All roads lead to liquidity (Paladin at EthCC)

Source: https://ethcc.io/archive/All-roads-lead-to-liquidity

Paladin is used to talk about governance. Since then, some people have started using a solution to grow their liquidity on-chain, and DeFi protocols seek to become the liquidity layer.

So Paladin wondered what's liquidity, and why it is so important.

What is liquidity? (1:40)

This quote is not from Romain (the speaker), but from a friend's blog post called "FinTech Ruminations".

Somehow liquidity acts as an "oracle", as it represents the value of an asset to individuals and groups.

Liquidity in finance (2:20)

Traditional finance uses order books, intent-based liquidity, and DeFi introduced Automated Market Makers (AMMs) for resilient liquidity.

Whatever is going to happen, we're going to be able to trade, but this will be what defines the asset's actual price. So it's a different mechanism of quantifying supply and demand, more by buying and selling pressure.

Why is crypto important? (3:15)

Crypto is important as it enables the creation of tamper-proof assets. In other words, crypto allows for digital value creation without trusting a centralized database.

Before we had to trust the database, now we have to trust the smart contracts.

The thing is, crypto just can't work without liquidity. We need liquidity to measure the value, bridge assets, and create new assets, and we still face challenges with it:

- Limited capital circulation within the ecosystem.

- Lack of proper bridges between different ecosystems and industries.

- Regulatory challenges.

- Insufficient incentives

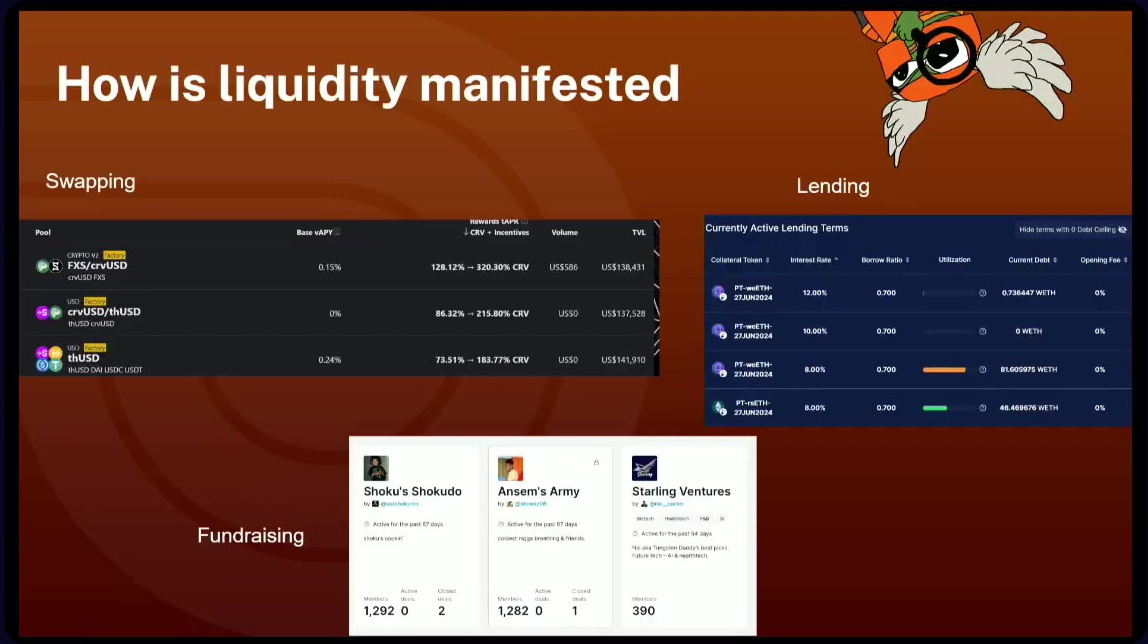

How is liquidity manifested (4:45)

Three main ways to create liquidity in crypto:

- AMMs (Automated Market Makers) for swapping, like Uniswap and Curve

- Fundraising, which occurs in a less public context

- Lending, where assets are used as collateral

Despite this, there are difficulties in quantifying the total asset value in crypto. Information is public but scattered across various platforms, and does not include centralized exchanges, OTC demand, and other sources.

