Are RWAs the answer to the DeFi Boom-Bust Cycle ?

Source : https://www.youtube.com/watch?v=MLu0F3lW_UI

Nicholas Kunkel (the speaker) was part of the founding team of MakerDAO, worked for the protocol for about 6 years before starting Chronicle, an oracle protocol.

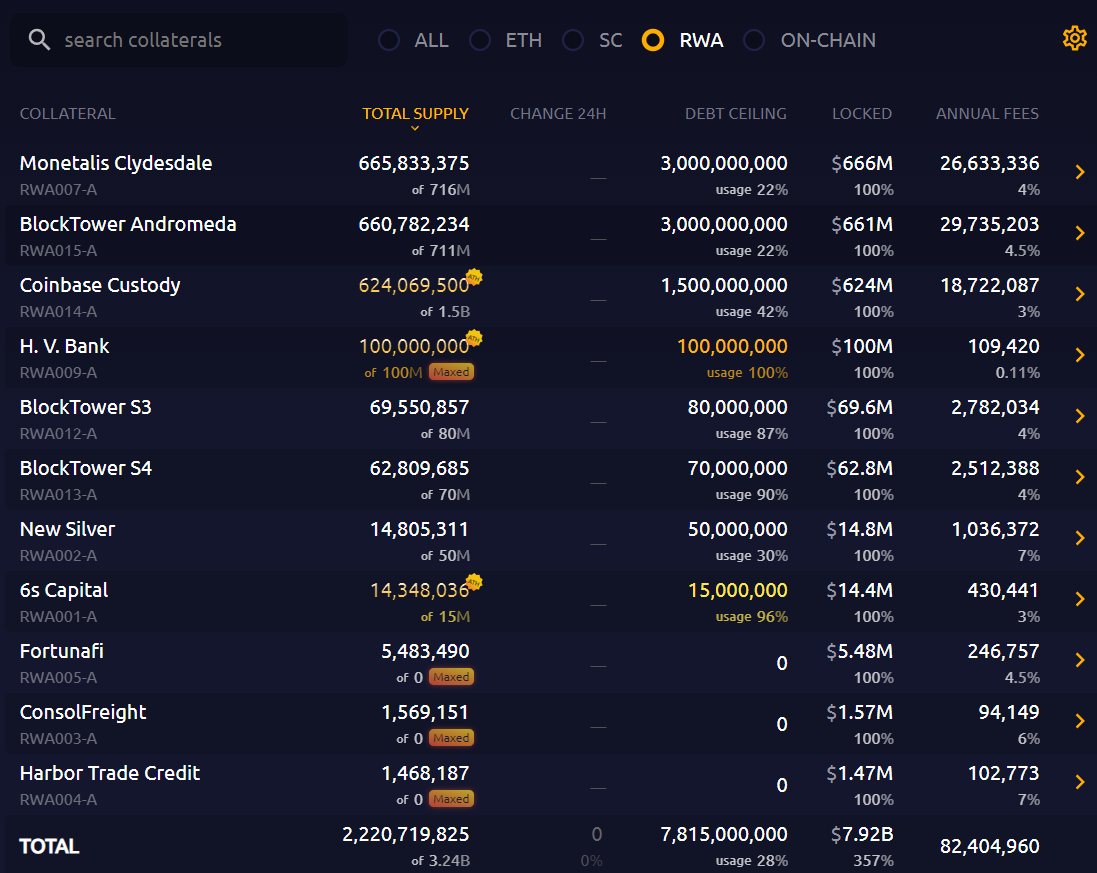

MakerDAO has proven the concept that capital generated on-chain can be deployed into Real World Assets (RWAs) to generate yield, maintaining protocol profitability when DeFi usage drops yet this is not accessible for most.

This could enable a new wave of on-chain customers for DeFi, but we have a problem.

Let's talk first about MakerDAO (1:30)

