Chat with Possum Labs

Source : https://twitter.com/i/spaces/1lPKqbdbXDnGb

Introduction

The DeFi Collective (TDC) is a nonprofit association incorporated in Switzerland. They provide support to resilient, trustless and transparent DeFi protocols. Their catchphrase is "DeFi to better DeFi"

The Collective has released protocol guidelines to analyze and evaluate different dimensions of protocol implementations.

They will be conducting in-depth protocol reviews to explicitly show how protocols match their guidelines.

TDC is described as a "political party for DeFi that walks the talk" :

- They advocate for and promote maximally decentralized DeFi

- They control assets (currently $3.5 million) and deploy them transparently into protocols that match their guidelines, mostly for liquidity but also through other means.

- They support decentralized protocols spontaneously without asking for compensation.

What is decentralization ? (10:20)

Decentralization means having no single point of failure, with many parties involved in the protocol or an autonomous protocol that doesn't require maintenance.

A key benefit of decentralization is censorship resistance, where no single entity (founders, government, corporation, wealthy individual) can interfere with or control the protocol.

Decentralization and censorship resistance are closely linked, as achieving maximal censorship resistance requires embracing decentralization.

Building immutable code is an important aspect of decentralization in practice.

TDC has guidelines on their website that specify the methodology for analyzing the degree of decentralization, considering factors like :

- The base layer (e.g., Ethereum, Optimism)

- Protocol's dependencies

- Protocol's practices

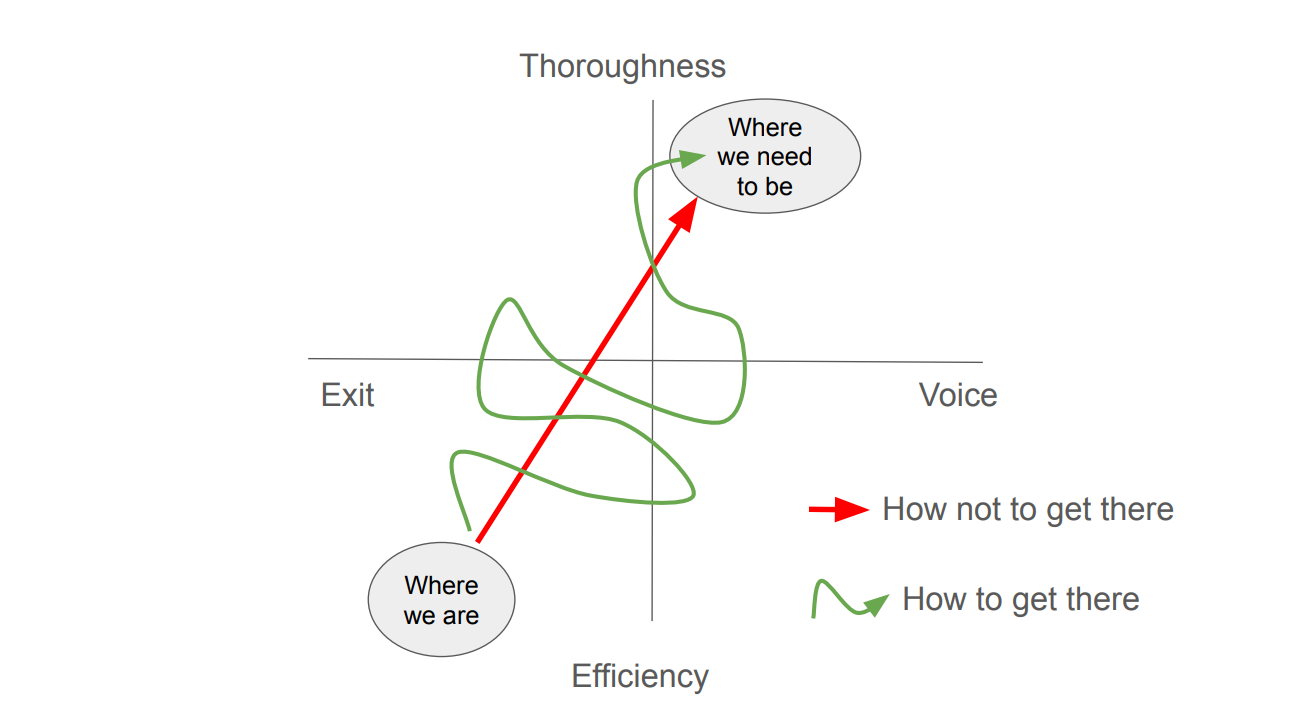

Decentralization is a specter (13:20)

Decentralization has different shades/levels :

- Highly centralized or ethically dubious projects sometimes gain more attention and adoption

- More responsible and resilient projects with decentralization often have less awareness initially

Centralization often correlates with wider awareness/adoption, so it's a tough challenge to achieve the right level of decentralization

Possum Labs is 100% bootstrapped and community-owned (no private sales or VC backing :

😇 Allows wide community involvement and focuses on building for users

👿 Slower growth and scaling compared to VC-backed projects

The "Positive Sum" DeFi (18:00)

Positive Sum DeFi means enabling free trade without intermediaries. Traditional finance has many intermediaries that extract value and distort pricing, whereas Positive Sum DeFi removes third parties that want to extract value without contributing.

