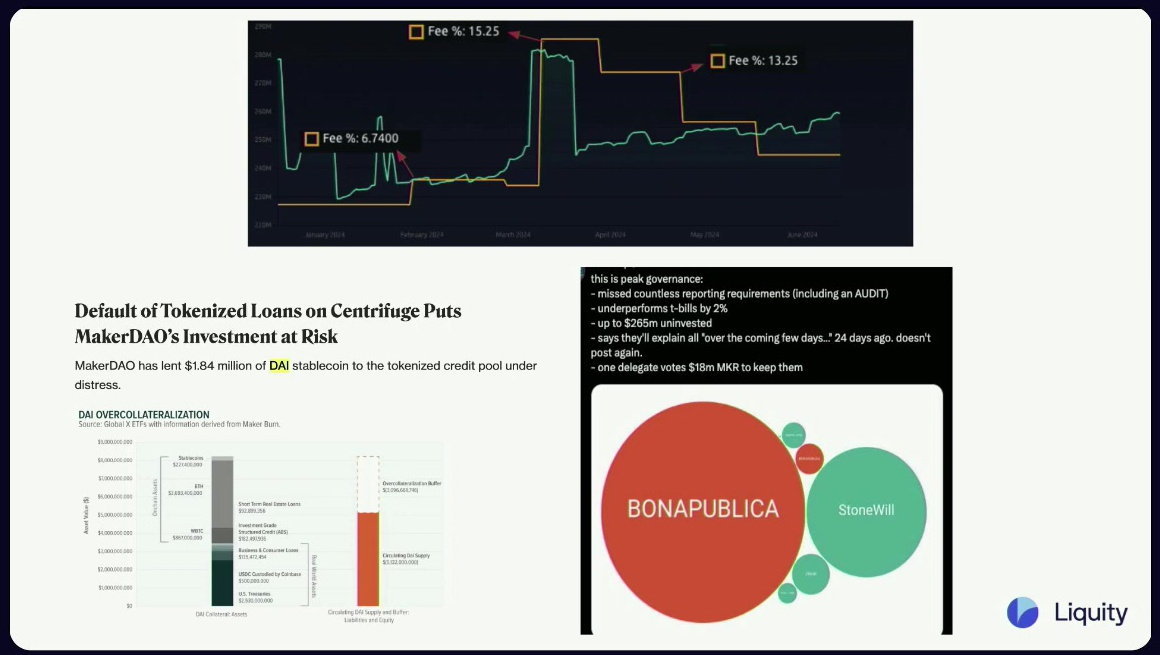

Stablecoin holders in CDPs face collateral changes and governance risks:

