Building DeFi yield curves

Source : https://www.youtube.com/watch?v=FMh_LgUC7Go

Introduction

Term Structure Protocol (0:50)

This is a on-custodial fixed income protocol which aims to establish interest rate curves in DeFi by enabling fixed-rate, fixed-term borrowing and lending.

They use a private ZK rollup for fast, scalable, and secure transactions

They plan to deploy on Arbitrum by the end of the year

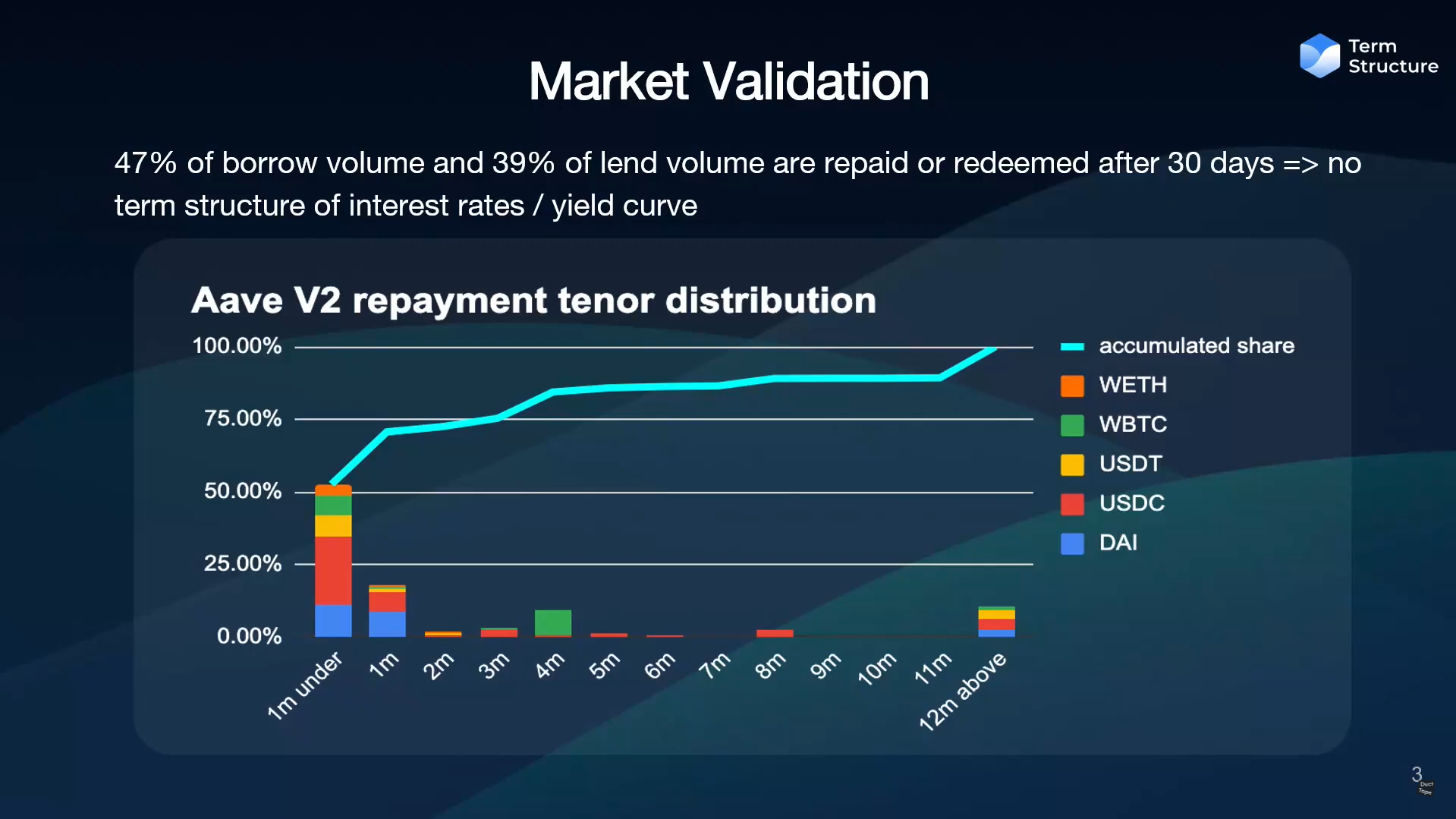

Current DeFi market (1:40)

Nearly 50% of borrowed and lent volume is repaid or redeemed within 30 days. Beyond 30 days, there is little to no activity

This proves a lack of concept and infrastructure for interest rate curves or yield curves.

Yield curves

Financial markets history (2:05)

17th century :

- Banknotes and modern money were invented

- Government bonds first issued in Netherlands and UK, funding wars and reconstruction

18th century : futures contracts were invented, these were rice futures in Japan to hedge price risk for farmers

1790 : First U.S. government bonds, lied to commodities and meant to hedge farmers' price risks

1848 : Chicago Board of Trade introduced grain futures, and futures contracts have significant growth

Futures contracts and government bonds were initially created to serve real-life needs, not for speculation

What is a yield curve ? (4:00)

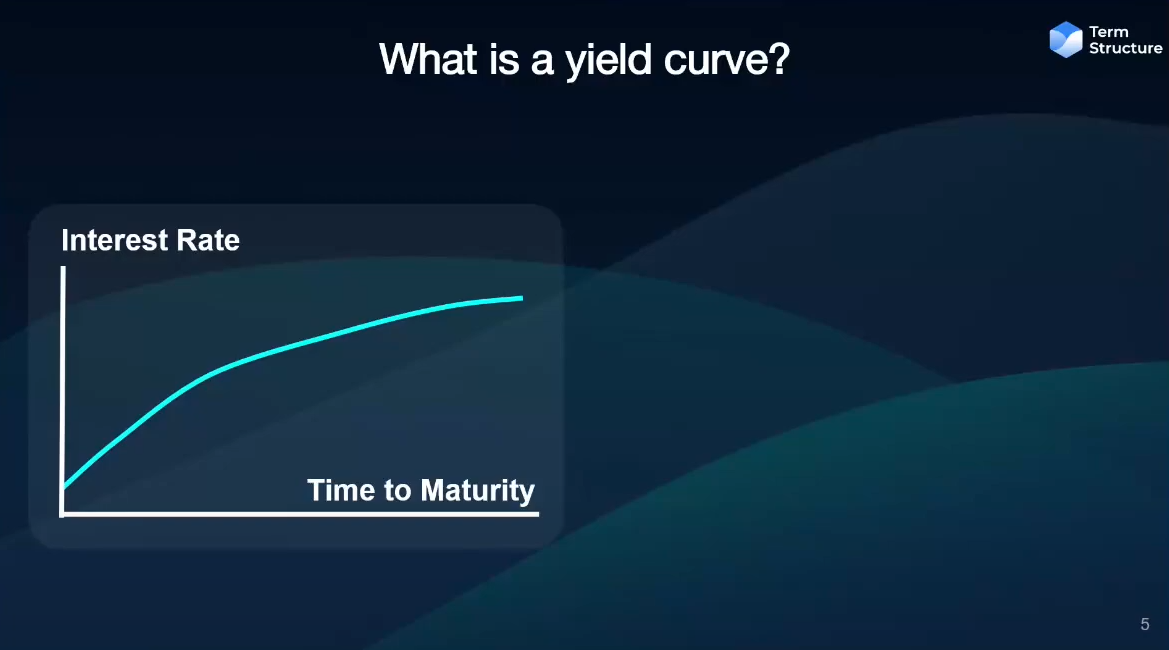

"Yield curve" and "interest rate term structure" are interchangeable terms

The curve represents increasing interest rates for longer maturities due to higher uncertainty. Example: Lending $100 to a friend for a week vs. a real estate developer for 2 years (higher risk, higher interest rate)

