Blueprint & Dyad : future of liquidity on Ethereum mainnet

Source : https://twitter.com/blueprintfi_eth/status/1762199767684419764

Dyad overview

What is Dyad ? (4:20)

Dyad is a new stablecoin project that aims to combine the battle-tested design of overcollateralized collateralized debt positions (CDPs) like MakerDAO with improved capital efficiency.

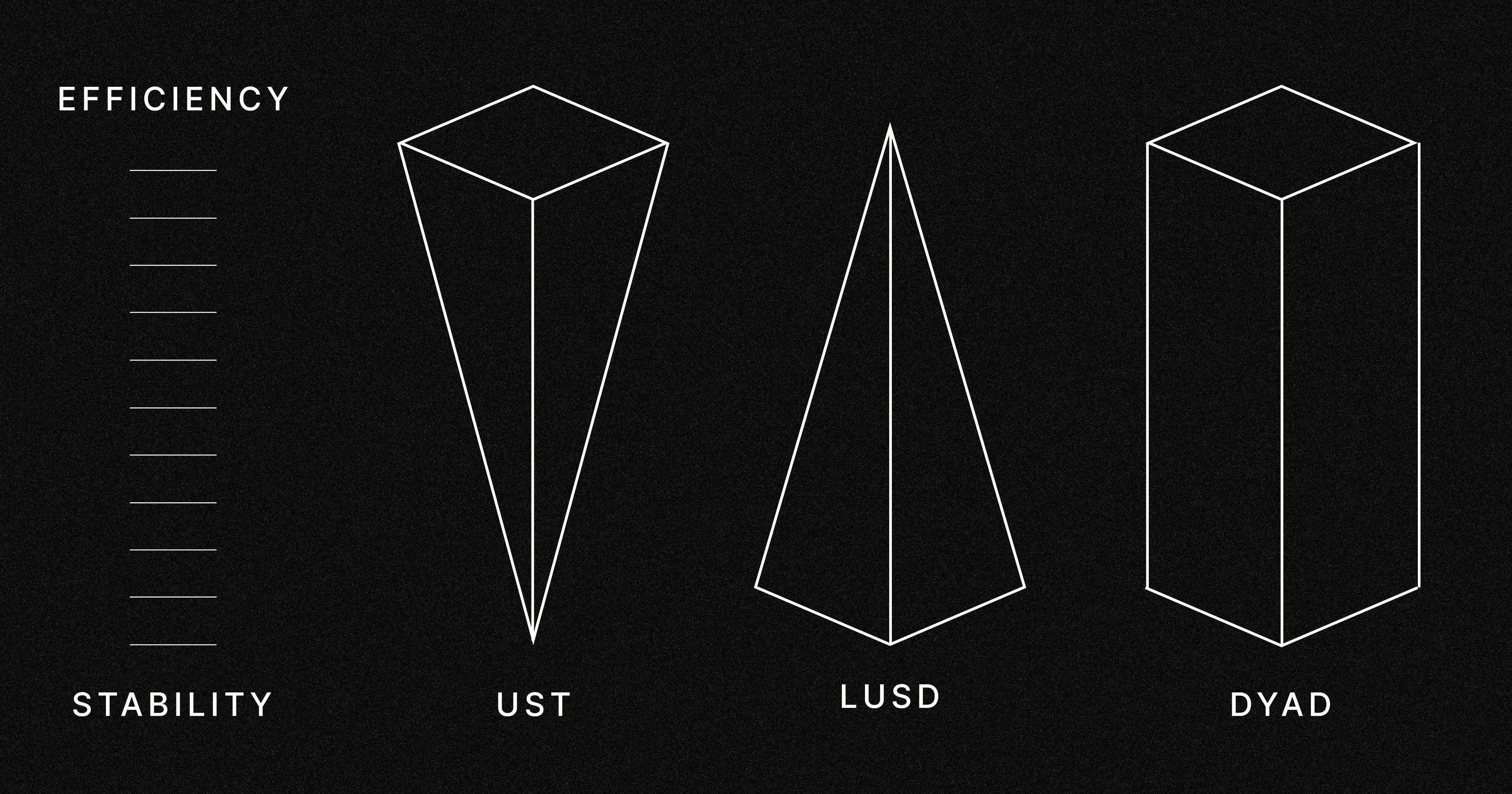

Existing CDP-based stablecoins have a tradeoff between volatility absorption (overcollateralization) and capital efficiency. The more overcollateralized, the more costly each stablecoin is to issue and carry.

This is why stablecoins like USDT & USDC dominate over 90% of all stablecoin liquidity : they issue one dollar for each dollar deposited in their reserves, and keep the yields on assets they hold in their reserves. In other words, issuing stablecoins from centralized providers is more valuable than what it costs to back it, unlike CDP-based stablecoins.

Dyad aims to improve the unit economics of CDP-based stablecoins so issuing them is profitable, just like USDT & USDC. This comes from optimized collateral yields and reduced costs.