In free trade, both parties gain subjective value/profit from any intermediary. That intermediary can be centralized (exchange) or technical (liquidity pool, front-end...)

That's why Uniswap can't be considered as Positive Sum DeFi anymore. Uniswap started with no fees and open-source, aligning with DeFi principles. Now that it introduced frontend fees with UniswapX, it creates potential value destruction

It moves DeFi closer to traditional business models, which is a disservice to blockchain, as it has the potential to create free trades for any financial service.

Balancing needs and ideals (24:15)

Positive sum DeFi aligns with the idea of not having any privileged access, both technically (e.g., no admin keys) and at the token distribution level (e.g., no pre-sales at discounted prices)

But there are practical limits :

- Some centralization is needed initially to steer the project, but should be minimized over time

- While ideally tokens could be distributed fairly, this severely limits growth potential for projects needing capital. On the other hand, projects need a treasury for growth, but it becomes a point of failure/centralization over time

Possum Labs' approach to decentralization is to have no private token sales, fixed token supply, core token on Ethereum. The goal is to decentralize token holdings, be across multiple chains, and get rid of the project treasury to achieve maximum decentralization

The Collective can act as an external, decentralized treasury for protocols. It mutualizes resources (financial, operational, etc.) across multiple projects, avoiding centralization risks

The end state vision :

- For protocols : Achieving maximum decentralization by getting rid of internal treasuries

- For the Collective : Providing shared, decentralized resources for multiple protocols' operational needs

Possum's path to decentralization (31:25)

The immutable, non-value extractive smart contracts will create a strong network effect

If we cannot get rid of our tokens, we will just send it to you

Possum (31:30)

A highly successful treasury could become too centralized. That's why they want to get rid of the project's internal treasury.

The solution would be to incentivize an independent ecosystem. After establishing the base protocols, they want sufficient incentives for others to build on top, and projects building on top can have their own tokens/business models.

This strategy has several advantages :

- Keep the base layer credibly neutral and reliable

- Aiming for a network effect to attract talent and projects

About Portals (34:15)

Portals provide upfront yield/yield acceleration

- Instead of accruing yield over time, users get the yield upfront by staking capital in Portals

- Portals then stakes the capital in underlying yield protocols

Upfront yield is paid out in PSM tokens, and it ties into establishing PSM as the ecosystem currency, deeply integrated into products

Value accrual mechanism :

- Instead of extracting fees (equity model), PSM accrues value as a currency

- Yield generated from staked capital is used to buy back PSM tokens

- Creating a circular loop to sustain the system perpetually

Current and upcoming Portals :

- First Portal live on HMX's HLP pool (basically like GLP from GMX)

- New Portals coming soon for USDC, ETH, WBTC, ARB, LINK on Vaultka lending

- Initial boosted yields around 30% APR, rebalancing to Vaultka's rates over time

Portals initially offers premium yields by leveraging PSM token, but long-term aligns with sustainable yields from partner lending protocols

The partnership between TDC and Possum Labs (40:30)

Providing liquidity for the POSM token :

- PSM/LUSD pool on Ramses DEX with ~$60k (half donated by Possum, half from Collective)

- Allocating 20-25% of Collective's ~9M veRAM position to support the pool

- Liquidity is vitally important for Possum's products to onboard more users

Increasing visibility and awareness

- Working to get the PSM/LUSD pool listed on data aggregators like CoinGecko

- Helping facilitate a stronger launch for Possum's new multi-asset Portals

Signaling trust and security

- Undergoing top-tier audits like Hacken to assure users of protocol security

- As an immutable system, strong security reviews are crucial with no emergency interventions possible

Proving bootstrapped community-driven model

- No private investors, want to demonstrate ability to deliver value as a community-owned project

- Establishing culture and principles like immutability through product releases

There were suggestions from Collective on further support like decentralized frontends. For now, the focus is on building usable core products, but aim to tackle decentralization aspects over time

Being censorship-resistant to be fair (48:40)

Being immutable allows to prevent any external parties from forcing changes or shutdowns. By this way, Possum Labs purposely cannot make changes themselves, even under pressure

Current finance is deeply intertwined with geopolitics and power dynamics. DeFi protocols without privileged access can prevent dominant agendas being imposed. This could lead to a more equitable financial system if widely adopted

Future of Finance (53:30)

We just can't predict DeFi innovation and adoption. For example, Liquid Staking protocols are defying initial expectations

Instead of predictions, we should focus efforts on steering DeFi towards a sustainable, fair, and resilient path. If we want to see a future, we have to build it

In any case, DeFi is an experiment without guaranteed results. Outcomes cannot be assured, but efforts must be made to drive it in the right direction

The problem is, there is no "perfect" direction, so we need more builders to explore as much directions as possible. The more philosophically-aligned builders, the better

The biggest threats to DeFi (57:40)

The United States government, because they have the most resources and power, so they have the most to lose from DeFi's growth. They used the financial system as a means of oppression and control over countries historically, and they would remove this power.

Large corporations co-opting DeFi. Corporations like Facebook, Apple may try to create walled gardens posing as DeFi but under their control

Asset managers and corporatism. Examples like BlackRock's Bitcoin ETF show centralized forces wield power over people's money, and disrupting and decentralizing their power is the "end-level boss" for true DeFi