A well-behaved market should have an upward-sloping, concave yield curve

Use cases of fixed income (5:00)

- Capital preservation and income generation (beating inflation)

- Valuing simple and complex financial products

- Benchmarking and risk management (e.g., using U.S. Treasuries as a benchmark)

- Duration and asset-liability management (for pension funds, insurance funds)

- Funding and liquidity management

- Hedging interest rate risk, future payables/receivables

- Arbitraging against other interest rate instruments

- Leverage and risk-taking (more financial use cases)

Potential market size (6:55)

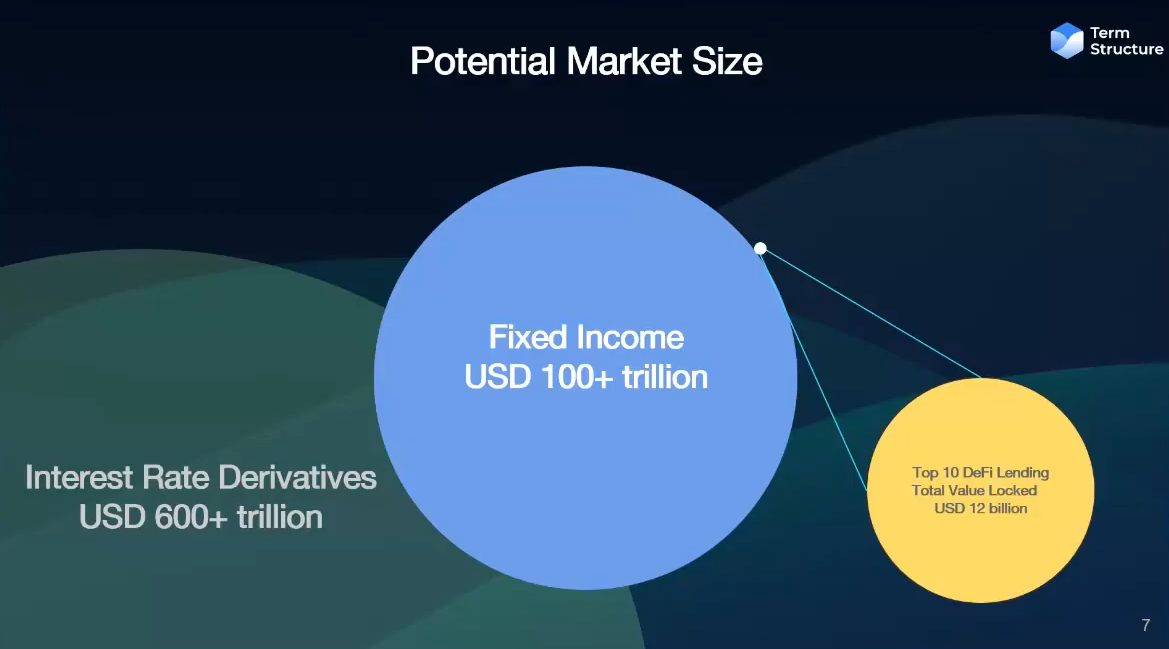

Top 10 DeFi lending protocols have ~$12 billion in Total Value Locked (TVL). This is tiny compared to over $100 trillion in traditional fixed income market, and over $600 trillion in U.S. interest rate derivatives market

There is a huge gap for DeFi to catch up in the next few years

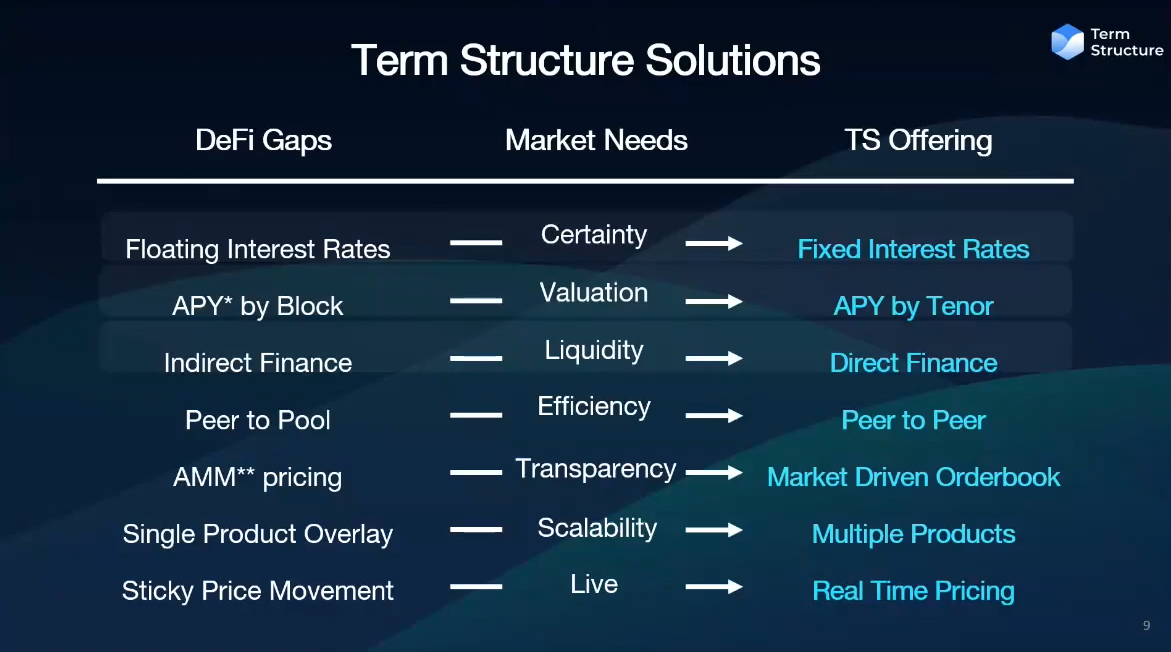

What are the gaps ? (7:25)