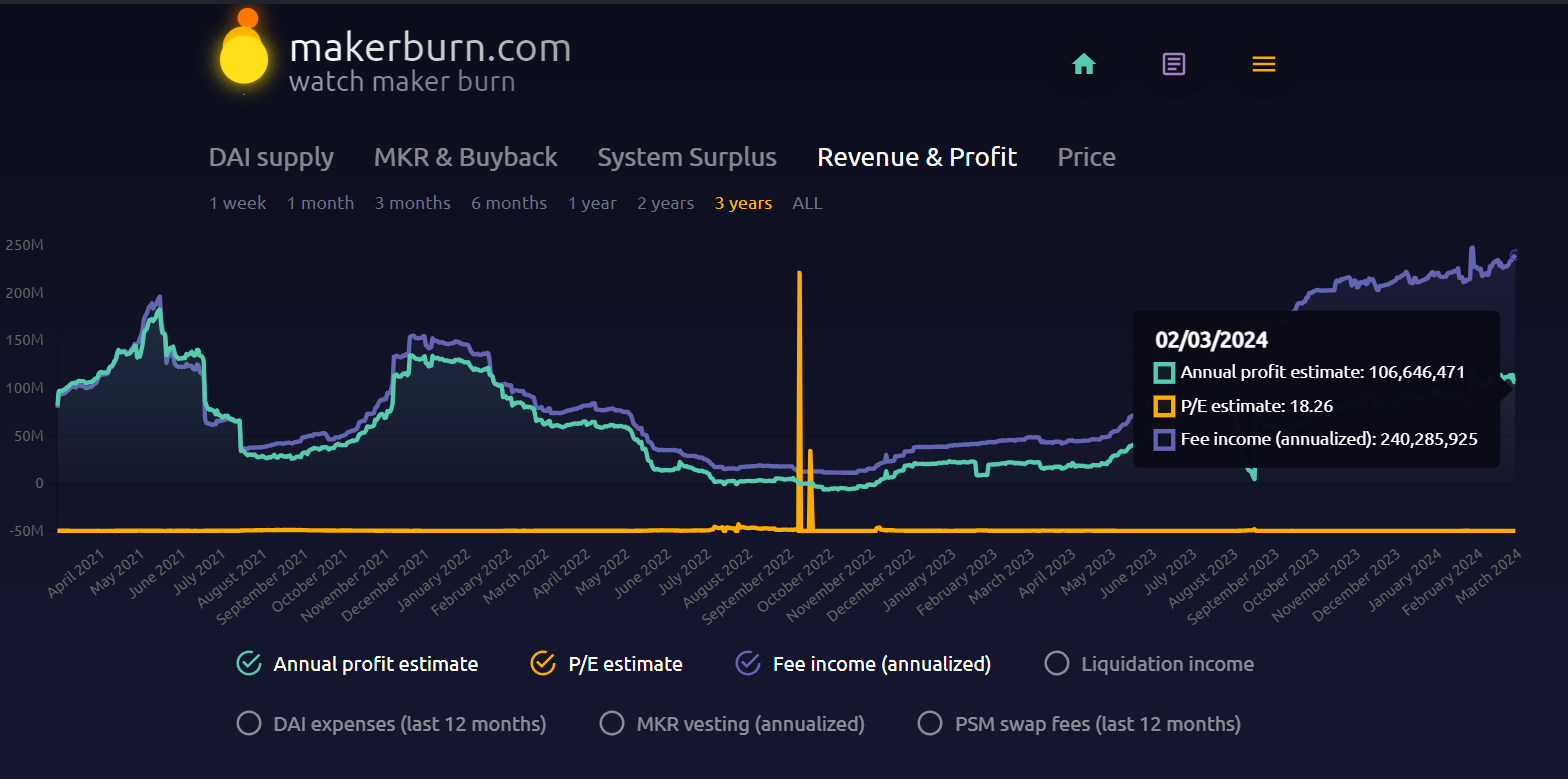

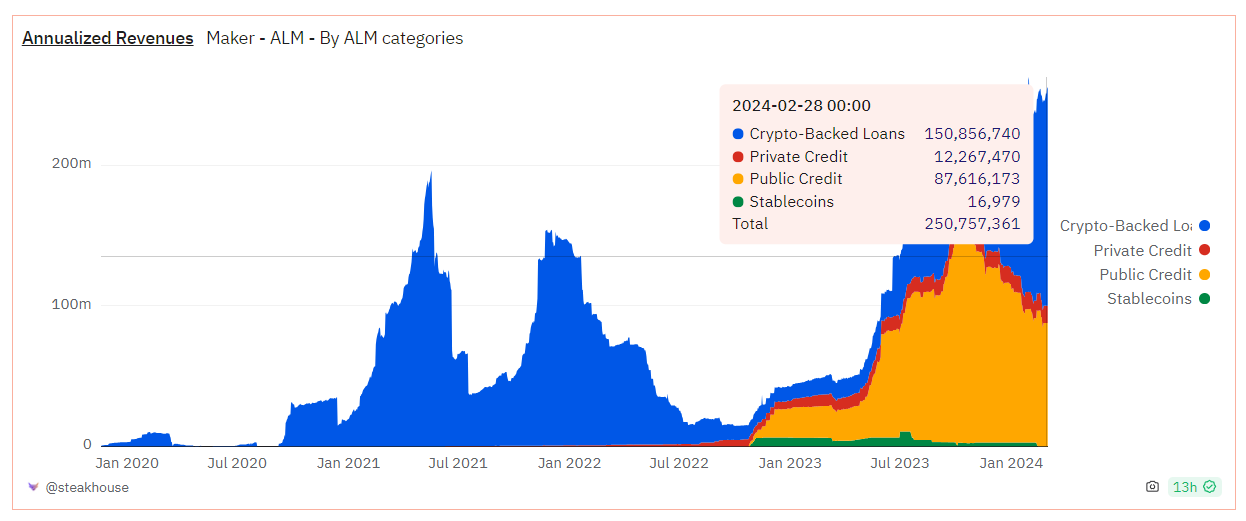

MakerDAO revenue fluctuates significantly based on crypto market cycles, with peaks in 2021 and 2022 aligning with bull markets. Most of Maker's revenue - around $155 million/year - comes from crypto-collateralized loans against assets like ETH, staked ETH, and WBTC.