The goal is a stablecoin that has the decentralized qualities of CDPs but with unit economics that scale sustainably without needing constant external capital.

If successful, Dyad would combine the best of both worlds : battle-tested CDP designs and sustainable, profitable unit economics. So decentralized stablecoins could scale.

End users must be profitable (10:00)

Usually, stablecoin issuers have a business model :

- Tether/Circle charge fees on USDT/USDC mint & burn, and put assets in their reserves to work which are protfitable for the companies

- Liquity charges borrow fees for LUSD minters, which are profitable for the protocol

In short, there's a source of revenue taken from the protocol. But Dyad doesn't seek protocol-level profits, the goal is that users profitably issue stablecoins.

To be able to deposit collateral, mint & redeem DYAD stablecoins, users must have at least one Dyad NFT (a.k.a. "Notes" or "dNFTs")

Note holders must be incentivized to supply DYAD, so the protocol must optimize their ability to issue DYAD below 1$ cost, and therefore be profitable doing it.

We can think of Note holders like "companies" profiting from issuance. But profits accrue to users, not the protocol. Users profits motive stablecoin issuance and scale.

Velocity of money

Velocity is key for stablecoin dominance (13:30)

What is velocity ?

V = (P×Q) / M

- V is the velocity of money, which measures how often a unit of money is spent in a given period of time in an economy.

- P represents the general price level.

- Q is the total volume of transactions, or the quantity of goods and services exchanged in the economy.

- M is the circulating quantity of money

Velocity indicates liquidity and desirability for actual use cases, not just farming yields.

Circle and Tether don't need to incentivize use of their stablecoins because they already have tremendous velocity and circulation. This velocity gives a sense of security and leads to more stability.

We might wonder why they don't give direct yield incentives to users. The answer is that direct yield incentives like interest and staking can undermine velocity, as users hoard "good" high yield coins and transact with "bad" debased ones. This reduces circulation. As Gresham's law says, "bad money drives out good".

So USDT and USDC gain from high velocity that comes from liquidity and organic utility, not artificial yields.

Velocity > Yields (18:00)

For stablecoins, high velocity indicates organic demand and use for transactions, so it shows a stablecoin is robust as a medium of exchange, not just speculation.

Low velocity assets like UST fail if transactional demand falls away when yield incentives dry up.

Furthermore, many new stablecoins are essentially high yield savings accounts, but savings accounts incentivize holding, not spending. This makes them brittle as transaction mediums.

Velocity and savings/yield incentives are at odds. We have to prioritize one stablecoin purpose over the other.

True stablecoins need to be designed for high velocity as the primary goal. Dyad wants to optimize for similar velocity to gain stability and demand without compromising circulation incentives.

Create organic velocity (22:30)

Knowing that directly incentivizing or "bribing" people to use a stablecoin is ineffective, it must have an inherent utility.

Two critical factors for organic velocity and demand are :

- External liquidity - having guaranteed buyers at $1 peg to redeem coins.

- Backing collateral - having liquidators to stabilize underwater positions.

Problems arise when these roles are confused, like with permissionless redemptions against collateral. This leads to overcollateralization just to avoid redemptions, hurting efficiency.

The optimal stablecoin minimizes the cost of incentivizing external liquidity and backing collateral. This provides the fundamentals for redeemability and stability. If the cost of stability is minimized, velocity emerges naturally.

Improve capital efficiency with Kerosene

Kerosene Overview

Dyad builds on liquity's CDP model but with a second token called Kerosene to optimize capital efficiency

Kerosene lets us mint more stablecoins against the same exogenous collateral we hold. This encourages Velocity as it optimizes collateral to promote stablecoin issuance.

Kerosene Properties

It represents a share of the total excess collateral, and has a deterministic value 👇

Kerosene value = (Total Value Locked - Total Circulating DYAD) / (Kerosene Supply)

An oracle feeds its deterministic value based on surplus buffer, and smart contracts treat Kerosene just like any other collateral type.

Kerosene has a natural price floor based on its utility to mint Dyad. In other words, if below its collateral value, arbitrageurs can buy Kerosene and mint Dyad at a profit and bring Kerosene market price up.

There is a total supply of 1 billion Kerosene tokens emitted over 10 years.

Minting with Kerosene

Need minimum $1 external collateral per $1 Dyad minted. Kerosene can take you from 100% with a minimum collateral ratio at 150%

We can add unlimited Kerosene to raise our collateral ratio. The more Kerosene, the more excess collateral we utilize, and this reduces liquidation risk.

But we can't have a Note purely in Kerosene with no external collateral, this stops a "race to mint" situation that would quickly eat the surplus buffer.

When closing CDPs, Kerosene is returned like any other collateral

Providing liquidity

Waiting for audits (47:30)

There is currently only one liquidity pool for DYAD stablecoin on Blueprint, which is DYAD/LUSD.