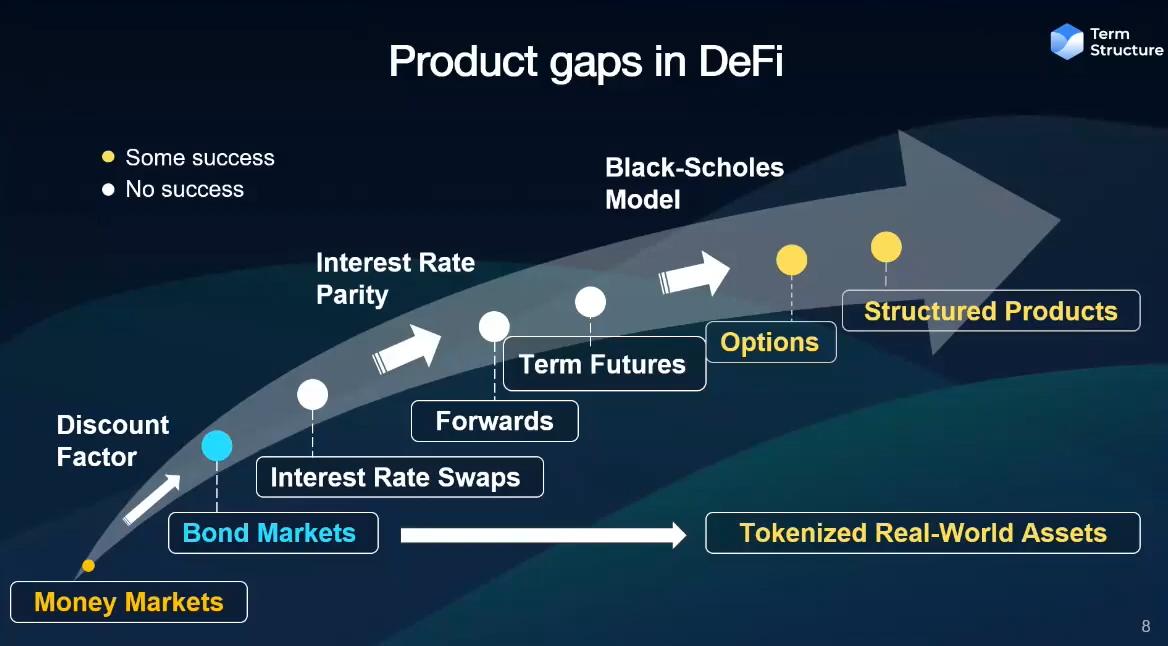

Money markets (Aave, Morpho) and tokenized real-world assets exist, but lack of solid foundation and backbone (bond markets, interest rate swap curves, yield curves) :

- Floating interest rates that vary by block, lacking certainty

- Peer-to-pool AMM pricing model lacks transparency and efficiency

- Subject to imbalances from large liquidity withdrawals

- Difficult to scale

In other words, DeFi has jumped to complex products without solving fundamentals

The solutions

Term Structure solutions (8:30)

- Fixed interest rates that vary by term (e.g., 4% for 1 month, 5% for 3 months)

- Peer-to-peer market-driven order books with bids and offers for price discovery

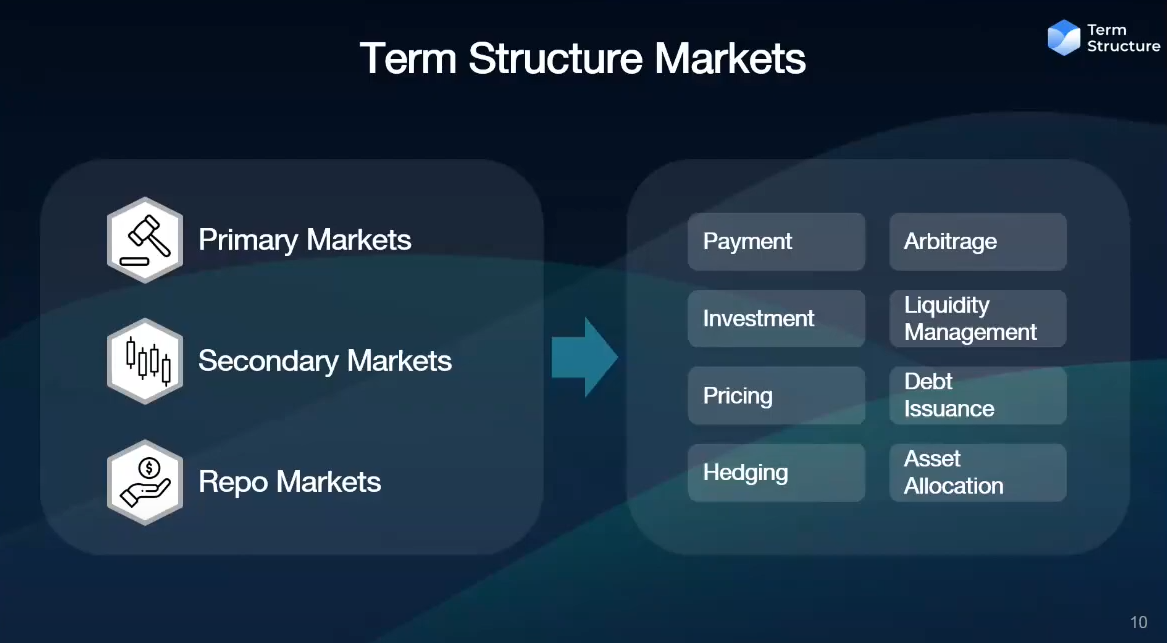

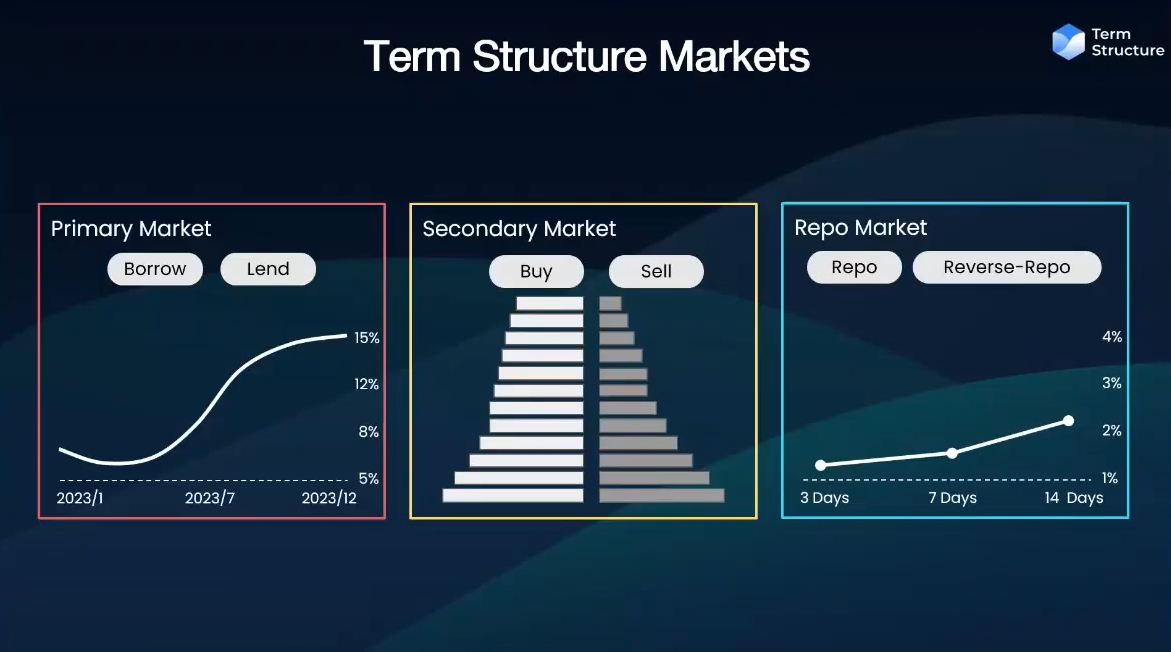

Team Structure markets (9:25)