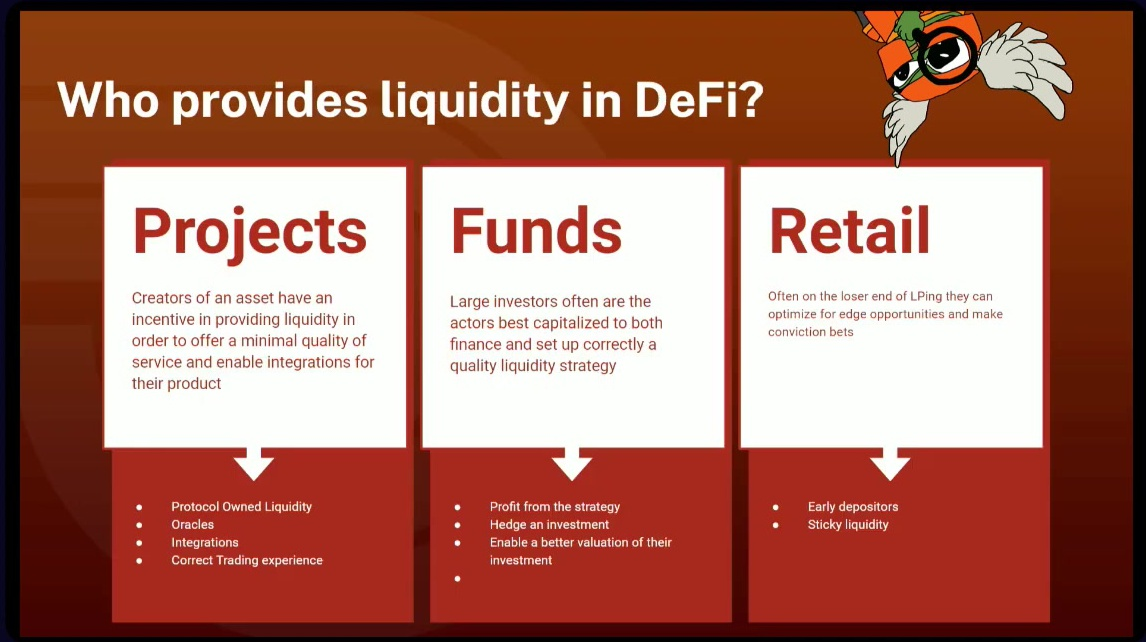

Who provides liquidity in DeFi? (6:10)

The main liquidity providers are projects, funds, and retail.

Projects:

- Incentivized to create liquidity for their assets

- Supports building and composability

- Necessary for Oracle integration and lending platforms

- Often build "Protocol-Owned Liquidity" (POL)

Funds:

- Investors or supporters of the project

- May seek to profit or hedge investments

Retail:

- Motivated by potential yield earnings

- Often at a disadvantage in current DeFi liquidity setups, implies a need for better incentives or structures for retail liquidity providers

Risks (8:10)