There are also two liquidity pools on Uniswap : USDC/DYAD pool and ETH/DYAD. Those Uniswap pools were created by users when Dyad launched.

For anyone looking to acquire Dyad without buying a Note, the current options are Uniswap or Blueprint. The Uniswap pools have more liquidity currently.

In total there is around $1 million in total value locked (TVL) across the pools. That's no so much, but Dyad is not trying to maximize TVL and growth right now. The focus is on testing that redemptions and liquidations are working properly on mainnet (which they are)

Once audits are complete and the full kerosene contracts are deployed, Dyad will be more comfortable with significant growth in TVL.

Attract liquidity providers with Kerosene (49:20)

Stablecoins like Dyad don't tend to attract buyers since people don't understand the mechanisms behind them. Buying stablecoins only makes sense if the peg is below $1, hoping it will repeg.

The main challenge is attracting liquidity providers to supply other tokens in pools with DYAD. This provides arbitrage opportunities.

For non-Note holders, the incentive to provide liquidity is to earn Kerosene emissions from the pool. Kerosene will be highly demanded by Note holders to increase yields.

Once kerosene contracts are deployed, there will be a retroactive airdrop that looks on-chain for in what term, what length of time, and also in what size, we were contributing liquidity to the blueprint pool and to the ETH/DYAD pool.

Other incentives like LQTY rewards from Liquidly are short-term bootstrapping mechanisms before Kerosene emissions.

Blueprint x Dyad (59:45)

Dyad chose to build liquidity on Blueprint for several reasons :

- TokenBrice, a respected voice in DeFi, was very bullish on Blueprint which got their attention.

- Discussions with the Blueprint team confirmed their technology and approach made sense.

- Polygon's head of DeFi Jack Melnick was also enthusiastic about Blueprint, further validating it.

- Blueprint's ve(3,3) design seemed one of the most successful.

As a new stablecoin, getting in early with a quality trading platform is important to build liquidity. Dyad believes Blueprint is well-positioned for the future which made it an attractive platform for integrating and building liquidity.

Yields are high (1:03:00)

Stablecoins like DYAD need sustainable liquidity incentives without a native token, since they don't generate trading fees. ve(3,3) AMMs like Blueprint allow partner protocols like Dyad to incentivize their pools without a token.

Furthermore, Blueprint's auto-compounding oBLUE and bveBLUE tokens are very compelling for small users. They don't have to manually claim and compound, so we can "set and forget" without worrying about Ethereum's high gas gosts.

Blueprint is exploring partnerships like Ichi to expand liquidity options in future.

Current DYAD/LUSD APR on Blueprint is 3-digits. This is because DYAD supply is currently capped (354k in circulation), the difficulty of getting DYAD keeps yields high.

Before allowing unrestricted growth, the goal is ensuring stability. The cap will raise to 500k later this week after completing two audits. After more audits and a code4rena review in March, the cap will be fully removed.

For those considering providing liquidity on Blueprint :

- Can swap USDC for similar value of LUSD on llamaswap due to LUSD being slightly below peg.

- Provide the LUSD/DYAD liquidity on Blueprint.

- Do your own research before participating !

Details about Notes

Dyad's governance (54:00)

There are currently 507 Notes minted by 286 wallets. The 286 active wallet addresses using Dyad now weren't whitelisted. In fact, they act like a combination of seed investors and early adopters.

Notes are the only governance token. They vote on new collateral types and Kerosene emissions :

- Votes are equal & not weighted by Note number (to avoid plutocracy)

- Votes act like switches : any Note can vote “Yes” or “No” on any collateral anytime Note holders want

- As long as there are 2/3 voting yes for a collateral, it is whitelisted.

- The kerosene emissions are proportional Yes VS No for a given LP token

This governance setup is secure because the cost to mint 2/3 of Notes exceeds the protocol's TVL to avoid centralization.

No protocole-owned liquidity (1:12:40)

The Dyad protocol itself doesn't own anything. It is just a set of rules coordinating users, like a game.

The Note holders can be thought of as "the protocol". They collectively own the liquidity, rather than a core team benefiting directly.

The concept of a protocol as an immutable system of coordinating actors seems more decentralized than an organization.

A secondary market for Notes (1:15:45)

Minting a Note currently costs 0.492 ETH. But there is also a secondary market for Notes on OpenSea, where we can find Notes with a discount.

For now, OpenSea has the largest secondary market. In the future, Dyad plans to build its own NFT marketplace later for better metadata-based utility.

At this stage, Notess bought on OpenSea or minted on site have the same utility. But Notes have momentum :

- The longer we provide liquidity, the more "momentum" builds as metadata on the Note.

- This momentum increases kerosene accrual, making the Note more valuable over time.

- Selling also gives up the Note's momentum

Dyad wants a liquid secondary market where sellers get premiums beyond backing value, thanks to that momentum.

This retains collateral and liquidity if someone wants to "rage quit" rather than exit properly.