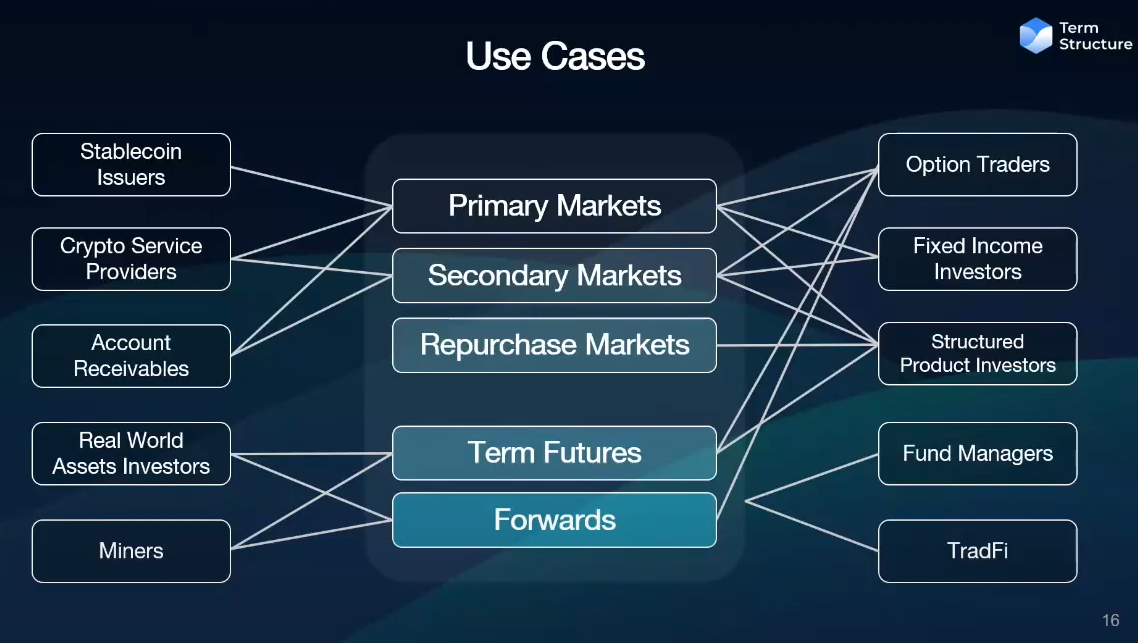

Having primary markets, secondary markets, and repurchase (repo) markets make it scalable

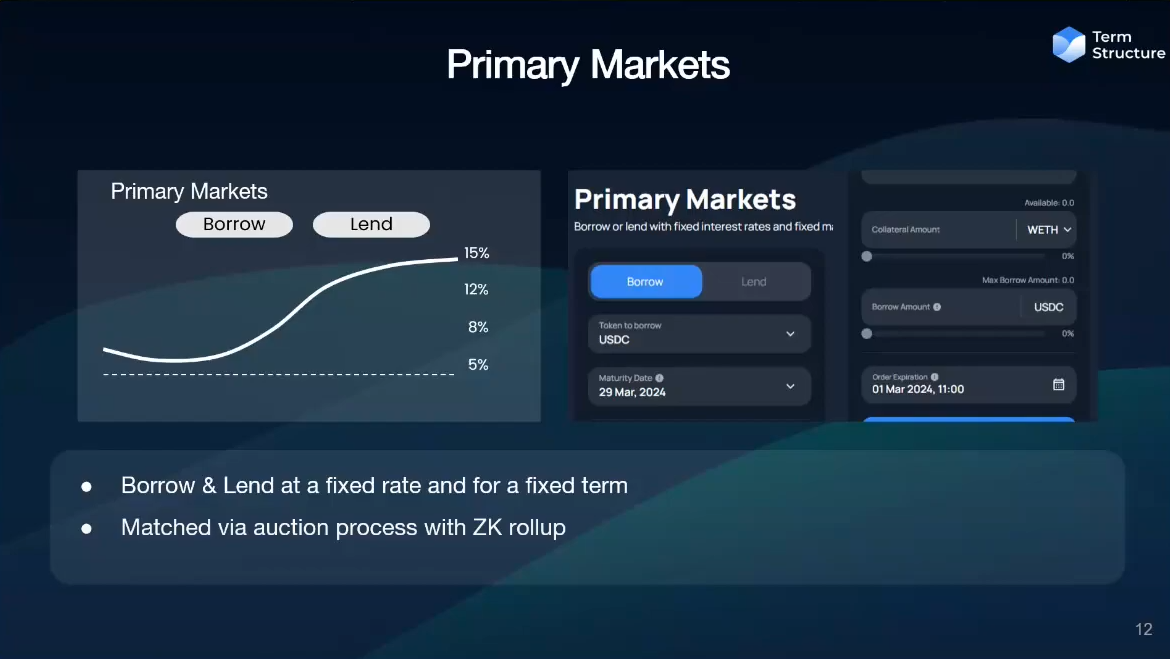

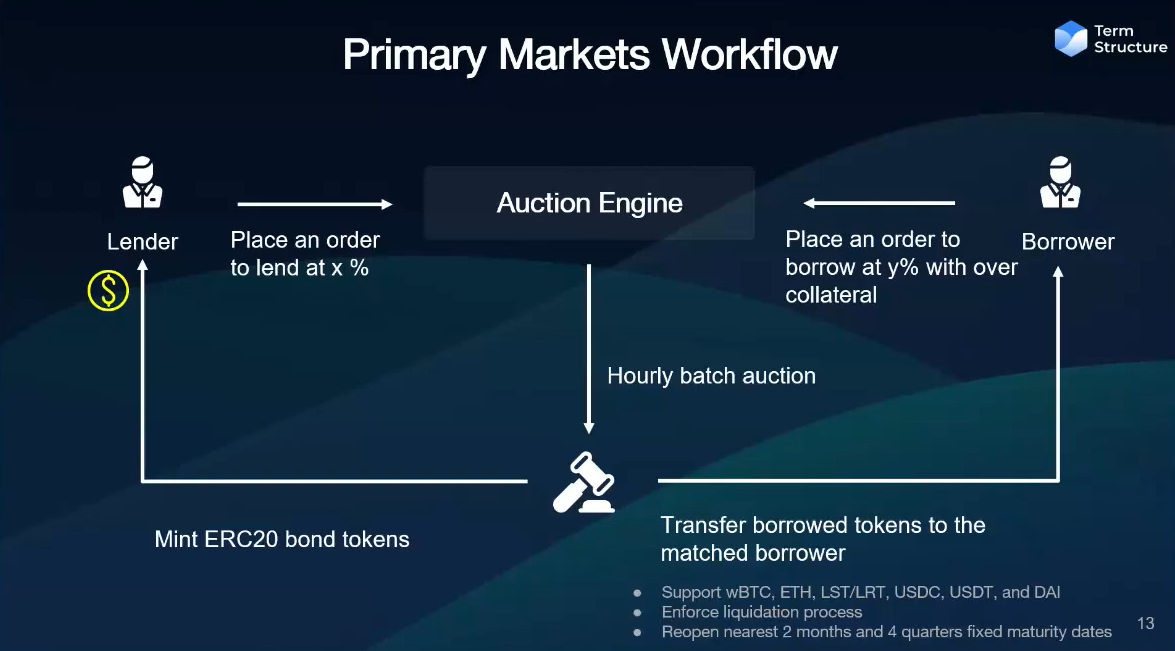

Primary markets (10:25)

User choose token to borrow (e.g., USDC), maturity date (standardized), collateral, and amount, and they borrow/lend at fixed rate for fixed term (e.g., 5% for 1 month)

User are matched via auction process on ZK rollup, and lenders receives ERC-20 fixed income bond token