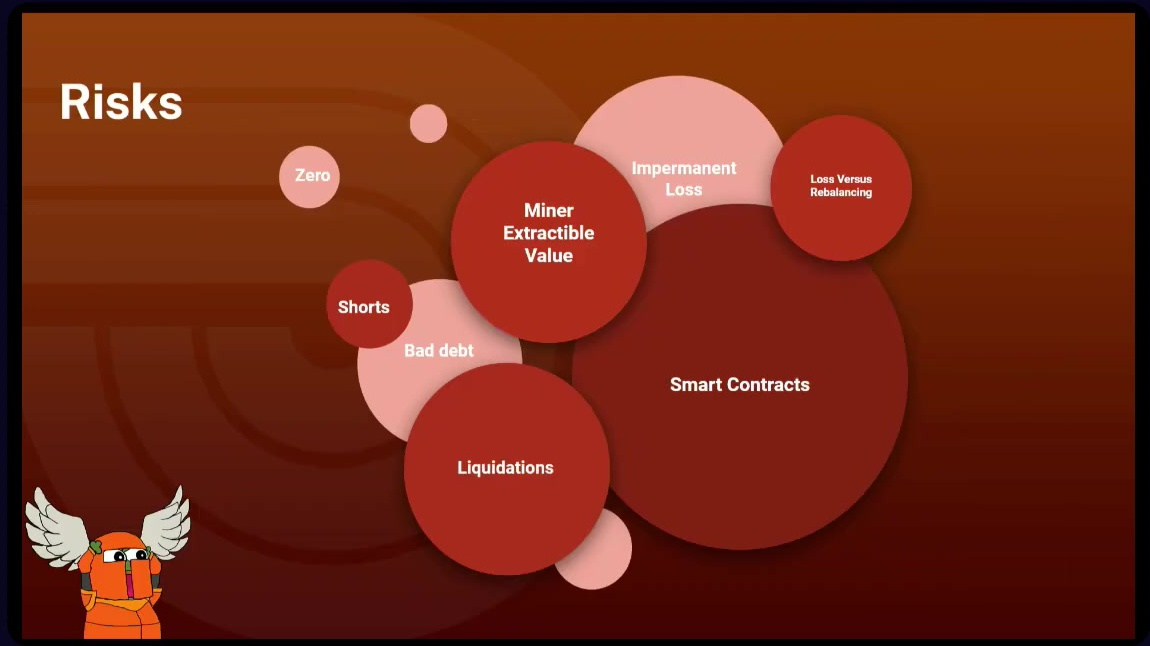

Risks associated with providing liquidity:

- Smart contract risks

- Impermanent loss

- Loss Versus Rebalancing

- MEV (Maximum Extractable Value) attacks

- Liquidations and bad debts in lending

- Potential for assets to be shorted

- "Zere" risk: investing in projects that never deliver

Current organic rewards do not adequately compensate for the risks involved in providing liquidity.

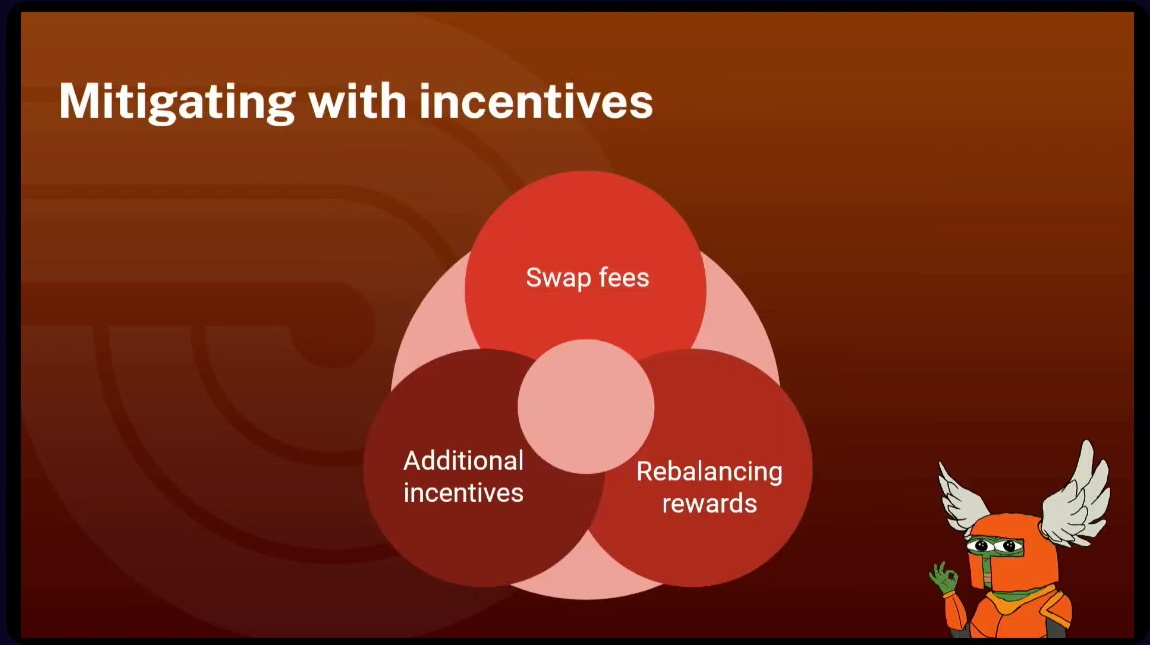

Solutions for incentivizing liquidity (9:15)

- Deposit incentives like token incentives, swap fees

- Rebalancing rewards like Curve gauges

- Additional incentives like specialized services (like Paladin) help projects direct these incentives effectively

The goal for projects is to bootstrap liquidity until the project is secure enough that organic yield becomes sufficient.