- Governance has a lag time to change interest rates

- Governance can change eligible collaterals, and potentially put risky assets

- Governance can contain apathetic players

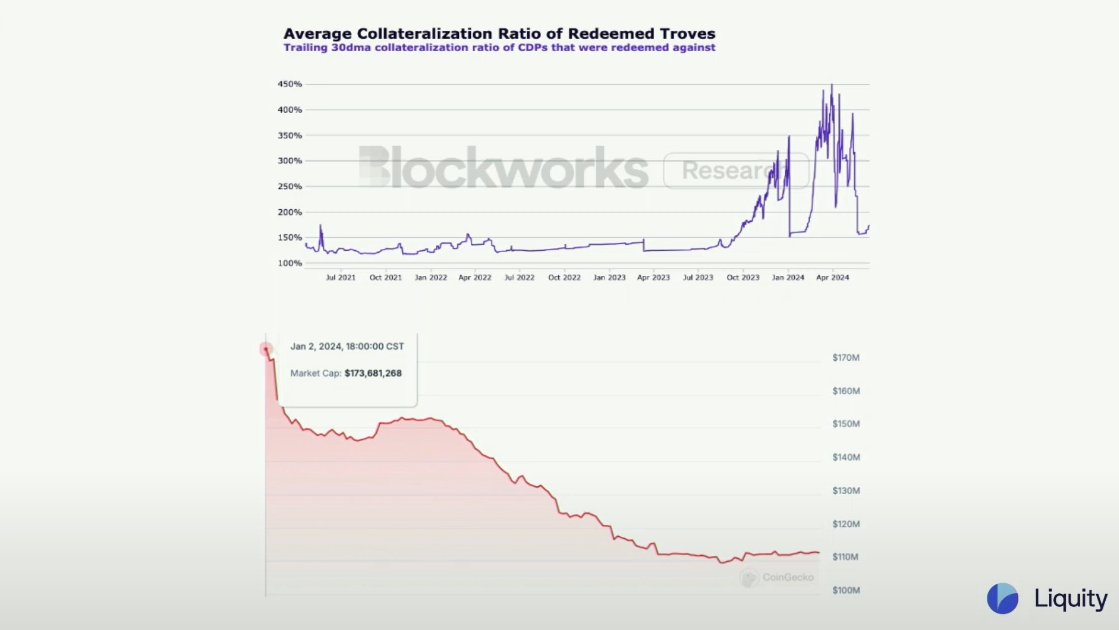

Fixed-rate borrowing models have issues. Liquity V1 had a one-time fee to mint LUSD. But one-time fees are expensive for short-term borrowing, and not adaptive to changing market environments (e.g. rising interest rates)

We have to create an efficient interest rate market between borrowers and stablecoin holders.

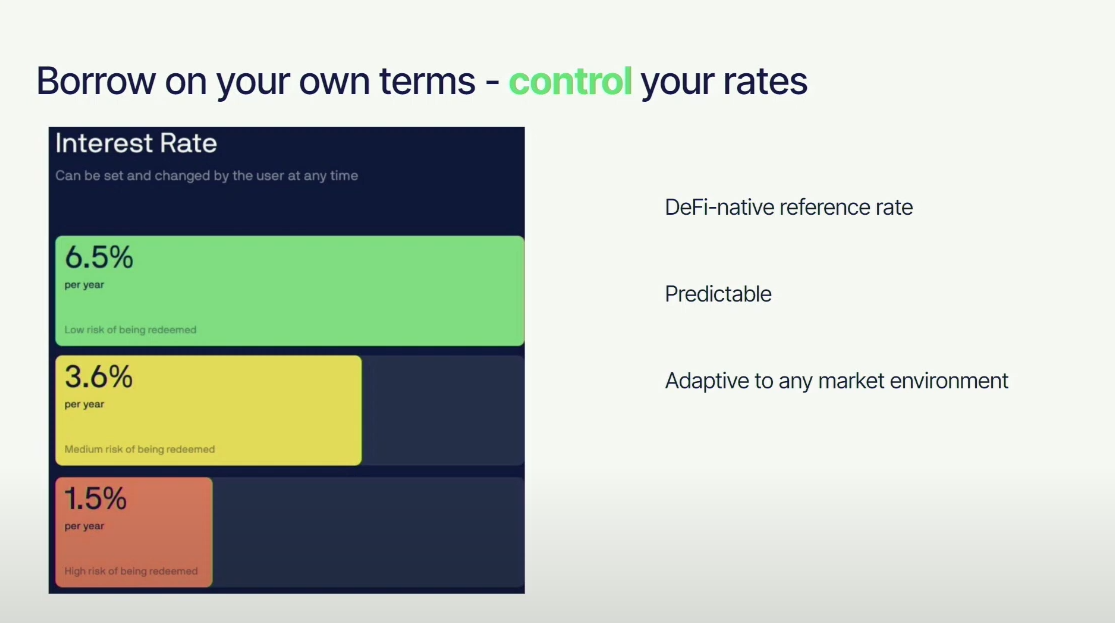

Liquity's solution: user-set interest rates (3:30)

In Liquity V2, borrowers can adjust their rates at any time to adapt to market conditions, so it works in both low and high-interest-rate environments

Liquity V2 is a market-driven approach, not reliant on algorithms or governance. Borrowers can control and customize their interest rates based on their risk profile and time horizon

It provides a more proactive vs. reactive environment for borrowers and may lead to convergence of borrowing rates across DeFi protocols, meaning that Liquity V2 serves as a DeFi-native benchmark rate for borrowing against ETH.