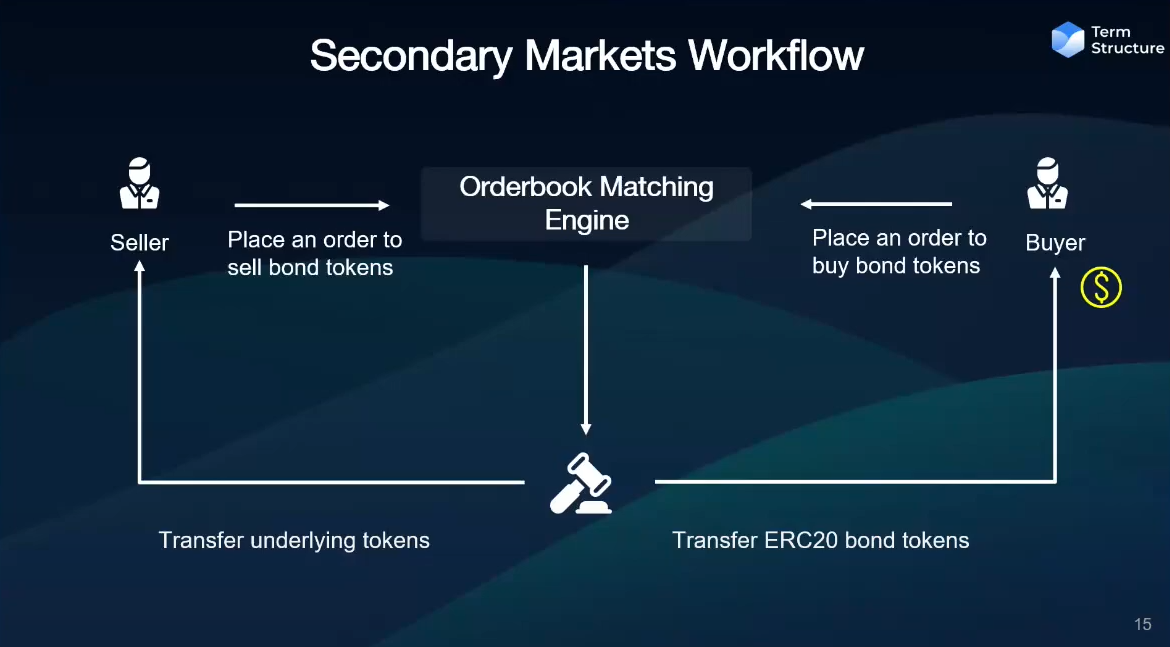

Secondary markets (12:25)

In secondary markets, Trade fixed income bond tokens are on an order book. This a replication of TradFi

It allows lenders to sell tokens if better opportunities arise (e.g., higher rates for longer terms)

Use cases (12:50)

- Bitcoin miners hedging future bitcoin production

- RWA investors borrowing/lending against collateral

- Fund managers, structured products, options traders

- Arbitrageurs, stablecoin issuers

- Interactions between primary and secondary markets

Stablecoins

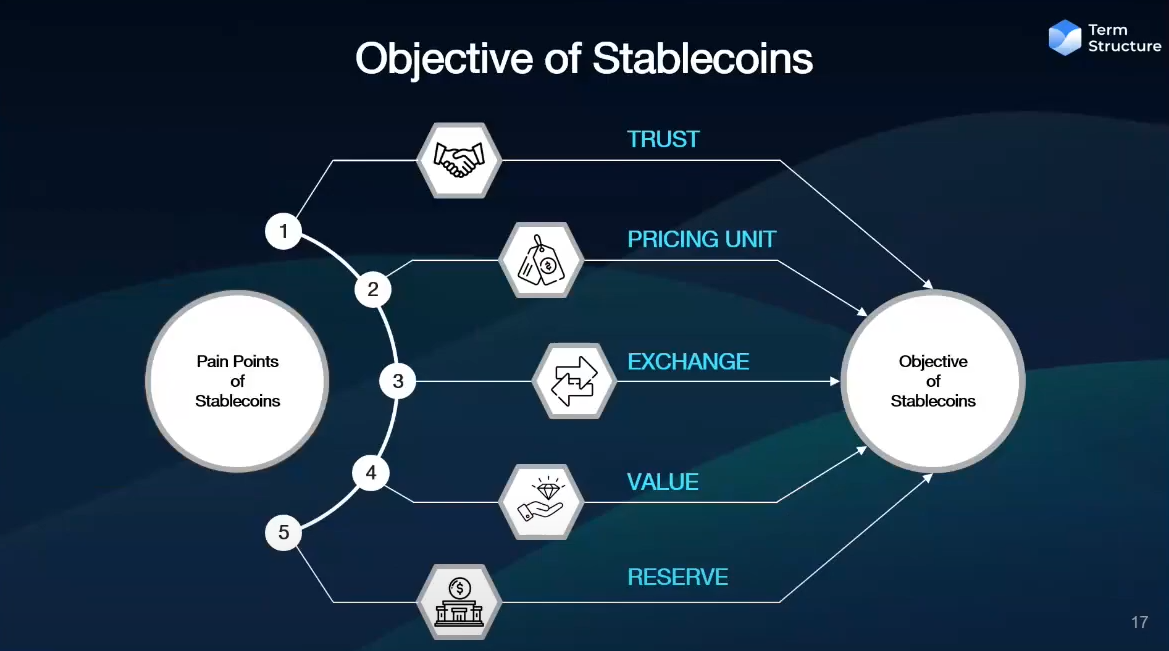

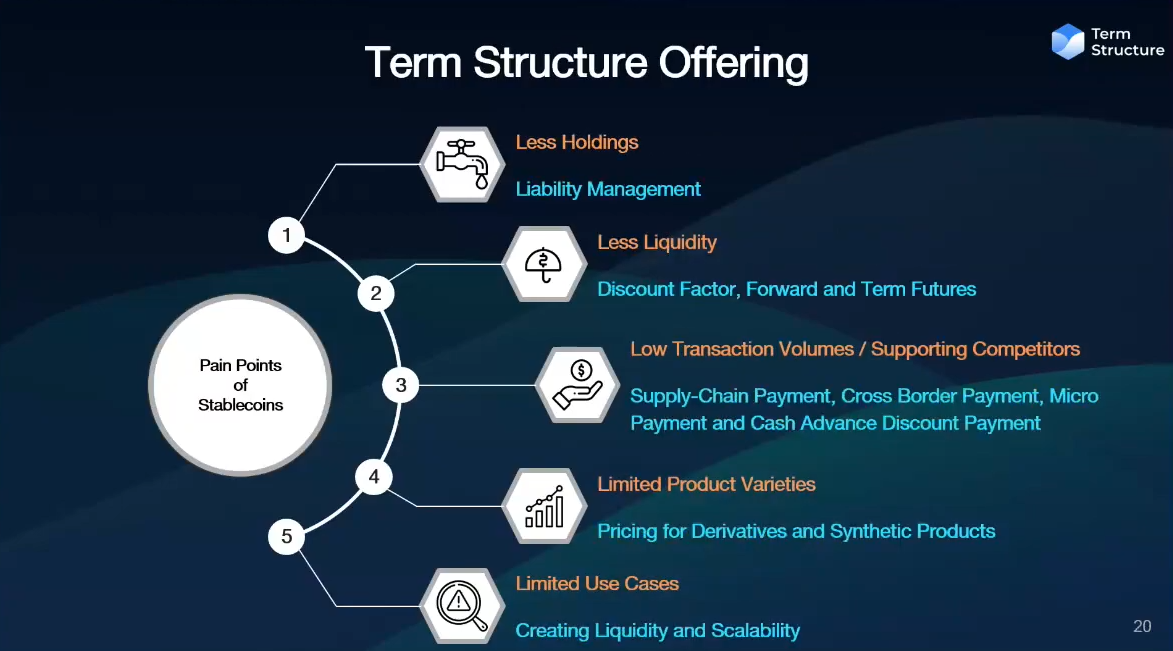

Stablecoins have issues(13:25)

Current lack of risk management, yield curves, and ability to discount future cash flows. This leads to less liquidity, transaction volume, and limited use cases