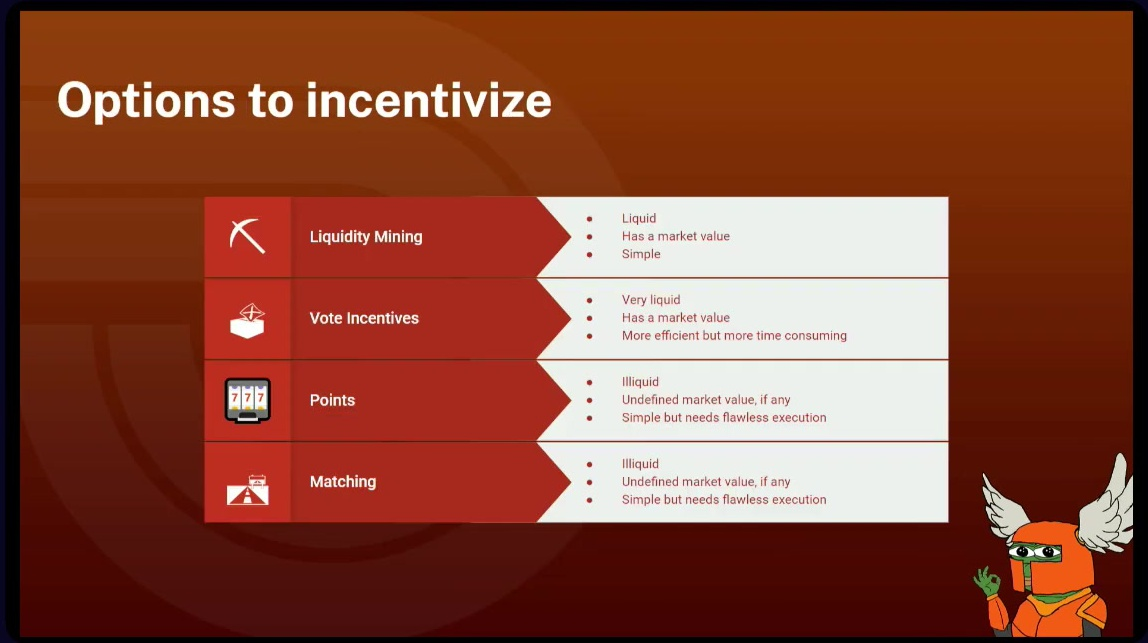

Options to incentivize (10:20)

Four major waves of liquidity incentivization in DeFi:

- Liquidity Mining

- Vote Incentives

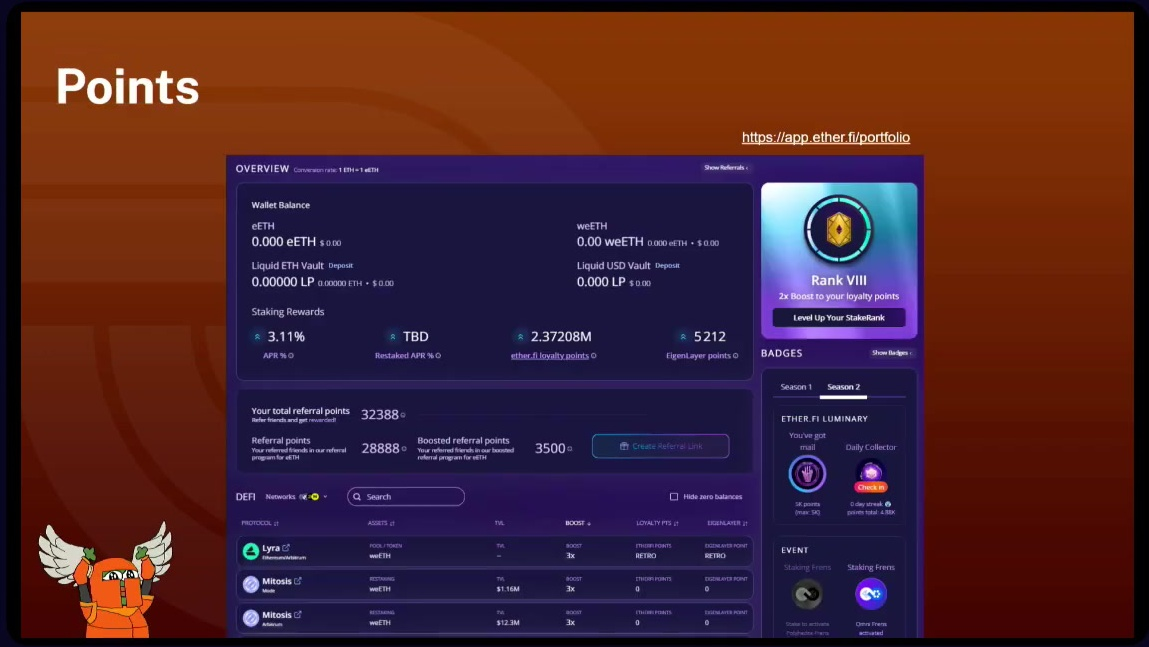

- Points

- Liquidity Matching

Liquidity mining (11:25)

Liquidity mining involves giving out tokens representing a share of the protocol to early users.

It started the "DeFi summer" in 2020 and made users stakeholders in the project.

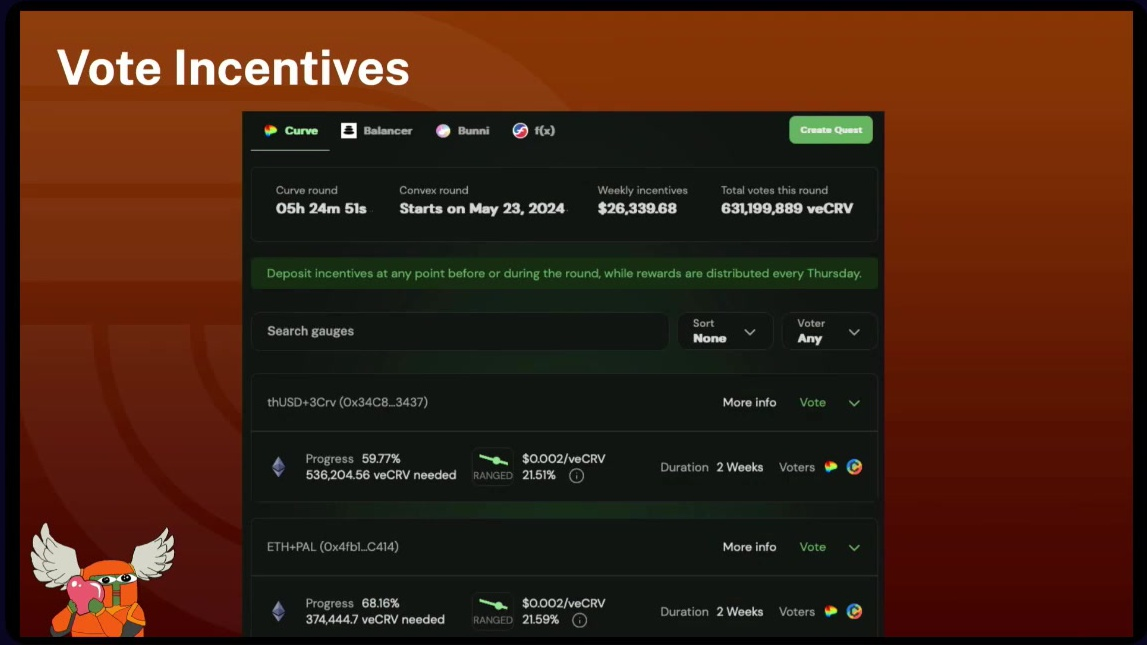

Vote incentives (12:00)

An optimized version of liquidity mining, where projects pay stakeholders to drive emissions

It creates a more sustainable system

Points (12:40)