However, there is also a massive spike in 2023 not fully explained by crypto hype cycles. The bigger question is where the other outlier spike in revenue came from in 2023.

This is likely related to RWAs, which can help address limitations of crypto-only collateralized lending in DeFi.

RWA's smoothing effect (2:35)

Looking historically, the chart shows Maker's revenue from crypto-backed loans in blue. This spikes in bull markets as people leverage long crypto, but crashes in bear markets.

As a result, DeFi protocols like Maker, Compound, Aave etc face the problem of surging revenue and growth in bull markets, but then sharp declines and need for layoffs in bear markets. Their revenue curves are very volatile.

Maker recognized early on that RWAs could help diversify revenue streams and flatten out these extreme peaks and valleys. So RWAs creates a revenue floor even in bear markets, allowing more sustainability.

Now Maker earns about 60% of revenue from crypto loans and 40% from RWAs. This is a healthier and more sustainable mix compared to being overly dependent on crypto collateral.

RWAs are no free lunch (6:00)

Despite their benefits, we face a problem with Real World Assets : they are not crypto native. They exist off-chain and on-chain tokens are just representations of the real asset. This is like wrapped or bridged assets on other chains.

So we have to deal with many things :

- Ownership - on-chain tokens may not be redeemable for the real asset due to counterparty/compliance issues.

- Liquidity - RWAs have different liquidity profiles from their native off-chain assets. For example, treasury bills are highly liquid markets but tokenized versions have low liquidity.

- Transfers - RWAs have transfer restrictions off-chain that may not be reflected on-chain.

- Settlement - Settlement of RWA transactions off-chain introduces delays versus native on-chain settlement.

These issues mean protocols have to choose between inefficient on-chain liquidations with low liquidity or delayed off-chain liquidations. Additionally, pricing RWAs accurately is difficult without real-time off-chain data and on-chain prices may deviate from true value.

Counterparty Risk (10:35)

RWAs have complex structures behind the scenes that protocols interact with, unlike crypto-native assets.

Nicholas gives an example of how an RWA may be issued through various parties :

- A trust represents the protocol's ownership of the asset.

- A broker purchases and sells the actual RWAs for the trust.

- A custodian holds and stores the assets.

- An auditor verifies the assets exist and transactions occurred.

There are many intermediaries involved compared to a crypto asset. This creates significant counterparty risk, where each party has incentives to lie or misreport information to earn fees from protocols using the RWA.

For example, Maker has $1.5B lent against RWAs - they can't trust any one party to truthfully report on the assets' existence, characteristics, holdings, etc :

- The broker could lie about purchases

- The custodian could lie about holdings

- The auditor could produce a false report.

But if Maker cuts off credit, these parties lose fee revenue, so they are incentivized to maintain the status quo with potential misinformation. So there is a lack of transparency and trust with RWAs versus on-chain crypto assets.

Overcoming this opaque web of intermediaries and misaligned incentives is the core challenge for DeFi to tackle with real world asset integration.

The solution for derisking RWAs (15:00)

We need to eliminate manual reporting of RWA data and remove trust in any single data provider.

Instead, we need real-time automated reporting from all parties in the RWA issuance process - the trust, broker, custodian, auditor etc.

No single party's data can be trusted. There needs to be symmetry : all data reported must match across parties to cross-verify accuracy. This minimizes potential misreporting.

Once reliable real-time data is available through resistant oracles, DeFi protocols can automate decisions and actions based on that data. Some examples :

- Protocols could automatically rebalance RWA exposures based on yield or risk optimization.

- Protocols could build automated circuit breakers to react to RWA instability, like the USDC depeg event, without slow governance input.

- Access to rich real-time RWA metadata beyond just pricing data unlocks more sophisticated automation.

This is critical to derisking RWA integration. Relying on manual reporting and centralized parties creates unacceptable levels of counterparty risk.

Long story short : Resistant oracles that aggregate symmetric data across parties resolves the lack of transparency and trust issues with real world assets.

About Chronicle (20:35)

Chronicle Labs seeks to build those resistant oracles that aggregate symmetric data across parties

Nicholas invites interested engineers in various roles to help build this solution by working at them :

- Backend engineers

- Smart contract engineers

- DevOps and infrastructure engineers

If interested in learning more or keeping in touch :

- Email : hello@chroniclelabs.org

- Twitter : @chroniclelabs