Proposed solution: Create liquidity, scalability, pricing of derivatives/synthetics via discount factor curves, forward curves, term futures

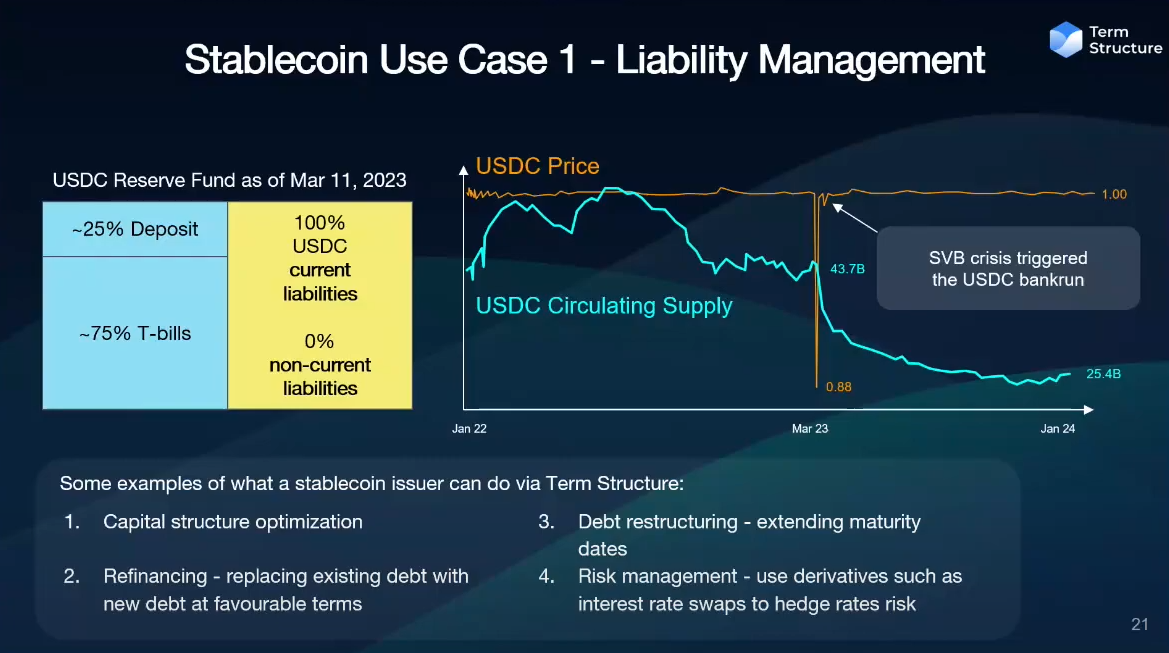

Liability management (14:30)

Optimize capital structure by issuing new debt :

- Refinance existing debt at favorable terms (e.g., replace 10% debt with 4% debt)

- Restructure debt by extending or reducing maturity profile

- Use derivatives like interest rate swaps to hedge risk

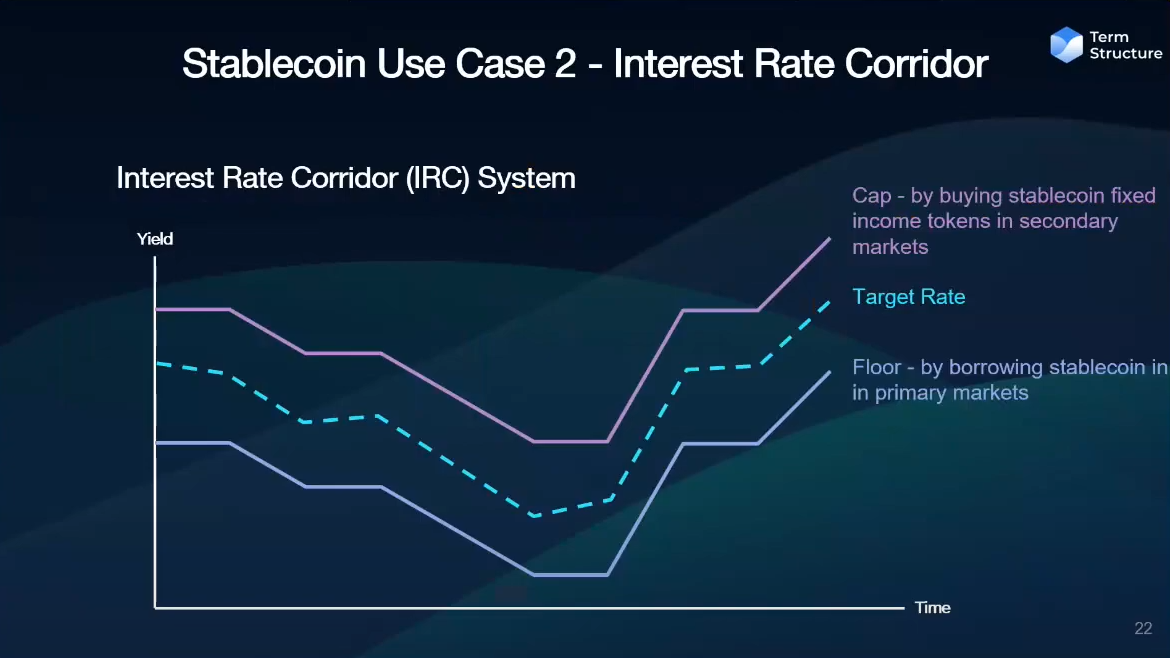

Interest rate corridor (15:20)

Maintain stablecoin lending/borrowing rates within a desired range :

- If rate drops too low, borrow more stablecoin to increase demand and push rate up

- If rate rises too high, buy stablecoin fixed income tokens to decrease rate

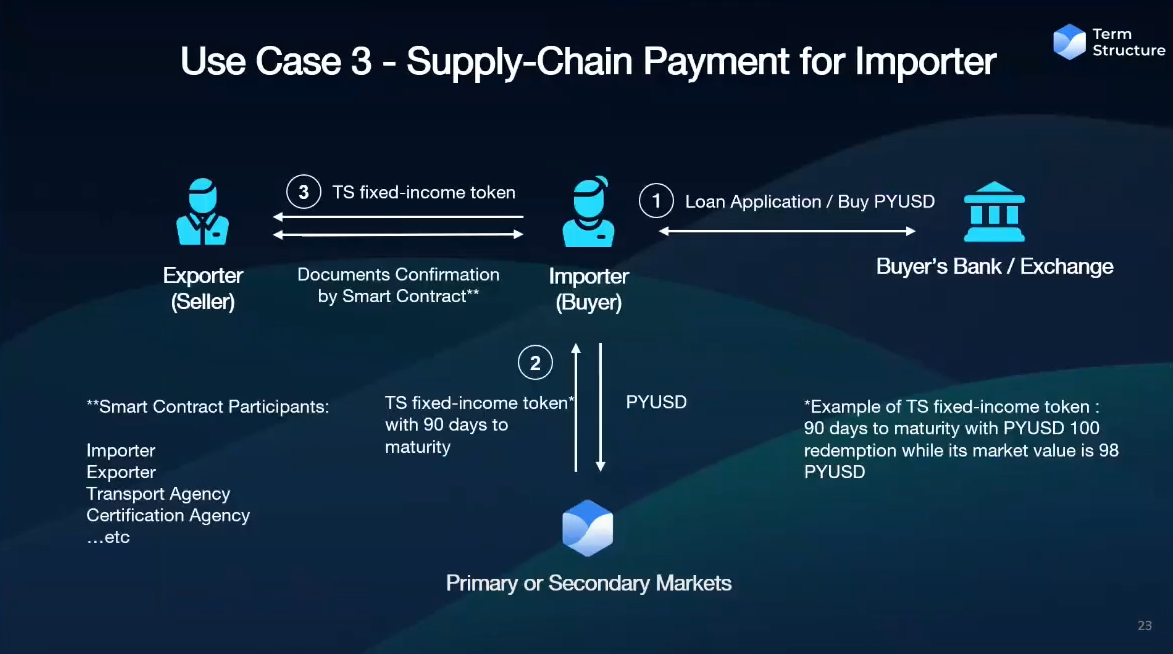

Supply-chain Payment for importer (16:25)