Tokens are distributed at once (TGE or end of season) rather than streamed

Points give projects more control over distribution and create healthier price action with periodic large liquidity events

The main drawback is trust issues due to hidden rules and project control

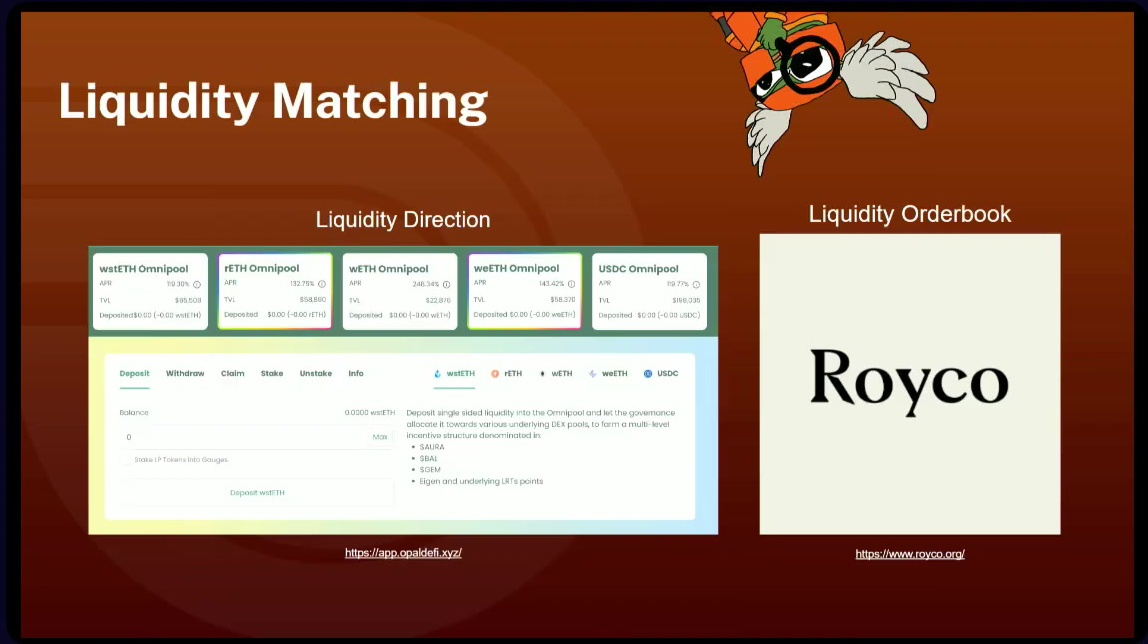

Liquidity matching (14:40)

An emerging trend in liquidity management: matching large cash pools with different liquidity pools. This can be applied to lending, LPs, or more general use cases

Improves user flow, especially for users who can't constantly move between different POLs, and addresses challenges of switching between complex positions (e.g., Uniswap v3)

Each option doesn't replace the previous ones entirely, projects still use various methods in combination and they trend towards more sophisticated and tailored approaches as they face challenges :

- Points systems need standardization and "golden rules"

- Liquidity matching faces UX complexities and smart contract challenges

- Constant innovation as large actors figure out and optimize each system

Goals of liquidity strategies (16:00)

Their goals:

- Building Protocol-Owned Liquidity (PoL)

- Finding partners (retail, funds) to provide liquidity

- Creating organic demand

To enable trading experience, establish temporary business deals for liquidity provision, and ultimately create enough demand for self-sustaining liquidity

Liquidity Solutions VS TradFi (17:25)

60% of companies on Euronext Paris have zero daily trading volume. These low-volume stocks might benefit more from AMM solutions

Crypto solutions (like AMMs) are better for smaller and early-cap projects, but Traditional order books work better for high-scale, big projects

There is a distinction between Open Finance and DeFi:

- Open Finance: Integration of traditional finance with on-chain systems, following existing regulations

- DeFi: Focuses on decentralized, autonomous systems

A future outlook would be that the majority (90%) of projects are likely to be built in Open Finance due to a larger user base and capital.

DeFi is expected to have a higher impact, especially during market crunches or when resilient solutions are needed.

So Open Finance and DeFi are two different paths that will develop separately. Projects need to choose which direction they want to pursue