Liquity V2 mechanisms (5:30)

- Stablecoin holders can deposit their BOLD in the stability pool to earn yield from the interest paid by borrowers

- A portion of the interest rate paid by borrowers will be used to provide liquidity for BOLD (always liquidity available for swapping in and out of BOLD)

- Liquity V2 will only have ETH and LST as collateral

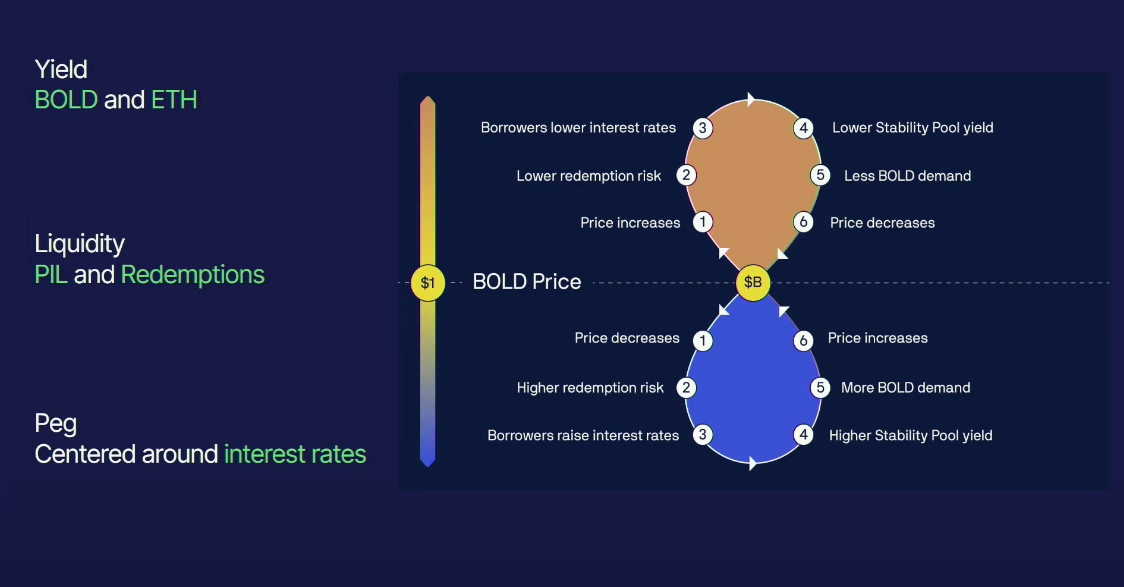

- When BOLD trades above $1, borrowers will reduce rates to make borrowing more attractive than holding BOLD. Below $1, borrowers will increase rates, providing higher yield to stablecoin holders

- Maximum control: we can set our interest rates and be a maker rather than a taker

- Market-driven: no intermediaries, this is only the supply and demand at work

- Sustainable: borrowers will benefit from predictable costs, costs that they set, while yield generation for the stablecoin holders will come from the interest fees that the borrowers will pay

- True DeFi: immutable smart contracts, decentralized front-ends, peg protected by the users themselves

Questions & answers (10:45)

What happens to the protocol fees in Liquity V2?

All the protocol fees (i.e., the interest rates paid by borrowers) will go to the users, Liquity V2 has no treasury

The goal is for the stablecoin holders to receive the vast majority of the protocol revenue to help the stablecoin thrive.

How is redemption calculated in Liquity V2?

Redemption is based solely on the interest rate of the trove, not the LTV.

Troves with the lowest interest rates will be redeemed first. LTV only matters for liquidations.

How will the protocol allocate revenue toward liquidity and the stability pool?

The majority (70%) of the revenue will go towards the stability pool for safety.

The remaining revenue will go towards growing protocol-incentivized liquidity, but the specific mechanics are still being decided.

What is the difference between LUSD and BOLD (the new Liquity V2 stablecoin)?

LUSD is the stablecoin for Liquity V1, while BOLD is the new stablecoin for Liquity V2.

Liquity V2 has a different fee structure (user-set interest rates) compared to Liquity V1 (fixed one-time fees). Liquity V2 will accept ETH and multiple LSTs as collateral, unlike Liquity V1 which only accepted ETH.

If the BOLD stablecoin is under-pegged, how can borrowers manage their interest rates?

If BOLD trades below $1, borrowers can increase their interest rates to earn higher yields for stablecoin holders.

This is a hybrid approach between Aave's model and Liquity V1's redemption mechanism. Borrowers cannot avoid redemption by adding more collateral, as in Liquity V1, but must adjust their interest rates.