(Example skipped due to complexity)

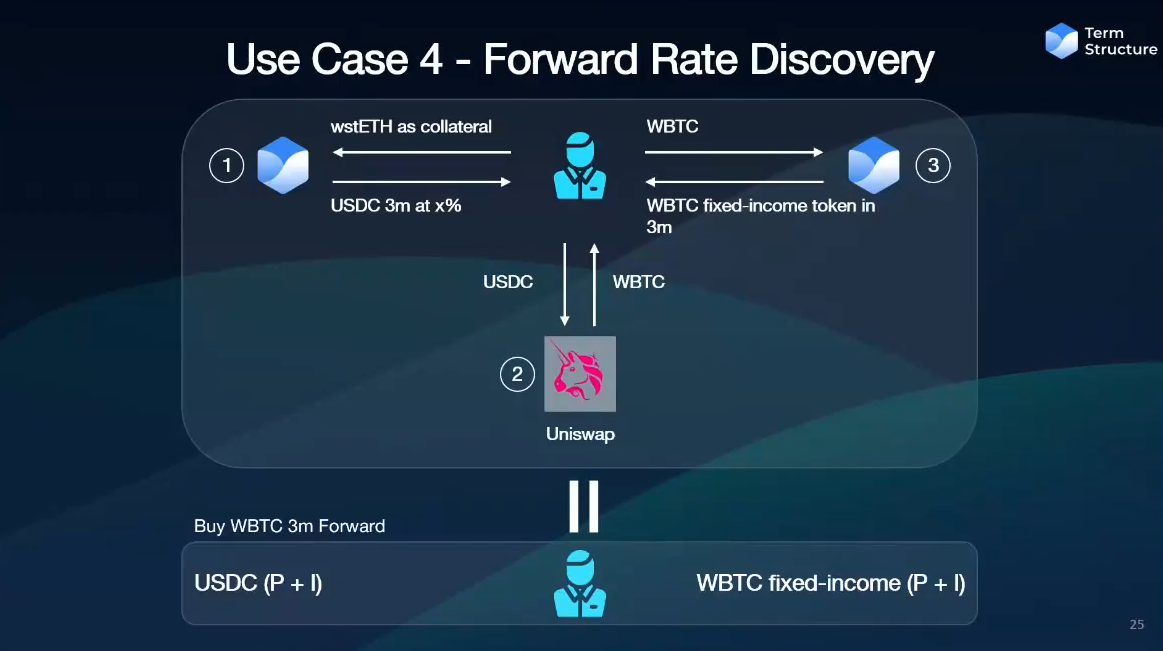

Forward rate discovery (16:35)

Ability to discover and price forwards (e.g., 3-month BTC forward rate)

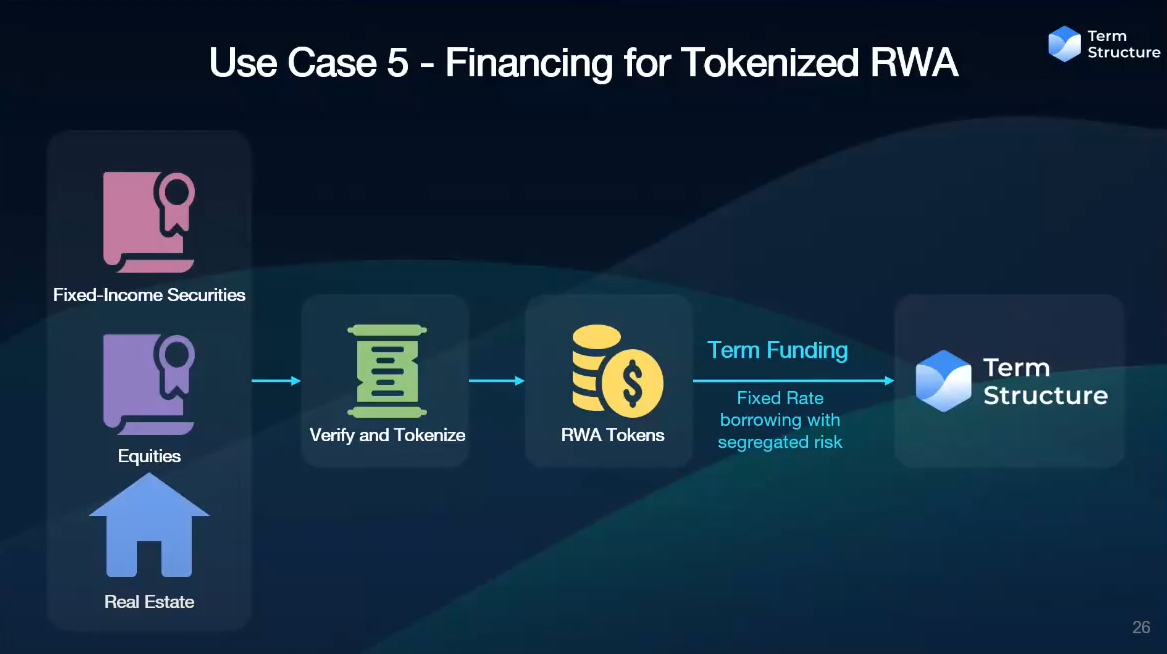

Financing for tokenized RWA (16:55)

Tokenize fixed income securities, equities, real estate, credit...They use RWA tokens as collateral for fixed-rate borrowing and risk is segregated on Term Structure protocol

Benefits

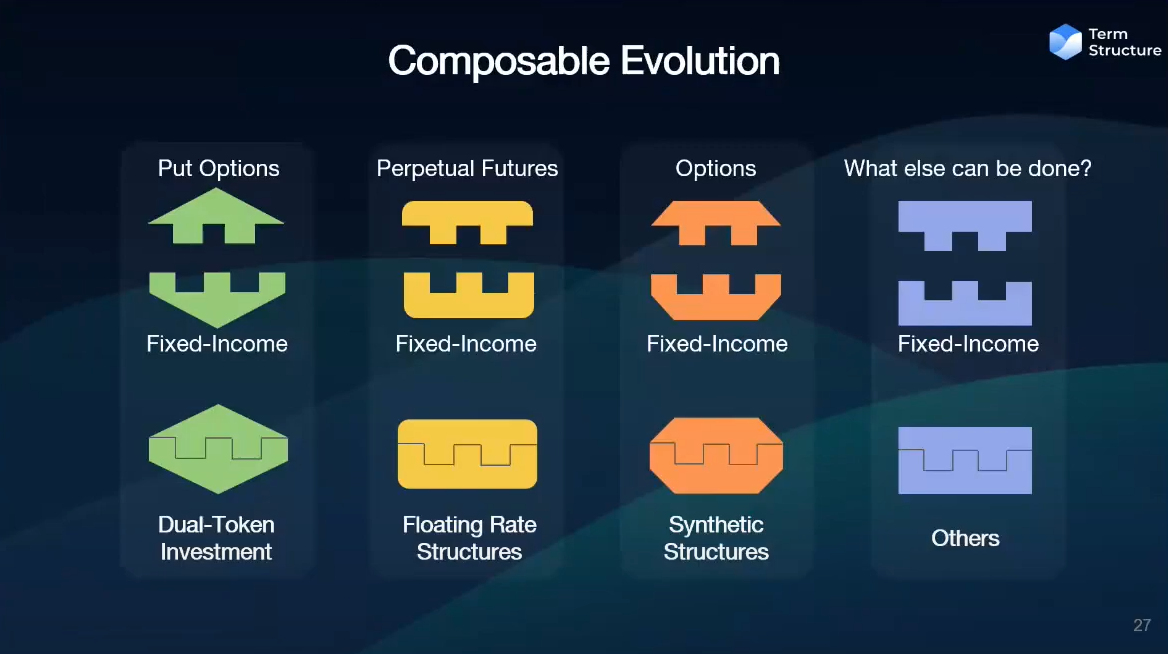

Composable Evolution (17:20)

We can combine the usecases to create synthetic structures, structured products

TradFi Benefits (18:30)

Real-Life Benefits (19:25)

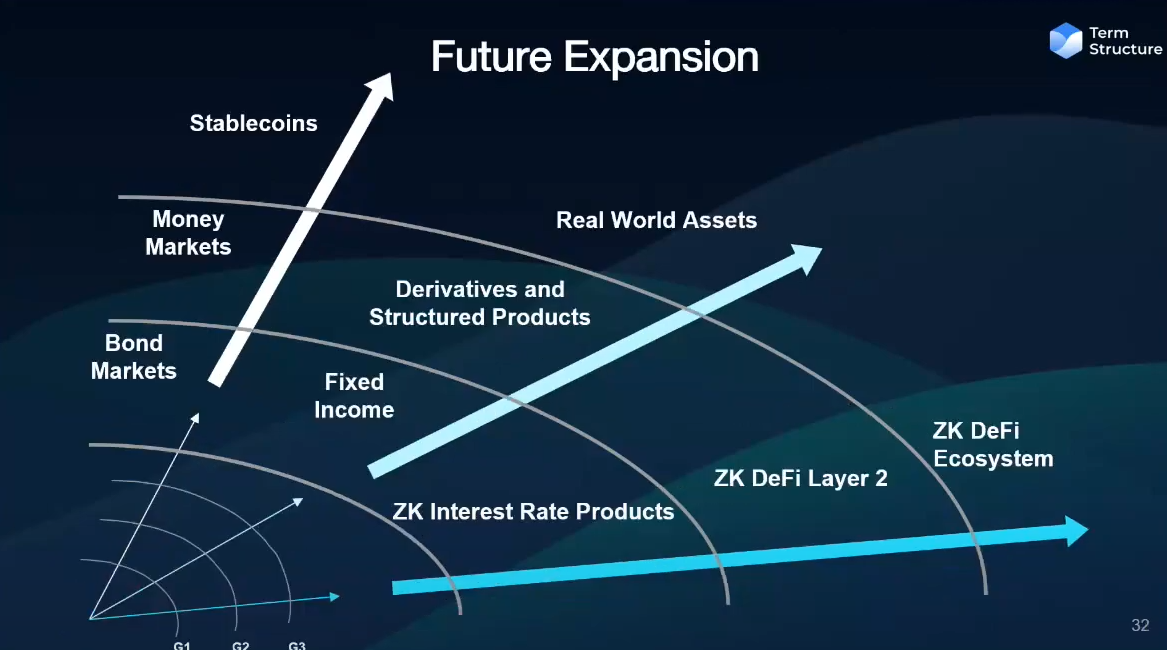

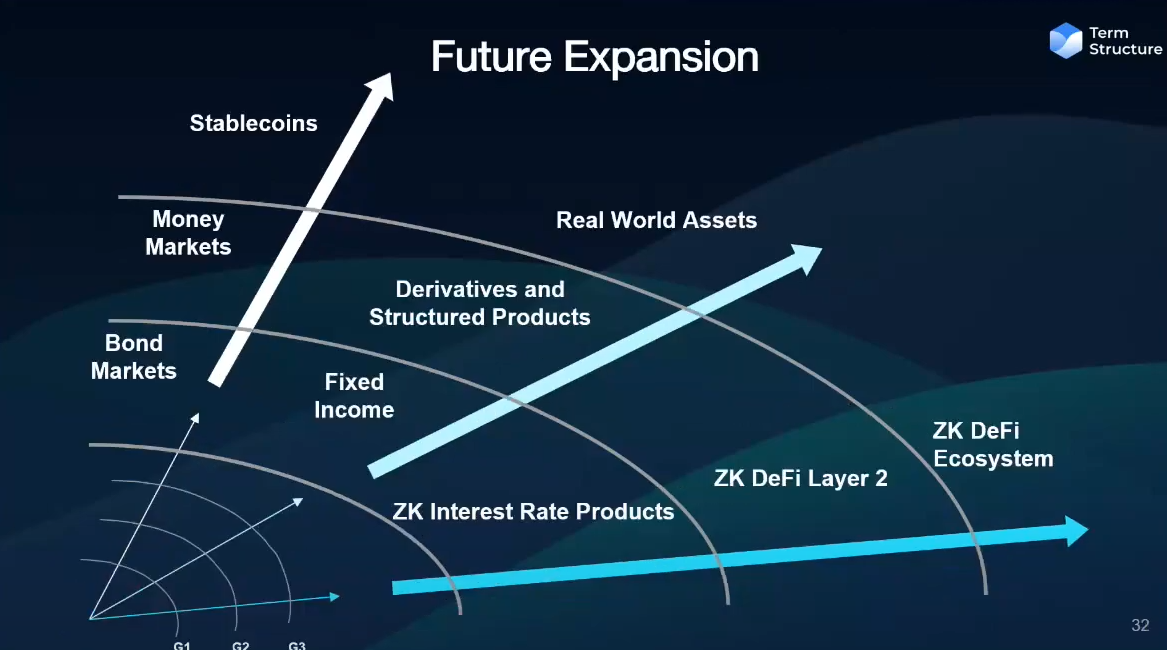

Evolutionary competitive advantage (21:05)

The endgame according to Term Structure :

- Security : Non-custodial wallet with ZK capabilities

- Efficiency : Peer-to-peer + ZK orderbook (efficiency)

- Cost : Customized ZK rollup for trading/DeFi activities

Questions & Answers

Before we get to RWAs, I think we could probably tokenize a few things like gas (computation) futures or block space. How far do you think we are until we can get there ? (22:20)

There have been past attempts to try to hedge for gas risk, but it's not something being worked on currently.

As scalability solutions emerge, gas itself will become less of a problem.

In traditional finance, government bonds (e.g., U.S. Treasuries) are considered the risk-free rate.

How are you going to access the risk free rate and if there is any way how users could possibly get rid of the premium that you have to pay for the canalization process ? (23:20)

It's a philosophical question in crypto what should be considered the risk-free rate.

The assumption that Ethereum will never get hacked is required to consider its staking rate as risk-free. But if there are technological risks to Ethereum, there is no true risk-free rate.

- Stablecoins like USDT should trade at a premium over the Ethereum staking rate due to risks like depegging.

- BTC would be risk-free rate, but WBTC wouldn't.

The goal is for Ethereum to become the de facto risk-free rate on which other risk premiums in the ecosystem are built, but what qualifies as a risk-free rate is an open question.